Ninepoint Fixed Income Strategy

January 2024 Commentary

Monthly commentary discusses recent developments across the Ninepoint Diversified Bond, Ninepoint Alternative Credit Opportunities and Ninepoint Credit Income Opportunities Funds.

Summary

- North American economic growth continues to surprise to the upside, even here in Canada.

- Elevated wage growth will prevent a rapid normalization of services inflation.

- Global markets have an overly optimistic view on rate cuts.

- With inflation still above target, central bankers will drag their feet to ease policy.

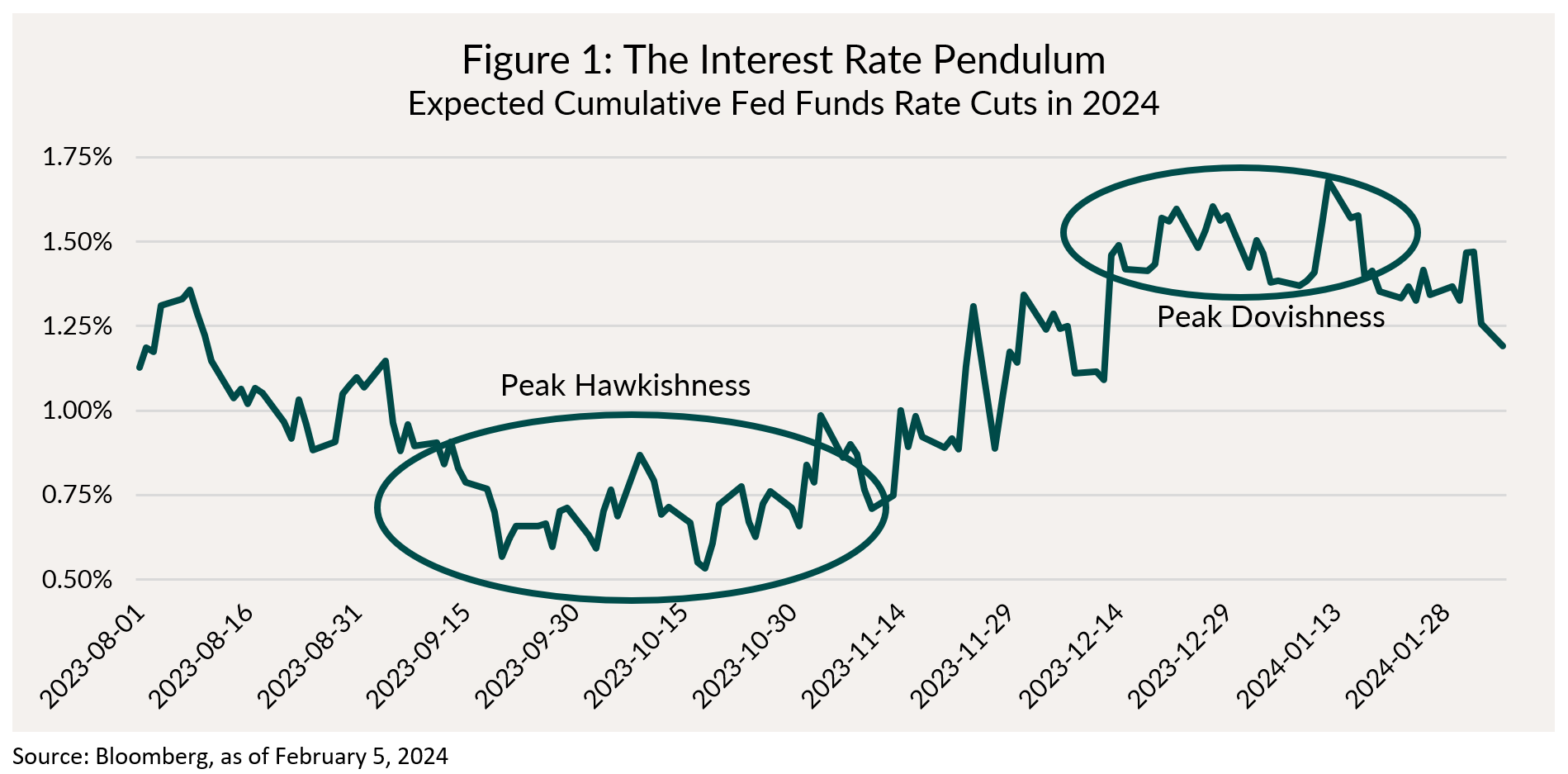

In the interest rate markets, January was a little bit like a hangover from the New Year’s celebrations. After a fast and furious rally in Q4-2023, driven by higher and higher rate cut expectations, it was only normal to see the pendulum swing back. Now that central banks are on hold, a good way to illustrate these mood swings is to look at rate cut expectations for the year ahead. Figure 1 below shows the history of market implied cumulative Fed Funds rate cuts by December 2024. As we know, September and October of 2023 saw peak hawkishness in the rates markets (only about 0.5% of cuts priced in for all of 2024), only to be followed by weaker economic data and a surprisingly dovish Fed, paving the way for the Q4 rally in pretty much every asset class (peak market euphoria was for as much as 1.7% of cuts in 2024).

Now, with core inflation in Canada and the U.S. still above 3%, those rate cut expectations are clearly at odds with our central bankers’ targets. Unsurprisingly, both Governor Macklem and Chair Powell made that point, at their respective January meetings, to pour cold water on this idea of imminent and large potential rate cuts. The Fed, through its famous Dot Plot, is guiding to only 0.75% of cuts this year, assuming inflation continues to behave as expected. Powell was clear during the press conference that followed, insisting that March is off the table for rate cuts. After all the heavy lifting that was done over the past 18 months to rein back inflation, it would be disingenuous to declare victory early, only to be proven wrong, and have to hike again.

