Ninepoint Alternative Health Fund

January 2024 Commentary

Summary

The Fund’s US cannabis names had a strong month to begin the year. The key driver improving sentiment occurred when the US Dept of Justice (DOJ) released the Health & Human Services (HHS) report that detailed the reasoning behind Re-Scheduling cannabis to Schedule III on the Controlled Substances Act (CSA) from the more restrictive and prohibitive Schedule I. This release was forced to be made public under Freedom of Information laws. Reaction to the HHS report was swift and generally positive. Also driving positive sentiment in the US cannabis sector were statements from Gov. Ron DeSantis of Florida on the approaching Florida Supreme Court decision approving a ballot initiative this November on transitioning the state of Florida to adult use. We believe that the early April decision by the state court will allow voters to decide next November. Despite the strong start YTD, as at the time of writing, US MSOs are trading at ~9x 2024 EV/EBITDA. When we consider the catalysts that could increase cash flow substantially, we see the potential for cash flow growth and subsequent multiple expansion to get closer to more traditional alcohol businesses that trade at ~16x. Valuation alone is generally not a catalyst but valuation AND pending material catalysts are. As we finally begin to proceed down the rescheduling path institutional interest and momentum in the space is building.

Leading names for the Fund this month include TRUL 84.86%, VRNO +43.65%, TSND +23.61% And GTI +22.7%. The Ninepoint Alternative Health Fund is up 14.82% for Series F to start the year.

Mid-January the US cannabis sector got a significant boost as the US Department of Justice was forced to release the entirety of the 252-page report from The Department of Health & Human Services (HHS) supporting its recommendation to the Drug Enforcement Agency (DEA) that cannabis should be moved from the more restrictive and prohibitive Schedule I to a Schedule III substance on the Controlled Substances Act (CSA). Since August, reports of the HHS recommendation were discussed however the full documentation and supporting research had not been made available. In fact, lack of clarity over the last five months has led to skepticism that the DEA wasn’t reviewing any information at all. The complete report was released due to a legal challenge issued against HHS under the Freedom of Information Act.

The released HHS documents illustrate the assessment standards used to analyze cannabis for medical purposes using an 8-factor approach that determines the most appropriate classification of a substance under the CSA. The amount of scientific evidence in the report confirming "Currently Accepted Medical Use" (CAMU) is a major positive step forward in supporting decades of claims by cannabis patients while also refuting negative and baseless claims by previous White House administrations, the DOJ and the DEA.

Key findings support marijuana’s low abuse potential compared to other drugs that are similarly rated on the CSA as Schedule III, in addition to showing that marijuana has currently accepted medical uses (CAMU) and is relatively safe and has a low risk of dependence.

Details of the HHS Schedule III recommendation include recognition that more than 35 states have implemented legal medical cannabis programs, that provide legal and medical frameworks, mitigating potential risks against abuse. In terms of whether cannabis has currently accepted medical uses (CAMU), supporting its medical properties, there are a number of indications for cannabis use (particularly chronic pain and relief from nausea caused by chemotherapy treatments) that illustrate support for cannabis as a legitimate medical treatment.

The HHS document states, “The available data indicate that there is some credible scientific support to substantiate the use of marijuana in the treatment of pain; anorexia related to certain medical conditions; and nausea and vomiting (e.g. chemotherapy-induced), with varying degrees of support and consistency of findings. In addition, “none of the evidence from the systematic reviews included in our analysis identified any safety concerns that would preclude the use of marijuana in the indications for which there exists some credible scientific support for its therapeutic benefit.”

HHS recognizes that although its review is focused on the medical use of cannabis, the existing market approach within each state provides for sanctioned non-medical (recreational) purposes. Despite the growth in recreational state markets, negative outcomes do not seem to be as serious or as fatal as other drugs currently classified as Schedule I or II, such as heroin, LSD, fentanyl, methadone or morphine. This leads to the reports’ next supportive finding discussing cannabis’ low risk to public health. The HHS report notes that the risk of harm from cannabis is significantly less than other drugs currently classified as Schedule I and states categorically that there is next to no mortality risk from overuse which is significantly different from other Schedule I substances that can cause fatal overdose. A final point in the HHS report that should be noted involves comparing non-medical cannabis usage to alcohol. This was a surprising comparator study for HHS as the primary focus was a medical comparison relative to other Schedule I, II and III drugs. Given the extent of non-medical use (recreational markets), HHS added a comparison to alcohol consumption to examine the potential for abuse in related markets. Overall, the report states that “the rank order of the comparators in terms of adverse outcome counts typically placed alcohol or heroin in the first or immediately subsequent positions, with marijuana in a lower place in that ranking… also observed for serious medical outcomes… where marijuana was in the lowest ranking group.” The comparisons illustrate that across many drugs and alcohol, marijuana abuse tends to be less common and less severe than alcohol, as well as other Schedule I, II and III drugs, suggesting that reduced restrictions are applicable.

