Ninepoint Flow-Through Limited Partnerships

What are flow-through shares?

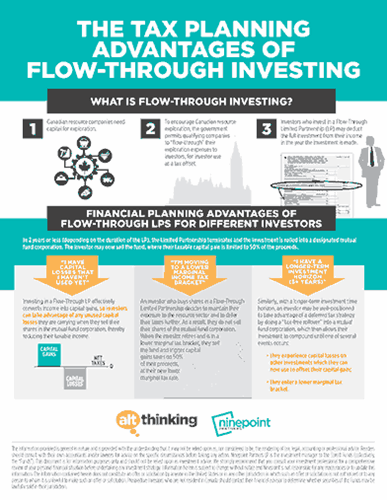

The Federal Government allows Canadian resource companies that invest in the oil and gas, mining and renewable energy sectors to fully deduct certain exploration expenses, known as Canadian Exploration Expenses (CEE). To raise capital for exploration, those companies often issue flow-through shares and pass along the rights to claim the CEE to the purchasers of those shares. The shareholders are then able to deduct the CEE against their own income.

Who should invest in flow-through shares?

Flow-through investing is most suitable for investors taxed at the highest marginal tax rates and who can accept the risk of investing in small to mid-size resource companies.

The Ninepoint Flow-Through Advantage:

- Breadth of manager with significant experience investing in the natural resource sector

- Ability to leverage Ninepoint’s existing relationships with hundreds of Canadian resource companies

- Ninepoint’s long history of investing in common shares of Canadian resource issuers

Flow-Through Limited Partnerships

Investors can access the flow-through market by purchasing shares directly or by investing in a flowthrough limited partnership. Flow-through limited partnerships are investment vehicles that add three important benefits to the tax advantages of flow-through investing: 1) professional management, 2) access to a broad range of flow-through issues, 3) diversification.

The risk of investing in smaller resource companies may be reduced when experienced, professional investment managers select a well-diversified portfolio of companies.

How do flow-through limited partnerships work?

Flow-through limited partnerships provide the same tax benefits as investing in flow-through shares directly. The amounts invested are generally fully or almost fully deductible against taxable income in the year the investment is made.

The illustration below shows how flow-through limited partnerships work.

Investors purchase units of a flow-through limited partnership and the net proceeds are used by the limited partnership to purchase the flow-through shares of resource companies. The resource companies relinquish their CEE rights to the limited partnership, which then allocates the CEE to its investors. The investors can then deduct the CEE against their income.

Most flow-through limited partnerships have a life span of one to two years, enough time to allocate most of the tax deductions to investors. The adjusted cost base of the units (ACB) is reduced by the tax deductions and increased by any capital gains from the investments sold within the limited partnership portfolio. Those capital gains are allocated to investors annually.

At termination, the flow-through limited partnership unitholders receive shares of a corporate class mutual fund and the rollover transaction is completed without triggering an immediate tax liability. This allows investors the option to defer their tax liability further, until they redeem the mutual fund.

More Information

- Flow-Through Tax Filing Guide

- Ninepoint Announces 2019 Flow-Through

- Flow-Through Investing Guide

- 4 Reasons to Consider Flow-Through Investing

- Flow-Through Tax Information