Monthly Update

Ninepoint Focused Global Dividend Fund - Compounded Returns¹ As of June 30, 2025 (Series F NPP964) | Inception Date: November 25, 2015

1M |

YTD |

3M |

6M |

1YR |

3YR |

5YR |

Inception |

|

|---|---|---|---|---|---|---|---|---|

Fund |

4.52% |

-0.60% |

6.72% |

-0.60% |

13.06% |

17.12% |

11.95% |

9.28% |

S&P Global 1200 TR (CAD) |

3.68% |

4.43% |

5.64% |

4.43% |

16.08% |

20.76% |

15.00% |

12.15% |

Markets continued to march higher through June, with the tech-heavy NASDAQ up 6.64% during the month (in USD), followed by the S&P 500 up 5.09% (in USD) and the Dow Jones Industrial Average up 4.47% (in USD). Globally, stocks had a good month, with the S&P Global 1200 up 3.68% (in CAD) and Canadian stocks had a decent month, with the TSX Composite up 2.91%.

Despite all the chaos in the world, investors were willing to allocate capital to stocks as, broadly speaking, things began to look better than originally feared. In terms of geopolitics, Israel and Iran exchanged terrifying barrages of missiles over the course of several days, which culminated with the US bombing Iran’s suspected nuclear facilities. But thankfully, hostilities de-escalated quickly after the decisive mission and a ceasefire was brokered by the US and Qatar. Oil prices had initially spiked, given the importance of the Strait of Hormuz to the global oil markets, but the passage remained open, and prices retreated, eliminating fears of an inflationary commodity shock.

Global trade relations also seemed to improve during the month, as the US and China appeared to come to some form of an agreement for a trade deal. Tariffs on Chinese exports were reduced to a combined 55%, (comprised of a baseline 10% “reciprocal” tariff, pre-existing 25% tariffs and an additional 20% on all imports), in exchange for the reinstatement of Chinese student visas and the resumption of the export of rare earth metals from China. Considering the amount of goods that flow from China to the US and the importance of securing a stable supply of rare earth metals to the US, investors cheered the news.

Central Banks around the world were busy during the month, with the ECB reducing its three key interest rates by 25 basis points each, although the Bank of Canada remained unchanged at 2.75% and the US FOMC remained unchanged at 4.50%. During the press conference, Chairman Powell’s arguments for not reducing interest rates hinged on future inflation expectations tied to the Trump administration’s tariffs. However, if inflation doesn’t materialize significantly over the course of the next couple of months, we expect that the Fed will lower rates in September and December, in line with consensus expectations. In the meantime, Chairman Powell will likely face continued pressure and insults from the President, though Powell has staunchly defended the Fed’s autonomy on numerous occasions.

Looking forward, deregulation, tax reform and fiscal stimulus are potential future tailwinds, with President Trump’s “Mega Bill” being signed into law just after month end. We are also extremely interested in the coming Q2 earnings season, where year-over-year earnings growth is expected to trough at about 5.0% (according to FactSet) for the year before accelerating through Q3 and Q4. It will be critically important to listen to commentary from various corporate management teams to form a view of how the balance of the year will play out. In this environment, we have reduced outsized allocations to individual stocks and investment themes while remaining invested in a diversified portfolio of dividend paying, high quality companies. We have also added more exposure to Europe across our portfolios, based on improving relative growth expectations and generally better stock valuations after being materially underweight in the past.