Implications of Re-scheduling

We believe this is a meaningful step forward for the industry on several fronts. Most importantly, cannabis being re-scheduled to Schedule III would eliminate punitive Internal Revenue Code Tax 280E, enhancing net profit and free cash flow generation for all US plant touching businesses. As a reminder, all ordinary business expenses other than cost of sales are currently not deductible for cannabis companies, leaving companies to pay expenses such as rent, salaries, marketing costs, contract labor, equipment repairs, and interest expense, all after taxes are allocated. This puts a significant strain on many operators. 280E singles out Schedule I and II substances, imposing strict limitations on expense deductions for businesses involved with these controlled substances. A Schedule III recommendation would represent the most meaningful valuation catalyst in the sector since the Cole Memo of 2013. There has been significant discussion on the potential upside related to MSOs given this significant catalyst. When one considers the cash flow that is no longer allocated to IRS 280E, and puts a multiple on those cash flows, we get an appreciation for the potential upside of key Fund holdings. The upside EBIT multiple ranges from current 9X to 13X, which would add approximately 35-50% equity upside from current levels.

From a longer-term perspective, the re-scheduling of cannabis reduces the stigma attached to the industry, which has indirect benefits such as increasing research, access to medical treatments and most importantly, reduces the complexities related to banking and capital markets. It is still unclear if a Schedule III re-classification would have an impact on access to FDIC banking for state-level operators. We are of the belief that up-listing to major US equity exchanges is also not an immediate outcome related to re-scheduling. We do see the prospect of some US institutions post re-scheduling to begin investing in the leading names as the stigma related to the industry will now be significantly reduced. That will add significant liquidity and trading opportunities for investors in the sector.

It must be remembered that current US Federal Law states that marijuana is illegal and that regardless of re-scheduling it remains illegal at the federal level. Ultimately this inconsistency is not sustainable and federal allowances should change, however, we do not think that legalization is on the table in 2024. Conditions for legalization are improving though with a new poll by the Tarrance Group revealing that 57% of American voters, including a significant number of Republicans, especially those under 55, support the legalization of marijuana nationwide. The poll also indicates that President Biden and other candidates could gain political support by endorsing this reform.

Next Steps and Considerations

The DEA decision is based on the medical and scientific recommendations from HHS. However, it is important to understand that the DEA’s authority to determine what is the appropriate place on the CSA is subject to U.S. compliance with international drug control treaties, like the UN Single Convention on Narcotics of 1961. Therefore, the DEA has to determine if rescheduling marijuana to Schedule III would still keep the U.S. compliant with its obligations under these international treaties. In this case, cannabis is not being legalized federally and is therefore less likely to conflict with the UN single convention. It should also be remembered that Canada and Uruguay have already by-passed or ignored the UN convention by legalizing cannabis at the federal level back in 2018.

We believe that a central component of the rescheduling of cannabis relates to the political calculus of the 2024 presidential election cycle. In October 2022, President Biden initiated the process of reviewing the Controlled Substances Act (CSA) and put this process in motion. The head of the Drug Enforcement Agency is a Biden appointee, Anne Milgram. Given that the Democratic Party is going to use its pro cannabis stance as part of the November election effort, we believe that to get maximum effect, the DEA must make its decision public within the next 90 days. Once the DEA makes its decision public, the next step is to have a public comment period followed by a process to develop federal rules and guidelines for dispensing cannabis, followed by publishing of the Final Rule in the Federal Registry. In our opinion, the Biden White House would realistically have to make their recommendation public no later than April in order to give these steps time to develop for both the election and regulatory calendars.

Option Strategy

Since the inception of the option writing program in September 2018, the Fund has generated significant income from options premium of approximately $4.90 million. We will continue to utilize our options program to look for attractive opportunities given the above average volatility in the sector as we strongly believe that option writing can continue to add incremental value going forward.

