Ninepoint Fixed Income Strategy

January 2023 Commentary

Monthly commentary discusses recent developments across the Diversified Bond, Alternative Credit Opportunities and Credit Income Opportunities Funds.

Macro

As inflation continues its descent from 50 year highs and Central Bankers see the light at the end of the rate hike tunnel, market participants are now increasingly sanguine about the prospects of a soft landing, and perhaps even interest rate cuts later this year. This view rests on the idea that inflation will be declining back to its 2% target sooner than anticipated. Indeed, even Chair Powell at the most recent FOMC press conference, acknowledged that he was comfortable with the bond market pricing rate cuts later in 2023, given that it was based on a normalization of inflation at a pace that is faster than what the Fed currently anticipates.

The recent rally in equities, credit spreads and interest rates rests on the perceived increased likelihood of a soft landing, which itself is predicated on inflation normalizing rather quickly this year. With that in mind, how could the different categories of inflation take us back to 2% CPI Inflation by year end in the US?

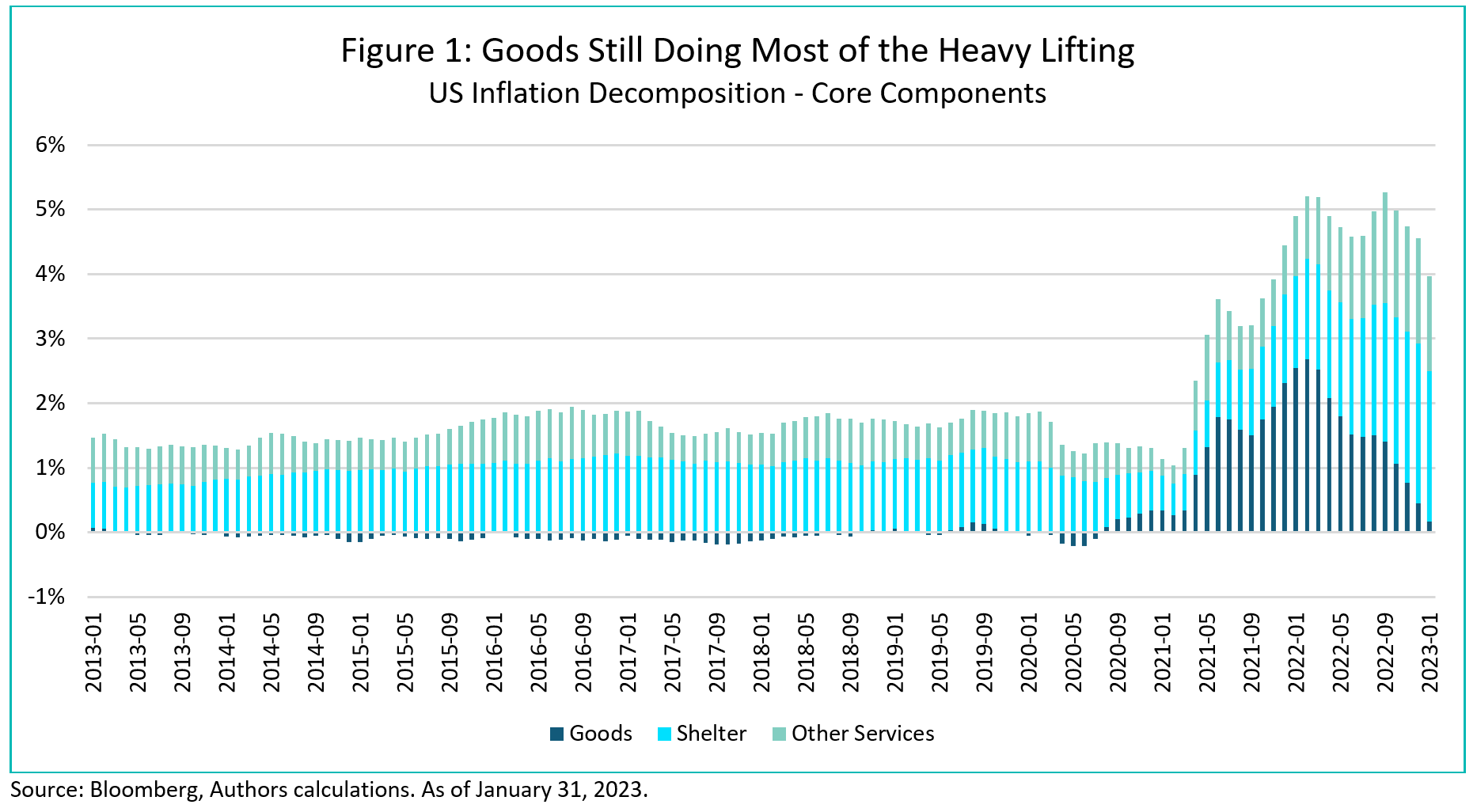

Figure 1 below decomposes U.S. CPI Inflation into its main Core Components: goods, shelter and other services (policymakers often make abstraction of more volatile components such as food and energy, and historically these have netted themselves out over long periods of time). So far, most of the decline in inflation has stemmed from the goods sector (21% weight in CPI). Historically, this sector had contributed very little to overall inflation, but with the previous supply chain issues and strong demand brought about by the pandemic, goods prices had exploded. Now that the pandemic is behind us and supply chains have normalized, we are seeing a stabilization in goods prices. With softer demand and elevated inventories, we wouldn’t be surprised if this component was to contribute negatively (i.e. deflation) to the overall inflation readings over the coming months. However, over time, it is unlikely that goods prices will perpetually decline, so this source of deflation is likely to be short lived.

