Monthly Update

Year-to-date to July 31, the Canadian Large Cap Leaders Split Corp Class A Shares generated a total return of 11.27% and the Preferred Shares generated a total return of 4.43%. For the month, the Class A Shares generated a total return of 2.31% while the Preferred Shares generated a total return of 0.62%1.

CANADIAN LARGE CAP LEADER SPLIT CORP. - COMPOUNDED RETURNS¹ AS OF JULY 31, 2025 | INCEPTION DATE: FEBRUARY 22, 2024

1M |

YTD |

3M |

6M |

1YR |

Inception |

|

|---|---|---|---|---|---|---|

Canadian Large Cap Leaders Split Corp - Class A Shares |

2.31% |

11.27% |

10.32% |

8.69% |

22.64% |

23.55% |

Canadian Large Cap Leaders Split Corp - Pref Shares |

0.62% |

4.43% |

1.87% |

3.78% |

7.71% |

7.72% |

Markets continue to climb a wall of worry, as fears of a post-liberation day worst-case scenario have yet to play out. Thus far, most industries and companies in the United States (barring a few notable exceptions such as automotive manufacturers) have been able to rely on selling current inventory and sharing the cost of tariffs with downstream suppliers to protect profit margins and earnings as best as possible.

As management teams navigate a difficult environment on both sides of the border, Canadian stocks continue to perform well, led by the Materials sector, with the Financials sector in line but the Energy sector behind the TSX Composite. Unfortunately, the macroeconomic data is weakening, as the Canadian economy lost over 40,000 jobs in July, while the unemployment rate remained at a multi-year high of 6.9% as discouraged job seekers stopped actively looking for work.

In the current environment, we remain invested in a diversified portfolio of high-quality, dividend-paying Canadian companies. With the weakening jobs outlook, we expect that interest rates will continue moving lower in Canada, making our holdings even more attractive from a yield perspective.

Information below is specific to individual securities held in the Portfolio. It is only intended to describe key characteristics of individual holdings at a point in time and makes no inference about the return nor yield of either the Preferred Shares or the Class A Shares of the Canadian Large Cap Leaders Split Corp.