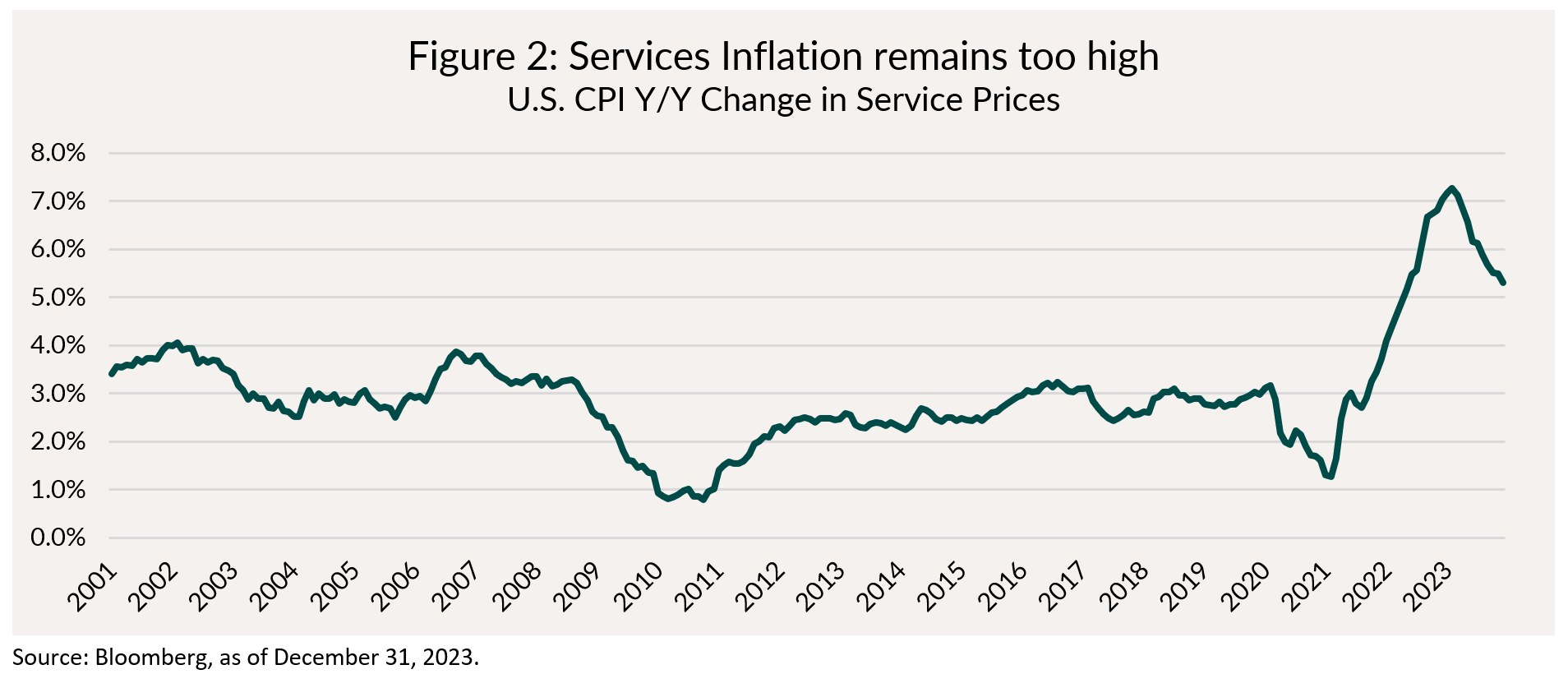

It isn’t too hard to understand why central bankers are wary of cutting too early. Looking at inflation category by category, a lot of the improvement in inflation has been driven by lower energy and goods prices. Services inflation (60% of the U.S. CPI basket) continues to run at elevated levels (Figure 2), reflecting, amongst other things, elevated wages and shelter costs. The mission hasn’t been accomplished yet.

Note: the exact same set of arguments could be made about Canada, we simply focused on the U.S. situation for clarity of presentation.

We therefore expect the first half of this year to be characterized by this tug-of-war between the Fed/BoC and markets, where central bankers try to hold rates steady for as long as possible, whereas market participants constantly recalibrate when, and by how much, the rate cut cycle will pan out. At this point, economic data will dictate the evolution of rates, and by extension all other risk assets. So far in 2024, data has surprised to the upside, even here in Canada, where GDP for November came in at 0.2% m/m, much better than originally expected. If this string of hot data continues, expect the pendulum to once again, swing to the hawkish side, creating a good entry point for those who want to increase allocations to fixed income.

Credit

Canadian and US investment grade spreads had a strong January tightening at 9bps and 5bps respectively. This move is impressive given January bond issuance set records in both Canada and the US. Investor appetite remains robust and the all-in yields that corporate bonds offer remain compelling, creating technical tailwinds for credit. We used the busy new issue market to proactively add to credits we like such as Canadian Western Bank and CIBC, in addition to Ford, who recently regained its investment grade rating. We also participated in the RBC preferred share new issue mid month, and with the extremely strong performance, we took profits and recycled the capital back into other attractive opportunities. In terms of sector performance, higher beta generally outperformed, specifically autos, bank sub-debt and REITs. Given our overweight exposure to bank sub-debt (albeit less so in recent months as we have been sellers into the strength) this helped drive performance in the month. Lastly, expect our HY allocation to continue to decline, as bonds come to maturity. With spreads back to historical lows, we do not find the High Yield market that attractive at this point in the cycle.

