Volatility, Uncertainty With a Few Moments of Horror.

The one thing that Q1 2025 has taught us is to expect the unexpected.

Gold has been one of the few asset classes which has benefited from the tariff turmoil and, as investors in this space, we are excited by the opportunities and performance this has provided.

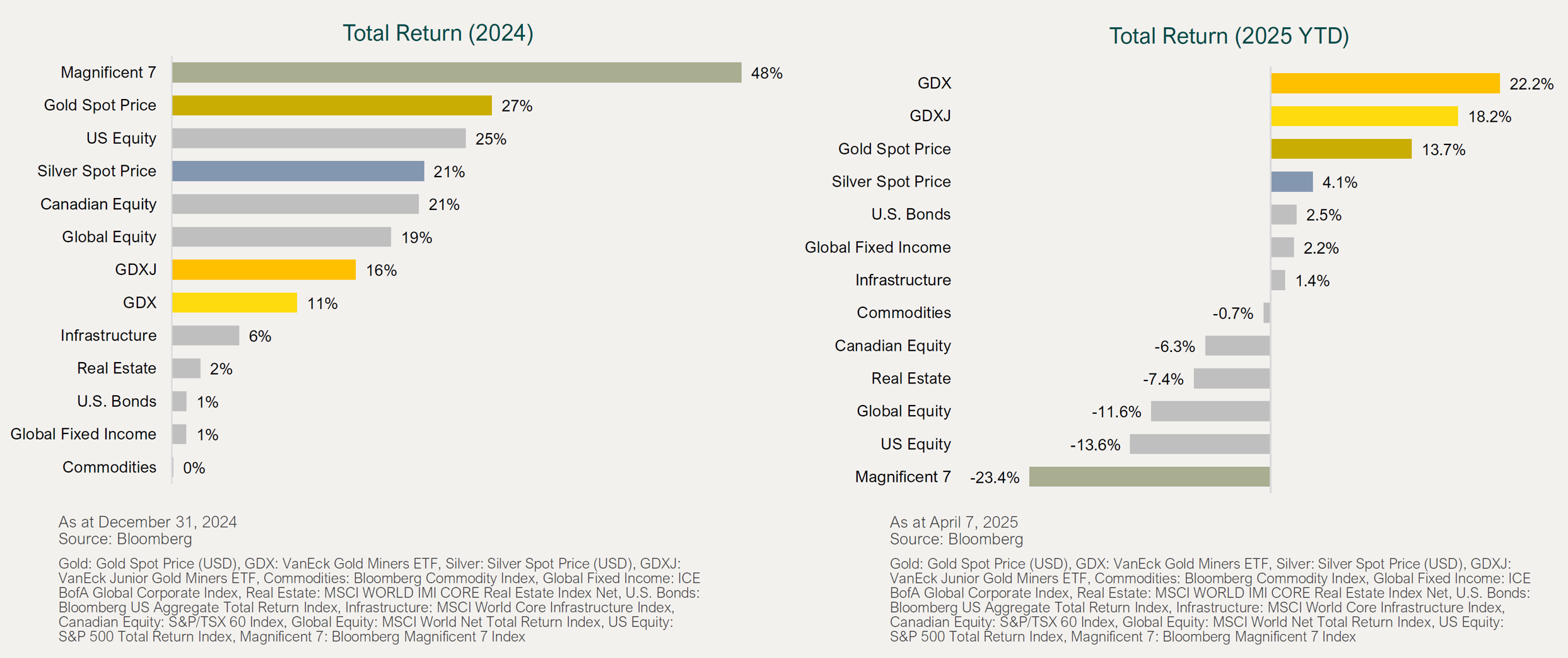

2024 vs Q1-2025 – A Different World

Our outlook for gold remains constructive. As central banks continue to buy record volumes as a means of diversification, Western investors are finally slowly stepping back into the market after largely ignoring the metal in 2024.

