Ninepoint Alternative Health Fund

February 2023 Commentary

Summary

In this month’s commentary, we go deep into the Alt Milk market, discussing the key drivers of demand and how that is gaining traction around the world. We show that it's not just the taste and not just the avoidance of dairy. There is health, environment as well as supply issues at play. At the same time, the “trade down” for consumers is affecting brands for all goods, especially grocery, pharmacy and health care. In this month’s commentary, we discuss how key names in the portfolio are well positioned for this change in consumer behaviour as inflation and higher interest rates play on consumer wallets. In the cannabis sector, we detail recent earnings reports from our top ten holdings and note that despite solid Q4 results, sentiment has become almost universally bearish as analysts’ estimates are trimmed to reflect the current environment. We are encouraged by this as it represents the capitulation necessary to begin the next phase of market growth.

February Update

The month of February saw much of the enthusiasm from January’s tech trade roll-off as investors continued to digest challenging economic data. On February 1st Fed Chairman Powell raised interest rates by an additional 0.25%, and by not going to 0.50% chose not to push his hawkish view that inflation is still a concern. The next FED meeting is scheduled for March 22nd where an additional rate hike is a virtual certainty given recent economic data. The window for markets to keep pushing the soft-landing narrative is now extended and Fed Chairman Powell’s lack of pushback against easier financial conditions adds fuel to this narrative. At this moment the FED is suffering from a loss of credibility. Capital market participants simply do not believe him.

We see overall equity markets being challenged with; weakened consumer sentiment; fears of a US Fed focussed on further rate hikes; massive tech layoffs yet still seeing inflationary pressures in groceries and housing. But we believe that the combination of healthcare, pharmaceuticals, health and wellness and cannabis all exhibit stable growth, with inelastic demand features within each sector. In addition, many of the leading companies in our portfolio are trading at multiples either below their peer groups or are generating significant cash flows that are important stabilizers when inflationary pressures and higher interest rates reduce sentiment for growth stocks.

Growth in Demand for Alt Milk Continues

A top ten holding of the Fund is Sunopta (STKL), one of the largest alt-milk providers in North America. We believe that this company represents a great way to gain exposure to this health and wellness trend. Future Market Insights sees the alt dairy category growing to $20 billion in sales worldwide in 2023. The growth rate for alt milk had a CAGR (compound annual growth rate) of 7.8% in the last five years and is expected to grow with a CAGR of 10% over the next 10 years. This is at a time when dairy milk consumption around the world has come off. In Canada, per capita milk consumption, has fallen by 14.5% between 2015 and 2021.1

Alt-milk’s global market share of the overall milk market has increased from 5.9% in 2017 to 9.4% in 2022, based on data from IRI, a market research group. Worldwide sales of alt-milks are growing steadily, driven by several drivers; chronic lifestyle diseases such as heart disease and type 2 diabetes and chronic kidney disease; a growing recognition of lactose intolerance, in addition to a global goal to reduce the environmental impact related to dairy farming.

On the health front, research released in Lancet back in 2017, estimated that approx. 66% of the global population is unable to digest or completely digest lactose, a sugar found in milk. Lactose intolerance is most common in Asia, the Middle East and Africa and to meet that demand plant-based milk is a good substitute since they contain no lactose. While milk producers have come out with lactose free milk, those account for 7% of overall milk sales while alt-milks are over 11% of the overall market for milk and alt-milk consumption.

