Year-to-date to July 31, the Ninepoint Crypto and AI Leaders ETF generated a total return of 17.44%. For the month, the Fund generated a total return of 15.72%.

Ninepoint Crypto And AI Leaders ETF - Compounded Returns¹ As of July 31, 2025 (Series ETF CAD- TKN) | Inception Date: January 27, 2021

1M |

YTD |

3M |

6M |

1YR |

3YR |

Inception |

|

|---|---|---|---|---|---|---|---|

Fund |

15.72% |

17.44% |

50.32% |

11.05% |

48.11% |

46.13% |

19.56% |

Building on the momentum established in May and June, sectoral tailwinds across crypto and AI carried forcefully into July, delivering meaningful risk-adjusted returns across the portfolio and reinforcing our high-conviction positioning. The Fund rose 15.72% during the month, marking its second-best return of 2025 and surpassing December 2024 levels to set a new all-time high.

While Bitcoin reached a new all-time high of $123,092 and closed July up 9.3%, the fund’s diversified composition of cryptoassets and crypto-and-AI-related public equities materially outperformed. In fact, as per TradingView seven of the fund’s holdings delivered stronger returns than Bitcoin during the month: Ethereum (+52.9%), Galaxy Digital (+32.1%), Roblox (+31.3%), AMD (+27.5%), Solana (+18.1%), Nvidia (+13.9%), and Hut 8 (+11.3%). Compared to the Nasdaq’s 4.1% gain, 13 of the fund’s 16 holdings outperformed, underscoring the strength of our sector-specific positioning. The past few months have revealed two clear trends. First, crypto and AI have consistently delivered outsized returns relative to broader markets. Second, each month has brought a new standout, with Bitcoin dominating early in the year, equities outperforming in June, and Ethereum taking the lead in July.

To underscore this point, our fund is purposefully designed to capture these shifts through a three-pronged approach, offering diversified exposure to:

- Growth in digital asset platforms, like Bitcoin, Ethereum, and Solana, indirectly via listed Canadian cryptocurrency ETFs.

- Pure-play crypto and AI businesses.

- High-quality growth tech "beneficiaries."

As earnings season approached, all eyes were on big tech to see if the AI trade was losing steam or ready to erupt. Then, Microsoft and Meta reported quarterly results, both beat expectations and guided higher. Microsoft pointed to ongoing data infrastructure shortages for running AI models and earmarked $30 billion in capital expenditures for next quarter, while Meta credited stronger-than-expected ad revenue to AI and raised the low end of its capital expenditure guidance from $64 billion to $66 billion. Investors applauded the results, sending both stocks up roughly 10% after hours, along with the broader universe of AI-focused public equities. Coinbase also reported earnings at the end of the month, posting revenue just shy of expectations at $1.5 billion. To be sure, a weaker quarter was widely expected: global spot crypto volumes were down 31% from peak activity at the start of the year, and the company incurred $307 million in expenses related to a data theft incident in May. Still, Coinbase showed signs of strength, with $245 billion in platform assets, $332 million in stablecoin revenue (up 12% QoQ), $9.3 billion in cash, and a growing $1.8 billion crypto investment portfolio.

