Monthly Update

Year-to-date to June 30, the Canadian Large Cap Leaders Split Corp Class A Shares generated a total return of 8.75% and the Preferred Shares generated a total return of 3.78%. For the month, the Class A Shares generated a total return of 1.50% while the Preferred Shares generated a total return of 0.62%1.

CANADIAN LARGE CAP LEADER SPLIT CORP. - COMPOUNDED RETURNS¹ AS OF JUNE 30, 2025 | INCEPTION DATE: FEBRUARY 22, 2024

1M |

YTD |

3M |

6M |

1YR |

Inception |

|

|---|---|---|---|---|---|---|

Canadian Large Cap Leaders Split Corp - Class A Shares |

1.50% |

8.75% |

5.13% |

8.75% |

30.19% |

23.10% |

Canadian Large Cap Leaders Split Corp - Pref Shares |

0.62% |

3.78% |

1.87% |

3.78% |

7.73% |

7.73% |

Markets continued to march higher through June, with the tech-heavy NASDAQ up 6.64% during the month (in USD), followed by the S&P 500 up 5.09% (in USD) and the Dow Jones Industrial Average up 4.47% (in USD). Globally, stocks had a good month, with the S&P Global 1200 up 3.68% (in CAD) and Canadian stocks had a decent month, with the TSX Composite up 2.91%.

Despite all the chaos in the world, investors were willing to allocate capital to stocks as, broadly speaking, things began to look better than originally feared. In terms of geopolitics, Israel and Iran exchanged terrifying barrages of missiles over the course of several days, which culminated with the US bombing Iran’s suspected nuclear facilities. But thankfully, hostilities de-escalated quickly after the decisive mission and a ceasefire was brokered by the US and Qatar. Oil prices had initially spiked, given the importance of the Strait of Hormuz to the global oil markets, but the passage remained open, and prices retreated, eliminating fears of an inflationary commodity shock.

Global trade relations also seemed to improve during the month, as the US and China appeared to come to some form of an agreement for a trade deal. Tariffs on Chinese exports were reduced to a combined 55%, (comprised of a baseline 10% “reciprocal” tariff, pre-existing 25% tariffs and an additional 20% on all imports), in exchange for the reinstatement of Chinese student visas and the resumption of the export of rare earth metals from China. Considering the amount of goods that flow from China to North America and the importance of securing a stable supply of rare earth metals to the US, investors cheered the news.

Looking forward, we are very interested in the coming Q2 earnings season, where it will be critically important to listen to commentary from various corporate management teams to form a view of how the balance of the year will play out. In the current environment, we remain invested in a diversified portfolio of high quality, dividend-paying Canadian companies. Again, we expect that interest rates will continue moving lower in Canada, making our holdings even more attractive from a yield perspective.

Information below is specific to individual securities held in the Portfolio. It is only intended to describe key characteristics of individual holdings at a point in time and makes no inference about the return nor yield of either the Preferred Shares or the Class A Shares of the Canadian Large Cap Leaders Split Corp.

