The monthly commentary discusses recent developments across the Ninepoint Diversified Bond, Ninepoint Alternative Credit Opportunities and Ninepoint Credit Income Opportunities Funds.

Macro

April has been an exhausting month.

After weeks of promotion, we were expecting the tariff announcements on April 2nd “Liberation Day” to be somewhat substantial. We, and the rest of the world, were shocked by the magnitude and breadth of the tariffs announced. Not only were the tariffs calculated in a very unorthodox fashion, pretty much every country on earth was included, even some uninhabited islands.

Following the pushback by many U.S. corporations and the market mayhem that ensued, the administration decided to delay the implementation of the most egregious tariffs (maintaining a 10% baseline tariff on all countries) to open the door to one-on-one negotiations. At the time of writing, it is still unclear whether any trade deals will be signed within the 90-day reprieve. We still have no certainty on what will happen after the 90 days, or what other products might get their own tariff treatment (above and beyond autos, steel and aluminum, phones and computers).

The tariffs imposed on China were massive: 34%, on top of the already announced 20%, amounting to 54% on all Chinese imports. Of course, China did retaliate, leading to a tit-for-tat escalation to the 145% tariff rate they have today. We understand that above 55%, these tariff rates are so high that they amount to an effective embargo between the two countries. We have recently seen reports discussing important declines in shipping containers bound to the U.S. west coast, leading to fears of shortages of many products in the weeks to come, something the U.S. President seems complacent about, according to his social media posts.

