The monthly commentary discusses recent developments across the Ninepoint Diversified Bond, Ninepoint Alternative Credit Opportunities and Ninepoint Credit Income Opportunities Funds.

Macro

May has also been an exhausting month.

Yes, the worst of the “Liberation Day” tariffs has been walked back by the White House, but as things currently stand, the average U.S. tariff rate is still a whopping 17%, up from 2.5% at the end of 20241.

It oddly feels like we are in the eye of the trade war storm. “Liberation day” tariffs are on hold, and the situation with China has been temporarily de-escalated. But are we out of the woods yet? Will all major U.S. trading partners bow to the pressure and accept a deal that presents very weak outcomes for their constituents (like the UK has done)? We expect more fireworks.

Every week, each day, hour, the policy stance changes. In our view, it is futile to hope for an end to the “uncertainty”. We need to accept the new reality: for the next four years, we are in an age of policy instability. Deals can be made and unmade at record speed, and penalties imposed on friends and foes alike. This administration likes shooting from the hip and asking questions later, and we should continue to expect the unexpected.

There will be costs to be borne for this instability. Up until now, economic data has been positively distorted by the trade war. The front-loading of imports/exports and the accumulation of inventory ahead of the implementation of tariffs has distorted economic data in a good way. And although activity is weaker, it hasn’t collapsed as of yet.