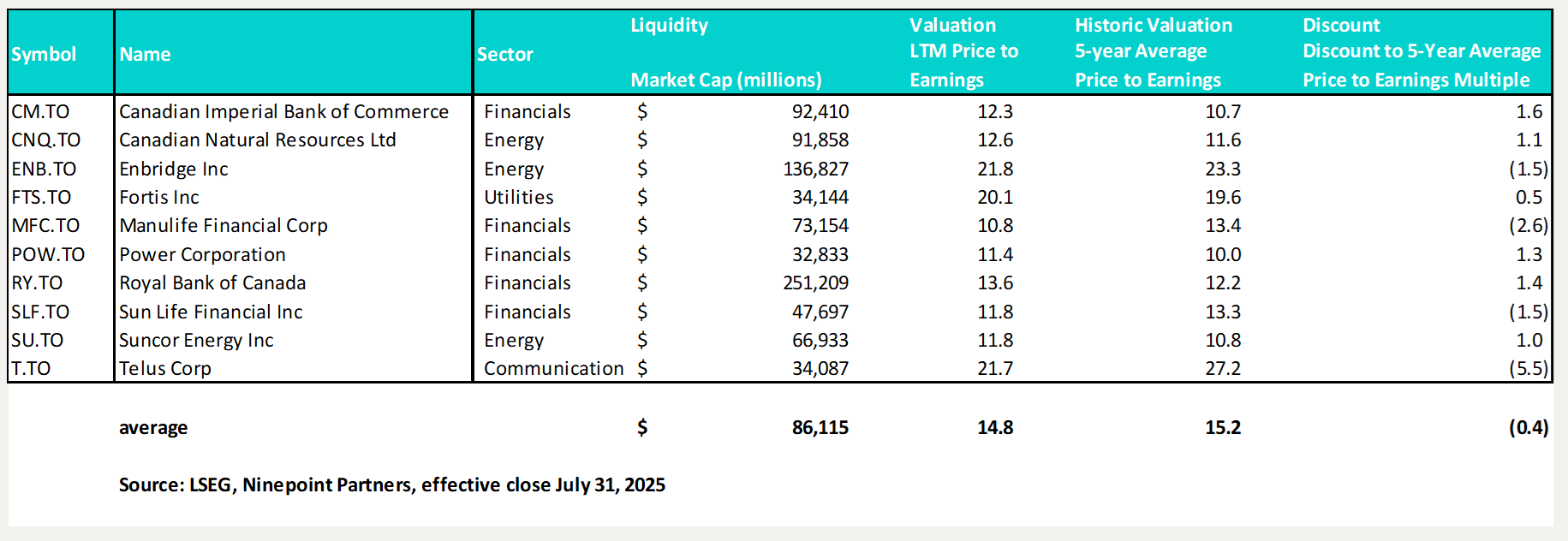

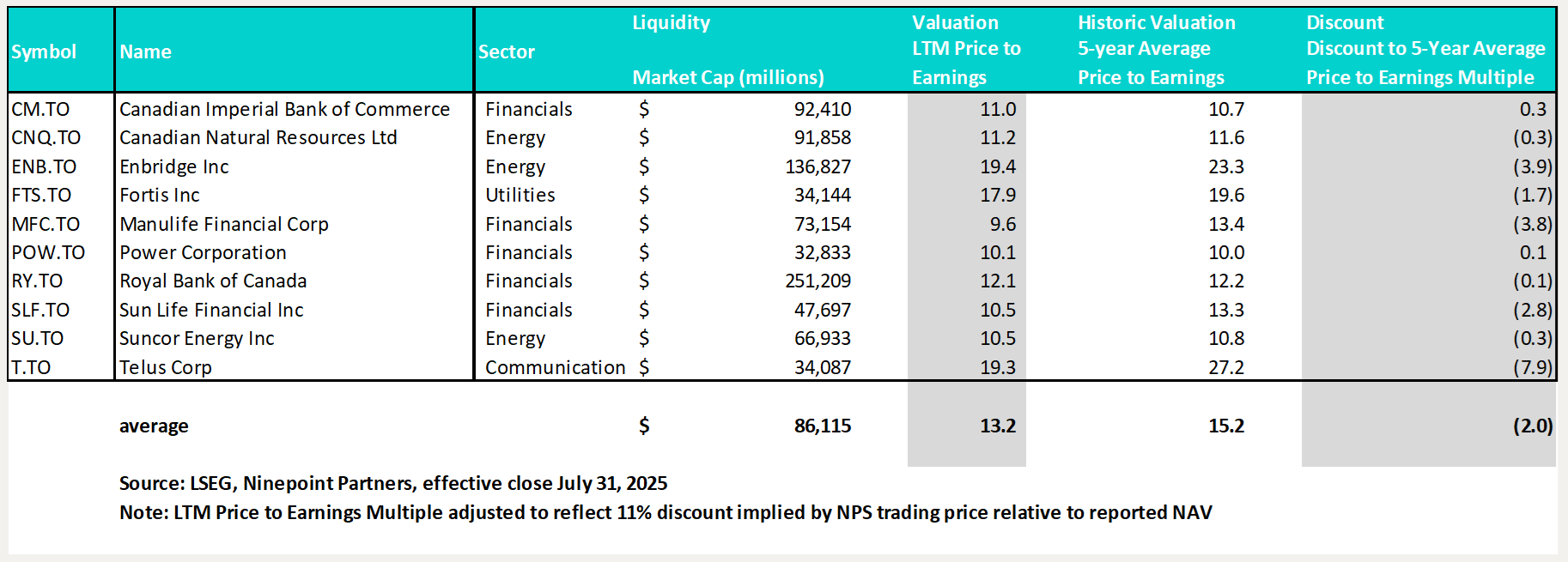

From the chart above, we can see that our holdings, on average, trade at an LTM price to earnings multiple of 14.8x, compared to the 5-year average price to earnings multiple of 15.2x. However, given our outlook for lower interest rates (and supported by a significant discount to the S&P 500, which currently trades at about 22x forward earnings, according to FactSet), multiples still have plenty of room to expand in Canada. Further, with the Class A Shares trading approximately 11% below the reported NAV at the close on July 31, 2025, we can adjust this table to visualize the implied valuation today:

Information below is specific to individual securities held in the Portfolio. It is only intended to describe key characteristics of individual holdings at a point in time and makes no inference about the return nor yield of either the Preferred Shares or the Class A Shares of the Canadian Large Cap Leaders Split Corp.

The implied discount was currently 2.0x worth of multiple points at the close on July 31, 2025, which highlights the opportunity to buy our portfolio of Canadian high-quality, dividend payers significantly below long-term historic valuations through the purchase of shares of NPS on the open market. Note that we have been active with our NCIB and the discount is beginning to narrow (on a combined basis, the Class A and Preferred Shares traded at only a 2.3% discount to the reported NAV at the end of the month).

Finally, we would like to highlight that the Canadian Large Cap Leaders Split Corp has announced its next distribution, payable on August 14, 2025, to Class A Shareholders of record at the close of business on July 31, 2025. As planned, holders of the Class A Shares will receive the $0.12500 per share regular monthly dividend.

As always, we appreciate the support of all those who have invested in the Canadian Large Cap Leaders Split Corp.

Until next month,

John, Jeff & Colin

Ninepoint Partners

1All returns are based on Net Asset Value per Class A share, or the redemption price plus accrued interest per Preferred share and assumes that distributions made by the Fund on the Class A shares, or Preferred shares in the period shown were reinvested in additional Class A shares and Preferred shares of the Fund as at 7/31/2025.

July 31, 2025

July 31, 2025