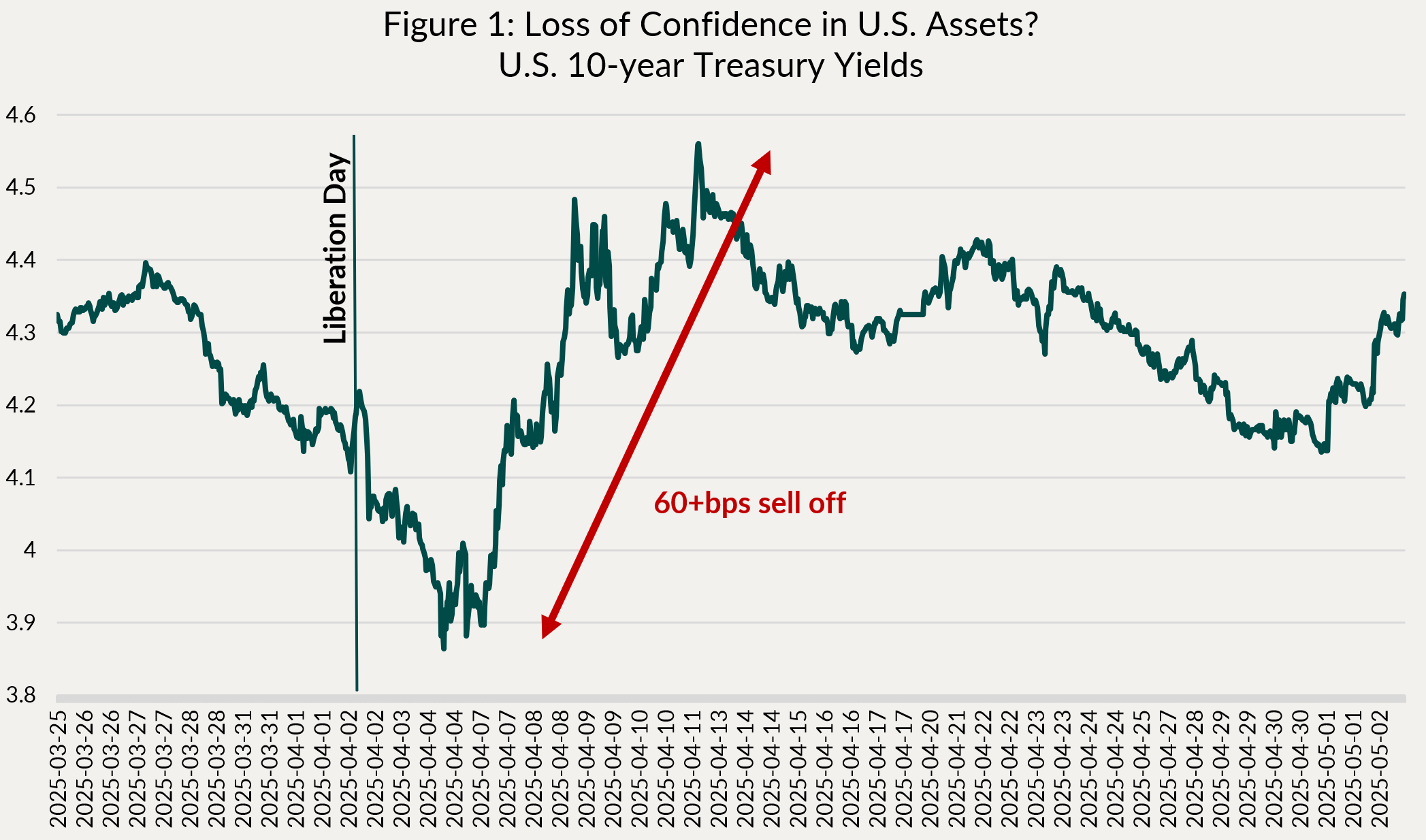

Ahead of April 2nd, we had been preparing our portfolios for a large shock, and markets didn’t disappoint, with risk assets selling off, treasuries & the U.S. dollar rallying. That was the reaction we were expecting to this large negative growth shock, and our funds performed well in that environment. However, the following week, something very peculiar happened. Treasuries sold off massively, from a yield of 3.9% to 4.5% in a matter of days, while at the same time, the U.S. dollar depreciated rapidly (Figure 1 below). Typically, when U.S. interest rates rise, we expect to see a stronger dollar, but this time it was different. Moreover, a lot of this price action happened overnight, during Asian and European trading hours, suggesting that investors from those geographies were involved in most of the selling.

There is an accumulation of evidence that seems to suggest the Trump administration’s actions, not only with trade, but in its overall relations with itself (think of the constant harassing of Chair Powell) and the rest of the world, are leading to a global rethink in the stability of U.S. fiscal & monetary institutions, and with that the role of the U.S. dollar as a source of stability in international finance. If global investors are losing faith in the U.S. dollar and in the ultimate risk-free asset, U.S. treasuries, then we could be witnessing the beginning of a paradigm shift in the global financial order.