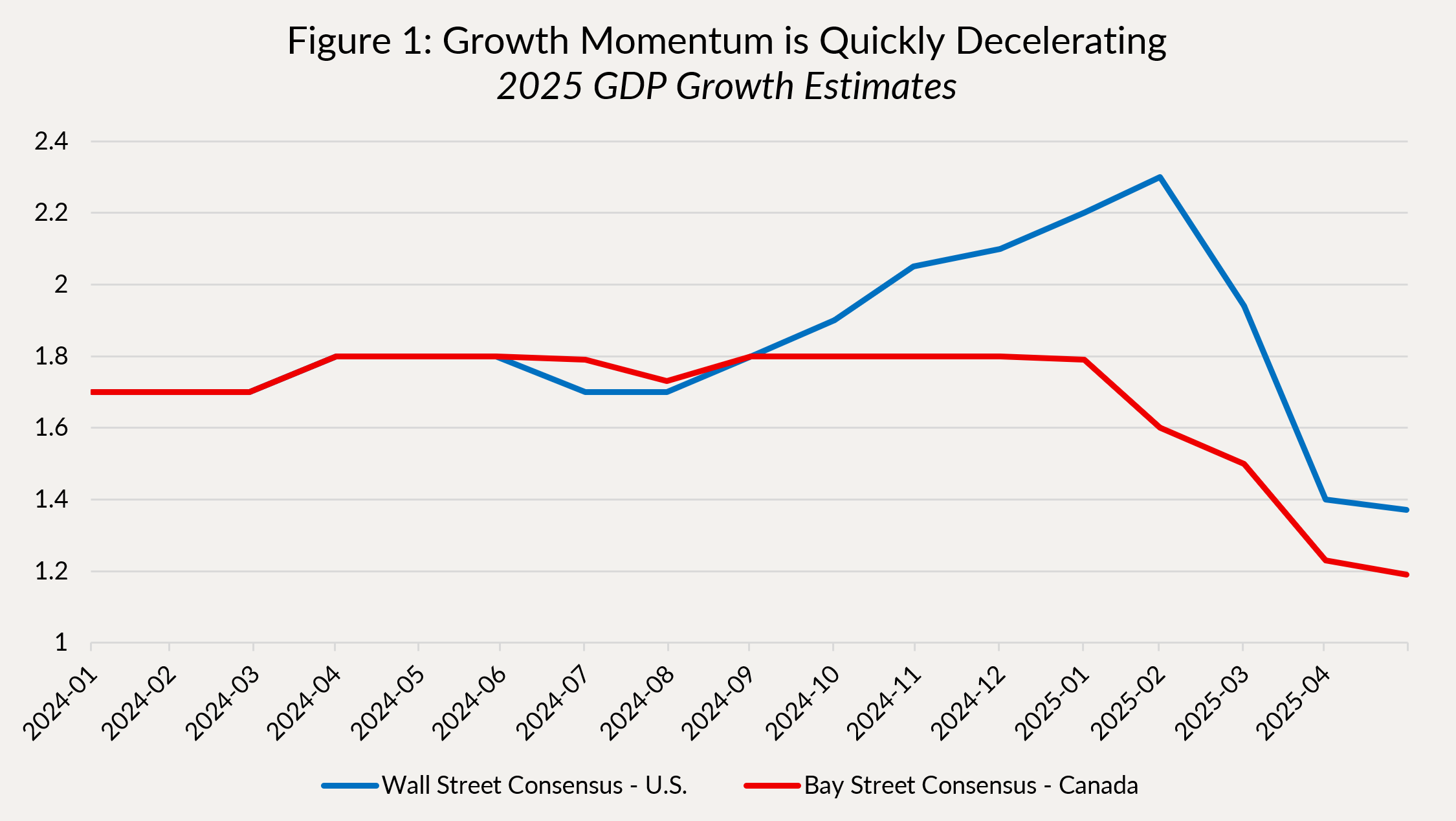

Nonetheless, economic growth of around 1%, as expected by most economists (Figure 1 above) isn’t very much growth at all. Hard to reconcile that with equities flat on the year and credit spreads back to all time tight.

That is leaving central bankers in a position to be patient. They know full well that tariffs are inflationary. What we hear from companies so far is that they see tariffs as a tax (they are right) and as such, they intend to pass that cost on to consumers. As Governor Macklem said at the BoC’s press conference, we should start seeing their impact in the May inflation reports. After having gone through a period of elevated inflation in 2022-2024, the last thing central bankers want is for a “temporary” tariff-induced inflation shock to become more persistent. That’s why, as long as economic activity doesn’t fall off a cliff, we expect both the BoC and FOMC to remain on hold.