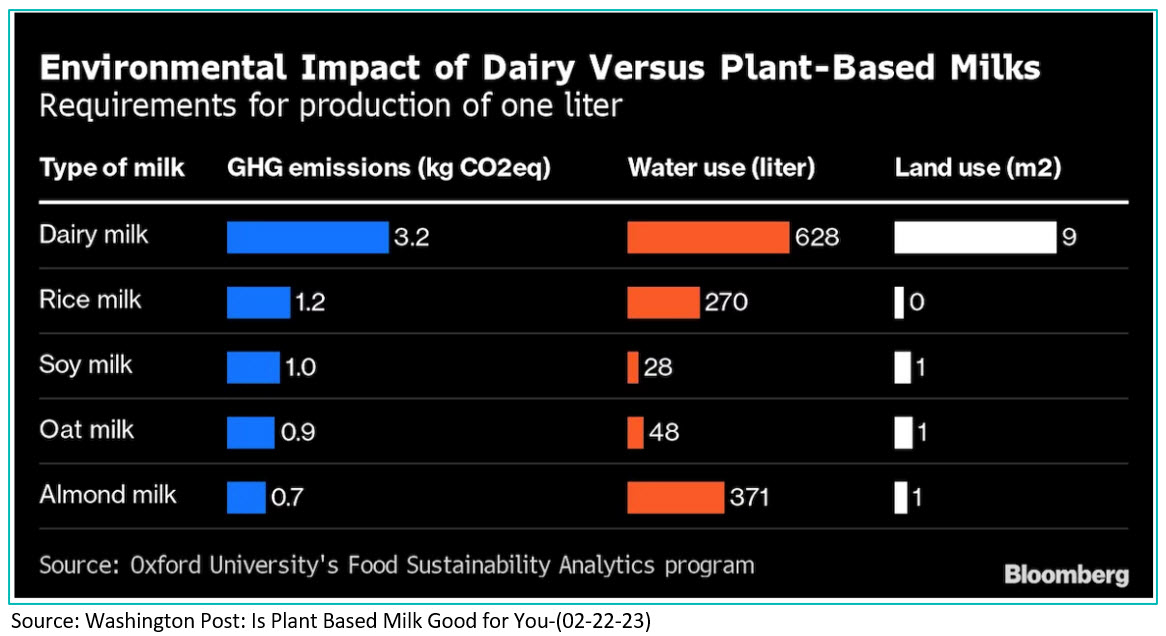

On the environmental side, consumers are motivated by concerns around dairy farming practices as cows emit the greenhouse gas methane, estimated at 3% of all greenhouse gas emissions related to societal activities. There are also those activists who have raised concerns about the living conditions and steroid use as part of the growth of cows. Alt-milk producers have also been criticized for the amount of water required to grow ingredients for al-milk. However, as the chart below illustrates from the Food Sustainability Analytics program at Oxford University, dairy milk is significantly more water-intensive than alt-milk.

