Year-to-date to September 30, the Ninepoint Crypto and AI Leaders ETF generated a total return of 30.19%. For the month, the Fund generated a total return of 8.41%.

Ninepoint Crypto And AI Leaders ETF - Compounded Returns¹ As of September 30, 2025 (Series ETF USD- TKN.U) | Inception Date: January 27, 2021

1M |

YTD |

3M |

6M |

1YR |

3YR |

Inception |

|

|---|---|---|---|---|---|---|---|

Fund |

8.41% |

30.19% |

21.52% |

75.50% |

62.83% |

55.23% |

18.26% |

After posting a modest 1.43% decline in August, the Fund’s first monthly setback since March, the Fund rose 8.41% in September, as sectoral momentum in crypto and AI returned, propelling the portfolio.

While Bitcoin closed September up only 5.2%, the Fund’s diversified mix of core cryptoassets and crypto-and-AI-related equities enabled it to capture outsized gains and deliver strong outperformance. Eight of the Fund’s holdings, representing approximately 52% of the portfolio, beat Bitcoin’s return: Galaxy Digital (+44.0%), Robinhood (+39.2%), Hut 8 (+29.4%), Broadcom (+12.4%), Coinbase (+10.6%), Nvidia (+8.7%), Roblox (+7.5%), and Solana (+7.3%). The same was true against the Nasdaq, which rose 5.6% in September, underscoring the ongoing strength of our sector-specific positioning and active management.

Consistent with the usual rotation we’ve seen throughout 2025, leadership shifted again in September. Equities like Galaxy Digital, Robinhood, and Hut 8 led performance this month, in contrast to the prior two months when cryptoassets such as Ethereum and Solana set the pace.

To reiterate, our active strategy seeks to capture the full breadth and potential of crypto and AI technologies through a three-pronged approach, offering diversified exposure to:

- Growth in digital asset platforms, like Bitcoin, Ethereum, and Solana, indirectly via listed Canadian cryptocurrency ETFs

- Pure-play crypto and AI businesses

- High-quality growth tech beneficiaries

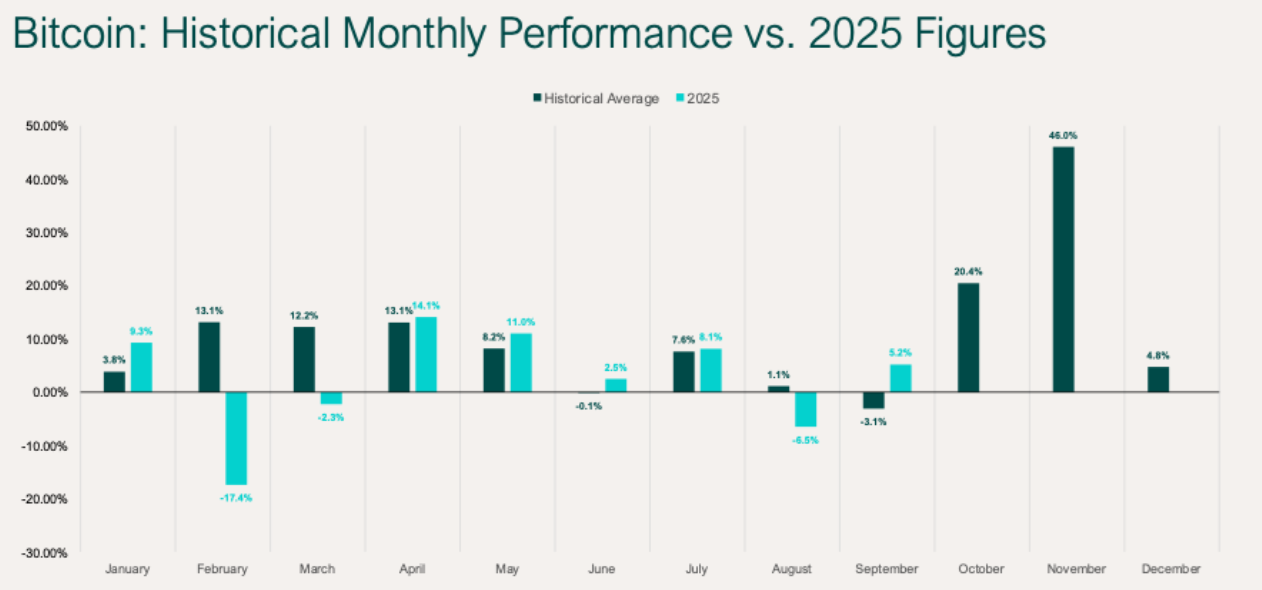

Historically, September is a weak month in cryptoasset markets. For example, Bitcoin has closed down seven of the past twelve Septembers, going back to 2014.