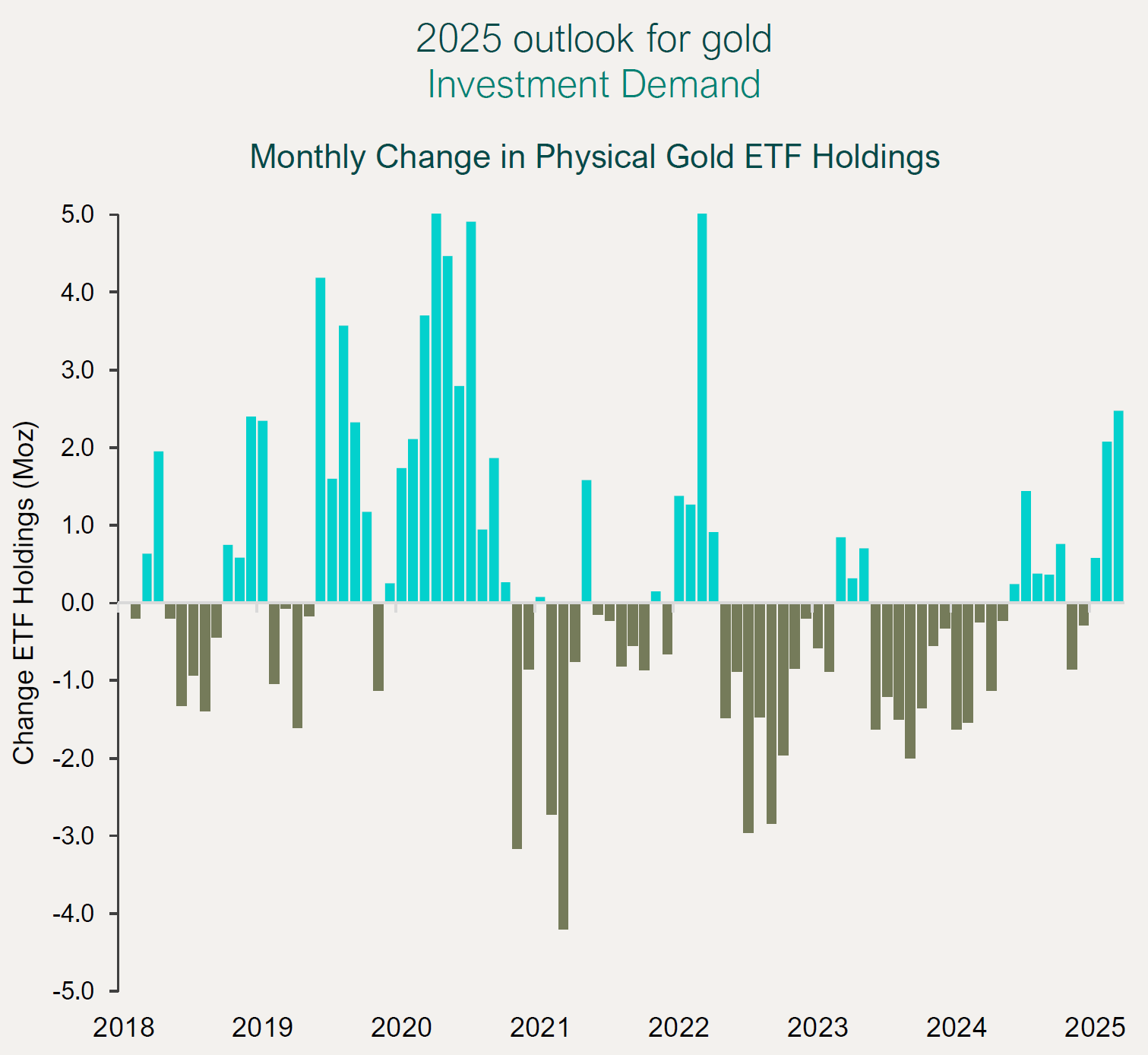

ETF Inflows have Started

Investors are returning driven by fear and uncertainty as well as a need for diversification. It’s a different world and concerns over inflation, global balance sheets and geopolitics remain front of mind for investors. This unprecedented level of uncertainty, as well as anticipated future rate cuts, has been supportive for gold and we can’t see these supportive factors weaning in the near term.