Macro View on The Consumer: The Trade Down

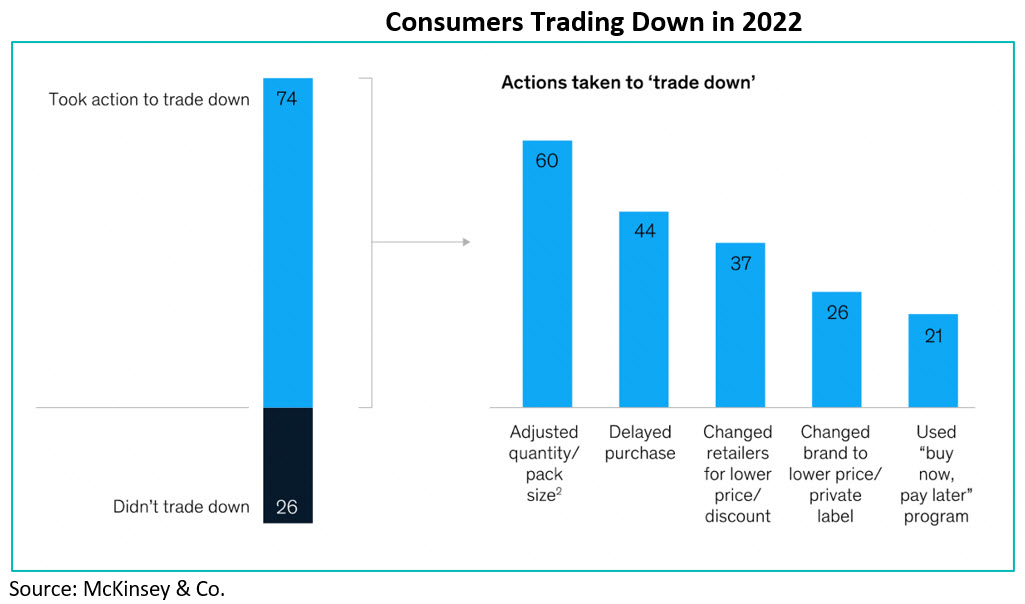

In a recent survey, McKinsey and Company found that 75% of consumers have reported trading down, whether that involves changing to a lower-priced retailer (dollar stores or club stores), switching to private label brands or buying brands that issue coupons. What is telling is that the trade down taking place in the latter part of 2022 and into 2023 was seen across all income ranges and demographic categories with 87% of younger purchasers (18-25 years old) trading down vs 67% of those 58+ years old.

Consumers Trading Down 2022

As recessionary pressures continue to weigh on consumers, the “trade down” continues with consumers looking for value and one area that benefits is the private label food category. According to the Private Label Manufacturers Association, store brand sales grew 11% to $228 billion in 2022 as the inflationary environment led to higher prices for all basic needs.

We believe that the Ninepoint Alternative Health Fund is able to provide upside potential with select names that are best positioned to take advantage of the trade down. In early 2023, one of the Fund’s positions, Sunopta (STKL) is poised to gain market share from the growth of demand in the alt milk category. In the pharma OTC market, Perrigo (PRGO) is a leader in the pharma self-care market with a broad mix of products that offer value to consumers. Costco (COST) also offers a very strong suite of private label products across grocery and health products.

US cannabis Update

Many US cannabis names now trade at very attractive multiples and our key positions have multiples that represent excellent value with portfolio top ten holdings Trulieve Cannabis (TRUL) trading at 4-5X, while Green Thumb Industries (GTI) trades at 6-7X EBITDA. It's worth noting that GTI released Q4 results, detailed below with a record Cash Flow generated in Q4 of $70 million. We believe it's best to look at each company individually rather than just exclude the sector. There are diamonds in the rough if you know where to look.

An interesting step forward is that California Gov. Newsom is in the process of approving Inter-State Commerce for Cannabis shipments. A key here is regardless of whether it passes or not, it puts pressure on US Attorney General Garland to do something. If the DOJ does nothing they are implicitly allowing interstate commerce and trade of cannabis. A better and more clear response would be a reinstatement of the COLE MEMO, which would now be called the GARLAND MEMO. Cole was an Assist AG in the DOJ during the Obama Presidency that wrote the memo, directing the DOJ not to allow federal funding to take enforcement action against legal cannabis in those jurisdictions where it is allowed. On March 1st, US Attorney General Merrick Garland discussed the likelihood of an updated “Cole Memo” that should have positive implications for capital raising and listing opportunities for US based cannabis companies.

We also note that in 2023 there are several states opening for recreational sales. Those in addition to NJ that is tracking at more than 35% above estimates since opening in April. MD is the next state that can move the needle, already generating $500 million in Medical Cannabis revenue going to $2 billion at maturity. We also have MO which began recreational sales in February, although not of the size of MD but still more States continue to open adult use markets.

Quarterly Financial Summaries

Sunopta (STKL) a leading US supplier of plant based milk generated revenue for the year that reached $935 million meeting consensus expectations with a significant beat on its EBITDA of $84 million above the $76-80 million guidance range. Total revenues in Q4 were $221.3 million with growth in revenues due to price increases of 10% along with a 4.7% increase in volume/mix. The Plant-Based segment generated revenues of $138.6 million in Q4, an increase of 10.8% YoY. Gross profit in Q4 was $28.2 million or 56.4% despite higher costs related to the new manufacturing plant in Texas while adjusted EBITDA was up 122.7% to $23.5 million. Adjusted earnings were $2.1 million or $0.02 per diluted common share, compared to a loss of $5.2 million or $0.05 per diluted common share in the prior year period.