However, we challenged the idea of seasonality in financial markets, and particularly in crypto, arguing that the summer-long consolidation, incoming rate cuts, and accelerating public-market activity encompassing DATs, ETFs, and IPOs could defy the historical odds of September. Greenday may have sung “wake me up when September ends,” but for anyone asleep during the past month, they would have missed out on some big gains and a shifting landscape in the cryptoasset market. Bitcoin closed September up 5.2%, a sharp contrast from its historical average of -3.1%, its weakest month of the year.

Figure 1: Bitcoin Monthly Returns – Historical Average vs. 2025 Performance

To be sure, some initial choppiness in September was validated. Mid-month, a clear bifurcation emerged between traditional and crypto markets: stocks continued to grind higher while cryptoassets sold off sharply. The primary driver of this was a significant crypto leverage washout. On Sunday, September 21, roughly $1.65 billion of long positions were liquidated, the largest single-day amount in four years, since September 2021. This drove open interest in crypto futures down from $225 billion to $205 billion and erased nearly 5% from total crypto market capitalization. Bitcoin held up relatively well, falling just 3.5%, but altcoins were hit harder, with Ethereum down 8% and Solana down 10%.

Notably, Bitcoin-linked positions accounted for only 17% of total liquidations, underscoring that this was primarily an altcoin-driven leverage flush. We have seen this dynamic before, when leverage builds too aggressively during frothy market run-ups and sharp liquidations force a much-needed reset. While painful in the short term, these episodes are ultimately constructive because they clear out excessive leverage and can leave the market on firmer footing for future rallies. Unsurprisingly, it wasn’t just prices that took a hit during that stretch; sentiment did too. The widely followed Crypto Fear and Greed Index dropped to 32 out of 100, firmly in “fear” territory. The last two times we saw readings this low were around Trump’s Liberation Day in April and during the Yen carry trade unwind last year, both of which lined up almost perfectly with market bottoms that were followed by sharp V-shape recoveries. Given the month’s strong finish, it appears history is indeed rhyming.

Since the start of 2025, digital asset treasury companies (DATs), public firms with dedicated cryptoasset accumulation strategies, have raised more than $20 billion. To recap, DATs, pioneered by Strategy (formerly MicroStrategy), built a powerful model: so long as the stock traded at a premium to the net asset value (NAV) of its holdings, it could issue new shares to buy Bitcoin, thereby growing Bitcoin-per-share (BPS). Newer DATs could entice investors by pricing closer to NAV, with the expectation that the public markets would re-rate them higher and in line with peers. For the most part, this worked, attracting crypto-native and institutional capital alike. Recently, however, the trade has grown more challenging. Premiums have compressed, and several now trade at a discount; about 50% of DATs now trade below NAV, up sharply from earlier this year. While we believe high-quality operators can still defend premiums and keep the flywheel spinning, not everyone will succeed. The next phase for the sector is likely to be consolidation in what we’re terming “DAT M&A season.” We’re already seeing early signs: in September, Strive announced it would acquire Semler Scientific in an all-stock deal valued at $1.3 billion, a roughly 210% premium. By combining their Bitcoin treasuries, the merged company will become the 11th-largest public corporate holder with holdings of 10,900 BTC. If the premium squeeze sustains, we expect big DATs to swallow little DATs. Acquirers trading at a richer premium than their targets can grow accretively without raising fresh investor capital, which has become increasingly harder to source. Over time, we may see a few dominant champions emerge for each major cryptoasset, consolidating this trade into a smaller number of large, highly capitalized players.

