Ninepoint Target Income Fund

January 2023 Commentary

The Ninepoint Target Income Fund portfolio update for the month of January.

January began with a strong rally in equities, as many of the worst performing sectors in 2022, namely tech, reversed course driving upside to broad based equity indexes during the month. The tech rally was in part driven by “better than feared” earnings in key tech giants along with equity valuations expanding on a rally in global interest rates. Post the January rally, equities are now more forcefully pricing in a successful fed pivot and economic soft landing in our view. The more benign recent inflation trend, along with economic data that has yet to decelerate at the pace many bears had hoped for have been key drivers of performance.

We suspect this two-way bull/bear debate on central bank policy moderation and economic growth are unlikely to be resolved in the first month of the year alone, leading to more elevated volatility in the months ahead as investors reprice expectations for different economic/central bank policy regimes and any impacts on company specific fundamentals. While bulls are quick to highlight that negative back-to-back calendar years in equities are rare, they are however more common in recessionary scenarios making this a key focal point still for 2023. As savings are drawn down rapidly for many US households and the last remnants of covid related fiscal stimulus rolls-off into Q2, we will continue to closely monitor consumer related data for potential warnings signs that a harder landing scenario is ahead which would put equities at risk of greater downside.

While we can’t ignore a continuation of the 2022 bear market drivers of stronger employment/inflation driving aggressive central bank policy action, we tend to agree with the consensus view that this is likely to be a less dominant driver of risk in 2023 for equities. This is mainly due to our belief that long-term bonds are no longer as mispriced for inflation and rate hikes as they were a year ago and therefore less likely to impact equity valuations as considerably as they did in 2022.

Our expectations for 2023 as of today, are that the “hard landing” debate will be a challenging one for markets to completely de-risk for most of the year, leaving upside returns below what one might expect after a negative calendar year for stocks. Meanwhile the temptation of rotating into 4-5% yielding cash instruments post any meaningful equity rallies will be too enticing for investors to ignore caping gains. On the positive side we expect long term rates to perform more in line with historical norm of falling when growth deteriorates, potentially buttressing equity valuations on pullbacks. These dynamics likely drive a continuation of the extended period of two-way price action we saw in the later half of 2022, frustrating both bulls and bears alike.

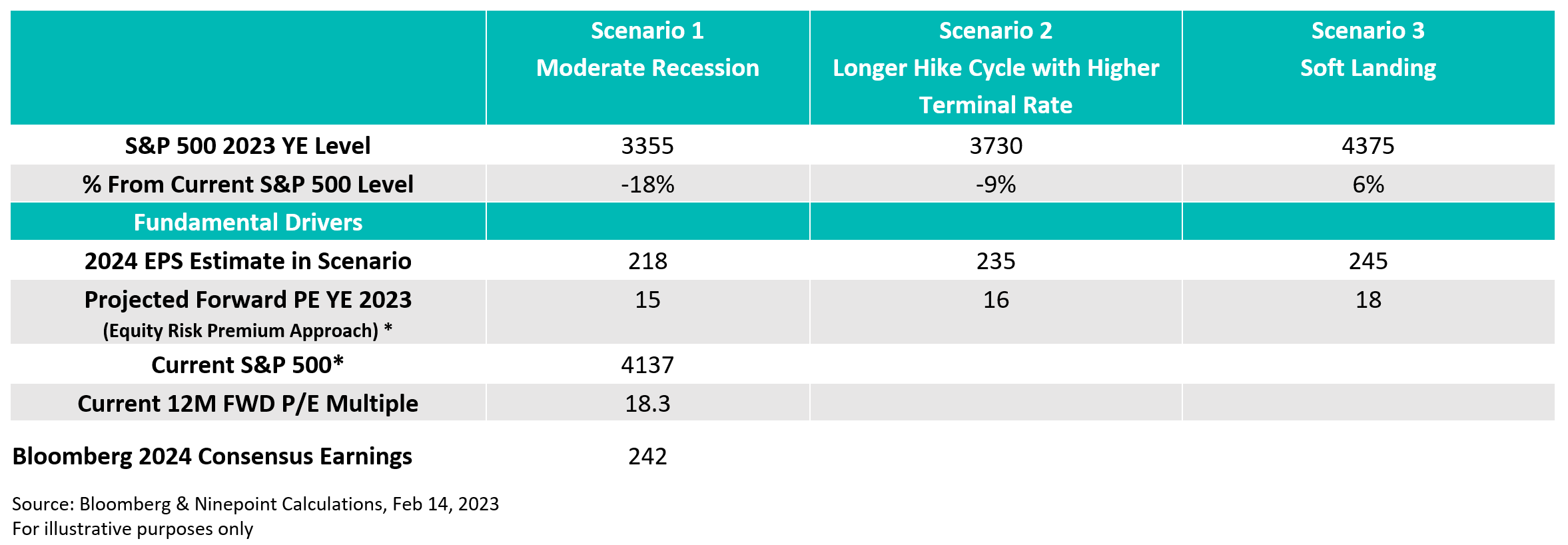

Below we provide several simplified scenarios to help frame the risk/reward from here. Needless to say, we expect a continued challenging environment for many long-only equity investment strategies given the lower return/higher risk regime. We believe options-based income strategies are better equipped to handle and potentially generate stronger risk adjusted returns vs. traditional equity long only approaches in a broader set of likely scenarios.

Until Next Time,

Colin Watson

Portfolio Manager

Ninepoint Partners

Why Invest in the Ninepoint Target Income Fund?