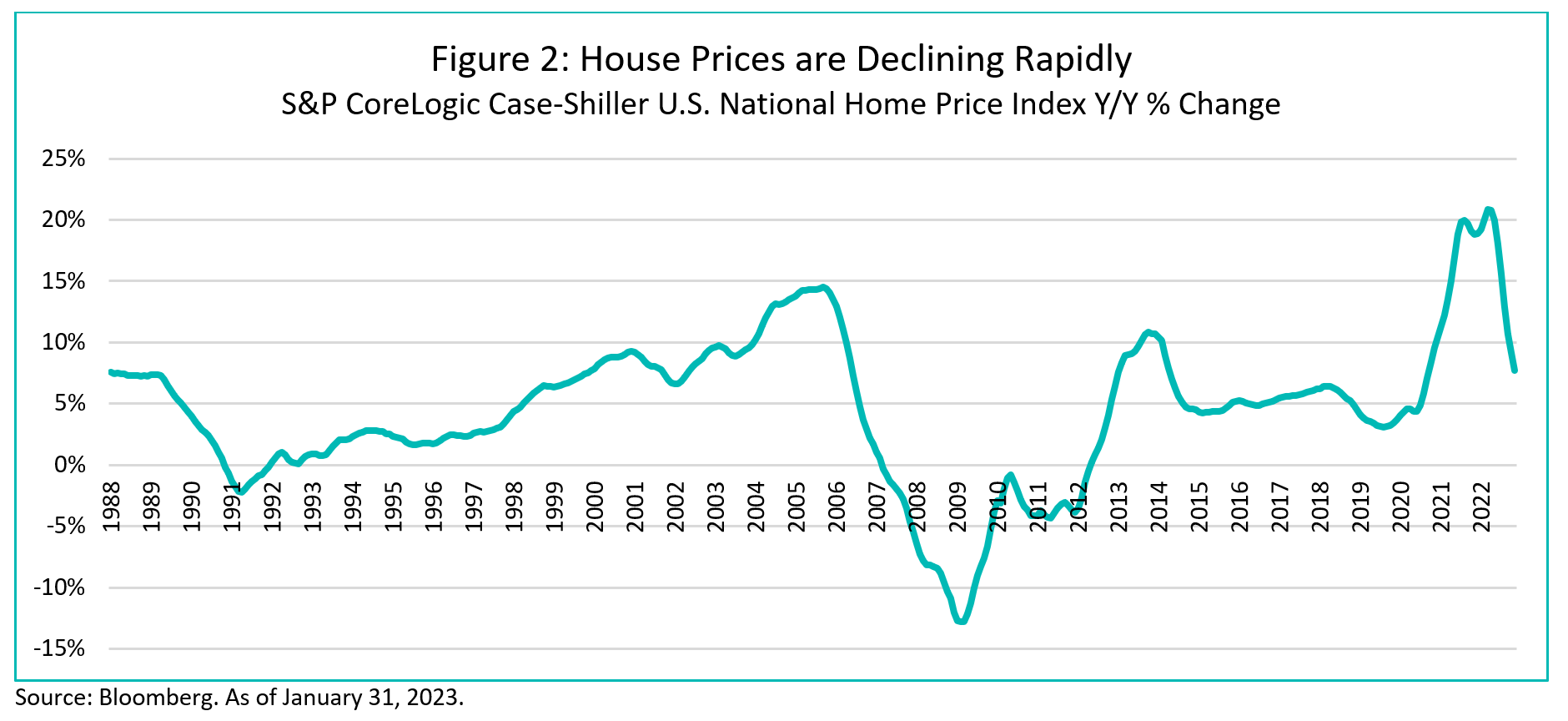

The largest category of inflation, shelter, carries a 34% weight in the CPI calculation. Historically, shelter’s contribution to the CPI Inflation reading was around 1%. Since the pandemic, this contribution has more than doubled, to 2.5%. Thankfully, real-time measures of house prices and rents (the largest contributors to the shelter inflation component) now show a moderation in price increases. For example, the S&P CoreLogic Case-Shiller U.S. National Home Price Index (Figure 2 below) has clearly peaked and is in the process of reverting back to more normalized levels. As long as the weakness in housing remains, Central Bankers and market participants should have a fairly high degree of confidence that the shelter component of inflation is on its way down. What remains to be seen is how much this measure declines from its peak and where it stabilizes going forward. As of the latest CPI release, the month-over-month change in shelter CPI is still at the highs.