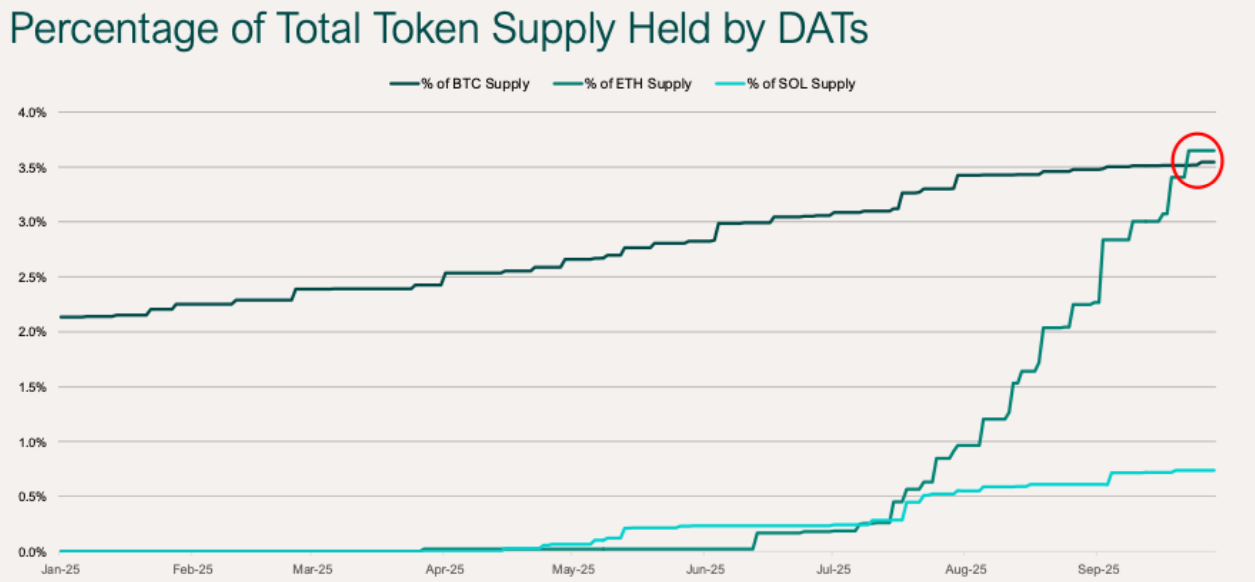

To close out our DAT commentary, there’s one other major development worth highlighting: as of this month, DATs now own a larger share of Ethereum’s total supply than Bitcoin DATs like Microstrategy hold of Bitcoin’s total supply. DATs hold 3.6% of all Ethereum compared to 3.5% of all Bitcoin. The real story isn’t necessarily the crossover; it’s the unprecedented speed with which Ethereum DATs have accumulated their treasuries. On June 1, they held just 0.02% of the Ethereum supply, around 24,000 ETH. Four months later, that figure has exploded nearly 180x to 4,300,000 ETH. The inflection point came in late May, when SharpLink launched the first large-scale Ethereum DAT, spearheaded by Ethereum Co-Founder Joseph Lubin. That debut ignited what quickly became known as “Ethereum DAT season,” with Bitmine, Ether Machine, ETHZilla, and others racing to follow with similar treasury strategies. Of course, this chart tracks the share of supply owned, not NAV. By dollar terms, Bitcoin DATs still reign supreme with $85 billion, compared to $15 billion for Ethereum DATs and roughly $1 billion for Solana DATs.

Figure 2: DAT Ownership Share of Bitcoin, Ethereum, and Solana Supply – 2025 YTD

In June, we said that while everyone was focused on IPOs, “crypto ETF season might be closer than you think.” Based on the activity in September, that season looks closer than ever to arriving and could commence in October. On September 18th, the SEC approved generic listing standards for select commodity-based ETFs, including those holding cryptoassets. As a result, exchanges can now list qualifying spot crypto ETFs without waiting on the SEC’s slow, case-by-case review, significantly speeding up the launch process. Shortly afterwards, there was a flurry of back-and-forth between issuers with crypto ETF filings and the SEC. Then, issuers were instructed to withdraw their 19b-4 filings, as the new generic listing standards rendered them unnecessary, with only S-1s now required. Following this, the strongest confirmation of them all came: Bloomberg Senior ETF Analyst Eric Balchunas revised his odds of Solana, Litecoin, and XRP ETFs being approved by year-end to “effectively 100%,” which carry final deadlines in the first two weeks of October. We’ve long maintained that ETFs would be a defining theme into year-end, and it appears that prediction will soon come to fruition.