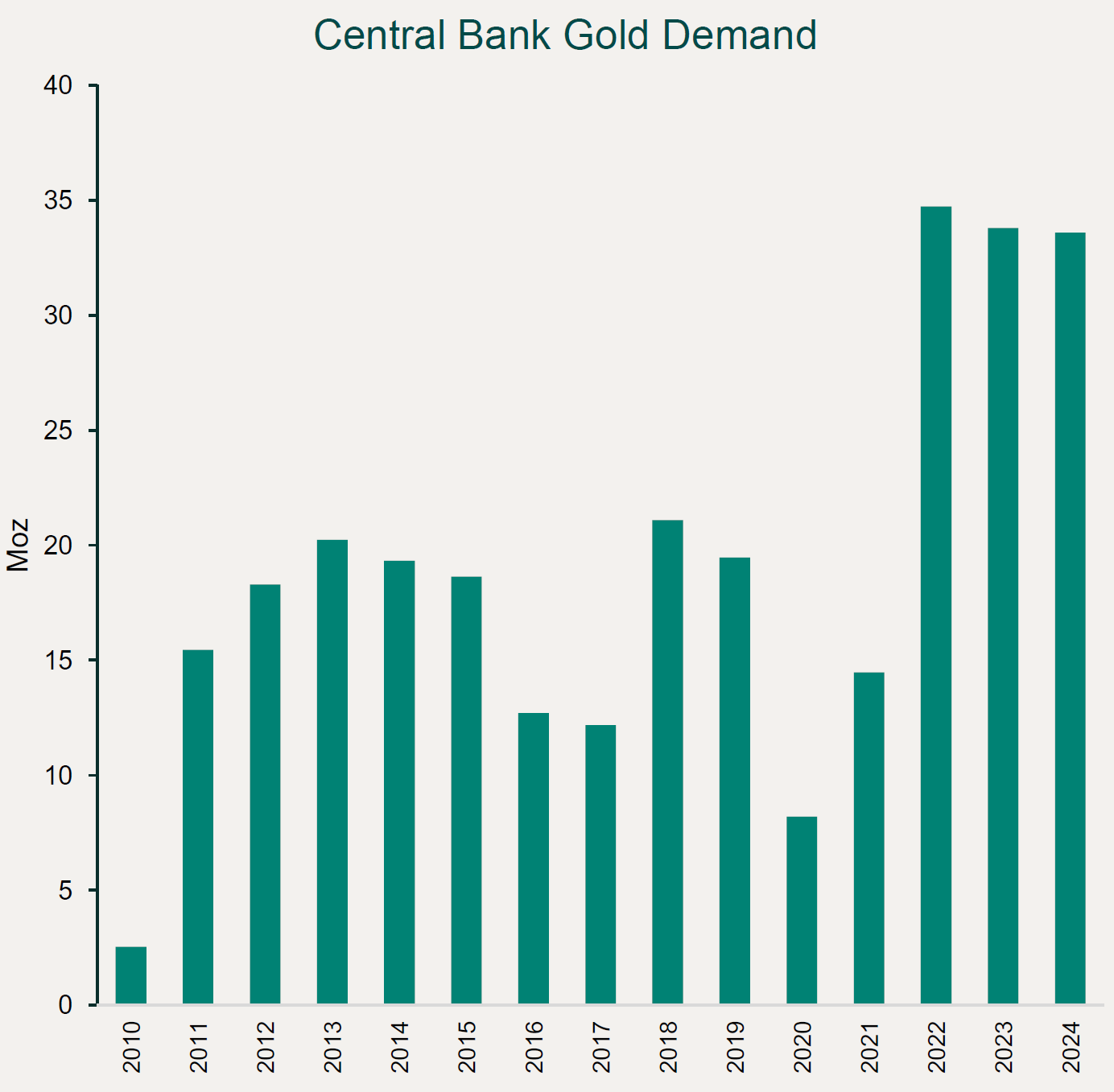

In the meantime, central banks continue their buying spree and we expect this trend to continue in 2025 and beyond as diversification and risk management continues.