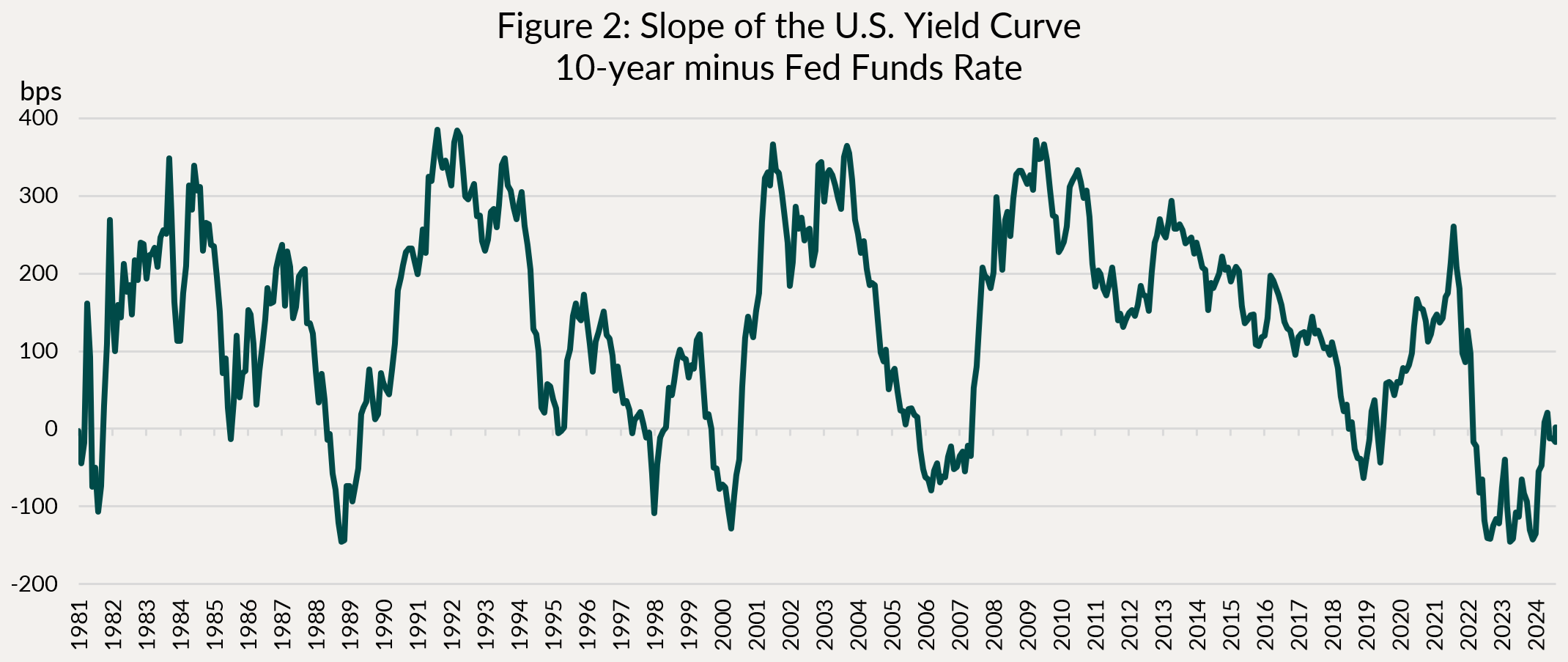

With a debt-to-GDP ratio above 120%, the U.S. Treasury operating with a deficit of 6%+ of GDP, further tax cuts and less demand for U.S. assets, you get a perfect recipe for higher term premiums and higher long-term yields. Since the election of this Republican administration, we have been particularly worried about the fiscal situation of the U.S., and these most recent developments could lead to seismic changes in the slope of the yield curve as investors require greater compensation for lending to the U.S. and for long-term periods. Since the Global Financial Crisis and the beginning of the QE era, the U.S. yield curve has become progressively flatter (Figure 2 below shows the difference between yields on 10-year treasuries and the Fed Funds Rate over time). In the 1990s and 2000s, it wasn’t unusual to see a spread as wide as 350 basis points between the two, peaking just around the time the Fed finishes the rate cut cycle. Given the current situation we wouldn’t be surprised to see the slope of that curve exceed the historic wides.

Many investors have become accustomed to owning long-term (say 10-year or 30-year) U.S. treasuries in times of market stress, using the asset class as a safe-haven. However, in an environment where the yield curve keeps steepening as the Fed cuts rates, the benefits this time around might be much smaller (if not nullified altogether). For example, say the FOMC decided, in response to a slowing economy cut rates from the current 4.5% funds rate to 2%. Well, with a much steeper curve, it wouldn’t be impossible to see 10-year rates around 5.5%! For reference, 10-year rates are currently around 4.3-4.4%, and remember, with bonds, higher yields mean lower prices.

That is precisely why, despite our view that this trade war is getting us closer to the end of the economic cycle, we aren’t involved in long-term bonds, favoring points on the curve that are more directly linked with central bank actions (5-year and shorter). Also, with this change of paradigm, we have rethought our exposure to the U.S. dollar, at current levels we are almost fully hedged.

We expect trade and fiscal policy uncertainty to remain elevated. One thing is certain: tariffs are here to stay, in one form or another. Things can change quickly, as the President seems to change his mind frequently. This doesn’t bode well for economic activity. As we discussed last month, firms and households need certainty to make economic decisions. Who would build a plant or hire more workers if they do not know the price of their inputs & outputs, the size of the end markets, and the overall stage of the economy? It is really difficult to model uncertainty’s impact on the economy, but directionally, it is a clear negative and we expect it to show up at some point in the hard economic data. It will simply take time, and central bankers will therefore drag their feet as they wait for more evidence of a slowdown to act.