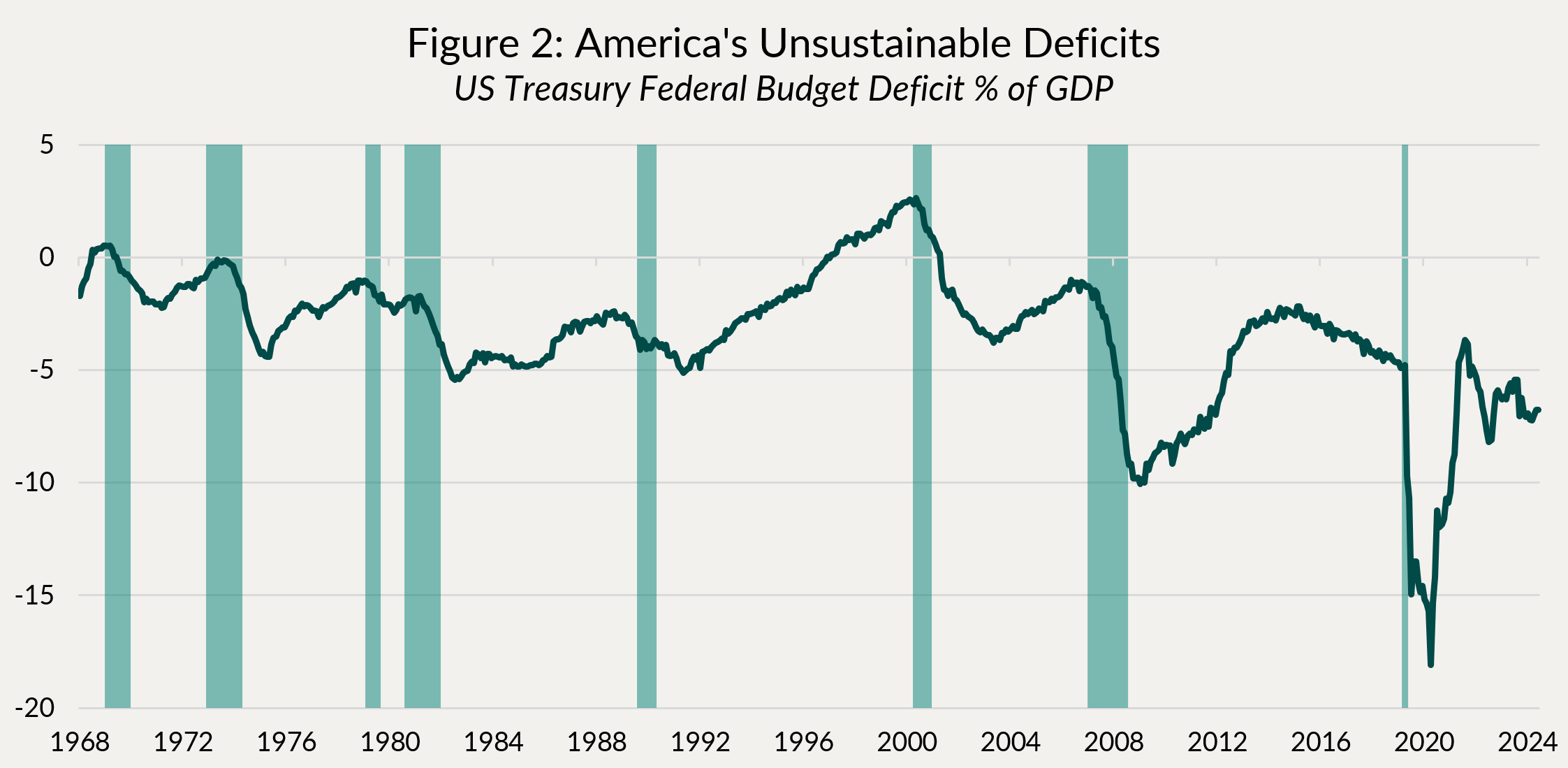

Trade wars and monetary policy aside, the big topic of discussion for fixed-income investors is the size of government deficits. Across the developed world, since the pandemic, governments have not stopped spending, and if anything, they want to spend even more. This is putting many in unsustainable fiscal positions. Nowhere is that more evident than in the U.S., where budget deficits have been >6% of GDP for several years, worse than at any point in U.S. history, barring the 2020 Pandemic and the Great Financial Crisis (Figure 2 below)2.

Not only is the current situation unsustainable, but the U.S. administration also wants to make it even worse, with their (in)famously called “One Big Beautiful Bill” or OBBB for short, which will add trillions of dollars to the public debt stock. They are playing with fire, as eventually, they will run out of buyers (or rather, buyers will demand a much higher rate of interest on their debt).

According to the U.S. Treasury Department, foreign investors hold about $9tn of the ~$36tn in Treasury debt outstanding, so about 25%. In the past, they had been willing buyers of more debt, but all this instability, tariffs, threats, challenges to the rule of law, to the independence of the Federal Reserve, is eroding the appeal of U.S. assets (debt in particular) for foreign investors, at the time the U.S. needs them most.

This is by far the biggest macro risk out there, more consequential than tariffs and trade wars. If we were, God forbid, to have an event similar to the Liz Truss Mini-Budget in the UK, where long-term treasury yields exploded higher, this would wreak havoc across markets and asset classes, and have significant repercussions for the U.S. & global economy.

Many unknowns still remain. What we do know is that some risks are not worth taking. A slowing global economy coupled with rising budget deficits, particularly in the U.S., implies two things:

1) Long-term government bonds: They are the most at risk from fiscal largesse and potentially worse outcomes as discussed above.

2) Credit spreads are (already) back to all-time tights, and as such, credit remains very expensive considering the slowing growth backdrop. Better to avoid risky sectors, stay up in quality and maximize carry per unit of duration.

