Ninepoint Global Infrastructure Fund

January 2024 Commentary

Summary

- Ninepoint Global Infrastructure Fund had a YTD return of -1.45% up to January 31, compared to the MSCI World Core Infrastructure Index with a total return of -1.84%.

- The Communication and Information Technology sectors continued their upward trend into 2024, while Real Estate and Utilities sectors lagged due to a slight increase in US 10-year Treasury bond yields.

- The Federal Reserve held interest rates steady at 5.25% to 5.50% during the January FOMC meeting, maintaining a tough stance to prevent inflation resurgence, with no significant change in policy direction indicated for the near term.

- Expectations for the initial rate cut have shifted to May or June of 2024, with the anticipation of some market volatility in the first half of the year as investors await clearer signs of monetary policy easing.

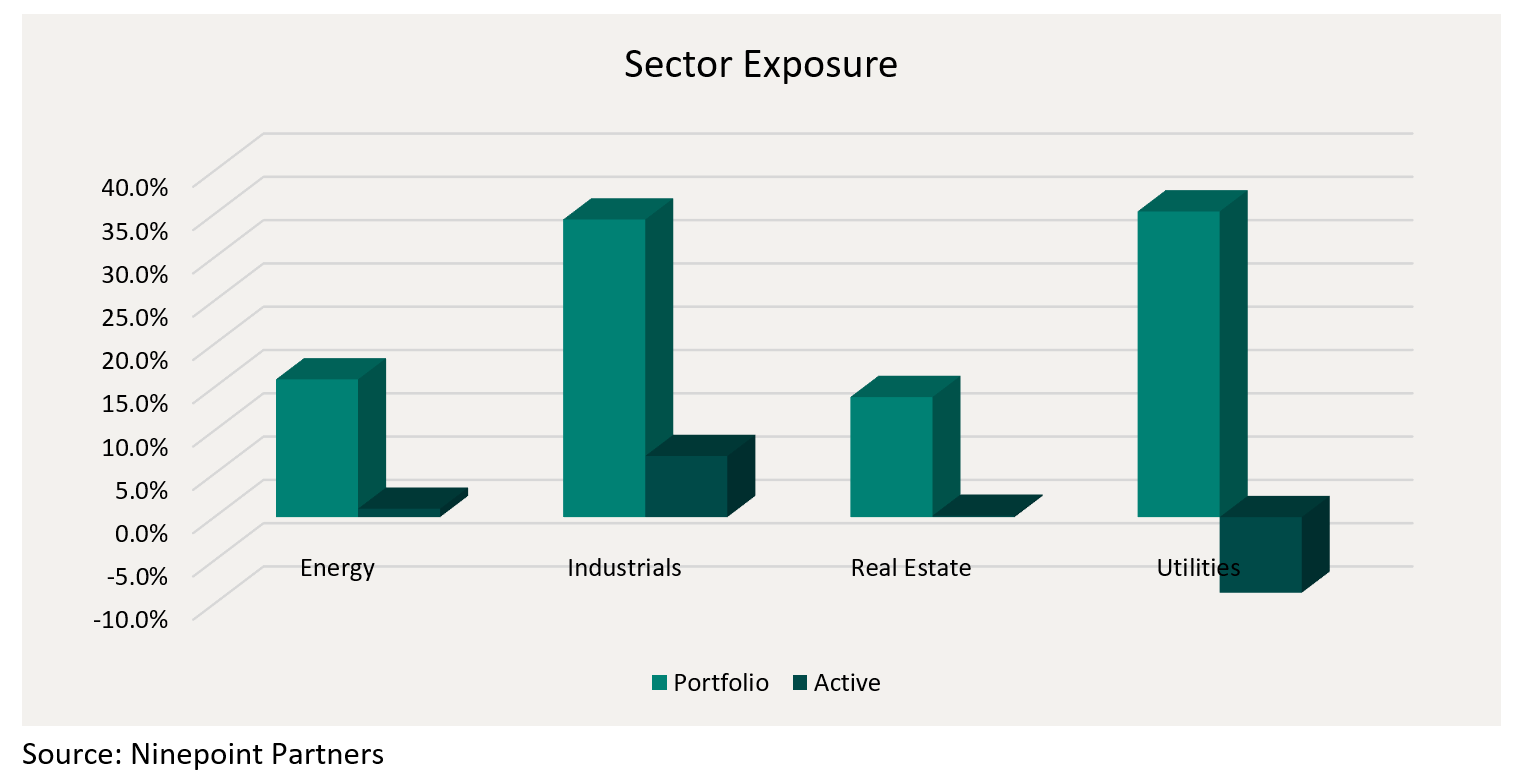

- The Fund is currently overweight the Industrials and Energy sectors, while underweight the Utilities and Real Estate sectors.