STKL had Q4 double digit sales growth in oat, almond, soy and coconut milk (its four largest product types). Its sales to its largest customers (one is Starbucks) also saw double digit growth. STKL oat milk growth was 37% in the quarter compared to the overall growth of the oat milk market at 23%, showing industry leadership in a growing segment. More importantly, management provided guidance of 14 to 20% for 2023 with revenue to reach $1.0 - $1.05 billion and EBITDA to $97 to 103 million, in line with consensus expectations driven by further growth with the new Texas plant up and running to meet market demand.

Jamieson Wellness (JWEL) continues to execute on its US and China expansion with Q4 revenue coming in at $194 million with overall sales growth of 72% YoY. The primary drivers of growth were its 42% growth in China and growth from the US expansion post Youtheory acquisition last summer. Domestic Canadian market growth witnessed 5.6% growth, which is still the largest market for JWEL. Adjusted EBITDA came in at $49 million with earnings per share (EPS) of $0.62 while operating cash flow was $41 million.

To assist JWEL in its expansion in the important Chinese market, the company announced an equity investment partnership in JWEL’s China operations with DCP Capital Partners. DCP is investing $47 million and will receive a 33% interest in the Chinese business. DCP is also investing $102 million in newly issued preferred shares at the parent company level (no par value) with warrants exercisable into 2.5 million shares at $40.19, which based on the current market, represents a 20% premium. The company now has a significant capital base upon which to grow its Chinese operation and continue to gain a share in that lucrative market.

Perrigo (PRGO) a provider of high quality consumer OTC self-care products reported Q4 results with net sales of $1.2 billion, while full year results generated net sales of $4.5 billion. 2022 was a year where previous acquisitions gained traction as the company executed its plan to become a leading self-care, OTC health products company. Gross margin was 33.1%, illustrating a 350 basis point improvement YoY, benefiting from the 2021 acquisition of HRA that added (over the counter) OTC self-care brands in blister care, women’s health and scar care. Cash and cash equivalents totalled $601 million as of year-end, and adjusted diluted EPS for 2022 was $2.07, as compared to $2.06 in the prior year.

Areas of growth include Nutrition (infant formula) up 32% supported by the fourth quarter purchase of the Gateway infant formula facility and U.S. & Canadian GoodStart® brand from Nestle as PRGO tried to assist in meeting the demand of a U.S. infant formula shortage. Other areas of growth were; Skincare was up 10.8%, vitamins, minerals and supplements sales increased by 11.2%, Oral Care increased by 13.7% and women’s health increased by 32.6%. A benefit from the 2021 acquisition of HRA.

Green Thumb Industries (GTI) a top Fund position in the US cannabis space operates in 15 state markets including California, Colorado, Connecticut, Florida, Illinois, Maryland, Massachusetts, Minnesota, Nevada, New Jersey, New York, Ohio, Pennsylvania, Rhode Island, and Virginia. The company announced solid Q4-22 financial results despite a backdrop of higher promotions due to Thanksgiving and Christmas and “croptober” pricing pressures. GTI delivered a strong quarter that brought 2022 results with 14% revenue growth; $160 million in Cash Flow from Operations, net of taxes paid of $120 million.

Q4 revenue was $259 million up 6% YoY beating consensus of $257 million while adjusted EBITDA came in at $81 million or 31% of revenue, again ahead of consensus estimates of $80 million. Gross profit for Q4 was $124 million or 47.8% vs $128 million or 52% in Q4-21. For the quarter, the company generated record breaking cash flow from operations of $70 million with total cash at quarter end of $178 million. Keeping in mind concerns that market participants have with consumer discretionary, we see GTI standing out despite the effects of inflation, and price compression in certain state markets (IL, PA, MA and NV) volume demand continues to grow along with efficient execution by GTI, the company was able to produce record cash flow generation in Q4.