Credit

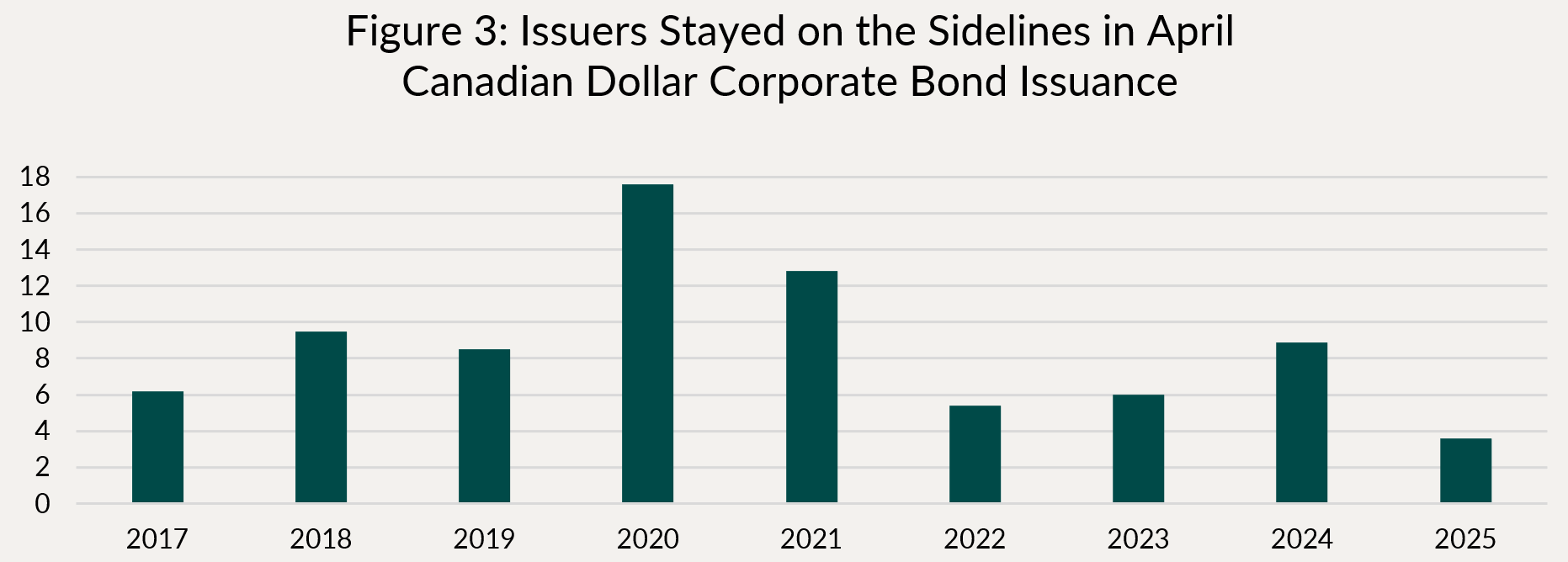

With the volatility in markets, corporate bond issuers stayed on the sidelines, leading to one of the slowest months of new issues on record (Figure 3 below). We were active in a few short-duration, higher quality deals this past month, such as CHIP mortgage trust, which offered a 3-year AAA 1st lien mortgage-backed bond with a spread ~35 basis points wider than equivalent large-cap Canadian banks. This is the kind of credit we are looking for these days, low duration, high quality and cheap to the rest of the market.

