Ninepoint Alternative Income Fund

Fund Highlights

- Multi-strategy Approach – Access to complementary alternative credit strategies with enhanced liquidity by utilizing laddered duration and diversified through geography, asset class, industry and duration.

- No Additional Fees – One layer of fees charged to the investor unlike traditional fund-of-funds managers.

- Senior Secured – Strategies are primarily senior secured and first lien credit with conservative loan-to-value ratios.

- Access to Best-In-Class Managers – Industry veterans with workout and restructuring experience and have managed their respective strategy through multiple business cycles.

- Dynamic Asset Allocation – Strategically adjust exposure to select strategies based on market conditions, funding requirements and liquidity with monthly rebalancing.

Click the image above to view larger

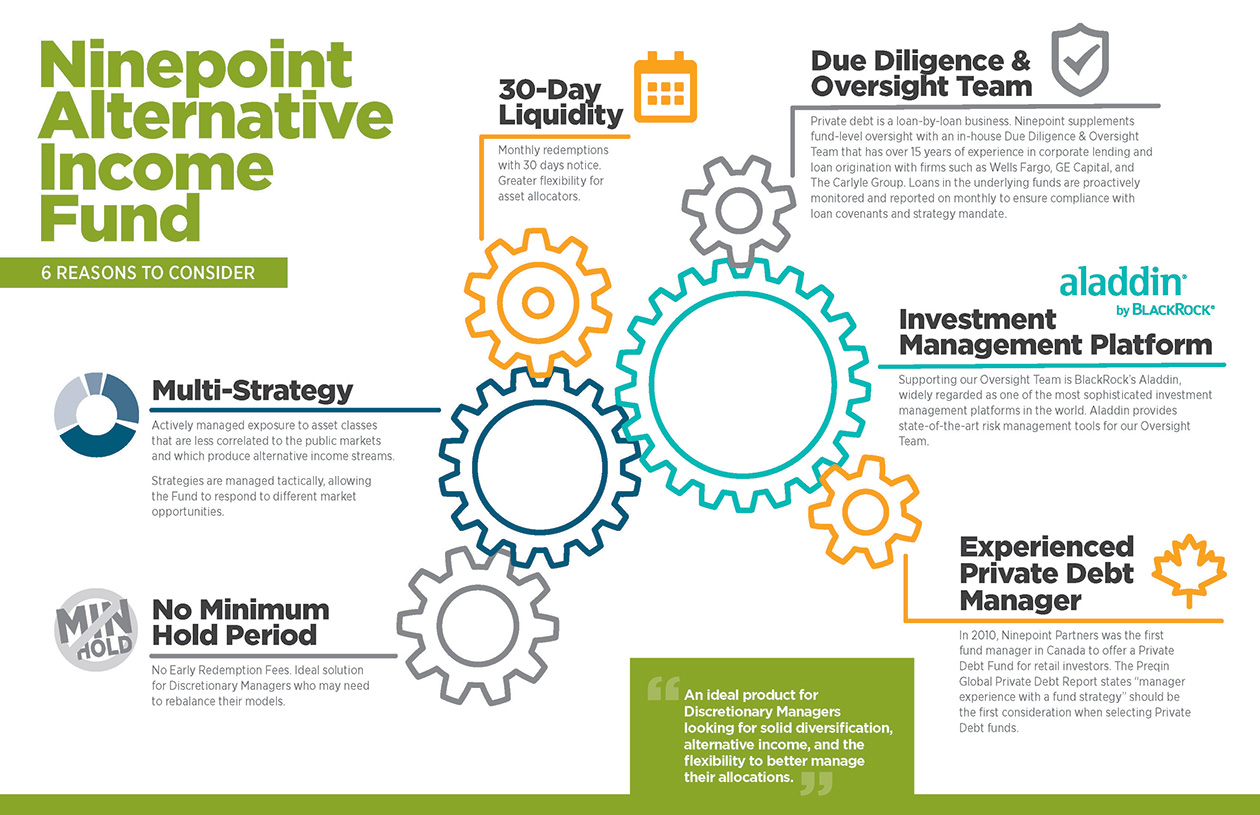

6 Reasons to Consider Alternative Income Fund

1. Multi-Strategy

Actively managed exposure to asset classes that are less correlated to the public markets and which produce alternative income streams. Strategies are managed tactically, allowing the Fund to respond to different market opportunities.

2. No Minimum Hold Period

No Early Redemption Fees. Ideal solution for Discretionary Managers who may need to rebalance their models.