Central Banks are on a Gold Buying Spree

Gold Equities Have Had a Good Start to the Year

The gold stocks have started to “work” in Q1 2025, after a lackluster performance in 2024, when they lagged the gold price. This is where the biggest opportunity lies, in our view.

As industry costs stabilized in H2 2024 and gold prices continued to rise, producer margins finally started to expand, and so did free cash flow. This is an important inflection point for the gold industry, and we have never seen this level of free cash flow generated while corporate balance sheets are this healthy. In our view, there is little excuse not to increase capital returns in this scenario.

Yes, capital returns. We don’t often associate the gold industry with such frivolous actions, yet it is becoming increasingly obvious that it will be a focus in 2025, and this is one of the reasons we are so bullish on gold equities.

And then there is the valuation. After 25 years of looking at this space, we have never seen the gold industry this financially strong and the stocks this cheap. We estimate that the stocks are trading at a 20-30% discount to the historical (5-year) average on all metrics – a truly fantastic opportunity for investors.

Before you ask, yes, we will probably continue to see M&A, but it’s notable that recent transactions in the gold industry have been more opportunistic and tactical, driven by the need to diversify geopolitically, operationally, offset cost inflation or rebalance portfolios for the future. This is not growth for the sake of growth, it’s more strategic. We will wait to see how the sector reacts in this higher gold price environment

Ninepoint Gold and Precious Minerals Fund

The Ninepoint Gold and Precious Minerals Fund had a strong Q1 2025 performance and remains well-positioned for a continuing rally. With approximately 60% of our portfolio in high-quality producers, we are now spending more time and effort evaluating earlier stage companies and projects. The fund remains concentrated, liquid and agile. Given our positive outlook for the gold market, we see significant upside. We will remain focused on quality assets and management teams and continue to skew the fund to the low political risk jurisdictions. It's been a long time since investing in gold equities has provided this much opportunity.

NINEPOINT GOLD & PRECIOUS MINERALS FUND - COMPOUNDED RETURNS¹ AS OF MARCH 31, 2025 (SERIES F NPP300) | INCEPTION DATE: OCTOBER 12, 2004

1M |

YTD |

3M |

6M |

1YR |

3YR |

5YR |

10YR |

15YR |

INCEPTION |

|

|---|---|---|---|---|---|---|---|---|---|---|

Fund |

18.26% |

38.27% |

38.27% |

35.78% |

69.73% |

10.78% |

20.63% |

13.01% |

3.97% |

5.34% |

Index |

14.83% |

36.58% |

36.58% |

25.28% |

60.45% |

11.93% |

16.56% |

12.99% |

3.94% |

5.05% |

Industrial Commodities

The Industrial commodity complex struggled to find direction as the market digested the ever changing news flow on tariffs against the potential demand benefits of stimulus in China, the largest end user.

Copper is a prime example of the ongoing tug of war. During the quarter, copper prices increased steadily (~12%), peaking in late March, supported by seasonal demand and the benefits of China's stimulus from late 2024 flowing through. Unfortunately, copper prices reversed these gains in early April, following the tariffs announcement and pricing remains volatile and without a clear path. Interestingly, copper stocks didn’t participate in the Q1 2025 copper rally and were down ~10-20% during the quarter, reflecting the general uncertainty in the market. We remain positive on the outlook for copper and copper equities at current price levels.