Individual Fund Commentary

Ninepoint Diversified Bond Fund

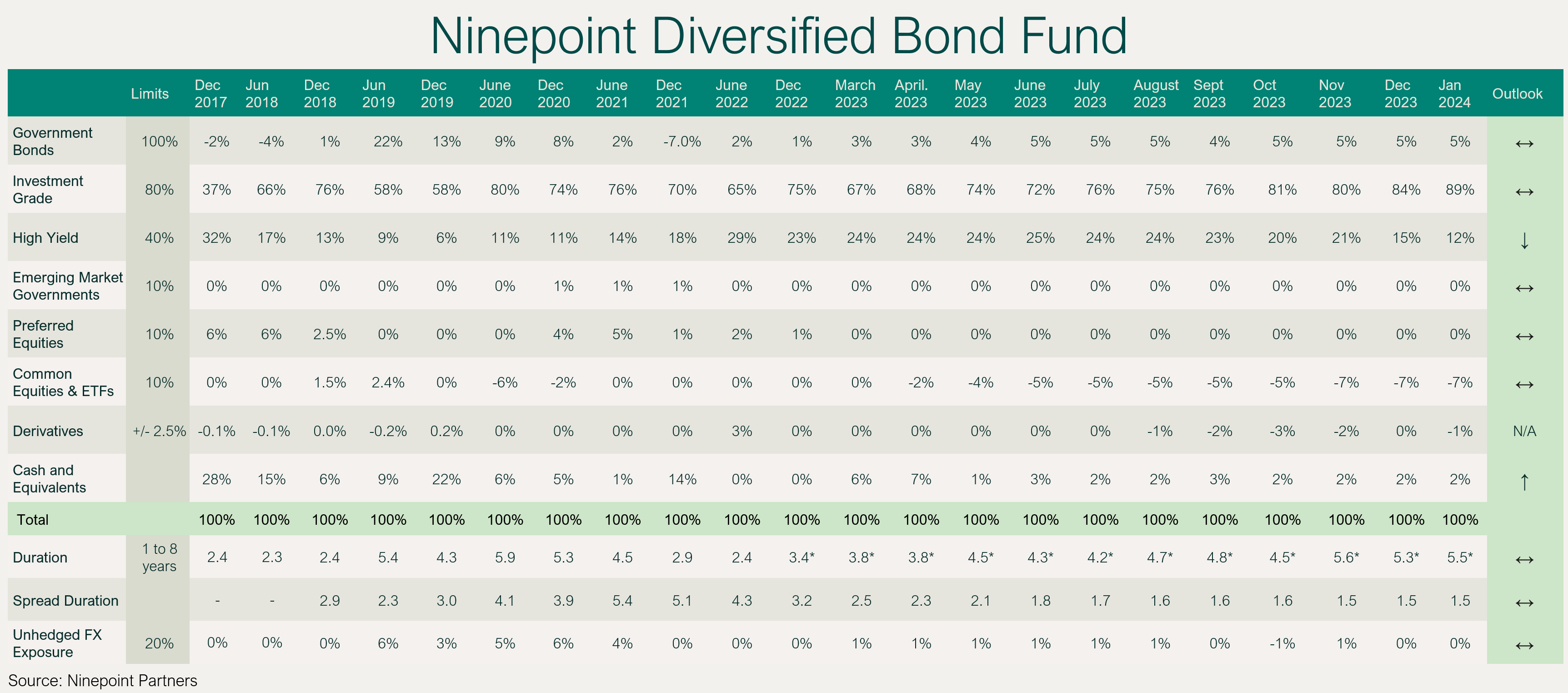

The fund remains defensively positioned with a focus on short-term investment grade bonds. Our High Yield weight moved down month-over-month from 15% to 12% given our sizeable High Yield maturities in the month. The average credit quality remains at BBB+ which we feel is prudent given our macro-economic outlook. The yield-to-maturity of the fund moved up 10bps month-over-month and now sits at 7.6%. Duration ended the month at 5.5 years while our short position in HYG (used for credit hedging purposes) remains at our target of -7%.