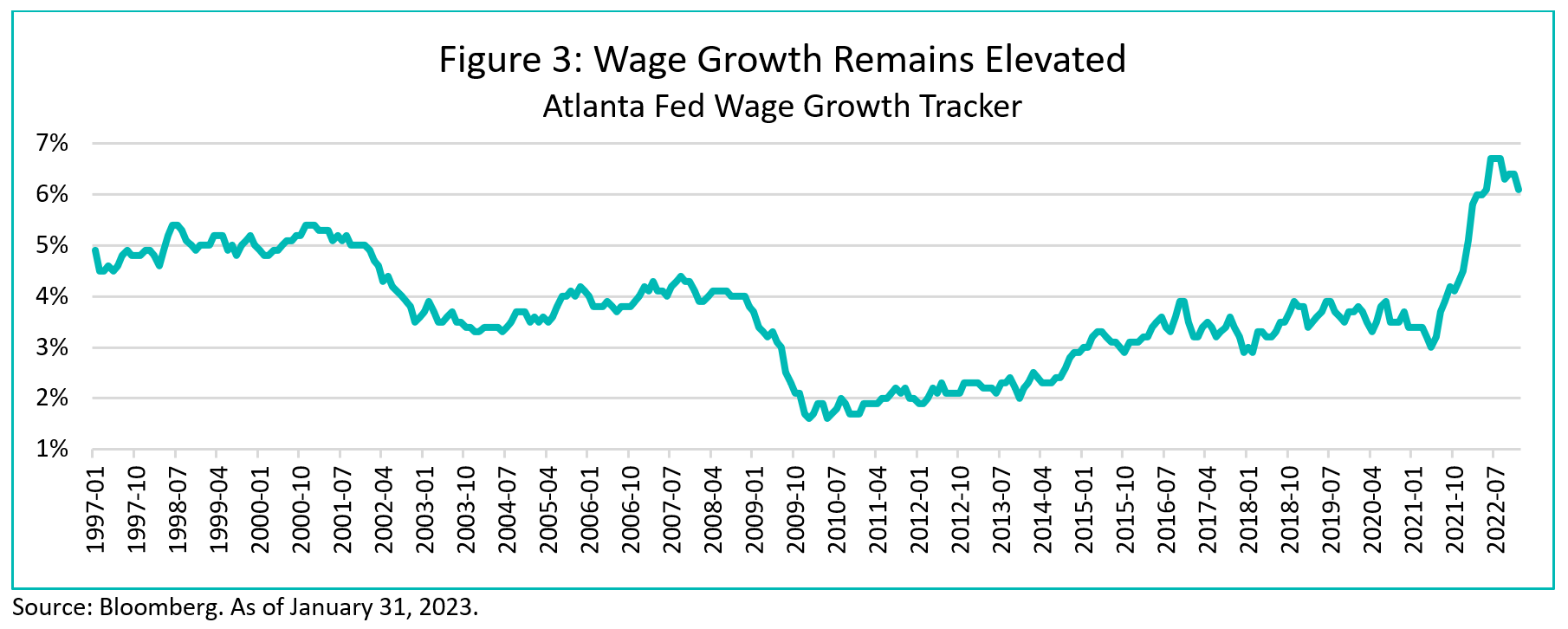

The last category of importance (24% of CPI), and what makes up the newly minted “core services ex. housing” is a catchall category including things like transportation, health care, recreation and education services. This is the most pro-cyclical component of CPI (excluding food and energy). Many of these services are labour intensive, and therefore their price tends to be correlated with wages, which in turn are mostly influenced by the tightness of the labour market.

Currently, these services ex. housing are contributing 1.5% to the annual CPI inflation reading, about double its historical contribution. And as shown in Figure 3 above, wage growth has been, and remains high. Until the labour market rebalances (i.e. labour supply comes back in alignment with demand), wages will stay elevated. This is why the labour market is so important to solving the overall inflation puzzle. Goods prices are no longer a source of inflation (and will probably be a source of deflation for a little while), shelter inflation, with house prices declining, will “solve itself” although slowly in the coming months, but wages, and their corollary, the unemployment rate, is really the last complicated piece of the puzzle.

So, going full circle, what would be needed from each of these to reduce Inflation to a sustainable 2% by year end 2023?

• Goods might generate some deflation in the short term as the massive price increases from the pandemic era normalize, but at best, in the medium term, goods should be expected to contribute, on average, almost nothing to inflation.

• Housing inflation remains at the highs, but with house prices declining, as well as rents, we should see some improvement in this category. But, given how shelter costs are estimated, the changes will only be gradual. Based on historical behaviour, the shelter component of CPI won’t return to pre-pandemic levels until 2024-Q1. Therefore, shelter’s current contribution of 2.3-2.5% to inflation could realistically slowly drift down to ~1-1.5% over the next 12-14 months.

• Other services, with their 1.5% contribution to CPI, if left unchanged due to high and persistent wage growth, would leave us with an overall CPI by 2023Q4/2024Q1 of around 2.5-3.0%, still above the Fed and BoC’s 2% target, but certainly a net improvement.

Would 2.5% CPI Inflation be enough for the Fed and BoC to declare victory and cut interest rates, as the market is currently expecting? We think that it would depend on the state of the labour market. If the unemployment rate is still at all time lows and wages continue to increase at current levels, we believe that it would be very difficult for the Fed (and BoC) to announce that the scourge of inflation has been conquered, and that it's now time to cut interest rates. Acting in this fashion would be walking into the exact same trap that led to the high inflation of the 1970s. No Central Banker in his right mind would consider cutting interest rates with the economy running above full employment.

For the Fed to realistically consider cutting rates, as the market expects, in late 2023, we would need to see both the housing and labour markets softening. In such an environment, wages would be decelerating, driving the other services component of CPI back towards its historical level of 0.5-0.6% contribution and only then would a sustainable 2% inflation level be achievable.