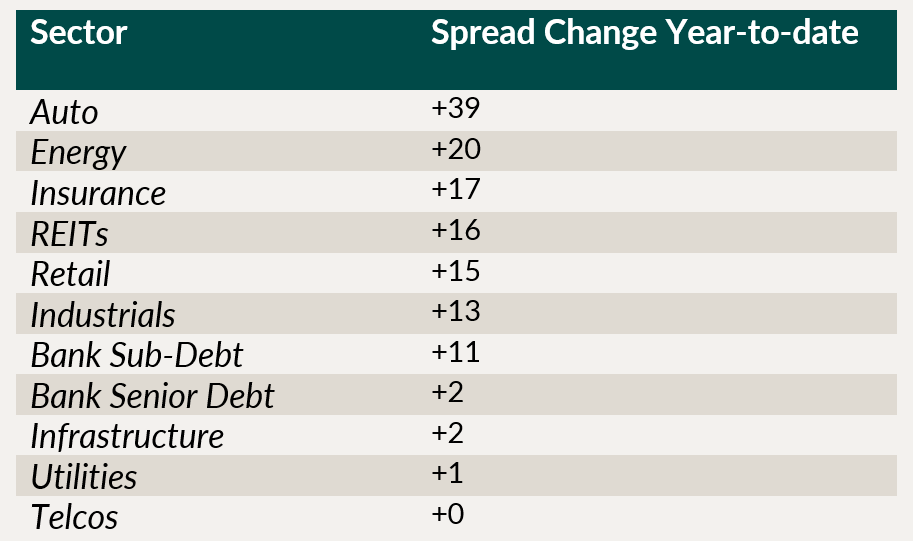

As the U.S. administration has tried to de-escalate their own trade war, we have seen risk assets rebound somewhat, and investment grade corporate credit spreads are now back to where they were pre-“Liberation Day”, and high yield remains a smidge wider. However, under the hood, dispersion across sectors is very high, as shown below, with sectors like autos underperforming materially, while more defensive utilities and infrastructure outperform.

As discussed in the prior section, our view on the direction of the economy hasn’t changed, and we therefore do not find lower-rated or longer-duration credit particularly attractive here. We maintain a defensive posture and have used the elevated volatility to actively trade corporate bonds across the funds.