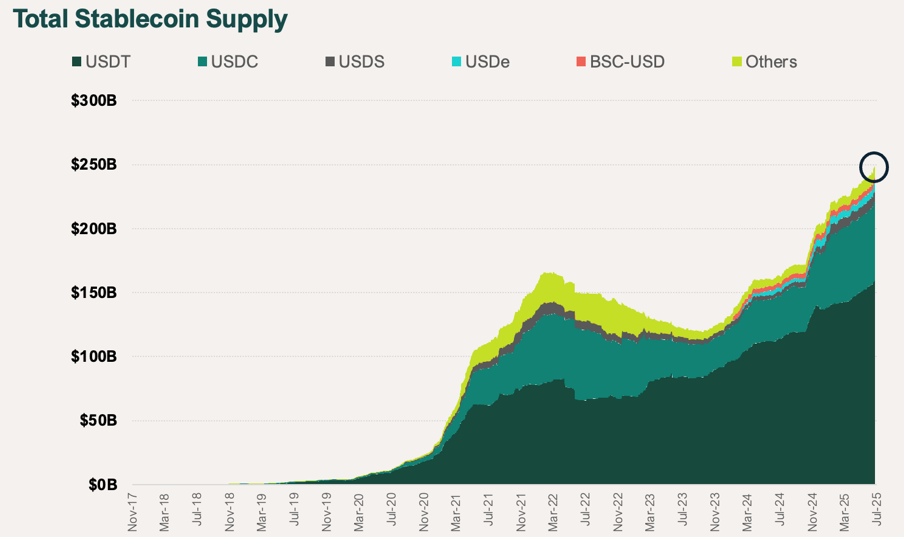

Then there was Tether, the world’s largest stablecoin issuer, with its flagship $160 billion USDT stablecoin. According to its Q2 Attestation Report, Tether recorded $4.9 billion in profit, largely driven by the $105 billion in U.S. Treasury holdings backing its stablecoin reserves. With fewer than a few hundred employees, Tether is one of the highest profit-per-employee companies in the world. For context, Goldman Sachs just reported $3.7 billion in quarterly profit. Yet Tether remains a private crypto firm. While it hasn’t revealed any plans to go public, there is now a strong backlog of high-quality crypto companies preparing for IPOs. Several had attempted to go public in 2021 but pulled back due to a hostile regulatory climate and a prolonged bear market. Today, those headwinds have flipped into powerful tailwinds. Circle’s public debut in June served as a major litmus test for investor appetite, and it was nothing short of a historic success. It will likely be remembered as the first domino to fall in what could become a full wave of crypto IPOs in the second half of 2025. That wave is already taking shape. In July, Bullish filed to go public, BitGo and Grayscale submitted confidential filings, and Figure co-founder Mike Cagney hinted the company plans to list this fall. This followed Gemini’s confidential filing in June, just one day after Circle’s IPO. A surge in new listings would significantly expand the investable public equity universe, offering investors more opportunities to gain exposure to strong, revenue-generating crypto businesses.

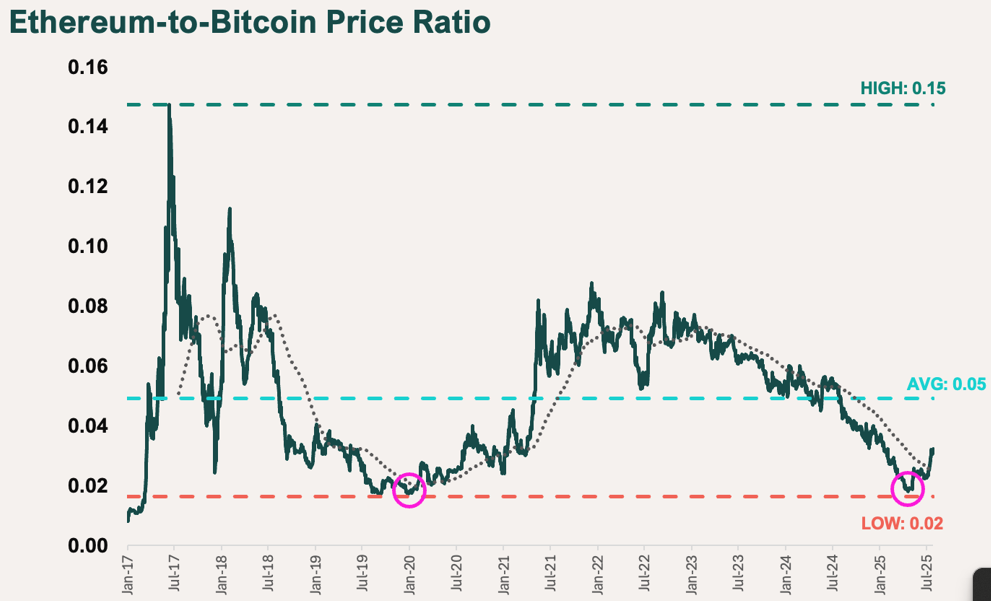

The biggest story of the past month, however, was Ethereum. It gained over 50% in July and closed near $3,800. With that, the Ethereum-to-Bitcoin price ratio broke above its 200-day moving average. It is now up more than 80% since rebounding from its historical low in mid-April. The last time Ethereum was in this position was January 2020, when it traded at just $143 before climbing to $4,892 in the altcoin season that followed. While history may not repeat exactly, it often rhymes.

And this setup feels strikingly reminiscent of past altcoin season beginnings. Throughout July, Bitcoin dominance fell from 65% to 60%, a classic early sign of altcoin season. That said, this cycle is different in a number of ways. Several new drivers have emerged that did not exist in prior cycles, and they have all hit at once, providing Ethereum with exceptionally strong tailwinds.

First is the extraordinary demand-supply imbalance, which has created a real supply crunch. So far in 2025, Ethereum supply has increased by just 236,000 ETH. During that same period, ETFs have purchased 2.3 million ETH, while public companies have acquired another 1.1 million ETH. Combined, those two cohorts have bought roughly $14 worth of ETH for every $1 of new issuance this year. Notably, much of this accumulation only began recently. The wave of Ethereum-focused digital asset treasury companies started with SharpLink Gaming’s announcement at the end of May, followed by Bitmine Immersion Technologies, Bit Digital, Ether Machine, and ETHZilla. Some speculated this trend would cannibalize ETF demand, but the opposite happened. Before SharpLink’s announcement, ETH ETFs had YTD net inflows of just $117 million. Since then, over the past 46 trading days, ETH ETFs have brought in $6.8 billion. In short, the whole pie grew.