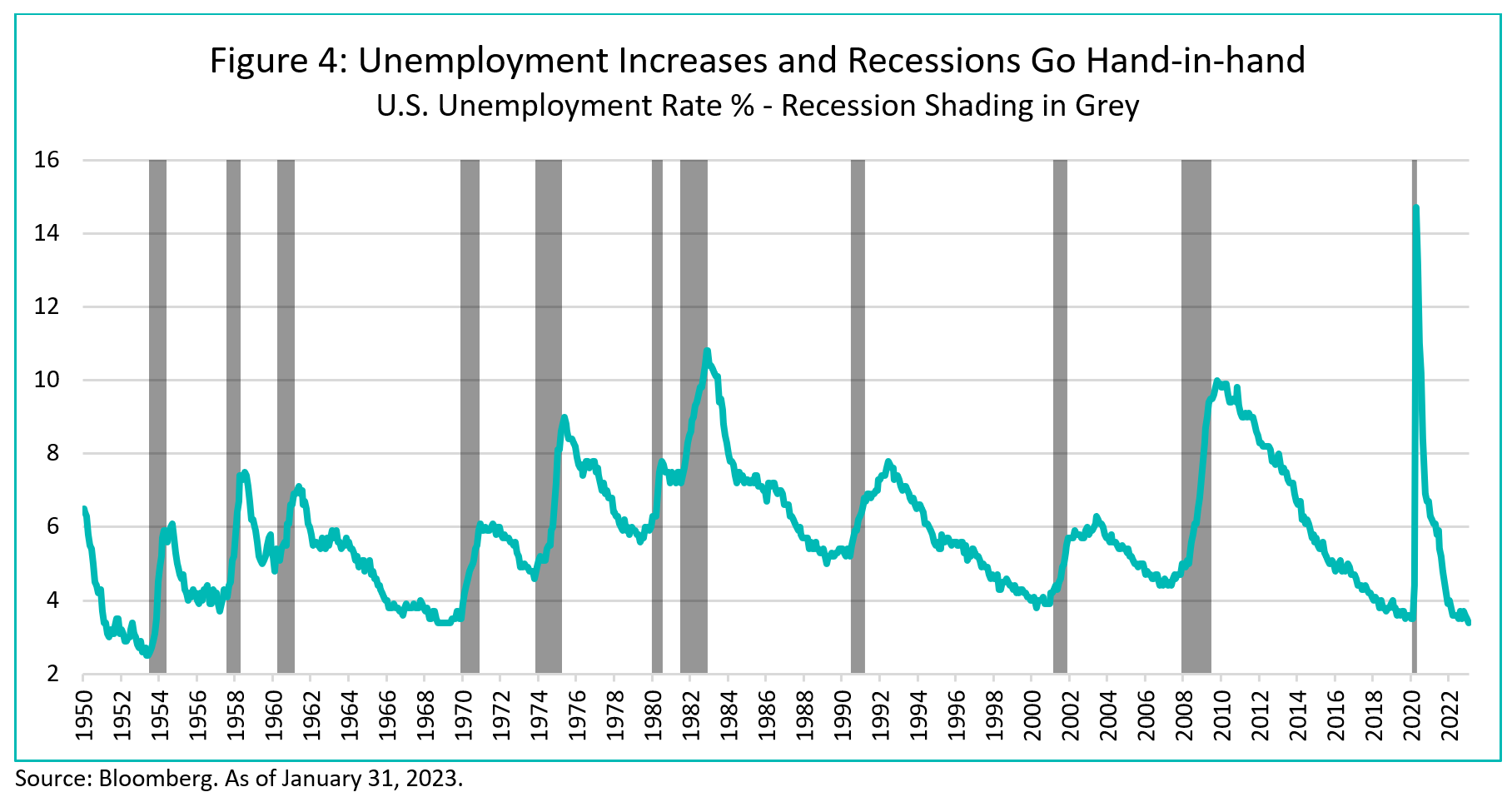

Unfortunately, for the whole post-war era, the U.S. has never experienced a meaningful increase in unemployment that wasn’t also accompanied by a recession (Figure 4).

Given our view on the persistence of inflation above the Fed and the BoC’s target, the recession scenario remains our base case going forward. We do not know exactly when recession will happen, but we think it is prudent to prepare our portfolios for its eventuality. Monetary Policy acts with long and variable lags.

Of course, the soft-landing scenario is not impossible. For the time being, the Fed is only too happy to share the enthusiasm of market participants, as inflation slowly declines and the risk of inflation expectations becoming de-anchored from the 2% target is diminished. With goods providing a near term deflationary impulse and shelter inflation starts its long decline, the soft-landing narrative can continue unscathed for several months to come. But, as we argued earlier, it is unlikely we can make our way back to the 2% target without a meaningful increase in unemployment.

Could the market be correct on rate cuts in 2023? Yes, certainly, but not without a real recession, not a soft landing. Unfortunately, equities, high yield and to some extent IG credit aren’t priced for this. This is the great cognitive dissonance that we are currently living through.