Individual Fund Discussion

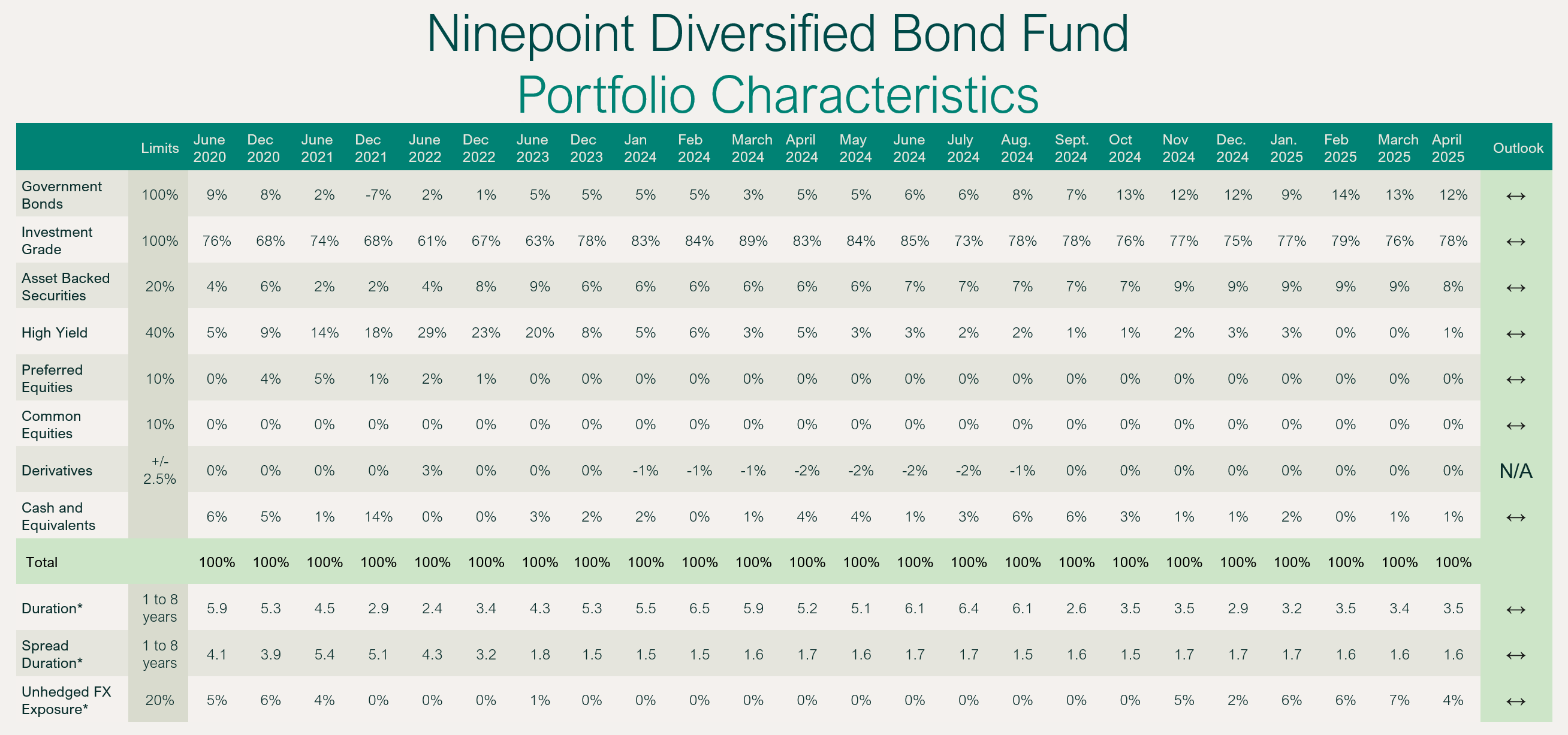

Ninepoint Diversified Bond Fund

April was a difficult month for everyone, including us. While the fund performed quite well in the first week of the month (rates lower, dollar higher, credit hedges in the money), these factors completely reversed during the balance of the month, leaving us with a small deficit of 26 basis points. We did not make material adjustments to the fund’s positioning, but slightly higher rates in Canada and wider credit spreads left us with a 4.8% yield-to-maturity (from 4.4% the month prior) and a duration of 3.5 years.

NINEPOINT DIVERSIFIED BOND FUND - COMPOUNDED RETURNS¹ AS OF APRIL 30, 2025 (SERIES F NPP118) | INCEPTION DATE: AUGUST 5, 2010

