Bilan et perspectives du marché S1 2022

21 Juillet 2022

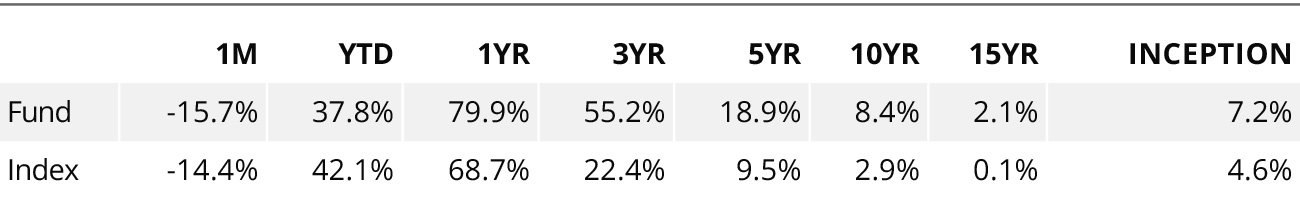

NINEPOINT ENERGY FUND - COMPOUNDED RETURNS¹ AS OF JUNE 30, 2022 (SERIES F NPP008) | INCEPTION DATE: APRIL 15, 2004

Transcript

Eric Nuttall: Hi, it's Eric Nuttall, of the Ninepoint Energy Fund and Ninepoint Energy Income Fund. The purpose of the discussion today is to review the first half of 2022, and what a year it's been for energy investors. We started off with the impact of Russia's invasion of Ukraine, concerns about an implosion Russian oil imports or exports rather than the oil price increasing on that, oil strengthened. We saw a high of into the 130s, and there was then discussions about OPEC's spare capacity exhaustion.

I had a meeting with the former Secretary General of OPEC, who subsequently passed away a few weeks afterwards. Speaking about the exhaustion of OPEC's spare capacity, it was a grave danger that the world has to come to grips with. Then a few weeks later, more and more headlines began about a recession, a possible recession in Europe, certainly from the energy crisis as a result of extremely poor energy policy. Now it's increasing and seemingly every day we get more and more headlines, interest rates going up, inflation, and the impact on the consumer, et cetera. That's been impacting oil.

We find ourselves today in an environment where the physical demand for oil remains very strong and yet the financial demand for oil has weakened. That's a very, very important distinction to make. Oil's the biggest commodity in the world. We trade about 100 million barrels of it every single day, and yet 30 times more than that is traded on a daily basis in all of the financial markets combined. You can have these weird periods of time, which today we're in, oil's down $4 today. Well, did anything fundamentally occur? There's no headline, there's no magical large field discovered overnight coming online, demand didn't implode by 10 million barrels per day, et cetera.

You can just have these times, these air pockets. Here we are in the summertime, volatility is exacerbated. The net speculative length in oil has come down, it has over the past several months. We're prone to these days of volatility and that's why I really think we need to tune out the noise. The biggest challenge for an energy investor today is, to tune out the noise, try to best ignore the volatility, and focus on the fundamentals because ultimately it's fundamentals that will rule the day. Why do we still believe we're in a multi-year bull market for oil? Why do we think this is not a one-month trade but is more like a four to six-year investment at a minimum?

It comes back to our four basic tenants of the thesis, and that is demand will grow, I think by about a million barrels per day per year for at least the next 10 years. The real story remains on supply. We believe we're in a world where US shale growth is constrained. It's constrained because the very owners of the businesses are demanding a return of capital, meaning share buy-backs and dividends, both base and variable dividends. That's restricting how much shale companies can spend.

At the same time, we just had service companies like Halliburton report and say, basically that they're sold out of their equipment. They're fully utilized and they're not building any more equipment because their own investors want buy-backs, dividends, et cetera. When people worry about a recession, they're forgetting that this environment that we're in today is very, very different. There is no playbook for the environment that we're in today.

