The Private Debt Industry Is Rapidly Expanding

The growth in private debt financing is largely attributable to a continuing retreat by banks from loan markets under the pressure of tougher capital rules.

Source: 2018 Preqin Global Private Debt Report.

A perfect storm of cash-hungry mid-market firms who are unable to secure conventional loans, plus investors searching for alternatives to low yielding bonds and volatile equities has injected tremendous energy into the Private Debt space. Here’s what it looks like:

Private Debt AUM has more than tripled since 2010

Source: Prequin Online Products, 2022.

Investor views on the performance of their Private Debt investments over the past 12 months

Source: Prequin Online Products, 2022.

In 2021 the Canada Pension Plan allocated significantly to Private Debt

Historical risk/return profile for Private Debt is attractive

Source: Morningstar, Cliffwater Direct Lending Index, as of December 31, 2021.

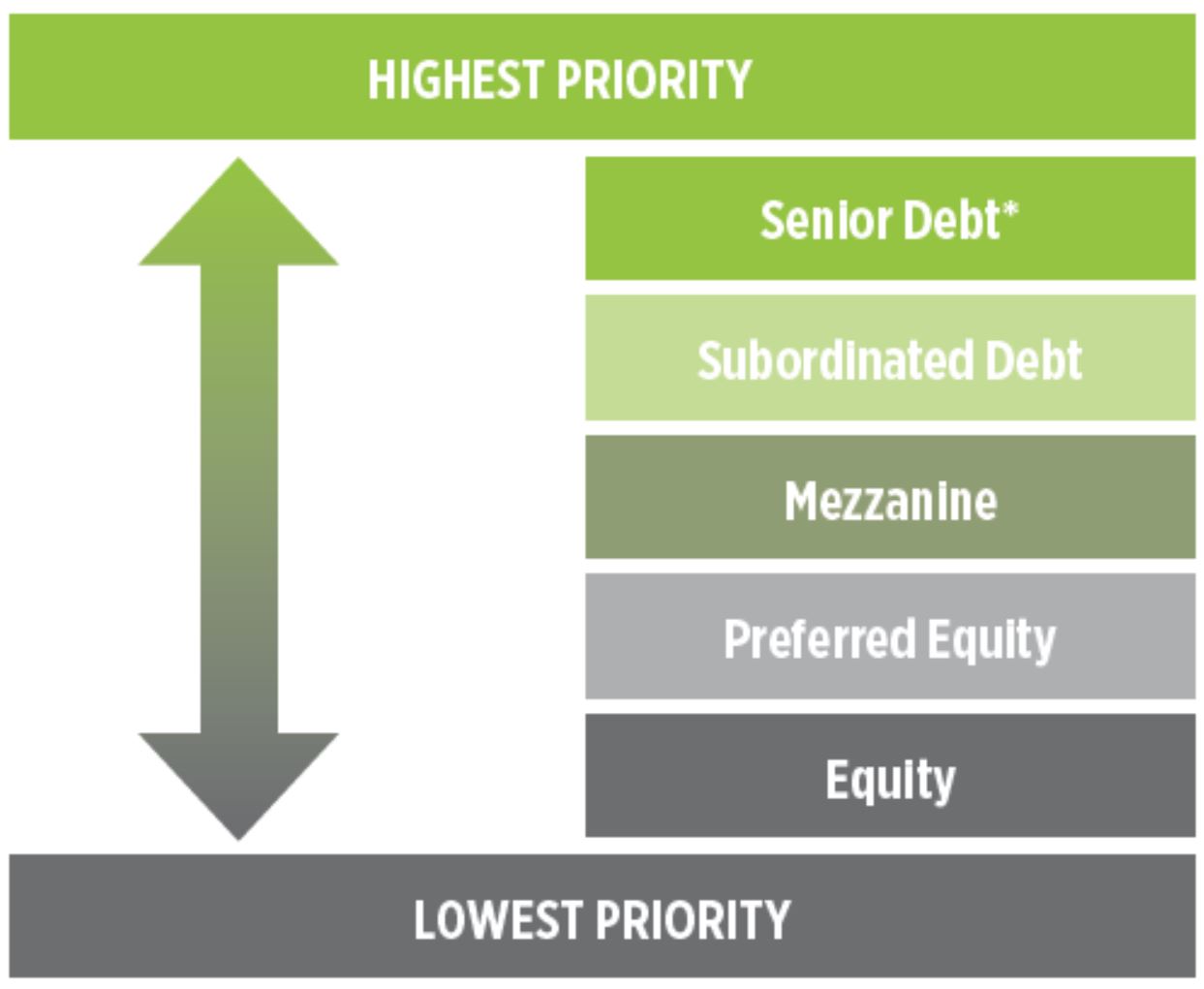

Two distinct approaches to Private Debt investing

*Ninepoint Partners’ current Private Debt strategy.

Senior Debt is the safest part of the capital structure

*Ninepoint Partners’ current Private Debt strategy.

“Although the perception of the private debt sector can sometimes be characterized as being more risky than traditional bank debt, the number of private credit funds opting for a more conservative ‘senior secured’ structure suggests the contrary.”

Source: CPPIB, May 2018.

Over 75% of current Private Debt investors intend to increase their allocations

Source: EQuilibrium Global Institutional Study, 2022.

Private Debt can help diversify traditional streams of income

Source: Morningstar, Cliffwater, as of December 31, 2021.

Private Debt can be viewed as a defensive asset class

Benefits

- An innovative way to generate income

- Low volatility

- Equity-like returns

- Typically floating rate loans

- Collateralized by assets

- Safest part of capital structure (Senior Debt)

- Non-correlated to traditional asset classes

- Lower historical default and loss rates than high-yield bonds

- Capital preservation with strong long-term performance

Challenges

- Illiquidity

- Transparency

- Limited information available on track record of the asset classes

- Lack of comparability with other asset classes in private and public markets

- No linear deal flow resulting in cash drag

A good manager can help you take advantage of the benefits while mitigating the challenges.

Do you want to

learn more

about Alts?

about Alts?

Subscribe to be notified when new Alts content is added to our library.