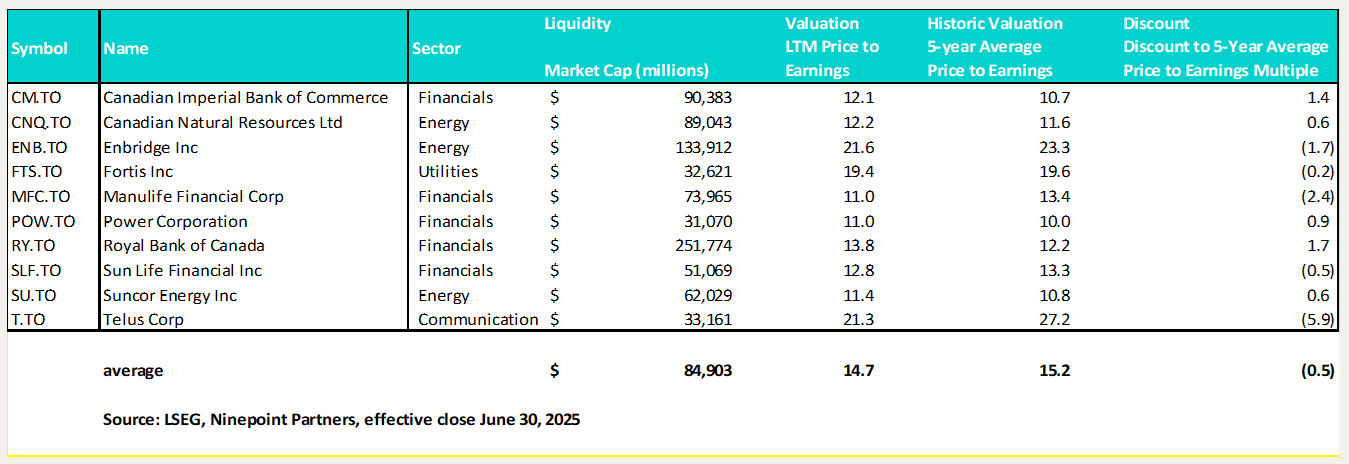

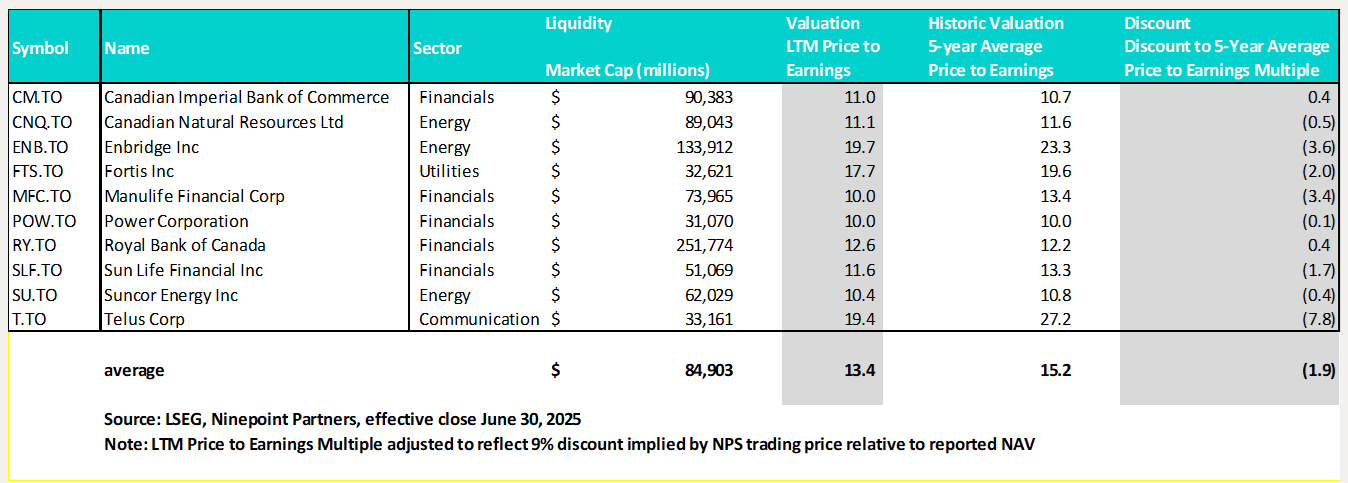

From the chart above, we can see that our holdings, on average, trade at an LTM price to earnings multiple of 14.7x, compared to the 5-year average price to earnings multiple of 15.2x. However, given our outlook for lower interest rates (and supported by a significant discount to the S&P 500, which currently trades at about 22x forward earnings, according to FactSet), multiples still have plenty of room to expand in Canada. Further, with the Class A Shares trading approximately 9% below the reported NAV at the close on June 30, 2025, we can adjust this table to visualize the implied valuation today:

Information below is specific to individual securities held in the Portfolio. It is only intended to describe key characteristics of individual holdings at a point in time and makes no inference about the return nor yield of either the Preferred Shares or the Class A Shares of the Canadian Large Cap Leaders Split Corp.

The implied discount was currently 1.9x worth of multiple points at the close on June 30, 2025, which highlights the opportunity to buy our portfolio of Canadian high-quality, dividend payers significantly below long-term historic valuations through the purchase of shares of NPS on the open market. Note that we have been active with our NCIB and the discount is beginning to narrow (on a combined basis, the Class A and Preferred Shares traded at only a 2% discount to reported NAV at the end of the month).

Finally, we would like to highlight that the Canadian Large Cap Leaders Split Corp has announced its next distributions, payable on July 14, 2025, to both Class A and Preferred Shareholders of record at the close of business on June 30, 2025. As planned, holders of the Class A Shares will receive the $0.12500 per share regular monthly dividend and holders of the Preferred Shares will receive the $0.18750 regular quarterly dividend.

As always, we appreciate the support of all those who have invested in the Canadian Large Cap Leaders Split Corp.

Until next month,

John, Jeff & Colin

Ninepoint Partners

1All returns are based on Net Asset Value per Class A share, or the redemption price plus accrued interest per Preferred share and assumes that distributions made by the Fund on the Class A shares, or Preferred shares in the period shown were reinvested in additional Class A shares and Preferred shares of the Fund as at 6/30/2025.

June 30, 2025

June 30, 2025