Never has there been a time when the world is emerging from a global lockdown, which China's still under lockdown, which reflect on that, we've averaged close to $100 per barrel, if not slightly more so far this year. China being under full lockdown because of their COVID policies and during the biggest release of barrels from the Strategic Petroleum Reserve in history, which is masking the tightness in the market. These worries about a recession and the impact when people think the demand suddenly implodes periods of negative demand growth i.e. when demand actually falls are very, very rare.

You've got to go back to COVID. You've got to go back to the financial crisis of 2009, and then you've got to go all the way back to the early 1980s. When we look to next year, I know people worry about a European recession, et cetera they forget that China should be emerging out of lockdown. That's an additive of over a million barrels per day of incremental growth. Even if the rate of growth moderates, we have some firms like Energy Aspects with whom we did a webcast, it's on our website. I've got it pinned on my Twitter feed. If you haven't listened to it, listen to it because it provides some comfort in terms of, even if we go into recession, what does it mean for oil? What they're doing is they're already modelling a recession in Europe. I believe they even for the United States, second half of next year, recession, moderation growth rates, they still have oil demand growing by 900,000 barrels per day. A recession does not necessarily mean negative demand growth. It means a moderation in the rate of demand growth, but at the same time, again, the story remains on supply.

US shale - I had a meeting yesterday with Tudor, Pickering. I think is one of the best analysts that covers US EMPs. He said that from the recent volatility in oil combined with FEARS (false evidence appears real), other recession next year, more and more shale companies that he's talking to are adopting what's called a maintenance mode budget for next year, i.e. keep production flat, we're not getting paid to gross. Why should we? Just de-lever, payout dividends, do share buybacks, et cetera, everyone's happy.

We think that next year and going forward, you're looking at US shale growth of 500,000-700,000 barrels per day per year. The other leg to the stool of the multiyear bull market thesis in terms of supply revolves around OPEC. I mentioned I had dinner with Secretary-General Barkindo about a month and a half ago, he passed away about two weeks ago, very unexpectedly, very warm man, very open, and shockingly honest. He said to an open room earlier that day, and then at dinnertime, that OPEC is nearing the exhaustion of its spare capacity.

In my opinion, this will be a watershed event for the energy sector as important if not more, than the end of US shale hypergrowth because we've always had as a world, spare capacity to be that shock absorber. If there's a geopolitical event like Russia invading Ukraine, where there's an actual impact on supply, they have capacity to bring onto the market, they no longer have that. Two days ago we had the crown prince of Saudi Arabia in a very wide-ranging speech, which that part of it was not reported properly. He said that, yes, we are growing spare capacity to 13 million barrels per day, but it reinforces the theme that we've talked about, which is cycle time.

He said it's going to take till 2027, that wasn't new. We've talked up with that before. Again, it's taking the most sophisticated oil company on this planet five years to add one million barrels per day, per year of productive capacity. That's one year of demand growth. When you think about that, the other thing he said was, "At that point, our production will be capped. We are no longer pursuing additional spare capacity." He's warning the world as the former Secretary General of OPEC warned the world, that it's not just on OPEC's shoulders, they cannot shoulder the burden anymore.

Yet when we look to the global super majors, this is the third major tenet of our multiyear bull market thesis. They're not investing, ESG pressures - even with the energy crisis that we have in Europe, which should have been a teachable moment for energy policymakers, what do you have? You have the UK government coming after companies with windfall profit taxes, injecting more uncertainty in the fiscal environment, hampering investment, and then taking money, from the oil companies, and giving it to consumers to basically buy votes, but that's you basically subsidizing demand.

We need the opposite. The only way this market balances is to increase supply and to lower demand, naturally it's through higher oil prices. The environment that we're in now, yes, oil's volatile and it's up and down, and trust me, I share the stress and the annoyance of having to watch that, but I'm focusing on what matters on your behalf and that is demand remains strong, relatively strong, but the real story is on supply. US shale growth is capped. OPEC is running out of spare capacity.

