Effective May 3, 2024, Ninepoint FX Strategy Fund was renamed Ninepoint Global Macro Fund. There are no changes to the investment objectives or strategies of this fund.

FX Strategy performance was negative for the month ended June 30, 2025. The Israel/Iran conflict both started and ended quickly. Inflation was subdued globally, as falling energy prices in both April and May led to lower-than-expected inflation data in June. The European Central Bank lowered rates again; while, the Federal Reserve was again on hold for more data. European investors hurried to hedge U.S. Dollar-based investments.

Entering July, the FX Strategy remains net long USD, driven by a variety of factors. Firstly, growth prospects for the U.S. have stabilized and have even improved relative to global counterparts. Secondly, interest rate differentials, between the U.S. and other developed countries remain attractive. Thirdly, speculators hold extreme levels of short U.S. Dollar positions. Finally, the U.S. Dollar weakness has made the Euro very expensive on a trade-weighted basis. Looking forward, we anticipate a reversal of speculative flows, as real money flows have been stable. We anticipate Euro weakness this summer, as both growth prospects and monetary policy divergences continue.

We will continue to incorporate new data, monitor adaptation rates of our factors, and explore new analytical tools. We look forward to keeping you informed of any material changes to our outlook.

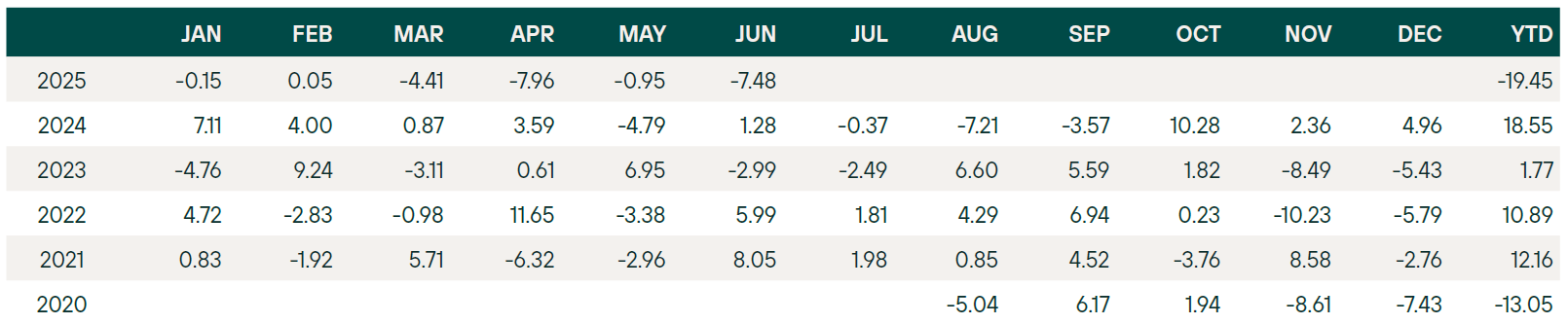

Ninepoint Global Macro Fund (formerly FX Strategy Fund) Monthly Returns (%) Performance as at June 30, 2025- Series F1 (NPP759) | Inception Date: August 6, 2020

The F1 Class units of the Fund returned net -4.50% (Class F1) for the Q1-25.

Compounded Returns (%) as of June 30, 2025

1M |

YTD |

3M |

6M |

1YR |

3YR |

INCEPTION |

|

|---|---|---|---|---|---|---|---|

Fund |

-7.48 |

-19.45 |

-15.65 |

-19.45 |

-14.91 |

-2.20 |

1.20 |

June 30, 2025

June 30, 2025