- The Fund was concentrated in 28 positions, with the top 10 holdings accounting for approximately 42.6% of the Fund. Over the prior fiscal year, 16 out of our 28 holdings have announced a dividend increase, with an average hike of 13.9% (median hike of 3.2%).

Monthly Update

Year-to-date to January 31, the Ninepoint Global Infrastructure Fund generated a total return of -1.45% compared to the MSCI World Core Infrastructure Index, which generated a total return of -1.84%.

Ninepoint Global Infrastructure Fund - Compounded Returns¹ As of January 31, 2024 (Series F NPP356) | Inception Date: September 1, 2011

| 1M | YTD | 3M | 6M | 1YR | 3YR | 5YR | 10YR | Inception | |

| Fund | -1.4% | -1.4% | 4.1% | 1.5% | 1.0% | 5.0% | 7.9% | 5.9% | 6.9% |

| MSCI World Core Infrastructure NR (CAD) | -1.8% | -1.8% | 6.1% | 0.7% | -2.7% | 4.8% | 5.0% | 8.2% | 10.1% |

The year 2024 has started off much like 2023 ended, with stocks in the Communication and Information Technology sectors continuing to rally. However, after peaking last October and falling through the end of the year, the US 10-year Treasury bond yield retraced some of its recent move lower this past month. As rates ticked slightly higher in January, rate-sensitive securities in the Real Estate and Utilities sectors underperformed. Longer term, we are not overly concerned about this backup in rates, since we believe that those looking for immediate rate cuts simply got ahead of themselves towards the end of last year. Instead of focusing on the near term, investors should take a step back and focus on the bigger picture: inflation is easing, growth remains resilient, the jobs market remains strong, the earnings recession is over and rate cuts will begin sometime in 2024.

At the January FOMC meeting, the Fed unsurprisingly held rates steady at a range of 5.25% to 5.50%. As we’ve discussed previously, we’ve been reasonably confident that the final interest rate hike for the cycle occurred at the July meeting, but we recognized that Fed officials would continue to talk tough to prevent resurgent inflation. During Powell’s press conference on January 31, the Chairman stuck to this script, saying “So if you take that to the current context, we’re going to be data dependent. We’re going to be looking at this meeting by meeting. Based on the meeting today, I would tell you that I don’t think it’s likely that the Committee will reach a level of confidence [to cut rates] by the time of the March meeting, to identify March as the time to do that. But that’s to be seen”. We don’t see anything in that statement that changes our view that the Fed is taking a more balanced view in pursuit of their dual mandate of full employment and price stability.

Admittedly, the odds of a March cut are lower today (but not zero) and the most likely scenarios suggest an initial rate cut in May or June of 2024. After almost two years since the first interest rate hike, we accept the need to wait patiently for another two or three months before an easier monetary policy. But because the precise timing is unknown and the future economic environment remains uncertain, it would be reasonable to expect some volatility in the first half of 2024. Further, with the S&P 500 currently above 4,900 (or almost 20x 2024 forward earnings according to FactSet), it feels like investors have optimistically pulled forward some future returns. Therefore, after a flat year of earnings growth in 2023, a return to earnings growth in 2024 (currently forecasted at just under 10%, again according to FactSet) will be required for the market to continue to move significantly higher over the balance of the year.

Nevertheless, if growth does meet expectations and mega-cap tech moves sideways or even underperforms in 2024 from here (quite possible given the high expectations and high multiples already applied to these equities), our dividend focused mandates should do well on both an absolute and relative basis. As always, we are continually searching for companies that are expected to post solid revenue, earnings and dividend growth but still trade at acceptable valuations today.

For the Ninepoint Global Infrastructure Fund, we are concentrating our research efforts on high quality, dividend growth companies given our positive assessment of the risk/reward outlook over the next few years. After many years of outperformance from the high growth and high valuation Information Technology sector, if interest rates fall and earnings growth becomes more widespread, we would expect a rotation out of the big winners of 2023 and into undervalued equities more aligned with our dividend-focused mandates in 2024.