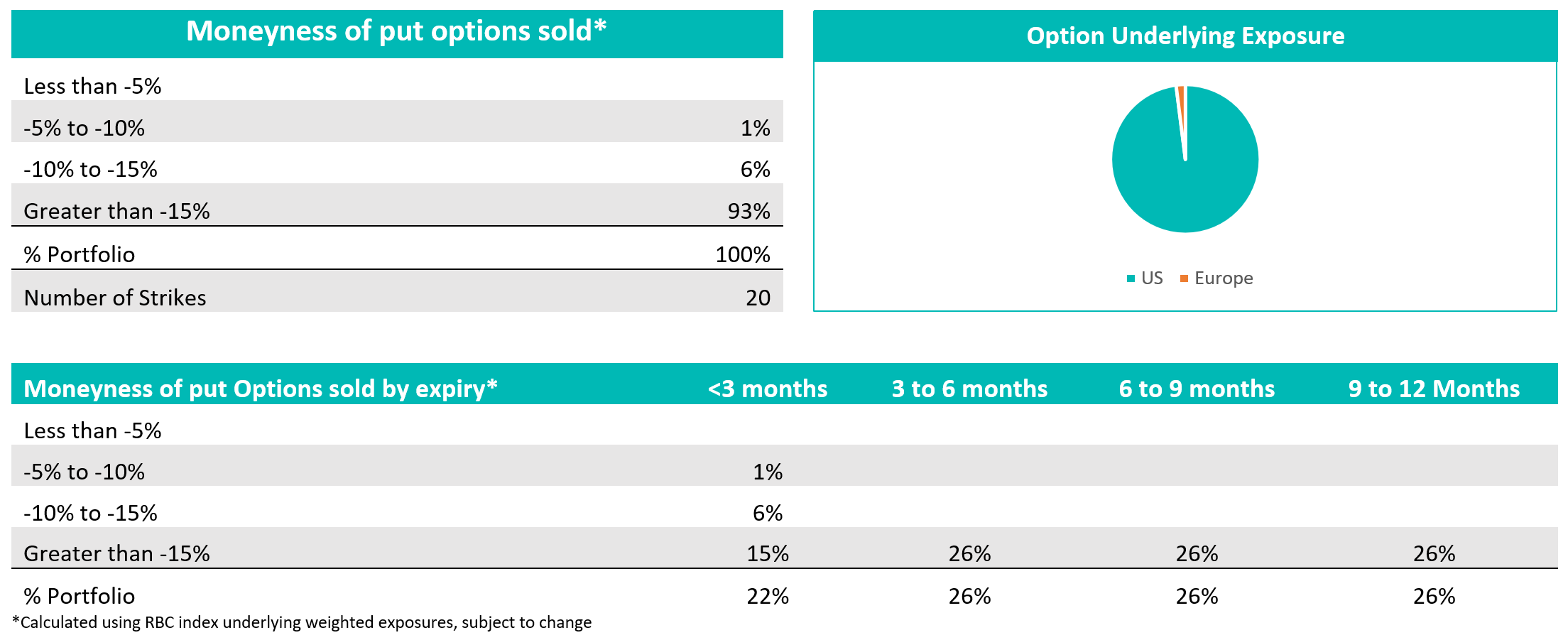

• Targeted Equity Yield: The Target Income Fund utilizes a cash covered put selling strategy to target a 6% yield while potentially providing investors with a downside buffer against market declines.

• Accessible: Offered in a low-medium risk rated traditional mutual fund structure with daily liquidity at NAV

• Income Potential & Diversification: A competitive target yield vs equity long only approaches while seeking to provide diversification for income portfolios during challenging equity markets.

• Execution Partnership: Leverages RBC Quantitative Investment Solutions diversified, rules based put selling strategies to generate income and diversification.

Ninepoint Partners LP is the investment manager to the Ninepoint Funds (collectively, the “Funds”). Important information about the Ninepoint Partners LP Funds, including their investment objectives and strategies, purchase options, and applicable management fees, performance fees (if any), other charges and expenses, is contained in their respective simplified prospectus, long-form prospectus or offering memorandum. Please read these documents carefully before investing. Commissions, trailing commissions, management fees, performance fees, other charges and expenses all may be associated with investing in the Ninepoint Partners LP Funds. Unless noted otherwise, the indicated rates of return for one or more classes or series of units or shares of the Ninepoint Partners LP Funds for periods greater than one year are based on historical annual compounded total returns and include changes in unit/share value and reinvestment of all distributions or dividends, but do not take into account sales, redemption, distribution or optional charges or income taxes payable by any security holder that would have reduced returns. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

The information contained herein does not constitute an offer or solicitation by anyone in the United States or in any other jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. Prospective investors who are not resident in Canada should contact their financial advisor to determine whether securities of the Ninepoint Partners LP Funds referred to on this website may be lawfully sold in their jurisdiction.

The Ninepoint Target Income Fund is generally exposed to the following risks. See the simplified prospectus of the Fund for a description of these risks: Absence of an active market for ETF Series risk; Concentration risk; Currency risk; Derivatives risk; Foreign investment risk; Halted trading of ETF Series risk; Inflation risk; Interest rate risk; Liquidity risk; Market risk; Securities lending, repurchase and reverse repurchase transactions risk; Series risk; Short selling risk; Substantial unitholder risk; Tax risk and Trading price of ETF Series risk.

Ninepoint Partners LP: Toll Free: 1.866.299.9906. DEALER SERVICES: CIBC Mellon GSSC Record Keeping Services: Toll Free: 1.877.358.0540