Monthly Update

Year-to-date to April 30, the Canadian Large Cap Leaders Split Corp Class A Shares generated a total return of 0.86% and the Preferred Shares generated a total return of 2.51%. For the month, the Class A Shares generated a total return of -2.50% while the Preferred Shares generated a total return of 0.62%1.

CANADIAN LARGE CAP LEADER SPLIT CORP. - COMPOUNDED RETURNS¹ AS OF APRIL 30, 2025 | INCEPTION DATE: FEBRUARY 22, 2024

1M |

YTD |

3M |

6M |

1YR |

Inception |

|

|---|---|---|---|---|---|---|

Canadian Large Cap Leaders Split Corp - Class A Shares |

-2.50% |

0.86% |

-1.48% |

4.30% |

18.79% |

18.97% |

Canadian Large Cap Leaders Split Corp - Pref Shares |

0.62% |

2.51% |

1.87% |

3.78% |

7.73% |

7.74% |

President Trump’s Liberation Day of “reciprocal” tariffs has come and gone, having triggered the sharpest equity market selloff since the depths of the Covid-19 crisis in 2020. Investors, even Canadians, should be forgiven for feeling that Liberation Day only served to liberate them from some of their capital given the President’s questionable strategy and dubious methodology. The lack of confidence in the current administration and serious concerns regarding U.S. exceptionalism (from an investment point of view), were obvious by the unusual, simultaneous and dramatic decline of stocks, bonds and the US dollar throughout much of April.

However, by mid-month, the President appeared willing to walk back some of his most extreme positions, likely spooked by the selloff in the U.S. Treasury market and extreme volatility across various asset classes. The rapid rise in interest rates was particularly worrisome since the US government is looking to refinance approximately $9 trillion worth of debt this year. We also believe that the US Treasury Secretary, Scott Bessent, was able to successfully convince the President to pause the collection of the reciprocal tariffs for 90 days, at least for countries other than China, giving trade discussions some time to play out. Deregulation and tax reform are potential future tailwinds but, if trade relations don’t improve, most still expect that prices will surge, global growth will slow, and job losses will increase.

Thankfully, the news of a 90-day pause on reciprocal tariffs was enough to trigger a snapback rally in equities, as a sense of relief powered markets back to pre-Liberation Day price levels. We were mildly surprised at the strength of the bounce, since the 10% “baseline” tariffs on all imports from most trade partners remain in effect and the macroeconomic outlook remains murky at best. Further, commentary from corporate leadership teams during the Q1 earnings season highlighted just how difficult it has become to make operating decisions and financial forecasts today. We would point out that the interest rate forward curve is currently pricing in at least three rate cuts in 2025, which should offer some downside support if the outlook continues to deteriorate.

In this environment, we remain invested in a diversified portfolio of high-quality, dividend-paying Canadian companies while we wait for the stock markets to stabilize. Again, we expect that interest rates will continue moving lower in Canada, making our holdings even more attractive from a yield perspective.

Information below is specific to individual securities held in the Portfolio. It is only intended to describe key characteristics of individual holdings at a point in time and makes no inference about the return nor yield of either the Preferred Shares or the Class A Shares of the Canadian Large Cap Leaders Split Corp.