Ninepoint Alternative Credit Opportunities

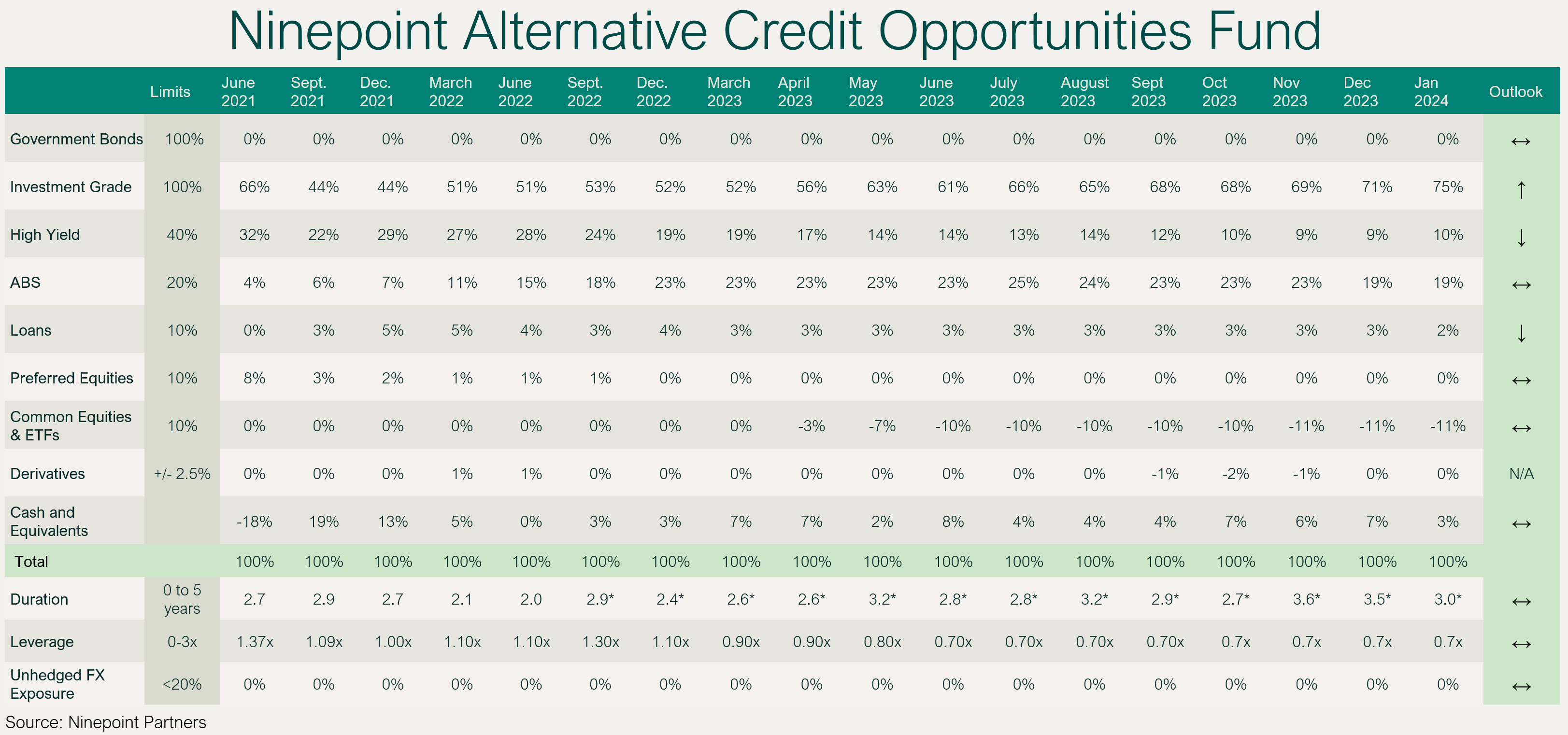

The fund remains defensively positioned with a focus on short-term investment grade bonds. The average credit quality remains at BBB+ which we feel is prudent while leverage remains historically low (by our standards) at 0.7x. The yield-to-maturity ended the month at 8.8% while duration ended the month at 3.0 years. Our short position in US High Yield ETFs (HYG and JNK used for credit hedging purposes) remains at our target of -11%.