During the month we used our options strategy to assist in rebalancing the portfolio in favor of names we prefer while generating approximately $14,000 in options income. We continue to write short dated covered calls on names we feel are range bound near term and from which we could receive above average premiums which included Perrigo Company PLC (PRGO). We also continue to write short dated cash secured puts out of the money at strike prices that offered opportunities to increase our exposure, at more attractive prices, to names already in the Fund including UnitedHealth Group Inc. (UNH) and Universal Health Services Inc. (UHS).

The Ninepoint Alternative Health Fund, launched in March of 2017 is Canada’s first actively managed mutual fund with a focus on the cannabis sector and remains open to new investors, available for purchase daily.

Charles Taerk & Douglas Waterson

The Portfolio Team

Faircourt Asset Management

Sub-Advisor to the Ninepoint Alternative Health Fund

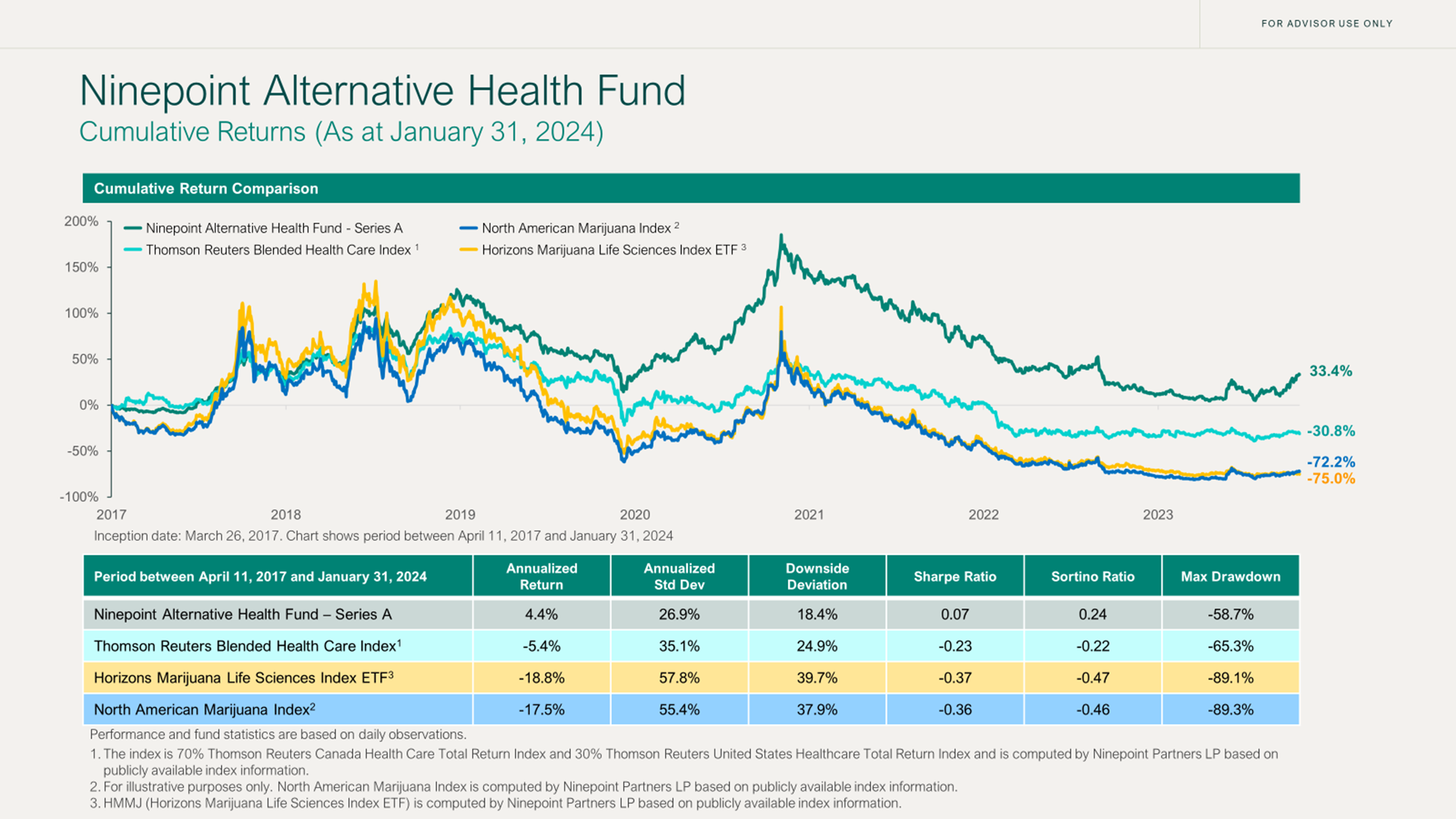

Ninepoint Alternative Health Fund - Compounded Returns¹ as of January 31, 2024 (Series F NPP5421) | Inception Date - August 4, 2017