3. 30-day Liquidity

Monthly redemptions with 30 days notice. Greater flexibility for asset allocators.

An ideal product for Discretionary Managers looking for solid diversification, alternative income, and the flexibility to better manage their allocations.

4. Due Diligence & Oversight Team

Private debt is a loan-by-loan business. Ninepoint supplements fund-level oversight with an in-house Due Diligence & Oversight Team that has over 15 years of experience in corporate lending and loan origination with firms such as Wells Fargo, GE Capital, and The Carlyle Group. Loans in the underlying funds are proactively monitored and reported on monthly to ensure compliance with loan covenants and strategy mandate.

5. Investment Management Platform

Supporting our Oversight Team is BlackRock’s Aladdin, widely regarded as one of the most sophisticated investment management platforms in the world. Aladdin provides state-of-the-art risk management tools for our Oversight Team.

6. Experienced Private Debt Manager

In 2010, Ninepoint Partners was the first fund manager in Canada to offer a Private Debt Fund for retail investors. The Preqin Global Private Debt Report states “manager experience with a fund strategy” should be the first consideration when selecting Private Debt funds.

All returns and fund details are a) based on Class F units; b) net of fees; c) annualized if period is greater than one year.

For accredited investor requirements please consult a financial advisor or the Fund’s offering documents.

** All returns are converted to CAD. The index proxies for each category are: Bloomberg Barclays Canada Aggregate TR Index; S&P/TSX Composite TR; S&P 500 TR USD. Indexes are computed by Ninepoint Partners LP based on available index information.

The Ninepoint Alternative Income Fund is generally exposed to the following risks. See the offering memorandum of the Fund for a description of these risks: fund of funds risk; not a public mutual fund; limited operating history for the fund; class risk; charges to the fund; changes in investment objective, strategies and restrictions; unitholders not entitled to participate in management; dependence of the manager on key personnel; reliance on the manager; resale restrictions; illiquidity; possible effect of redemptions; redemptions in kind; distributions; liability of unitholders; potential indemnification obligations; lack of independent experts representing unitholders; no involvement of unaffiliated selling agent; public mutual fund regulatory restrictions; limited operating history for the portfolio funds; charges to the portfolio fund; not entitled to participate in management; dependence of sub-advisor on key personnel; reliance on subadvisor; distributions and allocations; repayment of certain distributions; possible loss of limited liability; valuation of the partnership’s investments; tax liability; general economic and market conditions; assessment of the market; concentration; foreign investment risk; illiquidity of underlying investments; credit risk; impaired loans; no insurance; joint ventures and co-investments; litigation; fixed income securities; equity securities; possible correlation with traditional investments; idle cash; currency risk; suspension of trading; leverage.

The Ninepoint Alternative Income Fund is offered on a private placement basis pursuant to an offering memorandum and is only available to investors who meet certain eligibility or minimum purchase amount requirements under applicable securities legislation. The offering memorandum contains important information about the Fund including its investment objective and strategies, purchase options, applicable management fees, performance fees, other charges and expenses, and should be read carefully before investing. Performance data represents past performance of the Fund and is not indicative of future performance. Data based on performance history of less than five years may not give prospective investors enough information to base investment decisions on. Please contact your own personal advisor on your particular circumstance. This communication does not constitute an offer to sell or solicitation to purchase securities of the Fund. The information contained herein does not constitute an offer or solicitation by anyone in the United States or in any other jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. Prospective investors who are not resident in Canada should contact their financial advisor to determine whether securities of the Fund may be lawfully sold in their jurisdiction.

^There will be a limit on redemptions up to 5% of the NAV of the Fund for the previous quarter, applicable to any quarter where the sum of cash distributions and redemption requests exceed this limit, with cash distributions being paid first and redemption requests being satisfied pro rata up to the limit. Redemption requests in excess of the limit will be cancelled and may be resubmitted for payment on the following Redemption Date, unless a Unitholder requests to receive Redemption Notes for the cancelled portion of the redemption request. Please see OM for more details.

Are You An Accredited Investor?

An investment in this Fund requires the financial ability and willingness to accept the high risks and lack of liquidity inherent in this type of an investment. Investors in the Fund must be prepared to bear such risks for an extended period of time and should review suitability with their Investment Advisor.

The minimum subscription amount is $150,000.00 in all jurisdictions, unless you meet the definition of "accredited investor" under National Instrument 45-106 Prospectus and Registration Exemptions.