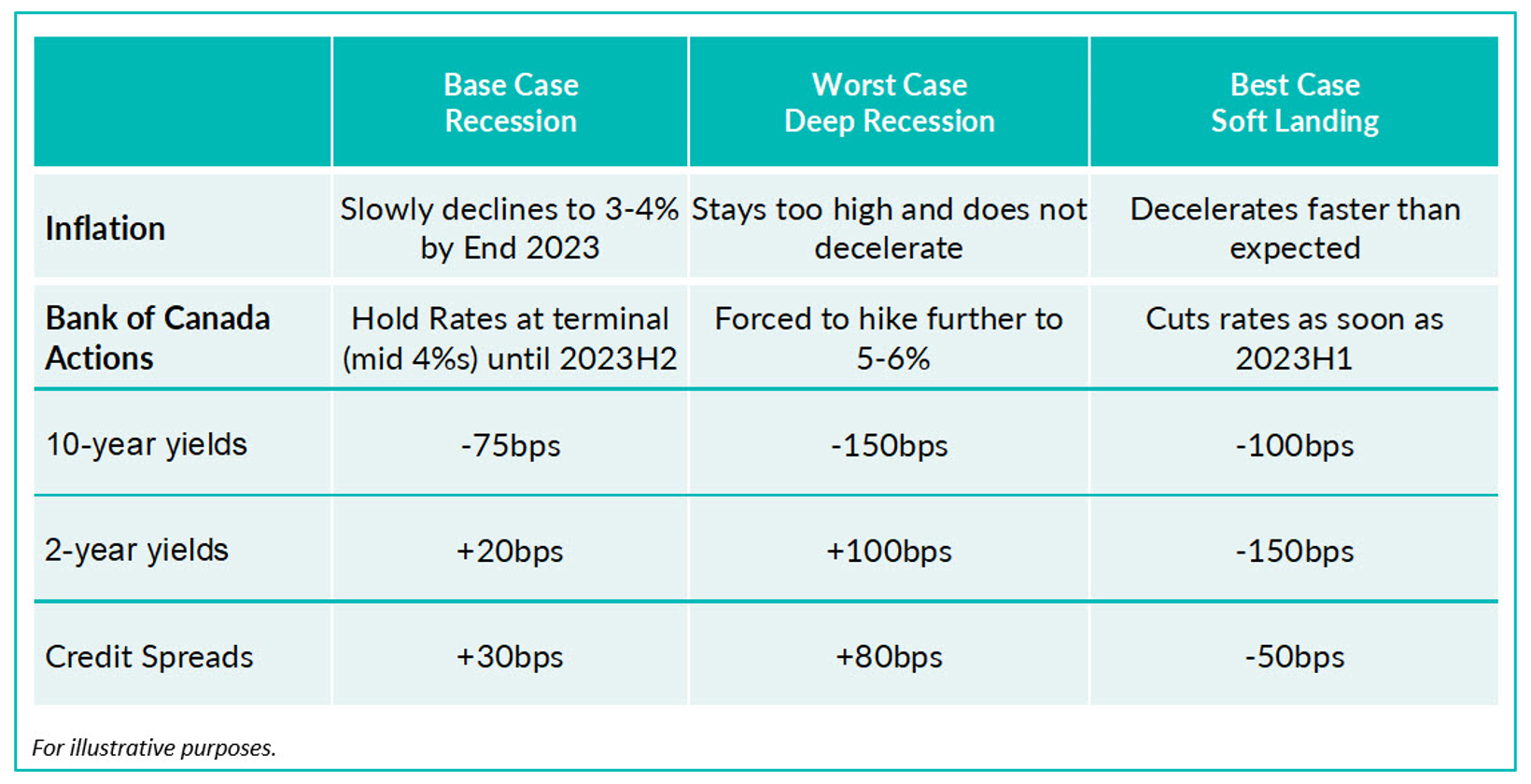

When we first devised our 2023 Outlook back in October, we put together three scenarios, shown in the table below:

As discussed previously, the market is currently leaning towards the Soft-Landing scenario. So far in 2023, interest rates have declined by 0.4% and 0.3% for the 10-year and 2-year, respectively, and credit spreads tightened by 15bps. Consistent with the Best-Case scenario.

Clearly, with the improvements seen so far on the inflation front, we believe that the odds of our Worst-Case scenario have gone down materially.

However, the rebalancing of odds in favour of the Soft Landing has gone a bit too far this year. We are not changing our Base Case for now, and as such are taking steps to adjust the positioning of the portfolios to be a bit more defensive, taking advantage of the current rally in credit to take some profits and add some hedges.

Credit

January 2023 was an exceptionally good month for credit spread performance. In the US, credit spreads tightened 15bps on the month bringing the cumulative rally to 52bps from the mid-October wides. In Canada, credit spreads tightened 14bps in January and have now rallied a cumulative 33bps from the late October wides. Spread performance has been relatively widespread across sectors, credit ratings, and tenor. In terms of sectors, the notable outperformers were subordinated bank debt, insurance and real estate. The strong performance in credit can be attributed to many factors: overall appetite for risk assets, more certainty on future monetary policy, a lackluster new issue pipeline in Canada, inflows into bond funds, and dealer inventories being on the lighter side.

Turning to primary markets, January was relatively muted in terms of gross issuance, but a few trends are worth highlighting. First, financial issuance remains robust with roughly half of the deals coming from that sector, however, at a much-diminished pace versus last year. Book stats remain very healthy with a high level of buyers participating, in addition to strong coverage ratios, despite new issue concessions (the amount of additional basis points required by investors to participate in the new issue) trending down (a sign of buyer appetite increasing). Lastly, numerous new issues this month have performed very well which has led to secondary markets adjusting spreads tighter. When taken in conjunction, these items point to the fact that bond investors are eager for new issues and if the primary pipeline continues to remain subdued, we expect secondary spreads to continue to perform well, benefiting the portfolios. After all, corporate bonds are the “least dirty shirt” out there, with attractive all-in-yields and relative safety versus other alternatives (stocks, high yield).