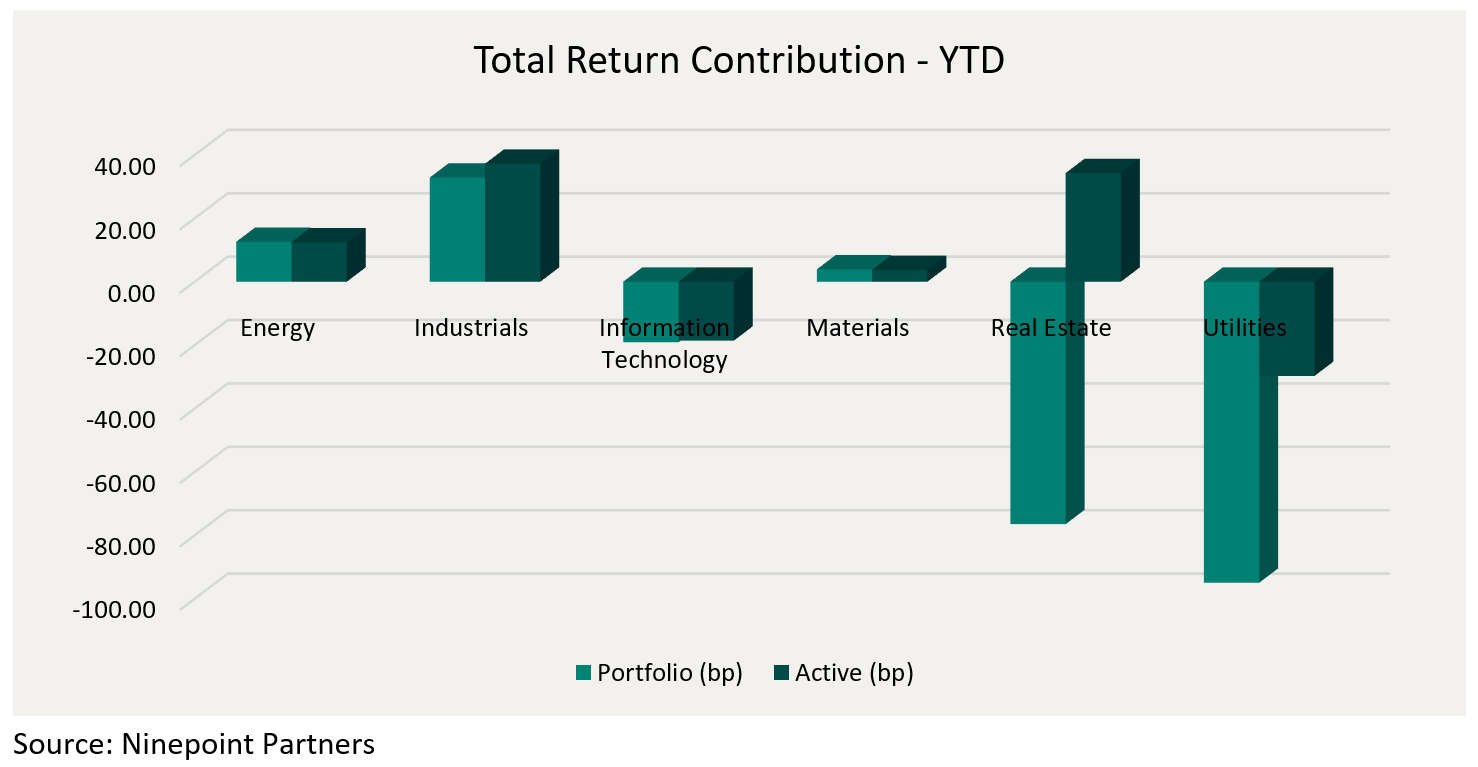

Top contributors to the year-to-date performance of the Ninepoint Global Infrastructure Fund by sector included Industrials (+33 bps), Energy (+13 bps) and Materials (+4 bps), while top detractors by sector included Utilities (-95 bps), Real Estate (-76 bps) and Information Technology (-19 bps) on an absolute basis.

On a relative basis, positive return contributions from the Industrials (+37 bps), Real Estate (+34 bps) and Energy (+12 bps) sectors were offset by negative contributions from the Utilities (-30 bps) and Information Technology (-19 bps) sectors.

We are currently overweight the Industrials and Energy sectors, while underweight the Utilities and Real Estate sectors. With the debate shifting toward the timing of the first interest rate cut of the cycle, we are looking forward to better relative performance from dividend paying infrastructure assets in 2024. In the meantime, we remain focused on high quality, dividend payers that have demonstrated the ability to consistently generate revenue and earnings growth through the business cycle.

