Monthly Update

Year-to-date to June 30, the Ninepoint Global Infrastructure Fund generated a total return of 3.93% compared to the MSCI World Core Infrastructure Index, which generated a total return of 7.62%. For the month, the Fund generated a total return of 1.25% while the Index generated a total return of 0.52%.

Ninepoint Global Infrastructure Fund - Compounded Returns¹ As of June 30, 2025 (Series F NPP356) | Inception Date: September 1, 2011

1M |

YTD |

3M |

6M |

1YR |

3YR |

5YR |

10YR |

Inception |

|

|---|---|---|---|---|---|---|---|---|---|

Fund |

1.25% |

3.93% |

0.08% |

3.93% |

20.62% |

11.86% |

10.99% |

8.02% |

8.35% |

MSCI World Core Infrastructure NR (CAD) |

0.52% |

7.62% |

-0.03% |

7.62% |

21.04% |

8.80% |

8.13% |

8.42% |

10.91% |

Markets continued to march higher through June, with the tech-heavy NASDAQ up 6.64% during the month (in USD), followed by the S&P 500 up 5.09% (in USD) and the Dow Jones Industrial Average up 4.47% (in USD). Globally, stocks had a good month, with the S&P Global 1200 up 3.68% (in CAD) and Canadian stocks had a decent month, with the TSX Composite up 2.91%.

Despite all the chaos in the world, investors were willing to allocate capital to stocks as, broadly speaking, things began to look better than originally feared. In terms of geopolitics, Israel and Iran exchanged terrifying barrages of missiles over the course of several days, which culminated with the US bombing Iran’s suspected nuclear facilities. But thankfully, hostilities de-escalated quickly after the decisive mission and a ceasefire was brokered by the US and Qatar. Oil prices had initially spiked, given the importance of the Strait of Hormuz to the global oil markets, but the passage remained open, and prices retreated, eliminating fears of an inflationary commodity shock.

Global trade relations also seemed to improve during the month, as the US and China appeared to come to some form of an agreement for a trade deal. Tariffs on Chinese exports were reduced to a combined 55%, (comprised of a baseline 10% “reciprocal” tariff, pre-existing 25% tariffs and an additional 20% on all imports), in exchange for the reinstatement of Chinese student visas and the resumption of the export of rare earth metals from China. Considering the amount of goods that flow from China to the US and the importance of securing a stable supply of rare earth metals to the US, investors cheered the news.

Global trade relations also seemed to improve during the month, as the US and China appeared to come to some form of an agreement for a trade deal. Tariffs on Chinese exports were reduced to a combined 55%, (comprised of a baseline 10% “reciprocal” tariff, pre-existing 25% tariffs and an additional 20% on all imports), in exchange for the reinstatement of Chinese student visas and the resumption of the export of rare earth metals from China. Considering the amount of goods that flow from China to the US and the importance of securing a stable supply of rare earth metals to the US, investors cheered the news.

Central Banks around the world were busy during the month, with the ECB reducing its three key interest rates by 25 basis points each, although the Bank of Canada remained unchanged at 2.75% and the US FOMC remained unchanged at 4.50%. During the press conference, Chairman Powell’s arguments for not reducing interest rates hinged on future inflation expectations tied to the Trump administration’s tariffs. However, if inflation doesn’t materialize significantly over the course of the next couple of months, we expect that the Fed will lower rates in September and December, in line with consensus expectations. In the meantime, Chairman Powell will likely face continued pressure and insults from the President, though Powell has staunchly defended the Fed’s autonomy on numerous occasions.

Looking forward, deregulation, tax reform and fiscal stimulus are potential future tailwinds, with President Trump’s “Mega Bill” being signed into law just after month end. We are also extremely interested in the coming Q2 earnings season, where year-over-year earnings growth is expected to trough at about 5.0% (according to FactSet) for the year before accelerating through Q3 and Q4. It will be critically important to listen to commentary from various corporate management teams to form a view of how the balance of the year will play out. In this environment, we have reduced outsized allocations to individual stocks and investment themes while remaining invested in a diversified portfolio of dividend paying, high quality companies. We have also added more exposure to Europe across our portfolios, based on improving relative growth expectations and generally better stock valuations after being materially underweight in the past.

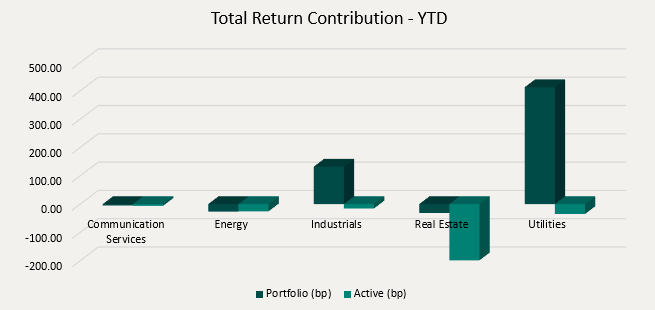

Top contributors to the year-to-date performance of the Ninepoint Global Infrastructure Fund by sector included Utilities (+413basis points) and Industrials (+132 basis points), while the Real Estate (-31 basis points) and Energy (-27 basis points) sectors detracted from performance on an absolute basis.

On a relative basis, negative contributions were generated from the Real Estate (-199 basis points), Utilities (-35 basis points) and Energy (-26 basis points) sectors.

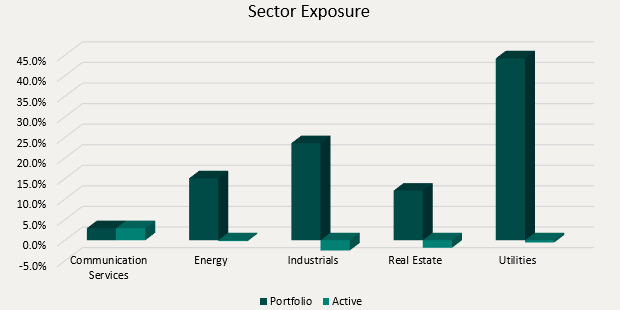

We are currently overweight the Communication Services sector and underweight the Industrials and Real Estate sectors. As the market continues to snap back, we are closely watching incoming data for any evidence that the Trump administration’s policies have damaged the labour market and/or future economic growth. To mitigate the risks, we remain focused on high quality, dividend paying infrastructure equities that have demonstrated the ability to consistently generate revenue, cash flow and earnings growth through the business cycle.

We continue to believe that the infrastructure asset class is ideally positioned to benefit from the electrification of the US economy and increased fiscal spending on infrastructure in Canada, the US and Europe. Importantly, electricity demand is expected to accelerate dramatically, led primarily by the construction of AI-focused data centers globally and the onshoring of industrial manufacturing in the US. Therefore, we are comfortable having exposure to various infrastructure sub-sectors or sub-industries in the Ninepoint Global Infrastructure Fund that are positioned to benefit from these themes, including traditional energy investments, electrical, natural gas, nuclear & multi-utilities and engineering & construction contractors.

The Ninepoint Global Infrastructure Fund was concentrated in 30 positions as at June 30, 2025, with the top 10 holdings accounting for approximately 39.0% of the fund. Over the prior fiscal year, 26 out of our 30 holdings have announced a dividend increase, with an average hike of 9.3% (median hike of 6.0%). Using a total infrastructure approach, we will continue to apply a disciplined investment process, balancing valuation, growth, and yield in an effort to generate solid risk-adjusted returns.

Jeffrey Sayer, CFA

Ninepoint Partners

June 30, 2025

June 30, 2025