Monthly Update

Year-to-date to May 31, the Canadian Large Cap Leaders Split Corp Class A Shares generated a total return of 7.15% and the Preferred Shares generated a total return of 3.15%. For the month, the Class A Shares generated a total return of 6.23% while the Preferred Shares generated a total return of 0.62%1.

CANADIAN LARGE CAP LEADER SPLIT CORP. - COMPOUNDED RETURNS¹ AS OF MAY 31, 2025 | INCEPTION DATE: FEBRUARY 22, 2024

1M |

YTD |

3M |

6M |

1YR |

Inception |

|

|---|---|---|---|---|---|---|

Canadian Large Cap Leaders Split Corp - Class A Shares |

6.23% |

7.15% |

4.16% |

0.88% |

21.34% |

23.37% |

Canadian Large Cap Leaders Split Corp - Pref Shares |

0.62% |

3.15% |

1.88% |

3.81% |

7.71% |

7.75% |

The broad equity markets have essentially recouped the losses from President Trump’s Liberation Day of “reciprocal” tariffs, in a dramatic “V-shaped” rally. The snapback was triggered, at least in the initial phase, by the President’s willingness to walk back some of his most extreme positions, likely spooked by the selloff in the US Treasury market and extreme volatility across various asset classes. Further, the news that the US and China were willing to de-escalate hostilities, slashing tariffs pending further trade talks, also helped to propel markets higher. Looking forward, deregulation and tax reform are potential future tailwinds in the United States, contingent upon a continued improvement in trade relations and negotiated trade deals.

Canadian stocks have experienced much better performance year-to-date compared to those based in the United States, with particularly good performance from the Financials sector. In the current environment, we remain invested in a diversified portfolio of high-quality, dividend-paying Canadian companies. Again, we expect that interest rates will continue moving lower in Canada, making our holdings even more attractive from a yield perspective.

Information below is specific to individual securities held in the Portfolio. It is only intended to describe key characteristics of individual holdings at a point in time and makes no inference about the return nor yield of either the Preferred Shares or the Class A Shares of the Canadian Large Cap Leaders Split Corp.