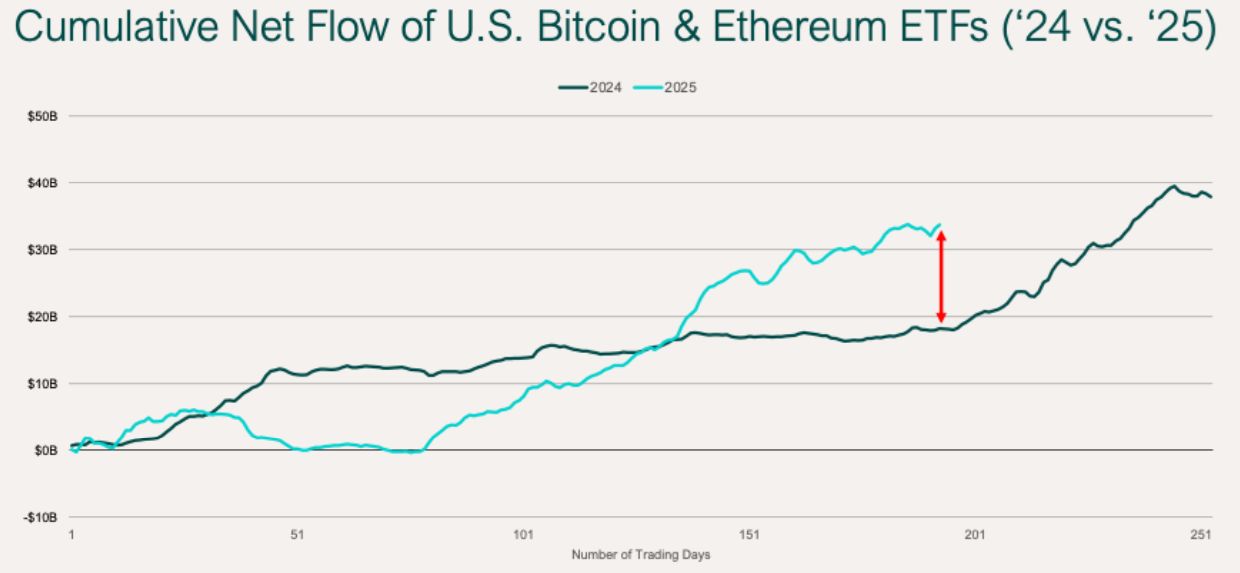

On the topic of ETFs, it’s worth mentioning that Bitcoin and Ethereum ETFs in the U.S. have already gathered $34 billion in net assets year-to-date, nearly 85% more than the $18 billion experienced by this point in 2024. For perspective, these products closed last year with $38 billion in net inflows, capped by an influx of capital flows following Trump’s election victory. At this current pace, 2025 could see inflows eclipse $60 billion, and even if that proves optimistic, $50 billion looks well within reach considering the catalysts in motion.

Figure 3: Cumulative Net Flows – U.S. Bitcoin and Ethereum ETFs (2024 vs. 2025)

Globally, assets under management in crypto investment products have nearly grown considerably over the past year, climbing from $93 billion in September 2024 to $220 billion today. This stream of immense capital through ETFs and DATs is steadily reshaping the crypto market structure and creating a stronger foundation than ever before. The clearest evidence of this is Bitcoin itself, which continues to grind higher as its volatility sinks to multi-year lows, showing that the wild, retail-driven boom-and-bust cycles of past bull markets may finally be giving way to a more stable, institutionalized composition.

Given the theme of crypto breaking into traditional public markets with DATs and ETFs, we’d be remiss not to discuss this month’s IPO activity. In September, Gemini, the Winklevoss-led crypto exchange, went public in a deal that was 20x oversubscribed, raising $425 million, while Figure, Mike Cagney’s blockchain-based lender, completed an upsized IPO that pulled in $787.5 million. Both stocks jumped more than 25% on their first day trading, though Gemini has since slipped below its IPO price while Figure has held its gains. These offerings followed other high-profile crypto debuts earlier this year, including Circle and Bullish. Still, the IPO pipeline remains full. Next up are BitGo, the crypto custodian that just filed to go public after reporting $4.19 billion in revenue through H1 2025, and crypto asset manager Grayscale, which confidently filed for its own IPO in July. Beyond IPOs, Tether emerged with news of its own: the world’s largest stablecoin issuer with its flagship $180 billion USDT is reportedly looking to raise $15–20 billion for about a 3% stake, valuing the private company at roughly $500 billion. That news came right on the heels of Tether’s introduction of USAT, its new U.S.-regulated stablecoin launching later this year that will be compliant with the GENIUS Act. The initiative will be led by Bo Hines, former Head of the White House Crypto Council, with Anchorage Digital serving as the federally regulated issuer and Cantor Fitzgerald managing reserves. Both Anchorage and Cantor will also take equity stakes in the new entity and share revenue derived from USAT’s reserves.

Bitcoin miners rallied to new highs in September, with the group surpassing a combined market capitalization of $50 billion for the first time in history. At this point, the term “Bitcoin miners” is a tad misleading. A closer look shows that many of the biggest beneficiaries of this rally are not pure-play Bitcoin miners, but past ones that have strategically pivoted into high-performance computing to capture surging demand in the AI data center market. In our portfolio, this has been most evident in the outsized performance of Galaxy Digital and Hut 8 during the month. It underscores an important point: crypto and AI are not exclusive, but deeply related technologies. The same theme was prevalent in Google’s launch of its Agent Payments Protocol (AP2), which includes support for AI agents to transact directly with one another via stablecoins. As Google Cloud’s Head of Web3 James Tromans put it, “If you think stablecoins are just for people, you’ve missed the plot. Crypto wallets and stablecoins are the optimal technology for agent-to-agent commerce and will unlock trillions in new value for consumers and merchants alike.”

