Ninepoint Target Income Fund - Mid Year 2025 Commentary

Our expectation that the low volatility regime of 2024 would see normalization through-out 2025 has started to come to fruition as equities experienced a rapid sell off into April, driving the VIX index above 50 and averaging 20 in the first half of 2025. As a reminder, The VIX Index, averaged a mere 15 in 2024, reminiscent of pre-COVID low volatility market conditions and well below the 18.5 10-year average. Equities witnessing a more normalized (higher) volatility environment going forward, while creating higher potential risk, can also offer higher potential put premiums on newly initiated puts.

The drivers of the sell-off gradually shifted from concerns surrounding AI & Cloud data center demand, a key area of recent market leadership, to broader economic risks surrounding the negative impacts of tariffs on economic growth. Street economists took down economic growth forecasts for Q1 and Q2 as consumer & investment spending were expected to stall. As the more draconian tariff scenarios were walked back, equity markets recovered from the rapid -19% peak to trough decline with the S&P 500 ending the first half at all time highs.

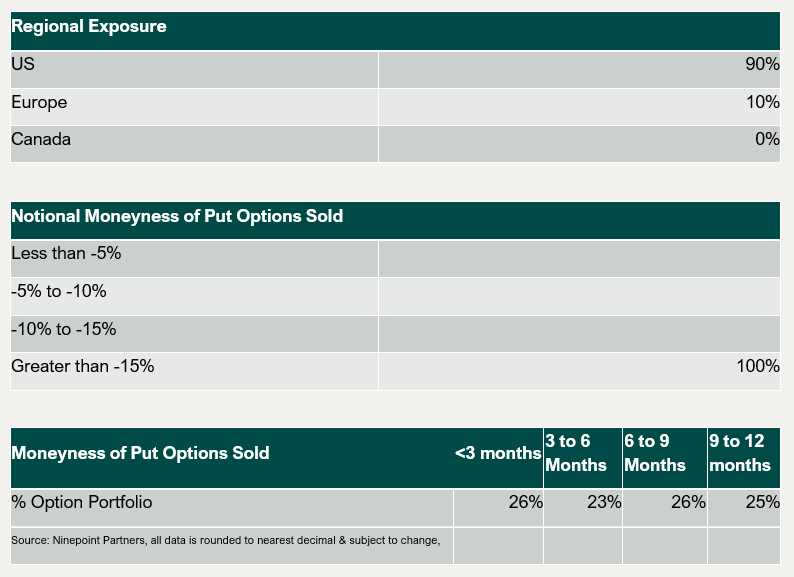

During the sell-off, the Ninepoint Target Income Fund provided defensive attributes despite being exposed to increases in volatility showcasing the ability to weather volatile markets. A quarter of the Target Income funds options portfolio rolled into new 1-year put options in June. The investment strategy rolled put ladders at just under 15% out-of-the-money for new 1-year put options. This posture aims to weather volatile markets, manage potential losses during market declines while providing the income potential and diversification income portfolios seek.

Colin Watson

Portfolio Manager

Ninepoint Partners

Why Invest in the Ninepoint Target Income Fund?

-

Defensive Equity Income Strategy:

Generates an annual 5% target income distribution with the potential for moderate downside protection in market declines.

-

Income Diversification:

Provides a differentiated income stream via put option premiums to complement traditional income portfolios.

-

Active Risk Management:

Ability to manage risk and index exposures to achieve investment goals.

June 30, 2025

June 30, 2025