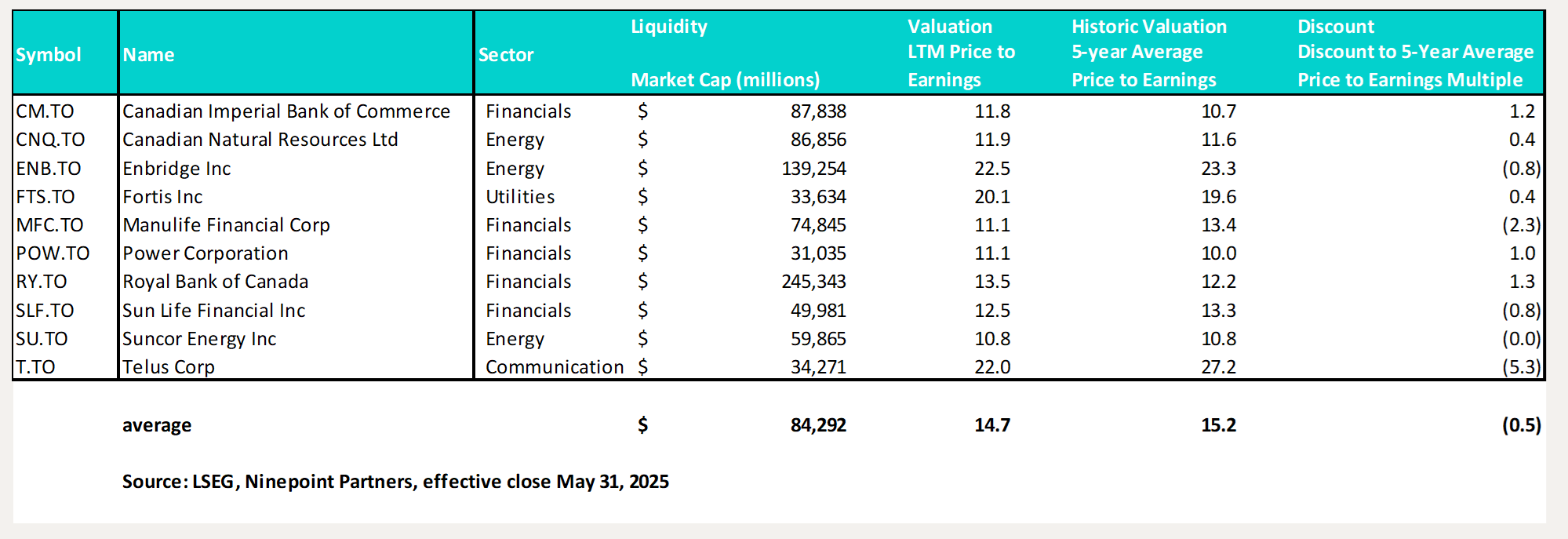

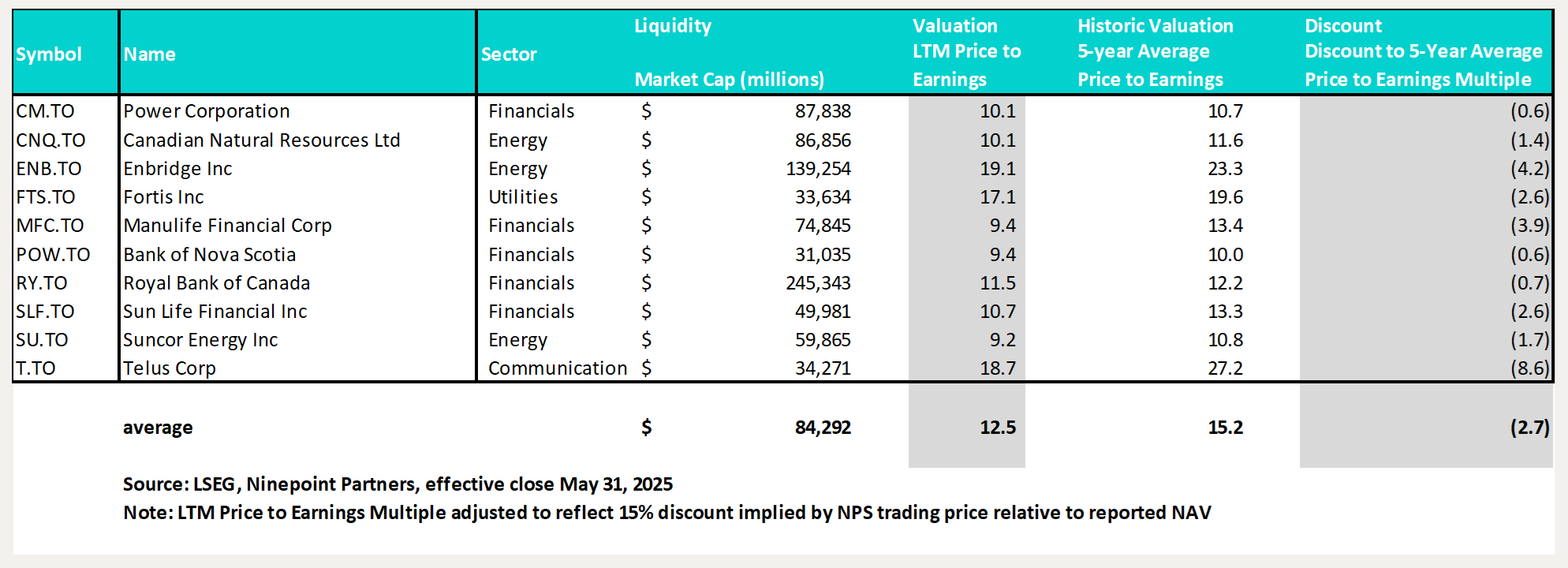

From the chart above, we can see that our holdings, on average, trade at an LTM price to earnings multiple of 14.7x, compared to the 5-year average price to earnings multiple of 15.2x. However, given our outlook for lower interest rates (and supported by a significant discount to the S&P 500, which currently trades at about 21.5x forward earnings, according to FactSet), multiples still have plenty of room to expand in Canada. Further, with the Class A Shares trading approximately 15% below the reported NAV at the close on May 31, 2025, we can adjust this table to visualize the implied valuation today:

Information below is specific to individual securities held in the Portfolio. It is only intended to describe key characteristics of individual holdings at a point in time and makes no inference about the return nor yield of either the Preferred Shares or the Class A Shares of the Canadian Large Cap Leaders Split Corp.

The implied discount was currently 2.7x worth of multiple points at the close on May 31, 2025, which highlights the opportunity to buy our portfolio of Canadian high-quality, dividend payers significantly below long-term historic valuations through the purchase of shares of NPS on the open market. Note that we have also just received approval from the Toronto Stock Exchange to continue our normal course issuer bid to purchase Class A Shares and Preferred Shares for another year.

Further details regarding the share buyback can be found here: https://www.ninepoint.com/about-ninepoint/press-releases/canadian-large-cap-leaders-split-corp-receives-approval-for-normal-course-issuer-bid-1/

Finally, we would like to highlight that the Canadian Large Cap Leaders Split Corp has announced its next distribution, payable on June 13, 2025, to Class A Shareholders of record at the close of business on May 30, 2025. As planned, holders of the Class A Shares will receive the $0.12500 per share regular monthly dividend.

As always, we appreciate the support of all those who have invested in the Canadian Large Cap Leaders Split Corp.

Until next month,

John, Jeff & Colin

Ninepoint Partners

1All returns are based on Net Asset Value per Class A share, or the redemption price plus accrued interest per Preferred share and assumes that distributions made by the Fund on the Class A shares, or Preferred shares in the period shown were reinvested in additional Class A shares and Preferred shares of the Fund as at 5/31/2025.

May 31, 2025

May 31, 2025