Crypto’s convergence with traditional finance isn’t solely about DATs, ETFs, and IPOs; September showed that enterprises and institutions are adopting the technology at scale. The Nasdaq filed to allow tokenized stocks and ETFs on its platform, while the CBOE announced that its launching perpetual futures for Bitcoin and Ethereum. BlackRock was said to be exploring tokenizing real-world assets (RWAs) such as stocks and ETFs, building on the success of its BlackRock USD Institutional Digital Liquidity Fund (BUIDL), a tokenized U.S. Treasury fund launched on Ethereum in March 2024 that has grown to $2.6 billion in assets. That comes as no surprise; BlackRock CEO Larry Fink has long been one of the most vocal advocates for tokenization, calling it “the next generation for financial markets.” The London Stock Exchange rolled out a blockchain platform for tokenized private funds, Galaxy Digital partnered with Superstate to let shareholders tokenize their equity directly on Solana, and Ondo Finance launched 100 tokenized U.S. stocks and ETFs with plans to expand to 1,000 by year-end. Meanwhile, the ongoing gold rush is not just happening offchain, but onchain, with the tokenized gold market, led by Tether’s XAUT and Paxos’ PAXG, reaching a record of over $2.5 billion. While those examples involve tokenized financial assets, the same momentum was visible with tokenized dollars, better known as stablecoins.

In September, Citi published its Stablecoins 2030 report, revising its initial forecast upwards, now projecting a $1.9 trillion to $4.0 trillion stablecoin market size by 2030, compared to today’s $290 billion. Visa began its stablecoin-powered cross-border payment pilot for businesses, SWIFT announced a collaboration with 30 banks to develop a blockchain-based settlement ledger, nine European banks teamed up to launch a MiCA-compliant Euro stablecoin, Cloudflare revealed its own NET Dollar stablecoin for online payments and the “agentic web,” and Deutsche Börse partnered with Circle to integrate USDC and EURC into its regulated infrastructure. To top it off, CFTC Acting Chair Caroline Pham is seeking to allow tokenized collateral in derivatives markets, calling collateral management the “killer app” for stablecoins.

Before concluding this month’s commentary, we’d like to flag one development that isn’t yet a trend, but one we expect could become a major theme going forward: enterprise tokens. Let us explain. This past month, SEC Chairman Paul Atkins said that the agency is preparing to introduce an “innovation exemption” for crypto firms by year-end. The measure would allow companies to launch innovative products under lighter requirements until dedicated crypto frameworks are established, rather than forcing full compliance with traditional securities laws from day one. The broader goal is to position the U.S. as a global hub for crypto innovation, attracting top talent, fostering competition, and ensuring industry leadership.

The timing could not be more striking. Almost simultaneously, several of the world’s leading platforms are moving toward token launches. Coinbase has signaled for the first time that it is exploring a token for its Ethereum layer-2 network, Base, long speculated since its August 2023 inception but consistently denied until now. MetaMask, one of the most widely used crypto wallets globally, has stated its intent to launch a token imminently. Polymarket, meanwhile, raised at a $1 billion valuation in June and is now reportedly lining up a fresh round at $10 billion just three months later. While some of that reflects its U.S. relaunch, it more importantly could signal that investors increasingly believe the long-rumored Polymarket token is now more plausible than ever. The regulatory climate appears ripe for such launches, and the sense is that enterprises are finally confident enough to roll out tokens without fear of regulatory backlash. The implications could be enormous. If Base were to launch a token, Coinbase would own a material share of the supply; given the scale and traction of the network relative to other cryptoassets, one could only imagine the value the market would assign it. That in turn could have a profound impact on Coinbase’s valuation.

To sum up, we believe the stage is set for a strong fall and year-end finish. Historic seasonality, steady capital flows, rapid technological progress, a supportive regulatory backdrop, and a steady stream of new opportunities within our investment universe give us conviction that our focus areas will continue to see meaningful growth. With adoption and innovation accelerating across every corner of the crypto and AI markets, our diversified portfolio is designed not only to capture the breadth of this expansion but also to mitigate over-concentration risk. We remain committed to our disciplined, active strategy that offers investors broad, dynamic exposure to these emerging technologies that are reshaping industries and driving profound change.

Until next month,

Ninepoint Digital Asset Group

A division of Ninepoint Partners LP

September 30, 2025

September 30, 2025