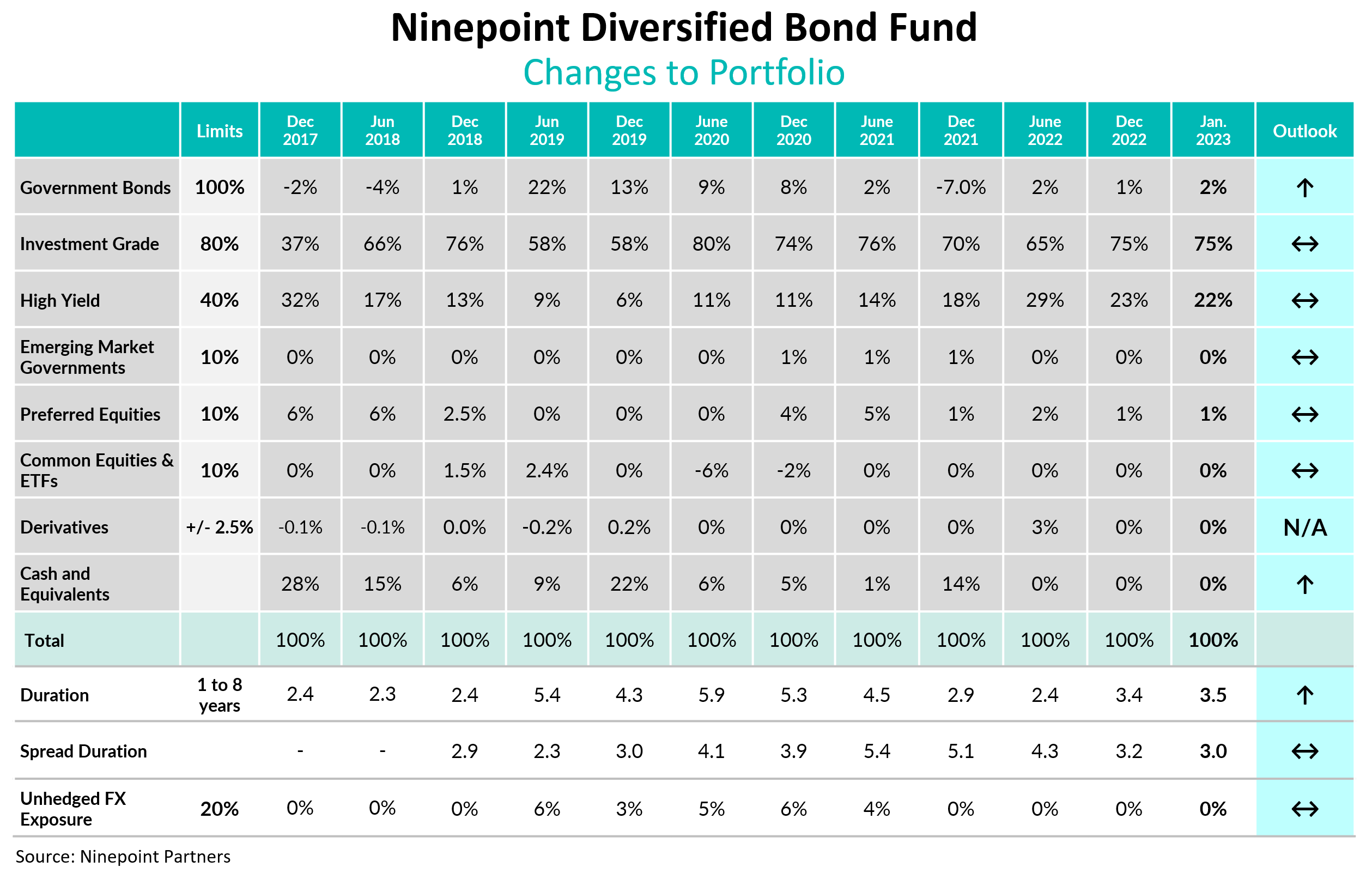

Ninepoint Diversified Bond Fund (DBF)

It was a very active month for the fund. We took some profit on some winners (e.g. recent new issues, longer-dated USD HY), executed on some switch ideas to take advantage of the inverted Canada yield curve and added duration via buying 30-year Government of Canada bonds. For example, we sold a Desjardins bond callable in 2027 to buy a Desjardins bond callable in 2026 while picking up one basis point and taking out $9 in price. Another example was moving out of the Brookfield 10-year new issue to buy a short-dated ABS security. We liked this for numerous reasonings including reducing term from 10 years to 3 years, moving from an ‘A’ rated bond to a “AAA” bond and selling a bond priced above par versus buying a bond that is deeply discounted. As of month-end, the fund’s yield-to-maturity was 7.2% (down from 7.5% from the prior month) while duration moved up to 3.5 years (from 3.4 years). We expect to continue to selectively add duration using long-term government bonds.

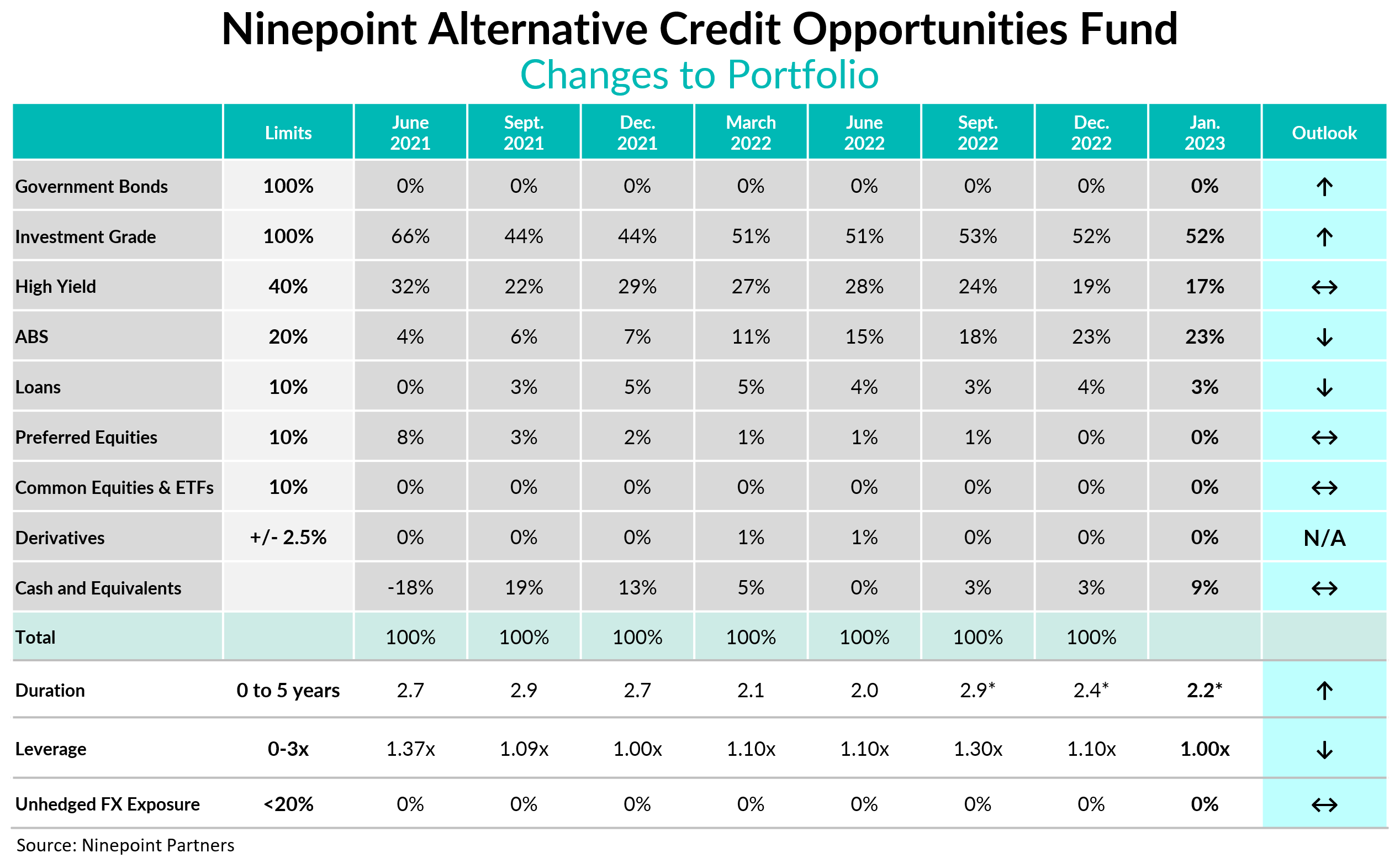

Ninepoint Alternative Credit Opportunities Fund (NACO)