Individual Fund Discussion

Ninepoint Diversified Bond Fund

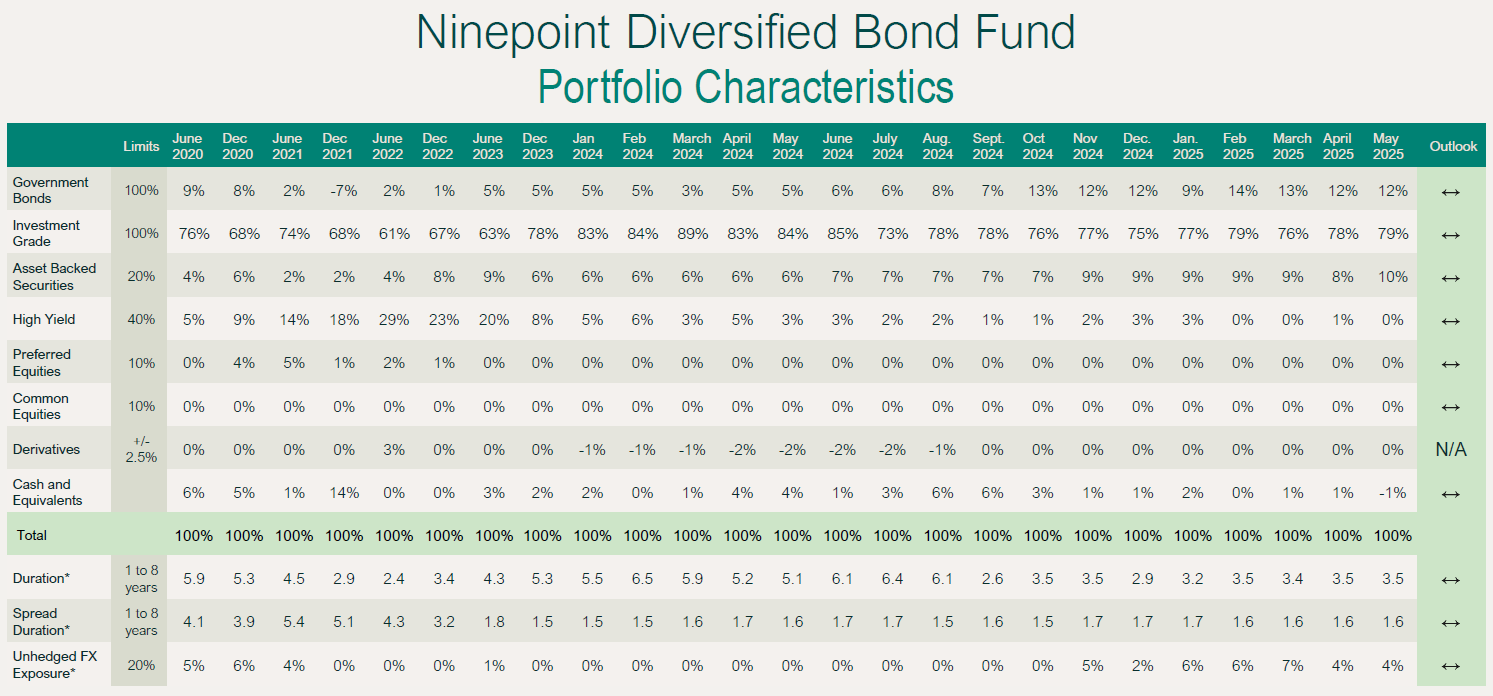

The fund was flat in May. Strength in credit was offset by rising interest rates (e.g. 5-year rates were up about 12 basis points in Canada and 24 basis points in the U.S.). Since the fund has more duration (3.5 years) than spread duration (1.6 years), the rate impact is more pronounced. Following month end, we reduced duration slightly by collaring (sell call, buy put spread) our U.S. 5-year Futures position. As of month end, the fund’s yield-to-maturity3 was 4.6%.

NINEPOINT DIVERSIFIED BOND FUND - COMPOUNDED RETURNS¹ AS OF MAY 31, 2025 (SERIES F NPP118) | INCEPTION DATE: AUGUST 5, 2010