1M |

YTD |

3M |

6M |

1YR |

3YR |

5YR |

10YR |

Inception |

|

|---|---|---|---|---|---|---|---|---|---|

Fund |

-0.26% |

1.74% |

0.66% |

2.92% |

10.36% |

3.90% |

1.91% |

2.63% |

3.56% |

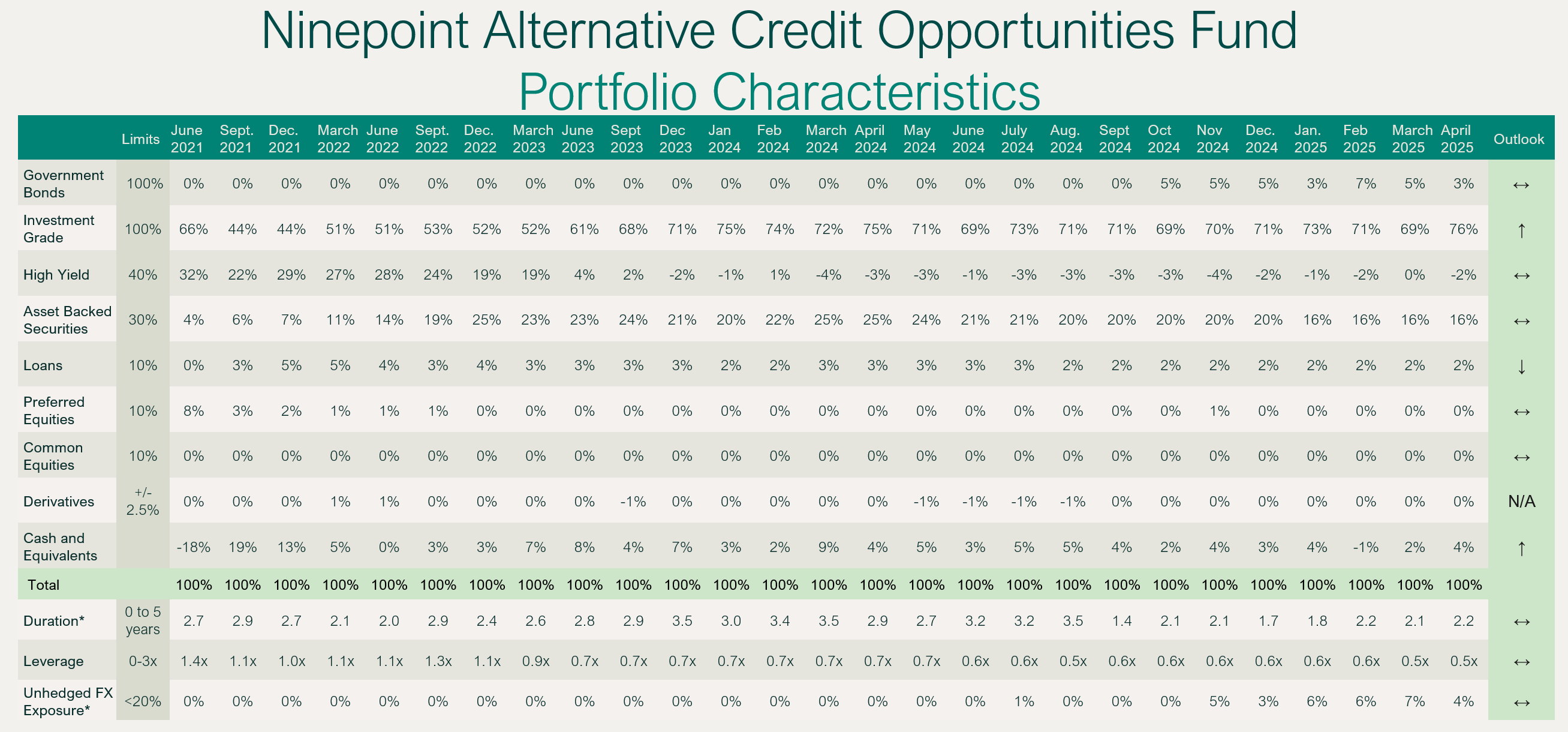

Ninepoint Alternative Credit Opportunities Fund

With wider credit spreads, the fund was down 43 basis points this past month. The fund performed well in the first week of the month (rates lower, dollar higher, credit hedges in the money), but these reversed during the balance of the month. Duration increased slightly to 2.2 years, and leverage was flat at 0.5x. Yield-to-maturity increased to 5.3% with wider credit spreads.

NINEPOINT ALTERNATIVE CREDIT OPPORTUNITIES FUND - COMPOUNDED RETURNS¹ AS OF APRIL 30, 2025 (SERIES F NPP931) | INCEPTION DATE: APRIL 30, 2021

