Effective May 3, 2024, Ninepoint FX Strategy Fund was renamed Ninepoint Global Macro Fund. There are no changes to the investment objectives or strategies of this fund.

Q1 2025 Commentary

The Ninepoint Global Macro Fund (“Fund”) seeks to generate long term total returns by investing globally in FX and gold futures on a long/short basis. To achieve the investment objective, the “FX Strategy”, at the standard level of risk, is employed. The FX Strategy utilizes a systematic Bayesian statistical process to identify current drivers of currency and gold returns. These drivers are primarily

macroeconomic in nature.

The Fund is advised by P/E Global LLC (“P/E” or the “Advisor”), a private asset management firm providing absolute return strategies, with special emphasis on the global currency markets. Founded in 1995, P/E serves investors worldwide with offices in Boston, MA, Jackson, WY, Singapore, Melbourne, Tokyo and London. As of April 1, 2025, P/E employed 70+ individuals, with assets under management of approximately USD $19.5 Billion.

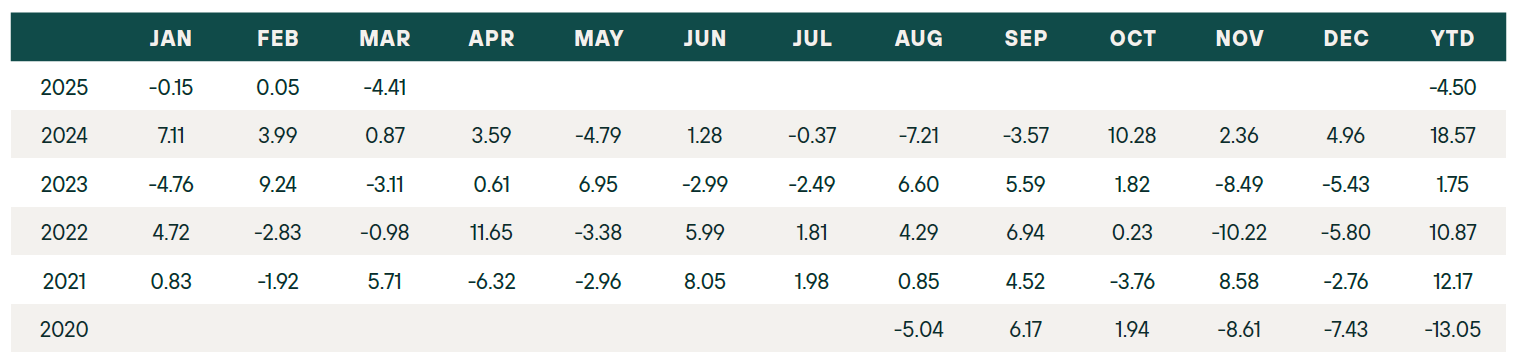

Ninepoint Global Macro Fund Monthly Returns (%) Performance as at March 31, 2025- Series F1 (NPP759) | Inception Date: August 6, 2020

The F1 Class units of the Fund returned net -4.50% (Class F1) for the Q1-25.

Compounded Returns (%) as of March 31, 2025

1M |

YTD |

3M |

6M |

1YR |

3YR |

INCEPTION |

|

|---|---|---|---|---|---|---|---|

Fund |

-4.4 |

-4.5 |

-4.5 |

13.6 |

0.8 |

8.2 |

4.8 |

During the past few months, the currency markets have experienced heightened volatility. The announcement and vote to change the German constitution was a positive growth shock for Europe in March. However, risk continues to increase globally as volatility rises and growth indicators slow, due to expected tariffs and policy uncertainty.

Global divergence continues as Europe, North America, and portions of Asia move in different directions relating to growth and

inflation.

The economic outlook for the U.S. is mixed. Recent economic surprises have been more negative than those seen at the end of 2024. Further, sentiment indicators have softened, reflecting investor uncertainty regarding the U.S. economic policy and announced federal government job cuts and tariffs.

From a factor perspective, global growth remains significant; however, the divergence between the U.S. and other regions has narrowed. The importance of risk aversion has increased.

With heightened concerns regarding recent tariffs imposed by the U.S. administration, we wanted to highlight the Ninepoint Global Macro Fund FX Strategy’s adaptive model, as the Strategy seeks to adjust to changing factor drivers, rather than having a particular bias. Strategy performance has been historically strong in both long-term bullish and bearish U.S. Dollar environments. As such, the portfolio does not have any inherent bias toward the U.S. Dollar, and we seek to provide consistent alpha over time.

We will continue to incorporate new data, monitor adaptation rates of our factors, and explore new analytical tools. We look forward to keeping you informed of any material changes to our outlook.

Portfolio

As of end of March, the largest positions of the Fund were net negative notional exposures to the Australian Dollar, Euro and long gold.

March 31, 2025

March 31, 2025