For the year, GTI generated over $1 billion in revenues, 14% higher than the FY 2021 and over $311 million in EBITDA or 31% of revenue. For the year, gross margin reached $504 million or 49.5% of revenue. Cash Flow from operations was $159 million with GAAP net income of $12 million or $0.05/share. Given the challenging operating environment within which US cannabis companies operate, GTI stands out with a strong Balance Sheet with current assets of $350 million including cash of $177 million while total debt is $276 million. Upside potential for GTI in 2023 focuses on consistent demand growth; price stabilization in some key markets where competitor attrition is beginning to set in; and increased cultivation and store counts in select markets.

Trulieve Cannabis (TRUL), is another top Fund position in the US cannabis space operating the largest U.S. retail cannabis network of 181 dispensaries with over 30% of its retail footprint outside its home state of Florida. TRUL operates in 11 state markets including Florida, Pennsylvania, Arizona, California, Colorado, West Virginia, Maryland, Ohio, Massachusetts, Connecticut, and Georgia. TRUL announced Q4-22 financial results that produced quarterly revenue of $302 million, with 2% retail revenue growth QoQ. Topline revenues were off expectations with inflationary headwinds impacting wholesale revenues and consumer headwinds leading to a “trade down” from mid-tier products to value priced products. From a management’s Q4 call, premium flower continues to sell well and has not seen pricing pressure or loss of market share. Despite these macro forces, TRUL was able to generate a gross margin of 50%, adjusted EBITDA of $85 million and free cash flow of $21 million in Q4.

Full year results were impressive with revenues of $1.2 billion, an increase of 32% year-over-year. Full year gross profit was $682 million or a gross margin of 55% in 2022 while adjusted EBITDA was $400 million, or 32% of revenue. Cash at year-end stood at $219 million illustrating solid cash management and long term operational efficiency. Management’s 2023 guidance outlined a singular goal of reaching $150 million in operating free cash flow which is forecasted to be after 5 tax payments that will be paid in the calendar year of 2023. In addition, the operational focus will include the full ramp up of the company’s flagship JeffCo (Jefferson Country) 750,000 sq ft processing and cultivation facility that will lower operating costs going forward. The process of getting JeffCo to the full ramp is being achieved while legacy facilities are getting wound down, with inventory management being the key. We also highlight our note above, the significant catalyst for the state of FL where TRUL is the leading operator, with a ballot initiative on recreational cannabis has now cleared a significant hurdle. FL is already the 3rd largest cannabis state market generating over $1 billion in revenues in the US, even though it is a medical only state. When one considers adult usage of cannabis, the opportunity with the state’s annual tourism bringing in approximately 130 million visitors, FL is poised to grow significantly in the next 18 months.

Option Strategy

Since the inception of the option writing program in September 2018, the Fund has generated significant income from options premiums of approximately $4.68 million. We will continue to utilize our options program to look for attractive opportunities given the above average volatility in the sector as we strongly believe that option writing can continue to add incremental value going forward.

During the month we used our options strategy to assist in rebalancing the portfolio in favour of names we prefer while generating approximately $43,000 in options income. We continue to write covered calls on names we feel are range bound near term and from which we could receive above average premiums which included Eli Lilly and Co (LLY), Tilray Brands Inc. (TLRY), Merck & Co. (MRK) and UnitedHealth Group Inc. (UNH). We also continue to write cash secured puts out of the money at strike prices that offered opportunities to increase our exposure, at more attractive prices, to names already in the Fund including Tilray Brands Inc. (TLRY), Procter & Gamble (PG), Merck & Co Inc. (MRK), and Bristol-Myers Squibb Co (BMY).

The Ninepoint Alternative Health Fund, launched in March of 2017 is Canada’s first actively managed mutual fund with a focus on the cannabis sector and remains open to new investors, available for purchase daily.