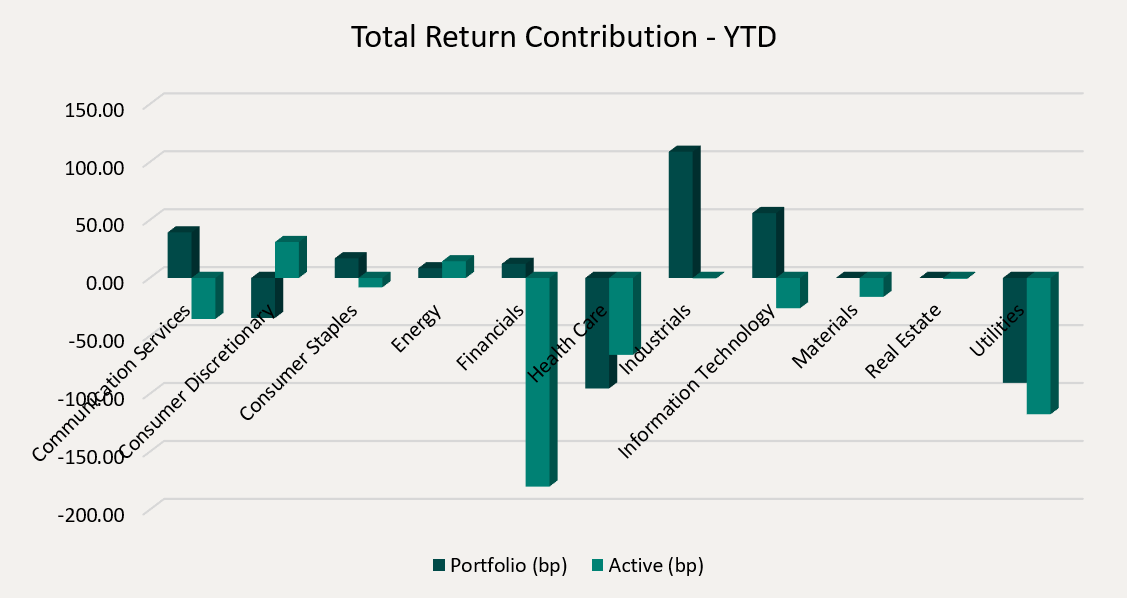

Top contributors to the year-to-date performance of the Ninepoint Focused Global Dividend Fund by sector included Industrials (+109 basis points), Information Technology (+56 basis points) and Communication Services (+39 basis points), while the Health Care (-95 basis points) Utilities (-91 basis points) and Consumer Discretionary (-35 basis points) sectors detracted from performance on an absolute basis.

On a relative basis, positive return contributions from the Consumer Discretionary (+31 basis points) and Energy (+14 basis points) sectors were offset by negative contributions from the Financials (-180 basis points), Utilities (-118 basis points) and Health Care (-66 basis points) sectors.

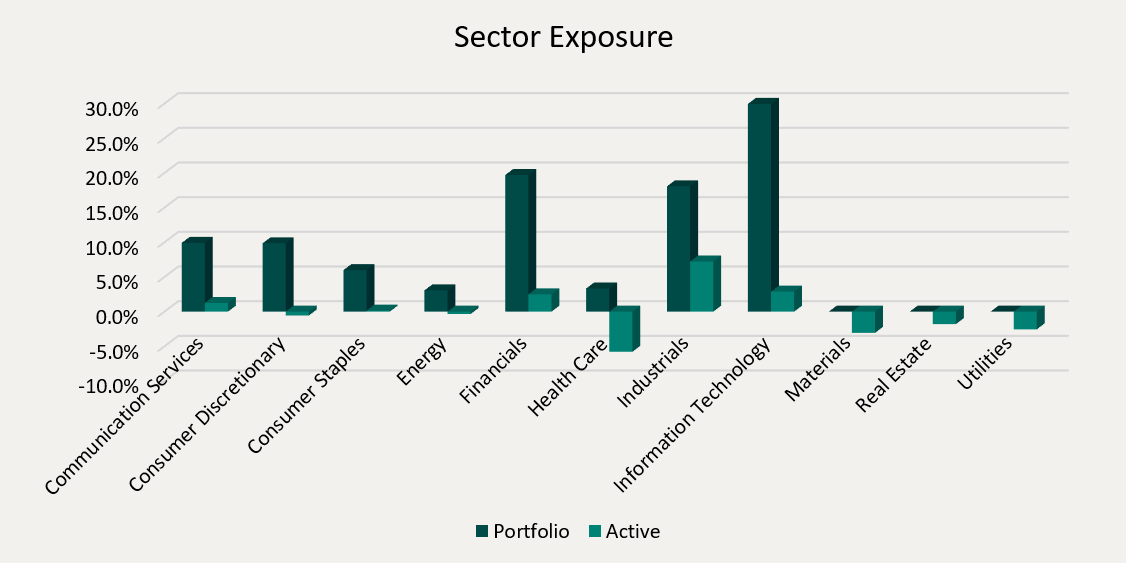

We are currently overweight the Industrials, Information Technology and Financials sectors, while underweight the Health Care, Materials and Utilities sectors. As the market continues to snap back, we are closely watching incoming data for any evidence that the Trump administration’s policies have damaged the labour market and/or future economic growth. To mitigate the risks, we remain focused on high quality, dividend payers that have demonstrated the ability to consistently generate revenue and earnings growth through the business cycle.

The Ninepoint Focused Global Dividend Fund was concentrated in 30 positions as at June 30, 2025, with the top 10 holdings accounting for approximately 39.0% of the fund. Over the prior fiscal year, 22 out of our 30 holdings have announced a dividend increase, with an average hike of 48.2% (median hike of 9.6%). We will continue to apply a disciplined investment process, balancing various quality and valuation metrics, in an effort to generate solid risk-adjusted returns.

Jeffery Sayer, CFA

Ninepoint Partners

June 30, 2025

June 30, 2025