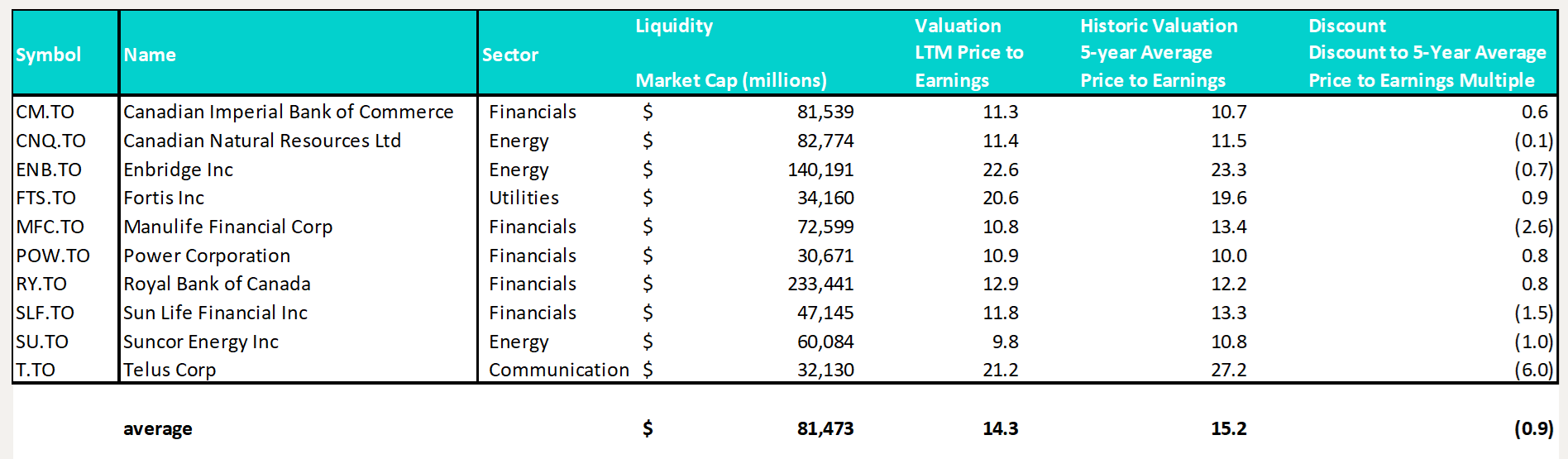

From the chart above, we can see that our holdings, on average, trade at an LTM price to earnings multiple of 14.3x, compared to the 5-year average price to earnings multiple of 15.2x. However, given our outlook for lower interest rates (and supported by a significant discount to the S&P 500, which currently trades at about 20x forward earnings, according to FactSet), multiples still have plenty of room to expand in Canada. Further, with the Class A Shares trading approximately 12% below the reported NAV at the close on April 30, 2025, we can adjust this table to visualize the implied valuation today:

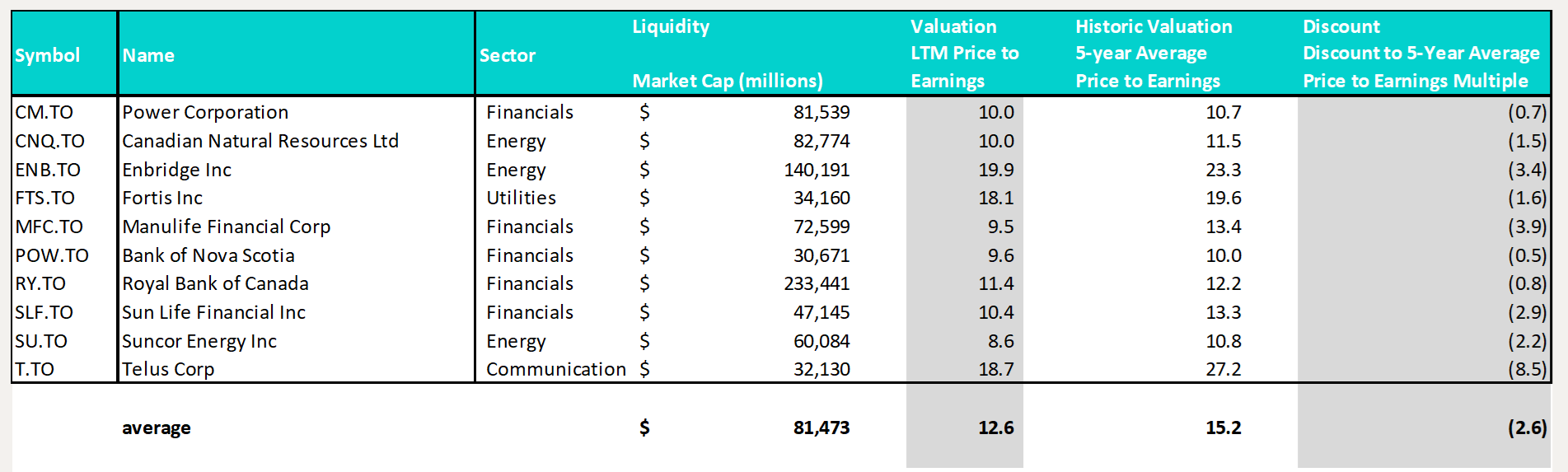

Information below is specific to individual securities held in the Portfolio. It is only intended to describe key characteristics of individual holdings at a point in time and makes no inference about the return nor yield of either the Preferred Shares or the Class A Shares of the Canadian Large Cap Leaders Split Corp.

The implied discount was currently 2.6x worth of multiple points at the close on April 30, 2025, which highlights the opportunity to buy our portfolio of Canadian high-quality, dividend payers significantly below long-term historic valuations through the purchase of shares of NPS on the open market.

Finally, we would like to highlight that the Canadian Large Cap Leaders Split Corp has announced its next distribution, payable on May 14, 2025, to Class A Shareholders of record at the close of business on April 30, 2025. As planned, holders of the Class A Shares will receive the $0.12500 per share regular monthly dividend.

As always, we appreciate the support of all those who have invested in the Canadian Large Cap Leaders Split Corp.

Until next month,

John, Jeff & Colin

Ninepoint Partners

1All returns are based on Net Asset Value per Class A share, or the redemption price plus accrued interest per Preferred share and assumes that distributions made by the Fund on the Class A shares, or Preferred shares in the period shown were reinvested in additional Class A shares and Preferred shares of the Fund as at 4/30/2025.

April 30, 2025

April 30, 2025