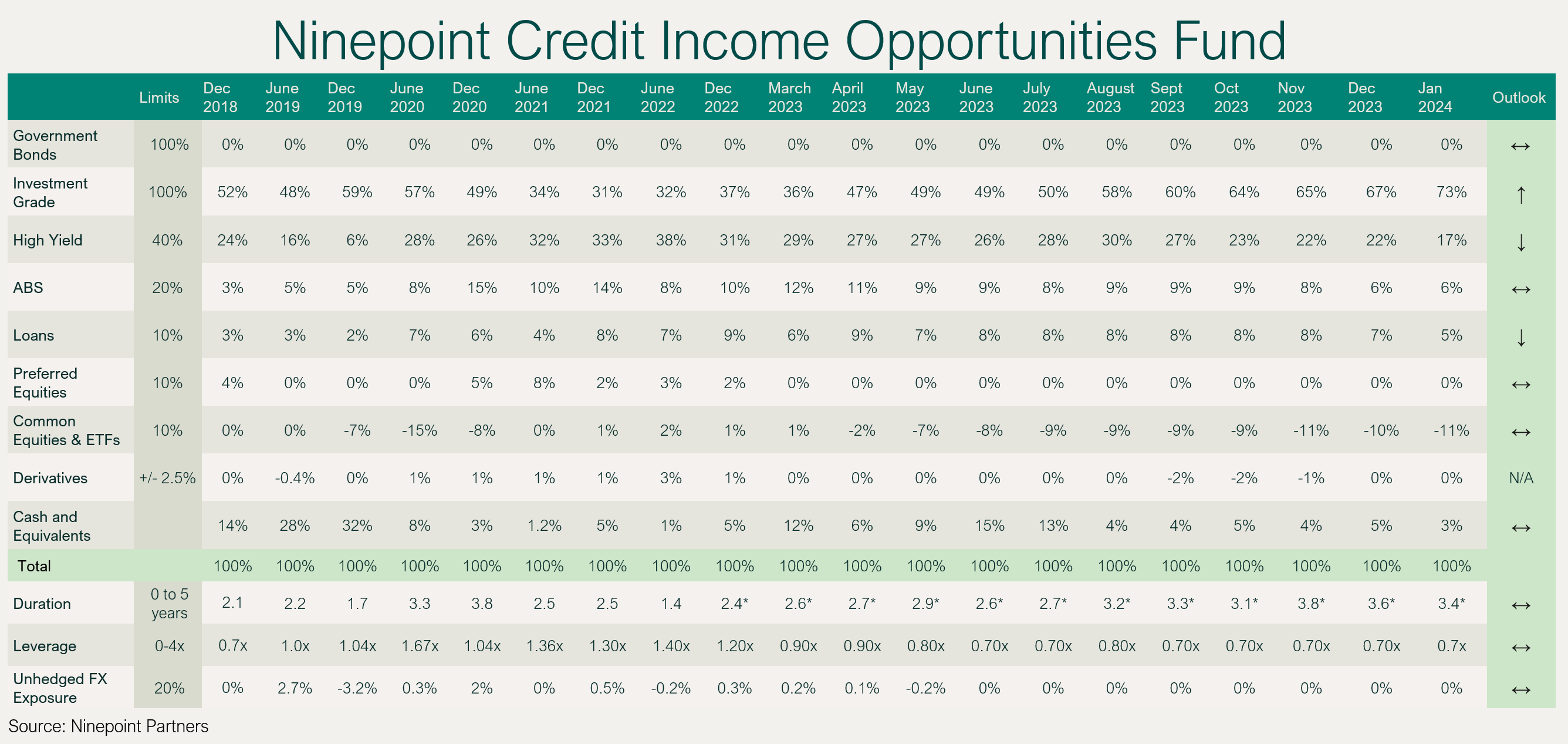

Ninepoint Credit Income Opportunities

The fund remains defensively positioned with a focus on short-term investment grade bonds. Our High Yield weight moved down month-over-month from 22% to 17% given sizeable High Yield maturities in the month. The average credit quality remains at BBB which we feel is prudent while leverage remains historically low (by our standards) at 0.7x. The yield-to-maturity ended the month at 9.5% while duration ended the month at 3.4 years. Our short position in US High Yield ETFs (HYG and JNK used for credit hedging purposes) remains at our target of -11%.

Until next month,

Mark, Etienne & Nick

Ninepoint Partners

1 All Ninepoint Diversified Bond Fund returns and fund details are a) based on Series F units; b) net of fees; c) annualized if period is greater than one year; d) as at January 31, 2024 1 All Ninepoint Credit Income Opportunities Fund returns and fund details are a) based on Class F units; b) net of fees; c) annualized if period is greater than one year; d) as at January 31, 2024. 1 All Ninepoint Alternative Credit Opportunities Fund returns and fund details are a) based on Class F units; b) net of fees; c) annualized if period is greater than one year; d) as at January 31, 2024.