If you meet the definition "accredited investor" (see below), you may invest a minimum of $25,000. Please consult the Offering Memorandum to determine your qualification status. Investment Advisors should consult their company's internal policies.

The Subscriber, or one or more beneficial purchasers for whom the Subscriber is acting, is (i) a resident of, or the purchase and sale of securities to the Subscriber is otherwise subject to the securities legislation of one of the following: British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, Québec, Newfoundland and Labrador, Nova Scotia, New Brunswick, Prince Edward Island, North West Territories, or Nunavut, and the Subscriber is (and will at the time of acceptance of the Subscription be) an accredited investor within the meaning of National Instrument 45-106 Prospectus and Registration Exemptions ("NI 45-106") because the Subscriber is one of the following:

| (a) | a Canadian financial institution, or a Schedule III bank; |

| (b) | the Business Development Bank of Canada incorporated under the Business Development Bank of Canada Act (Canada); |

| (c) | a subsidiary of any person referred to in paragraphs (a) or (b), if the person owns all of the voting securities of the subsidiary, except the voting securities required by law to be owned by directors of that subsidiary; |

| (d) | a person registered under the securities legislation of a jurisdiction of Canada as an adviser or dealer, other than a person registered solely as a limited market dealer under one or both of the Securities Act (Ontario) or the Securities Act (Newfoundland and Labrador); |

| (e) | an individual registered or formerly registered under the securities legislation of a jurisdiction of Canada as a representative of a person referred to in paragraph (d); |

| (f) | the Government of Canada or a jurisdiction of Canada, or any crown corporation, agency or wholly owned entity of the Government of Canada or a jurisdiction of Canada; |

| (g) | a municipality, public board or commission in Canada and a metropolitan community, school board, the Comité de gestion de la taxe scolaire de l'île de Montréal or an intermunicipal management board in Québec; |

| (h) | any national, federal, state, provincial, territorial or municipal government of or in any foreign jurisdiction, or any agency of that government; |

| (i) | a pension fund that is regulated by the Office of the Superintendent of Financial Institutions (Canada), a pension commission or similar regulatory authority of a jurisdiction of Canada; |

| (j) | an individual who, either alone or with a spouse, beneficially owns financial assets having an aggregate realizable value that before taxes, but net of any related liabilities, exceeds $1,000,000; |

| (k) | an individual whose net income before taxes exceeded $200,000 in each of the 2 most recent calendar years or whose net income before taxes combined with that of a spouse exceeded $300,000 in each of the 2 most recent calendar years and who, in either case, reasonably expects to exceed that net income level in the current calendar year; (Note: If individual accredited investors wish to purchase through wholly-owned holding companies or similar entities, such purchasing entities must qualify under section (t) below, which must be initialled.) |

| (l) | an individual who, either alone or with a spouse, has net assets of at least $5,000,000; |

| (m) | a person, other than an individual or investment fund, that has net assets of at least $5,000,000 as shown on its most recently prepared financial statements; |

| (n) | an investment fund that distributes or has distributed its securities only to:

|

| (o) | an investment fund that distributes or has distributed securities under a prospectus in a jurisdiction of Canada for which the regulator or, in Québec, the securities regulatory authority, has issued a receipt; |

| (p) | a trust company or trust corporation registered or authorized to carry on business under the Trust and Loan Companies Act (Canada) or under comparable legislation in a jurisdiction of Canada or a foreign jurisdiction, acting on behalf of a fully managed account managed by the trust company or trust corporation, as the case may be; |

| (q) | a person acting on behalf of a fully managed account managed by that person, if that person:

|

| (r) | a registered charity under the Income Tax Act (Canada) that, in regard to the trade, has obtained advice from an eligibility adviser or an adviser registered under the securities legislation of the jurisdiction of the registered charity to give advice on the securities being traded; |

| (s) | an entity organized in a foreign jurisdiction that is analogous to any of the entities referred to in paragraphs (a) to (d) or paragraph (i) in form and function; |

| (t) | a person in respect of which all of the owners of interests, direct, indirect or beneficial, except the voting securities required by law to be owned by directors, are persons that are accredited investors; |

| (u) | an investment fund that is advised by a person registered as an adviser or a person that is exempt from registration as an adviser, or; |

| (v) | a person that is recognized or designated by the securities regulatory authority or, except in Ontario and Québec, the regulator as an accredited investor. |

Advisor Use Only

This commentary is for Advisor use only. If you are an Advisor, please contact your Ninepoint Product Specialist for access.