Charles Taerk & Douglas Waterson

The Portfolio Team

Faircourt Asset Management

Sub-Advisor to the Ninepoint Alternative Health Fund

1https://www.statista.com/statistics/438584/consumption-of-milk-per-capita-canada/

Ninepoint Alternative Health Fund - Compounded Returns¹ as of February 28, 2023 (Series F NPP5421) | Inception Date - August 8, 2017

| MTD | YTD | 3MTH | 6MTH | 1YR | 3YR | 5YR | INCEPTION (ANNUALIZED) |

|

|---|---|---|---|---|---|---|---|---|

| FUND | -1.7% | -5.2% | -19.0% | -18.2% | -32.7% | -4.3% | -2.2% | 4.8% |

| TR CAN/US HEALTH CARE BLENDED INDEX | 2.9% | 10.6% | 0.1% | 2.5% | -27.7% | -13.3% | -11.3% | -6.3% |

Statistical Analysis

| FUND | TR CAN/US HEALTH CARE BLENDED INDEX | |

|---|---|---|

| Cumulative Returns | 30.4% | -30.5% |

| Standard Deviation | 28.2% | 30.0% |

| Sharpe Ratio | 0.1 | -0.2 |

1 All returns and fund details are a) based on Series F units; b) net of fees; c) annualized if period is greater than one year; d) as at February 28, 2023. The index is 70% Thomson Reuters Canada Health Care Total Return Index and 30% Thomson Reuters United States Healthcare Total Return Index and is computed by Ninepoint Partners LP based on publicly available index information.

The Fund is generally exposed to the following risks. See the prospectus of the Fund for a description of these risks: Cannabis sector risk; Concentration risk; Currency risk; Cybersecurity risk; Derivatives risk; Exchange traded fund risk; Foreign investment risk; Inflation risk; Market risk; Regulatory risk; Securities lending, repurchase and reverse repurchase transactions risk; Series risk; Specific issuer risk; Sub-adviser risk; Tax risk.

Ninepoint Partners LP is the investment manager to the Ninepoint Funds (collectively, the “Funds”). Commissions, trailing commissions, management fees, performance fees (if any), and other expenses all may be associated with investing in the Funds. Please read the prospectus carefully before investing. The indicated rate of return for series F shares of the Fund for the period ended February 28, 2023 is based on the historical annual compounded total return including changes in share value and reinvestment of all distributions and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The information contained herein does not constitute an offer or solicitation by anyone in the United States or in any other jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. Prospective investors who are not resident in Canada should contact their financial advisor to determine whether securities of the Fund may be lawfully sold in their jurisdiction.

The opinions, estimates and projections (“information”) contained within this report are solely those of Ninepoint Partners LP and are subject to change without notice. Ninepoint Partners makes every effort to ensure that the information has been derived from sources believed to be reliable and accurate. However, Ninepoint Partners assumes no responsibility for any losses or damages, whether direct or indirect, which arise out of the use of this information. Ninepoint Partners is not under any obligation to update or keep current the information contained herein. The information should not be regarded by recipients as a substitute for the exercise of their own judgment. Please contact your own personal advisor on your particular circumstances. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds managed by Ninepoint Partners. Any reference to a particular company is for illustrative purposes only and should not to be considered as investment advice or a recommendation to buy or sell nor should it be considered as an indication of how the portfolio of any investment fund managed by Ninepoint Partners is or will be invested. Ninepoint Partners LP and/or its affiliates may collectively beneficially own/control 1% or more of any class of the equity securities of the issuers mentioned in this report. Ninepoint Partners LP and/or its affiliates may hold short position in any class of the equity securities of the issuers mentioned in this report. During the preceding 12 months, Ninepoint Partners LP and/or its affiliates may have received remuneration other than normal course investment advisory or trade execution services from the issuers mentioned in this report.

Ninepoint Partners LP: Toll Free: 1.866.299.9906. DEALER SERVICES: CIBC Mellon GSSC Record Keeping Services: Toll Free: 1.877.358.0540

Related Funds

Historical Commentary

- Alternative Health Fund 12/2023

- Alternative Health Fund 11/2023

- Alternative Health Fund 10/2023

- Alternative Health Fund 09/2023

- Alternative Health Fund 08/2023

- Alternative Health Fund 07/2023

- Alternative Health Fund 06/2023

- Alternative Health Fund 05/2023

- Alternative Health Fund 04/2023

- Alternative Health Fund 03/2023

- Alternative Health Fund 01/2023