| MTD | YTD | 3MTH | 6MTH | 1YR | 3YR | 5YR | INCEPTION (ANNUALIZED) |

|

|---|---|---|---|---|---|---|---|---|

| FUND | 14.8% | 14.8% | 24.1% | 25.8% | 13.0% | -16.2% | -6.4% | 6.4% |

| TR CAN/US HEALTH CARE BLENDED INDEX | 0.3% | 0.3% | 10.3% | -5.7% | -1.6% | -20.1% | -16.3% | -6.1% |

Statistical Analysis

| FUND | TR CAN/US HEALTH CARE BLENDED INDEX | |

|---|---|---|

| Cumulative Returns | 49.9% | -33.6% |

| Standard Deviation | 27.5% | 28.5% |

| Sharpe Ratio | 0.14 | -0.30 |

1 All returns and fund details are a) based on Series F units; b) net of fees; c) annualized if period is greater than one year; d) as at January 31, 2024. The index is 70% Thomson Reuters Canada Health Care Total Return Index and 30% Thomson Reuters United States Healthcare Total Return Index and is computed by Ninepoint Partners LP based on publicly available index information.

The Fund is generally exposed to the following risks. See the prospectus of the Fund for a description of these risks: Cannabis sector risk; Concentration risk; Currency risk; Cybersecurity risk; Derivatives risk; Exchange traded fund risk; Foreign investment risk; Inflation risk; Market risk; Regulatory risk; Securities lending, repurchase and reverse repurchase transactions risk; Series risk; Specific issuer risk; Sub-adviser risk; Tax risk.

Ninepoint Partners LP is the investment manager to the Ninepoint Funds (collectively, the “Funds”). Commissions, trailing commissions, management fees, performance fees (if any), and other expenses all may be associated with investing in the Funds. Please read the prospectus carefully before investing. The indicated rate of return for series F shares of the Fund for the period ended January 31, 2024 is based on the historical annual compounded total return including changes in share value and reinvestment of all distributions and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The information contained herein does not constitute an offer or solicitation by anyone in the United States or in any other jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. Prospective investors who are not resident in Canada should contact their financial advisor to determine whether securities of the Fund may be lawfully sold in their jurisdiction.

The opinions, estimates and projections (“information”) contained within this report are solely those of Ninepoint Partners LP and are subject to change without notice. Ninepoint Partners makes every effort to ensure that the information has been derived from sources believed to be reliable and accurate. However, Ninepoint Partners assumes no responsibility for any losses or damages, whether direct or indirect, which arise out of the use of this information. Ninepoint Partners is not under any obligation to update or keep current the information contained herein. The information should not be regarded by recipients as a substitute for the exercise of their own judgment. Please contact your own personal advisor on your particular circumstances. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds managed by Ninepoint Partners. Any reference to a particular company is for illustrative purposes only and should not to be considered as investment advice or a recommendation to buy or sell nor should it be considered as an indication of how the portfolio of any investment fund managed by Ninepoint Partners is or will be invested. Ninepoint Partners LP and/or its affiliates may collectively beneficially own/control 1% or more of any class of the equity securities of the issuers mentioned in this report. Ninepoint Partners LP and/or its affiliates may hold short position in any class of the equity securities of the issuers mentioned in this report. During the preceding 12 months, Ninepoint Partners LP and/or its affiliates may have received remuneration other than normal course investment advisory or trade execution services from the issuers mentioned in this report.

Ninepoint Partners LP: Toll Free: 1.866.299.9906. DEALER SERVICES: CIBC Mellon GSSC Record Keeping Services: Toll Free: 1.877.358.0540

Related Funds

Historical Commentary

- Alternative Health Fund 12/2023

- Alternative Health Fund 11/2023

- Alternative Health Fund 10/2023

- Alternative Health Fund 09/2023

- Alternative Health Fund 08/2023

- Alternative Health Fund 07/2023

- Alternative Health Fund 06/2023

- Alternative Health Fund 05/2023

- Alternative Health Fund 04/2023

- Alternative Health Fund 03/2023

- Alternative Health Fund 02/2023

- Alternative Health Fund 01/2023