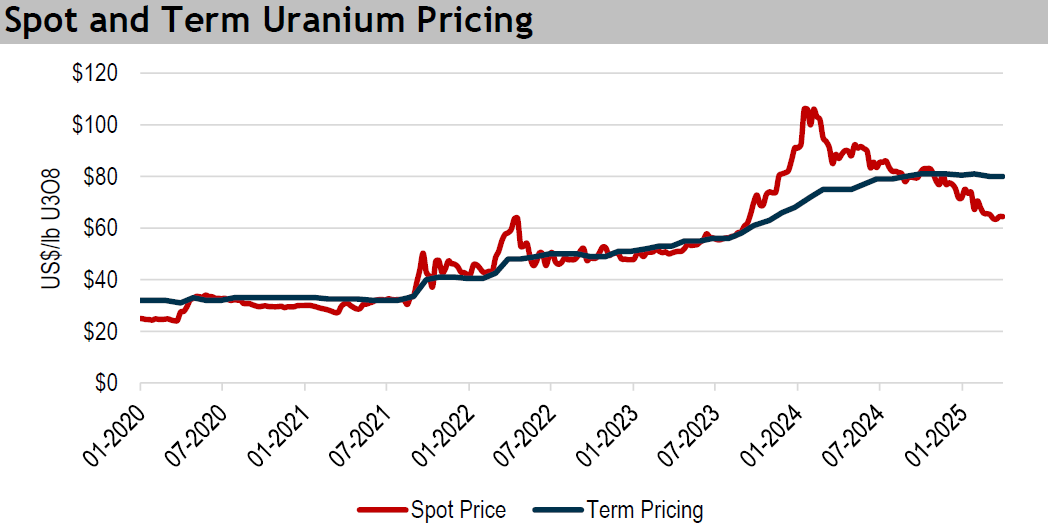

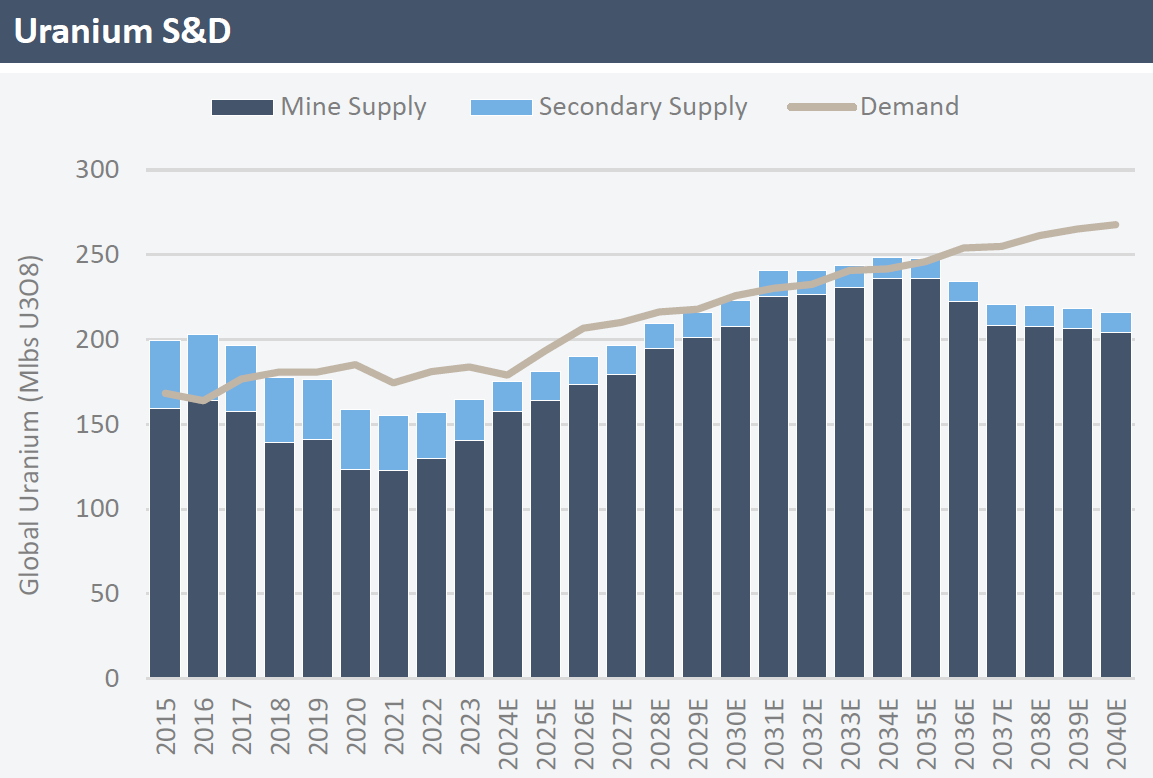

Spot uranium prices were under significant pressure in Q1 2025 (down ~16%), bottoming at $63/lb on extremely thin volumes as the lack of direction kept end users away while a fund is rumoured to have been a forced seller into this thin and illiquid market. While tariff and trade uncertainty have resulted in a significant slow-down in contracting, uranium has been exempt from trade actions and we believe that contract activity could improve going forward supporting the spot price.

Meanwhile, the uranium long-term contract price remained stable in the ~US$80/lb range, reflecting the tightness of the physical market. We remain constructive on the fundamentals for nuclear/uranium as demand continues to grow and geopolitical tensions are driving significant supply chain shifts in the nuclear industry.

During the quarter, uranium stocks followed the spot price down (20-25%), a selloff which left no one unscathed and we see significant upside from current levels.

While there is still significant uncertainty around price projections for critical minerals, most are now deep into the cost curve and we see limited downside. We found it quite telling that one of China’s first responses to 'Liberation Day' tariffs was the announcement of export controls on heavy rare earths - a suite of metals dominated by China and used in industries like defence, wind turbines and EVs. These rare earths are, in a nutshell, strategic. We see a scenario in which critical minerals become a bigger part of the ongoing tariff war, resulting in supply/demand dislocations in key markets. This could lead to significant short-term price volatility but is also supportive of prices in the medium to long term.