Despite some projects dealing with funding concerns in a higher interest rate environment, we continue to believe that the clean energy transition will be one of the biggest investment themes for many years ahead. Therefore, we are comfortable having exposure to both traditional energy investments and renewable energy investments in the Ninepoint Global Infrastructure Fund given the importance of energy sustainability and security of supply around the world.

The Ninepoint Global Infrastructure Fund was concentrated in 28 positions as at January 31, 2024 with the top 10 holdings accounting for approximately 42.6% of the fund. Over the prior fiscal year, 16 out of our 28 holdings have announced a dividend increase, with an average hike of 13.9% (median hike of 3.2%). Using a total infrastructure approach, we will continue to apply a disciplined investment process, balancing valuation, growth, and yield in an effort to generate solid risk-adjusted returns.

Jeffrey Sayer, CFA

Ninepoint Partners

All returns and fund details are a) based on {{disclaimerClass}} units; b) net of fees; c) annualized if period is greater than one year; d) as at January 31, 2024; e) 2011 annual returns are from 09/01/11 to 12/31/11. The index is 100% MSCI World Core Infrastructure NR (CAD) and is computed by Ninepoint Partners LP based on publicly available index information.

The Fund is generally exposed to the following risks. See the prospectus of the Fund for a description of these risks: capital depletion risk; concentration risk; credit risk; currency risk; cybersecurity risk; derivatives risk; exchange traded funds risk; foreign investment risk; income trust risk; inflation risk; interest rate risk; liquidity risk; market risk; regulatory risk; securities lending, repurchase and reverse purchase transaction risk; series risk; short selling risk; small company risk; specific issuer risk; tax risk.

Ninepoint Partners LP is the investment manager to the Ninepoint Funds (collectively, the “Funds”). Commissions, trailing commissions, management fees, performance fees (if any), other charges and expenses all may be associated with mutual fund investments. Please read the prospectus carefully before investing. The indicated rate of return for {{disclaimerClass}} units of the Fund for the period ended January 31, 2024 is based on the historical annual compounded total return including changes in unit value and reinvestment of all distributions and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The information contained herein does not constitute an offer or solicitation by anyone in the United States or in any other jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. Prospective investors who are not resident in Canada should contact their financial advisor to determine whether securities of the Fund may be lawfully sold in their jurisdiction.

The opinions, estimates and projections (“information”) contained within this report are solely those of Ninepoint Partners LP and are subject to change without notice. Ninepoint Partners makes every effort to ensure that the information has been derived from sources believed to be reliable and accurate. However, Ninepoint Partners assumes no responsibility for any losses or damages, whether direct or indirect, which arise out of the use of this information. Ninepoint Partners is not under any obligation to update or keep current the information contained herein. The information should not be regarded by recipients as a substitute for the exercise of their own judgment. Please contact your own personal advisor on your particular circumstances. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds managed by Ninepoint Partners. Any reference to a particular company is for illustrative purposes only and should not to be considered as investment advice or a recommendation to buy or sell nor should it be considered as an indication of how the portfolio of any investment fund managed by Ninepoint Partners is or will be invested. Ninepoint Partners LP and/or its affiliates may collectively beneficially own/control 1% or more of any class of the equity securities of the issuers mentioned in this report. Ninepoint Partners LP and/or its affiliates may hold short position in any class of the equity securities of the issuers mentioned in this report. During the preceding 12 months, Ninepoint Partners LP and/or its affiliates may have received remuneration other than normal course investment advisory or trade execution services from the issuers mentioned in this report.

Ninepoint Partners LP: Toll Free: 1.866.299.9906. DEALER SERVICES: CIBC Mellon GSSC Record Keeping Services: Toll Free: 1.877.358.0540

Related Funds

Historical Commentary

- Global Infrastructure Fund 12/2023

- Global Infrastructure Fund 11/2023

- Global Infrastructure Fund 10/2023

- Global Infrastructure Fund 09/2023

- Global Infrastructure Fund 08/2023

- Global Infrastructure Fund 07/2023

- Global Infrastructure Fund 06/2023

- Jeff Sayer - H1 2023 Market Review and Outlook - Real Asset Strategies

- Global Infrastructure Fund 05/2023

- Global Infrastructure Fund 04/2023

- Global Infrastructure Fund 03/2023

- Global Infrastructure Fund 02/2023

- Global Infrastructure Fund 01/2023