1M |

YTD |

3M |

6M |

1YR |

3YR |

Inception |

|

|---|---|---|---|---|---|---|---|

Fund |

-0.43% |

0.99% |

0.23% |

2.38% |

8.85% |

5.15% |

2.52% |

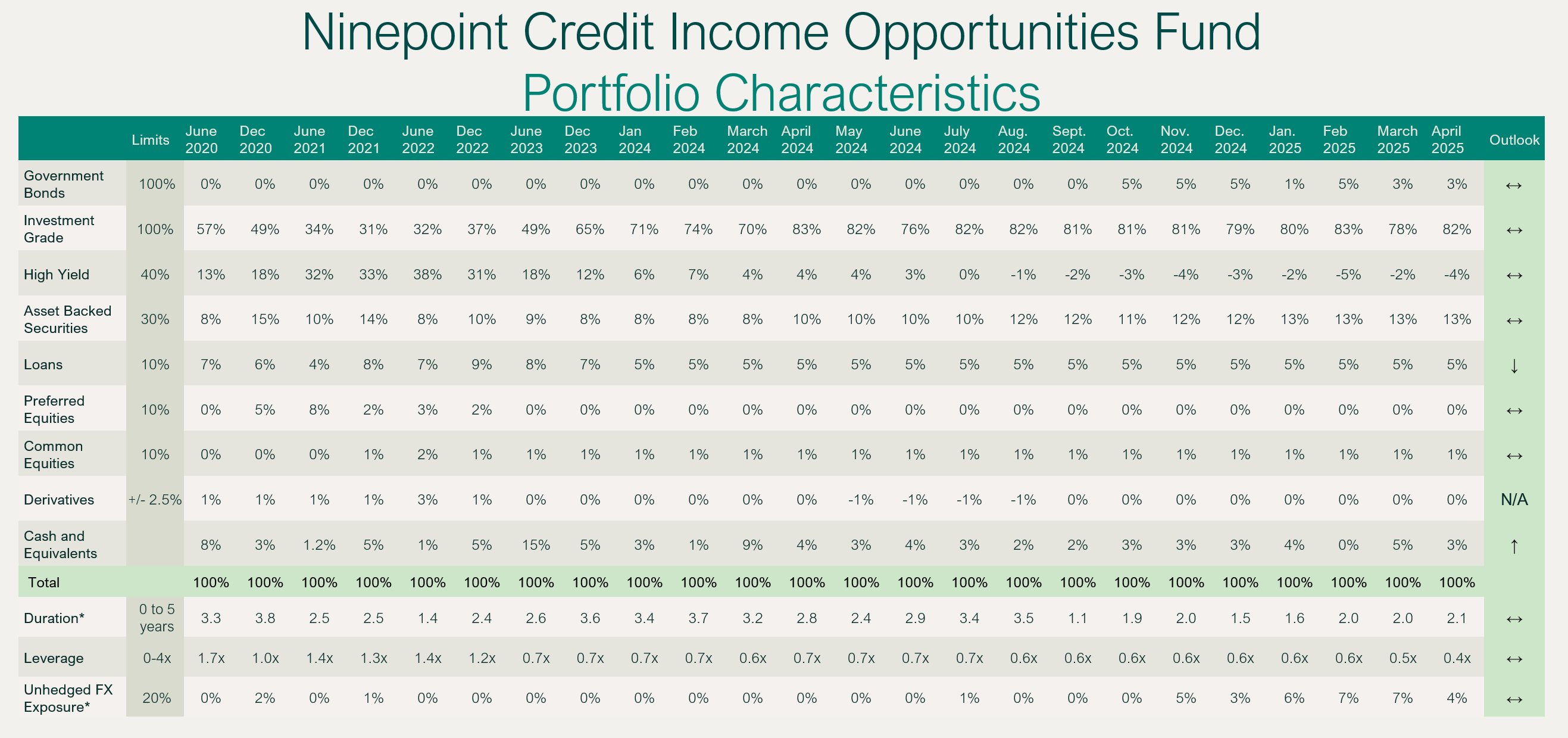

Ninepoint Credit Income Opportunities Fund

The fund was down 26 basis points in April, due to wider credit spreads. Leverage was down to 0.4x as we used cash from maturing positions to buy back government bonds. Duration was flat at 2.1 years while yield-to-maturity increased slightly to 5.7% as credit spreads widened.

NINEPOINT CREDIT INCOME OPPORTUNITIES FUND - COMPOUNDED RETURNS¹ AS OF APRIL 30, 2025 (SERIES F NPP507) | INCEPTION DATE: JULY 1, 2015

1M |

YTD |

3M |

6M |

1YR |

3YR |

5YR |

Inception |

|

|---|---|---|---|---|---|---|---|---|

Fund |

-0.26% |

1.22% |

0.39% |

2.39% |

8.38% |

5.25% |

6.90% |

4.95% |

Conclusion

So far, this has been a very volatile year, and the flip-flopping in Washington makes everyone’s job more challenging. Until we have a clear view on the state of the economy, the impact of tariffs and the Trump end game, we’ll continue to focus on the preservation of your capital.

Until next month,

Mark, Etienne & Nick

As always, please feel free to reach out to your product specialist if you have any questions.

April 30, 2025

April 30, 2025