It was a very active month for the fund as we took profits on some long-dated pipeline bonds, reduced our asset-backed-securities exposure to enhance overall liquidity, sold long-dated USD HY and executed on a favorable retraction trade. We also added a Metro 10-year bond to the portfolio as it is rare issuer operating in a very defensive sector. We continue to take profits where we can, increase fund liquidity and strengthen overall credit quality. As the Government of Canada curve remains deeply inverted, retraction trades continue to make sense. For example, we sold the recent SNC Lavalin 2026 new issue $1.50 above par to move into the SNC Lavalin 2024 bond at a price of $4 below par while only giving 22 basis points in yield. We also fully exited our exposure to Cenovus as the credit had an exceptional run in 2022 and we felt there was no more room for spreads to compress. As of month-end, the fund’s yield-to-maturity was 10.3% (down slightly from 10.5% in December) while duration edged slightly lower to 2.2 years. Given the strength in credit, we pro-actively reduced leverage to 1.0x from 1.1x in December, taking our spread duration down to 6.6 years.

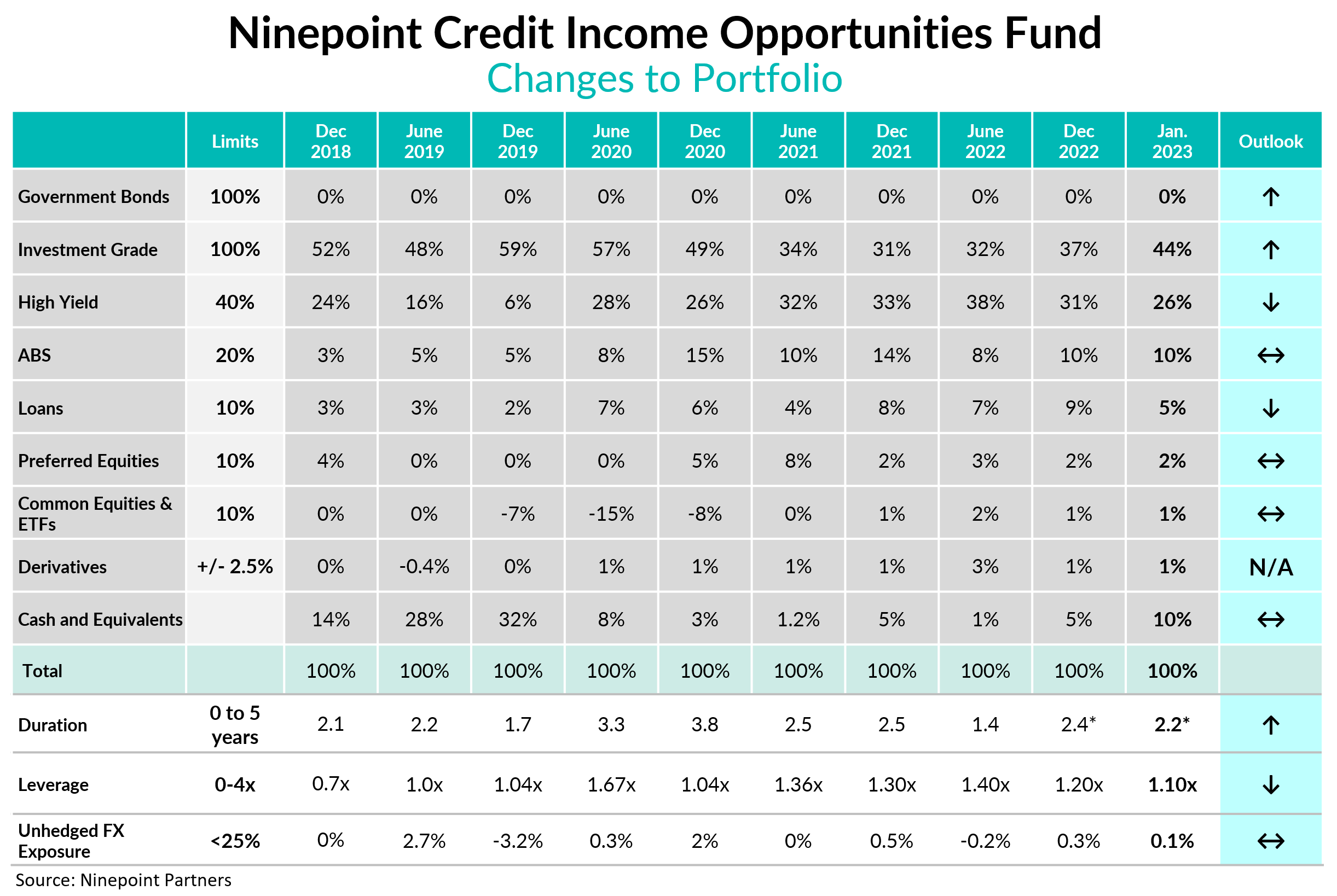

Ninepoint Credit Income Opportunities Fund (Credit Ops)

Similar to the other two funds, January was a busy month. We took profits on some long-dated pipeline bonds as demand for credit in that part of the curve remains insatiable (pension funds love long term bonds). We executed on the same SNC retraction trade as discussed above. Similar to NACO, we exited our position in Cenovus. Lastly, given the outperformance of the USD credit market (vs Canada) we sold the US Dollar Fairfax Financial 2030 bond to move into the Canadian Dollar Fairfax Financial 2029 bond while picking up 13bps for retracting 1-year. We remain vigilant on relative value opportunities in addition to attractive new issues should they arise. As of month-end, the fund’s yield-to-maturity was 10.3% (vs 11.3% one month prior), duration edged slightly lower to 2.2 years (from 2.4 years) and leverage was pro-actively reduced to 1.1x (from 1.2x) given the pace and severity of the recent rally, thereby reducing our spread duration by over 1 year to 7.1 years.