1M |

YTD |

3M |

6M |

1YR |

3YR |

5YR |

10YR |

Inception |

|

|---|---|---|---|---|---|---|---|---|---|

Fund |

-0.01% |

1.73% |

0.01% |

2.03% |

9.03% |

4.19% |

1.76% |

2.52% |

3.54% |

Ninepoint Alternative Credit Opportunities Fund

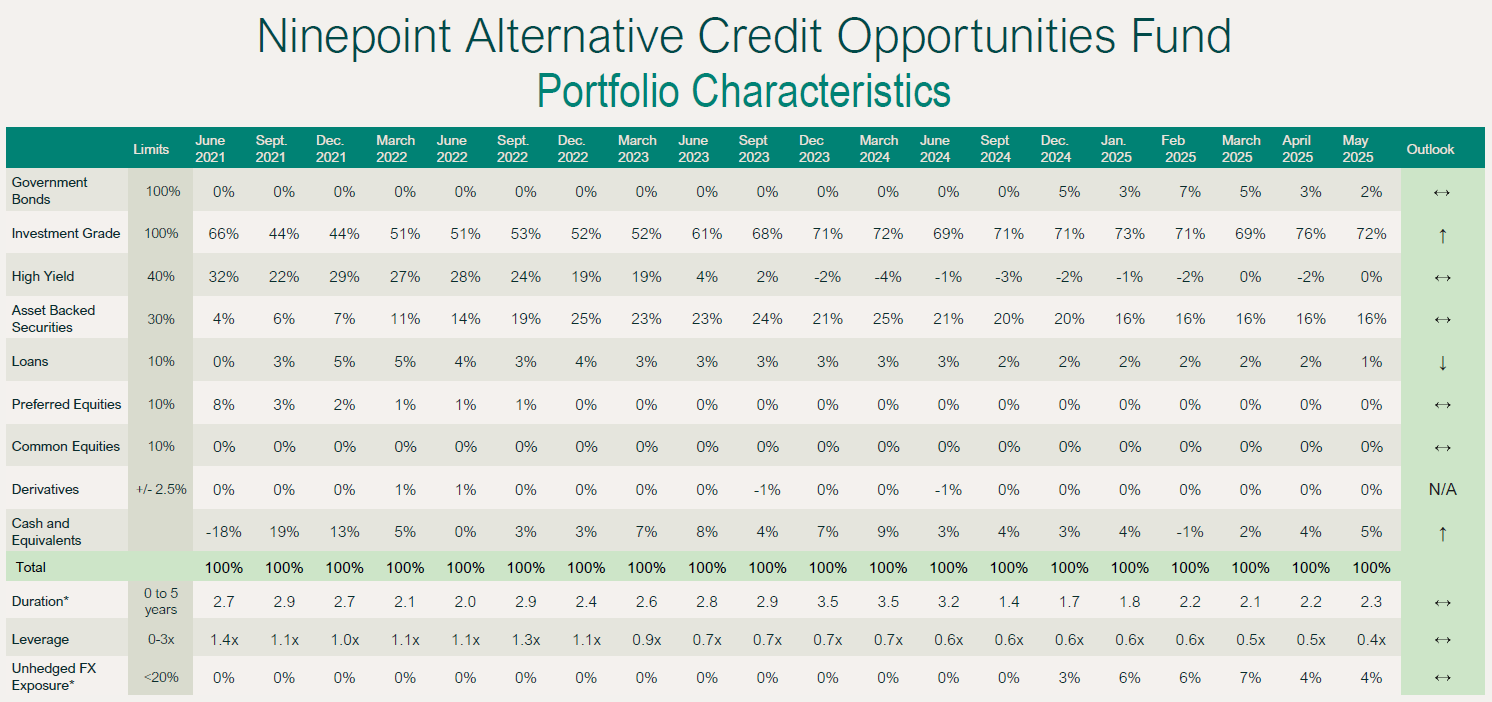

As spreads rallied back to all-time tights, the fund recaptured some of the losses from the prior month, returning 26 basis points. Given where credit spreads are, we reduced leverage even more to the lowest level we can recall (0.4x). The fund’s yield-to-maturity3 is now 5.1% and duration increased slightly to 2.3 years (lower post month end for the same reason as the Ninepoint Diversified Bond Fund).

NINEPOINT ALTERNATIVE CREDIT OPPORTUNITIES FUND - COMPOUNDED RETURNS¹ AS OF MAY 31, 2025 (SERIES F NPP931) | INCEPTION DATE: APRIL 30, 2021