Ninepoint Resource Fund and Ninepoint Resource Fund Class

The commodity mix of our Ninepoint Resource Fund and Ninepoint Resource Fund Class is currently dominated by gold but with a significant tilt to uranium as well as copper and other industrial metals and critical minerals, including rare earths and niobium. We also have exposure to the oil and gas sector via positions in the Ninepoint Energy Fund.

We continue to watch for clarity around the tariffs and the impact they will have on the global economy. In the meantime, the funds remain dominated by our positions in precious metals, which we view as having a positive outlook in these turbulent markets.

NINEPOINT RESOURCE FUND - COMPOUNDED RETURNS¹ AS OF MARCH 31, 2025 (SERIES F NPP864) | INCEPTION DATE: OCTOBER 17, 2011

1M |

YTD |

3M |

6M |

1YR |

3YR |

5YR |

10YR |

INCEPTION |

|

|---|---|---|---|---|---|---|---|---|---|

Fund |

9.91% |

9.59% |

9.59% |

7.10% |

2.27% |

-9.49% |

21.41% |

5.47% |

0.12% |

Index |

6.48% |

12.08% |

12.08% |

11.01% |

18.76% |

10.44% |

30.83% |

9.32% |

4.93% |

NINEPOINT RESOURCE FUND CLASS - COMPOUNDED RETURNS¹ AS OF MARCH 31, 2025 (SERIES F NPP967) | INCEPTION DATE: FEBRUARY 08, 2022

1M |

YTD |

3M |

6M |

1YR |

3YR |

INCEPTION |

|

|---|---|---|---|---|---|---|---|

Fund |

8.58% |

6.00% |

6.00% |

1.86% |

11.22% |

-12.57% |

-9.50% |

Index |

6.48% |

12.08% |

12.08% |

11.01% |

18.76% |

10.44% |

15.46% |

Nawojka Wachowiak, M.Sc., CIM

Ninepoint Partners

March 31, 2025

March 31, 2025