The super majors at best are flat until the end of this decade and these release of Strategic Petroleum Reserve from the US magically stops right ahead of a midterm election this fall time. Our expectation, summer who knows, it's going to be up and down volatile. Every single day, the free cash flow aggregates in the bank accounts of energy companies. Even if the stock price falls 5%, the free cash flow is not falling. When we look to Q3, Q4, we see as demand incrementally grows seasonality, and as China should be emerging at some point out of lockdown, and as the release from the SPR (Strategic Petroleum Reserve) ends, it should become more and more obvious just how chronically undersupplied the market is propelling the oil price up.

Again, we've referenced Energy Aspects. They're still calling for $120 Brent by the end of this year. Mike Rothman from Cornerstone remains very, very bullish, his price is even higher than that in relation to where inventories are going. We remain bullish. What does that mean for energy stocks? Performance so far this year has been great, not as good as it was two months ago. We've just had the biggest drawdown since March of 2020 as recessionary fears and concerns have increased.

What my main message to you would be is we've seen absolutely zero deterioration on fundamentals to explain that selloff. We look at our fund, we have 13 holdings in the Ninepoint Energy Fund (As at June 30, 2022). The average name is trading at 1.7 times enterprise value to cash flow at $100 oil. Our average holding is 16 years of state flight inventory. My math is I do 16 years of state flight inventory i.e. 16 years of free cash flow. We're paying for only two of them. I'm getting 14 years of free cash flow for free. Yet the average name is trading at a 38% free cash flow yield at $100 oil.

We have a seat at the table in terms of strategy and the mindset and what they're going to do with free cash flow and how much we're going to get to it. All of our holdings have pledged to us that we will get at a minimum 75% of the free cash flow next year, that's our ask of our holdings. If they disagree with that, we're going to have an issue.

Even if you want to get super negative on the oil price where we're in a mega recession, financial crisis, where demand is actually going to fall by 800,000 barrels per day. Sure. Certainly doesn't feel like '09. I managed the fund through '09, I know what it felt like, but let's just go there. We had Energy Aspects say, well, given how tight the market is and we would agree with this, they say, "Well, we have a difficult time seeing oil falling below $80." Take $20 off the oil price. Our average holding is still only trading at 2.2 times enterprise value cash flow limit and a 26% free cash flow yield.

This in a sector which will be debt free should they want to be by Q1 of next year. Even at a $80 oil price, if we get 75% of that free cash flow, that's a 20% yield either in a buyback or a dividend. In terms of catalyst, we've got Q2 results coming. We think we're going to see more and more announcements of share buybacks, of dividend increases. I think increasingly you're going to hear conversations around SIB (Significant Issuer Bids), where in Canada buybacks are constrained at 10% through an NCIB (Normal Course Issuer Bid). Companies we saw Imperial oil do it.

You can do an SIB for incremental shares above that. Given how profoundly mispriced these stocks are relative to where oil is, free cash flow, balance sheet strength. I expect some of our holdings and more and more companies are going to start talking about in Q4, if things remain the same, they'll be aggressive with SIB. That's going to be even another catalyst.

Just to wrap up, when we look at the physical demand for oil, it remains strong. The constraints on supply globally, going forward, remain intact. OPEC's spare capacity exhaustion comes, we have experienced the end of US shale hypergrowth. The supermajors are not investing. That my simple math is I say, okay, well I think demand for oil's going to grow by about at least a million barrels per day per year for the next 10 years. US shale can at best make up for half of that. We've got a 5 million barrel per day deficit. Saudi said, okay, they're going to grow by two, go from 11 to 13. We've got 3 million barrel per day deficit.

When I look at other areas of the world, like a Guyana, cannot offset the declines that we're seeing elsewhere due to that lack of spending. My simple mind says, okay, the math doesn't add up, we're in a structural imbalance for several years going forward. The only way to balance is the oil price has to go high enough to kill discretionary demand and incentivize the super majors who are experiencing on investments and ESG just start investing again. Even when they do, you press start on the stopwatch and you've got four to six years because it's cycle time.