1M |

YTD |

3M |

6M |

1YR |

3YR |

Inception |

|

|---|---|---|---|---|---|---|---|

Fund |

0.26% |

1.26% |

-0.06% |

2.02% |

7.82% |

5.62% |

2.54% |

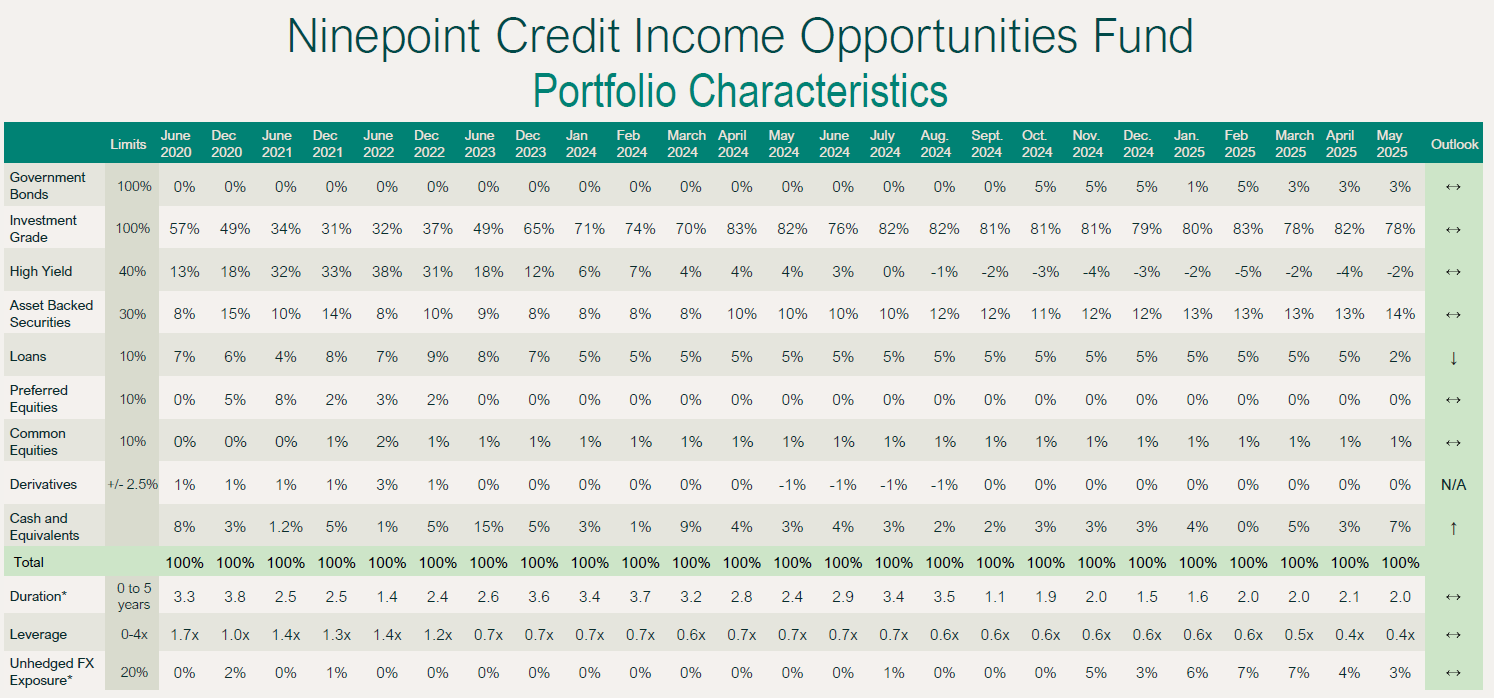

Ninepoint Credit Income Opportunities Fund

The fund was up 17 basis points in May; helped by tighter credit spreads. Leverage was down to 0.4x as we used cash from maturing positions to buy back government bonds that we were short. Duration was down slightly to 2.0 years while yield-to-maturity3 decreased to 5.3% as credit spreads tightened.

NINEPOINT CREDIT INCOME OPPORTUNITIES FUND - COMPOUNDED RETURNS¹ AS OF MAY 31, 2025 (SERIES F NPP507) | INCEPTION DATE: JULY 1, 2015

1M |

YTD |

3M |

6M |

1YR |

3YR |

5YR |

Inception |

|

|---|---|---|---|---|---|---|---|---|

Fund |

0.17% |

1.39% |

-0.16% |

2.03% |

7.45% |

5.85% |

6.59% |

4.92% |

Conclusion

While risk-assets have rallied back, government bond markets are sending different signals. Steeper curves and high long-term rates are something to keep an eye on. Bond vigilantes are watching closely, and so are we.

Until next month,

Mark, Etienne & Nick

As always, please feel free to reach out to your product specialist if you have any questions.

2. For contrast, Canada is currently running a deficit of 1.6% of GDP at the Federal level, and about 1.4% at the provincial level, for a total of ~3%, or less than half of the U.S. at 6.75%.

3. YTM is essentially a bond’s internal rate of return if held to maturity. It is calculated based on the NAV.

May 31, 2025

May 31, 2025