Second are the regulatory tailwinds coming from the new pro-crypto administration and SEC. The week of July 14th, often referred to as “Crypto Week” in Washington, did not disappoint. Lawmakers in the U.S. House passed three major bills: the Digital Asset Market Structure (CLARITY) Act to define jurisdiction between the CFTC and SEC, the GENIUS Act to establish comprehensive stablecoin regulation, and the Anti-CBDC Surveillance State Act to prohibit the Federal Reserve from issuing a central bank digital currency. Just one day later, President Trump signed the GENIUS Act into law. The other two bills are now headed to the Senate. Then, at the end of the month, two more major developments dropped: the White House crypto working group published a 166-page roadmap for formal crypto regulation, and the SEC launched “Project Crypto,” aimed at bringing capital markets onto blockchain rails. Compared to past cycles, the regulatory environment this time is entirely different. And Ethereum, where much of this activity is already and will take place, is a clear beneficiary.

Third is the rapid acceleration of enterprise crypto adoption, which continues to reach record highs. In July alone, Coinbase and JPMorgan announced a strategic partnership enabling the bank’s clients to seamlessly access the cryptoeconomy. Users will be able to link bank accounts to Coinbase wallets, fund accounts using bank-issued cards, and even convert reward points into crypto. Interactive Brokers was reported to be exploring a stablecoin of its own. SoFi CEO Anthony Noto said during the company’s recent earnings call that a SoFi stablecoin is also on the roadmap, alongside upcoming crypto features like asset-backed lending and staking. As Noto put it, crypto is “a key area of focus” for the management team. Visa shared that its settlement platform has expanded support to include the USDG, PYUSD, and EURC stablecoins, as well as the Stellar and Avalanche networks. eToro announced plans to tokenize U.S. equities on Ethereum, joining rivals like Robinhood and Kraken, who have already revealed similar tokenization initiatives. PayPal rolled out a new feature called Pay with Crypto, allowing merchants worldwide to accept over 100 different cryptoassets at checkout. To say enterprise adoption is sizzling hot would be an understatement. Already, 60% of Fortune 500 companies are actively building in crypto, and 1 in 5 already considers it a core part of their future plans.

This is all to say, we believe this rally is just getting started. It should be noted that the circulating supply of stablecoins hit a major milestone this month- $250 billion. As one of crypto’s fastest-growing sectors, stablecoins have proved to be crypto’s first killer app, and have helped open the mainstream’s eyes to the power behind leveraging tokens on blockchain rails.

Wall Street is finally waking up to the rise of tokenization and recognizing how foundational Ethereum is to powering it.

To close out this month’s commentary, we highlight two of the most important dynamics shaping today’s crypto markets: flywheels and reflexivity. The flywheel effect is playing out in several powerful ways. Digital asset treasury companies like Strategy have created a self-reinforcing cycle where issuing new shares funds additional Bitcoin purchases. This increases the company’s Bitcoin per share, pushes Bitcoin’s price higher, and attracts more investors to buy shares, spinning the wheel faster. We see similar momentum in spot markets and ETFs, as described earlier. Stablecoin issuers exhibit flywheel mechanics, too. Tether, for example, uses excess reserves to purchase Bitcoin. That pushes the price of Bitcoin higher, drives more interest in Bitcoin itself, and in turn increases demand for stablecoins like USDT used to buy it. Another flywheel is unfolding in the crypto IPO landscape. The explosive success of Circle’s debut and a friendlier regulatory backdrop have kicked off what could be a full IPO season. The successful listing of one company encourages others to follow, which expands the investable universe, broadens institutional interest, and accelerates the integration of crypto equities into traditional portfolios. Many of these flywheels touch on a broader concept we’ve discussed before: reflexivity. Popularized by George Soros, reflexivity describes how the actions of market participants influence market fundamentals, often creating self-reinforcing or self-defeating feedback loops. Of course, the good times won’t last forever. Markets are cyclical, and this one will eventually come to an end. But for now, the flywheels are in motion, and it will take a lot to stop this train.

As such, the fund remains diversified across core cryptoassets like Bitcoin, Ethereum, and Solana, as well as across crypto and AI-focused public equities, to ensure we capture the full breadth of this evolution as the internet enters a new era. We’ll be closely tracking the remainder of earnings season and monitoring onchain activity to understand where capital is flowing and how best to position the fund for what comes next.

Alex Tapscott, CFA

Ninepoint Partners

July 31, 2025

July 31, 2025