Conclusion

After a very difficult year last year, we are extremely happy with our funds’ performance so far. All the strategies are performing as they should, in a more normal and friendly fixed income environment. Given the heightened risk of recession later this year, we believe the current portfolio risk characteristics are appropriate. After the huge move in interest rates and credit spreads last year we believe that bonds present a very compelling opportunity for investors in 2023 and beyond. We are the most constructive on bonds that we’ve been in years.

This year will no doubt, continue to be a tricky environment. In addition to recession risk, the War in Ukraine, Taiwan tensions and energy prices, are a few items that we have added to our worry list. We always maintain an open mind and stand ready to update our views and portfolio positioning, should it be necessary.

We have no intention of fighting the Fed, and if by some miracle they decide to give risk the “all clear” on the inflation fight, we do have dry powder and can turn up our risk metrics quickly.

Mark, Etienne & Nick

Ninepoint Partners

1 All Ninepoint Diversified Bond Fund returns and fund details are a) based on Series F units; b) net of fees; c) annualized if period is greater than one year; d) as at January 31, 2023 1 All Ninepoint Credit Income Opportunities Fund returns and fund details are a) based on Class F units; b) net of fees; c) annualized if period is greater than one year; d) as at January 31, 2023. 1 All Ninepoint Alternative Credit Opportunities Fund returns and fund details are a) based on Class F units; b) net of fees; c) annualized if period is greater than one year; d) as at January 31, 2023.

The Risks associated worth investing in a Fund depend on the securities and assets in which the Funds invests, based upon the Fund's particular objectives. There is no assurance that any Fund will achieve its investment objective, and its net asset value, yield and investment return will fluctuate from time to time with market conditions. There is no guarantee that the full amount of your original investment in a Fund will be returned to you. The Funds are not insured by the Canada Deposit Insurance Corporation or any other government deposit insurer. Please read a Fund's prospectus or offering memorandum before investing.

Ninepoint Credit Income Opportunities Fund is offered on a private placement basis pursuant to an offering memorandum and are only available to investors who meet certain eligibility or minimum purchase amount requirements under applicable securities legislation. The offering memorandum contains important information about the Funds, including their investment objective and strategies, purchase options, applicable management fees, performance fees, other charges and expenses, and should be read carefully before investing in the Funds. Performance data represents past performance of the Fund and is not indicative of future performance. Data based on performance history of less than five years may not give prospective investors enough information to base investment decisions on. Please contact your own personal advisor on your particular circumstance. This communication does not constitute an offer to sell or solicitation to purchase securities of the Fund.

Ninepoint Partners LP is the investment manager to the Ninepoint Funds (collectively, the “Funds”). Commissions, trailing commissions, management fees, performance fees (if any), other charges and expenses all may be associated with mutual fund investments. Please read the prospectus carefully before investing. The indicated rate of return for series F units of the Fund for the period ended January 31, 2023 is based on the historical annual compounded total return including changes in unit value and reinvestment of all distributions and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The information contained herein does not constitute an offer or solicitation by anyone in the United States or in any other jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. Prospective investors who are not resident in Canada should contact their financial advisor to determine whether securities of the Fund may be lawfully sold in their jurisdiction.

The opinions, estimates and projections (“information”) contained within this report are solely those of Ninepoint Partners LP and are subject to change without notice. Ninepoint Partners makes every effort to ensure that the information has been derived from sources believed to be reliable and accurate. However, Ninepoint Partners assumes no responsibility for any losses or damages, whether direct or indirect, which arise out of the use of this information. Ninepoint Partners is not under any obligation to update or keep current the information contained herein. The information should not be regarded by recipients as a substitute for the exercise of their own judgment. Please contact your own personal advisor on your particular circumstances. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds managed by Ninepoint Partners LP. Any reference to a particular company is for illustrative purposes only and should not to be considered as investment advice or a recommendation to buy or sell nor should it be considered as an indication of how the portfolio of any investment fund managed by Ninepoint Partners LP is or will be invested. Ninepoint Partners LP and/or its affiliates may collectively beneficially own/control 1% or more of any class of the equity securities of the issuers mentioned in this report. Ninepoint Partners LP and/or its affiliates may hold short position in any class of the equity securities of the issuers mentioned in this report. During the preceding 12 months, Ninepoint Partners LP and/or its affiliates may have received remuneration other than normal course investment advisory or trade execution services from the issuers mentioned in this report.

Ninepoint Partners LP: Toll Free: 1.866.299.9906. DEALER SERVICES: CIBC Mellon GSSC Record Keeping Services: Toll Free: 1.877.358.0540

Related Funds

Historical Commentary

- Fixed Income Strategy 12/2023

- Fixed Income Strategy 11/2023

- Fixed Income Strategy 10/2023

- Fixed Income Strategy 09/2023

- Fixed Income Strategy 08/2023

- Fixed Income Strategy 07/2023

- Fixed Income Strategy 06/2023

- Fixed Income - H1 2023 Market Review and Outlook

- Fixed Income Strategy 05/2023

- Fixed Income Strategy 04/2023

- Fixed Income Strategy 03/2023

- Fixed Income Strategy 02/2023