We think that energy stocks remain profoundly mispriced. We look at companies, I should not be able to buy companies on average at 38% free cash flow yields at the current oil price, which I think isn't fundamentally sustainable. Yes, we're going to whip up and down for the next couple of months or whatever until we get past the SPRs. At that point, it should become more obvious to the masses just how chronically undersupplied we are. That's the main message I want to impart on you. As always, if there's any other questions you have - always reach out. We're extremely accessible.

Follow me on Twitter. We used that as our primary mechanism to deliver daily updates and whatnot and enjoy your summer. We look forward to an even better update in the next several months ahead. Thanks very much.

1 All returns and fund details are a) based on Series F units; b) net of fees; c) annualized if period is greater than one year; d) as at June 30, 2022; e) 2004 annual returns are from 04/15/04 to 12/31/04. The index is 100% S&P/TSX Capped Energy TRI and is computed by Ninepoint Partners LP based on publicly available index information.† Since inception of fund Series F.

The Fund is generally exposed to the following risks. See the prospectus of the Fund for a description of these risks: concentration risk; credit risk; currency risk; cybersecurity risk; derivatives risk; exchange traded funds risk; foreign investment risk; inflation risk; interest rate risk; liquidity risk; market risk; regulatory risk; securities lending, repurchase and reverse repurchase transactions risk; series risk; short selling risk; small capitalization natural resource company risk; specific issuer risk; tax risk.

Ninepoint Partners LP is the investment manager to the Ninepoint Funds (collectively, the “Funds”). Commissions, trailing commissions, management fees, performance fees (if any), other charges and expenses all may be associated with mutual fund investments. Please read the prospectus carefully before investing. The indicated rate of return for series F units of the Fund for the period ended June 30, 2022 is based on the historical annual compounded total return including changes in unit value and reinvestment of all distributions and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The information contained herein does not constitute an offer or solicitation by anyone in the United States or in any other jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. Prospective investors who are not resident in Canada should contact their financial advisor to determine whether securities of the Fund may be lawfully sold in their jurisdiction.

The opinions, estimates and projections (“information”) contained within this report are solely those of Ninepoint Partners LP and are subject to change without notice. Ninepoint Partners makes every effort to ensure that the information has been derived from sources believed to be reliable and accurate. However, Ninepoint Partners assumes no responsibility for any losses or damages, whether direct or indirect, which arise out of the use of this information. Ninepoint Partners is not under any obligation to update or keep current the information contained herein. The information should not be regarded by recipients as a substitute for the exercise of their own judgment. Please contact your own personal advisor on your particular circumstances. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds managed by Ninepoint Partners. Any reference to a particular company is for illustrative purposes only and should not to be considered as investment advice or a recommendation to buy or sell nor should it be considered as an indication of how the portfolio of any investment fund managed by Ninepoint Partners is or will be invested. Ninepoint Partners LP and/or its affiliates may collectively beneficially own/control 1% or more of any class of the equity securities of the issuers mentioned in this report. Ninepoint Partners LP and/or its affiliates may hold short position in any class of the equity securities of the issuers mentioned in this report. During the preceding 12 months, Ninepoint Partners LP and/or its affiliates may have received remuneration other than normal course investment advisory or trade execution services from the issuers mentioned in this report.

Ninepoint Partners LP: Toll Free: 1.866.299.9906. DEALER SERVICES: CIBC Mellon GSSC Record Keeping Services: Toll Free: 1.877.358.0540

Fonds liés

Commentaire historique

- Stratégie énergétique Ninepoint 12/2018

- Stratégie énergétique Ninepoint 11/2018

- Fonds énergie Ninepoint : vue du marché

- Stratégie énergétique Ninepoint 08/2018

- Vue du marché sur le Fonds Énergie Ninepoint : 14 août 2018

- Vue du marché sur le Fonds Énergie Ninepoint : 26 juin 2018

- Stratégie énergétique 05/2018

- Stratégie énergétique Sprott 02/2018