The Risks associated worth investing in a Fund depend on the securities and assets in which the Funds invests, based upon the Fund's particular objectives. There is no assurance that any Fund will achieve its investment objective, and its net asset value, yield and investment return will fluctuate from time to time with market conditions. There is no guarantee that the full amount of your original investment in a Fund will be returned to you. The Funds are not insured by the Canada Deposit Insurance Corporation or any other government deposit insurer. Please read a Fund's prospectus or offering memorandum before investing.

Ninepoint Credit Income Opportunities Fund is offered on a private placement basis pursuant to an offering memorandum and are only available to investors who meet certain eligibility or minimum purchase amount requirements under applicable securities legislation. The offering memorandum contains important information about the Funds, including their investment objective and strategies, purchase options, applicable management fees, performance fees, other charges and expenses, and should be read carefully before investing in the Funds. Performance data represents past performance of the Fund and is not indicative of future performance. Data based on performance history of less than five years may not give prospective investors enough information to base investment decisions on. Please contact your own personal advisor on your particular circumstance. This communication does not constitute an offer to sell or solicitation to purchase securities of the Fund.

Ninepoint Partners LP is the investment manager to the Ninepoint Funds (collectively, the “Funds”). Commissions, trailing commissions, management fees, performance fees (if any), other charges and expenses all may be associated with mutual fund investments. Please read the prospectus carefully before investing. The indicated rate of return for series F units of the Fund for the period ended January 31, 2024 is based on the historical annual compounded total return including changes in unit value and reinvestment of all distributions and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The information contained herein does not constitute an offer or solicitation by anyone in the United States or in any other jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. Prospective investors who are not resident in Canada should contact their financial advisor to determine whether securities of the Fund may be lawfully sold in their jurisdiction.

The opinions, estimates and projections (“information”) contained within this report are solely those of Ninepoint Partners LP and are subject to change without notice. Ninepoint Partners makes every effort to ensure that the information has been derived from sources believed to be reliable and accurate. However, Ninepoint Partners assumes no responsibility for any losses or damages, whether direct or indirect, which arise out of the use of this information. Ninepoint Partners is not under any obligation to update or keep current the information contained herein. The information should not be regarded by recipients as a substitute for the exercise of their own judgment. Please contact your own personal advisor on your particular circumstances. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds managed by Ninepoint Partners LP. Any reference to a particular company is for illustrative purposes only and should not to be considered as investment advice or a recommendation to buy or sell nor should it be considered as an indication of how the portfolio of any investment fund managed by Ninepoint Partners LP is or will be invested. Ninepoint Partners LP and/or its affiliates may collectively beneficially own/control 1% or more of any class of the equity securities of the issuers mentioned in this report. Ninepoint Partners LP and/or its affiliates may hold short position in any class of the equity securities of the issuers mentioned in this report. During the preceding 12 months, Ninepoint Partners LP and/or its affiliates may have received remuneration other than normal course investment advisory or trade execution services from the issuers mentioned in this report.

Ninepoint Partners LP: Toll Free: 1.866.299.9906. DEALER SERVICES: CIBC Mellon GSSC Record Keeping Services: Toll Free: 1.877.358.0540

Related Funds

Historical Commentary

- Fixed Income Strategy 12/2023

- Fixed Income Strategy 11/2023

- Fixed Income Strategy 10/2023

- Fixed Income Strategy 09/2023

- Fixed Income Strategy 08/2023

- Fixed Income Strategy 07/2023

- Fixed Income Strategy 06/2023

- Fixed Income - H1 2023 Market Review and Outlook

- Fixed Income Strategy 05/2023

- Fixed Income Strategy 04/2023

- Fixed Income Strategy 03/2023

- Fixed Income Strategy 02/2023

- Fixed Income Strategy 01/2023