The monthly commentary discusses recent developments across the Ninepoint Diversified Bond, Ninepoint Alternative Credit Opportunities and Ninepoint Credit Income Opportunities Funds.

Macro

As was widely expected, both the Bank of Canada (BoC) and the Federal Reserve (Fed) cut interest rates by 25 basis points at their September meetings, restarting the rate cut cycle. While both acknowledged the weakness in the labour market as an increasing concern, the tone was balanced, as inflation remains an issue as well, particularly in the U.S., where tariffs are still working their way through the economy. Nonetheless, market expectations for the future path of overnight rates still heavily favours the U.S. (1% of cumulative cuts for the next 12 months vs Canada at only 0.3% of cumulative cuts for the same period).

At this juncture, the evolution of the labour market AND inflation matter a lot for the monetary policy outlook, but unfortunately the shutdown of the U.S. government on October 1st will deprive everyone of official government statistics, obscuring the economic picture at a time when we would have been scrutinizing every data release with even more fervour than usual. As an imperfect substitute, market participants and central banks will have to rely on private data to assess the direction of the economy.

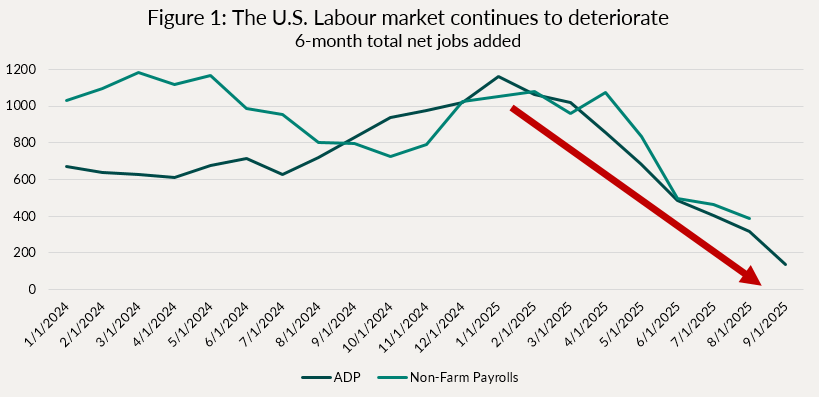

For example, instead of non-farm payrolls (NFP) and the household survey (official Bureau of Labor Statistics releases), the ADP employment report for September was more market moving than usual, despite having been historically dismissed as a poor leading indicator of NFP. For now, it will have to do, since we have nothing else to go by! And, looking at the behaviour of both series over time, it seems like the correlation between them has increased over the past few years, so we shouldn’t be so quick to dismiss the information contained in ADP. Indeed, it shows that the weakness in the labour market is continuing, with a decline of 32 thousand jobs (and the prior month revised to -3 thousand as well), bringing the pace of employment growth at a standstill. To smooth out the month-to-month variations, we show in Figure 1 below the 6-month rolling total net jobs added, based on both ADP and NFP. They are clearly sending a similar message, which justifies this “insurance cut” by the Fed a few weeks ago. Should this continue, we expect the FOMC to keep cutting rates.

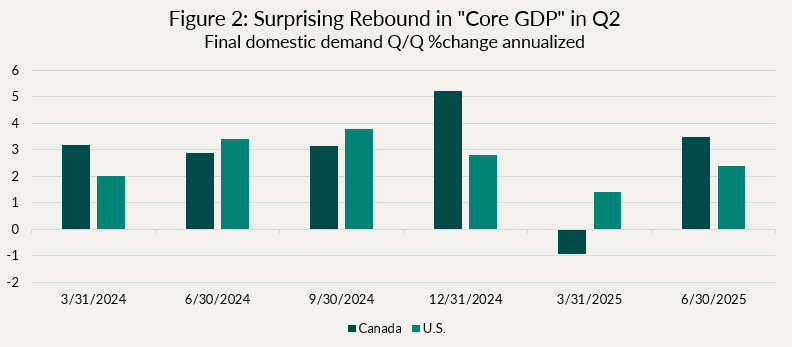

What is creating more uncertainty as to the future path of rates is the rebound we have seen in the second quarter’s final GDP revisions. Despite still elevated and sticky core inflation, if the labour market was weakening at the same time as consumption and investment, it would be a clear signal for the Fed/BoC to cut rates into an accommodative stance. But the economic data is sending mixed signals. Figure 2 below shows what we call “Core GDP” growth, or “Final Domestic Demand”. It takes out inventories and imports/exports to give us a better sense of how the domestic economy is performing. After a sharp contraction in Q1 for Canada and weakness in the U.S., we saw a solid rebound in the second quarter (first estimates were weak, but they got progressively stronger as the data got revised). If this holds for the balance of the year and into 2026, it becomes a lot harder to justify further rate cuts, as this likely means the stickiness in inflation is here to stay.

Normally, one would expect weakness in the labour market to spread to consumer spending, but we live in quite abnormal times, and so we should remain humble and vigilant. While it is not our base case, it is possible that further rate cuts might be delayed by an unexpectedly strong domestic economy, sending bond yields higher (and prices lower). We have and use tools to mitigate those risks to our portfolios.

As discussed last month, credit markets remain buoyant, compensation for default risk (credit spreads) remains at generational lows across the board, and we are seeing issuers take advantage of this. Issuance is set to break records in Canada this year, with ~$120 billion issued already with three months to go. August and September have been extremely busy, and we saw deals of questionable quality priced at very low credit spreads, another sign that the market is frothy and reaching for yield. We remain disciplined and selective in what we add to the portfolios.

Individual Fund Discussion

Ninepoint Diversified Bond Fund

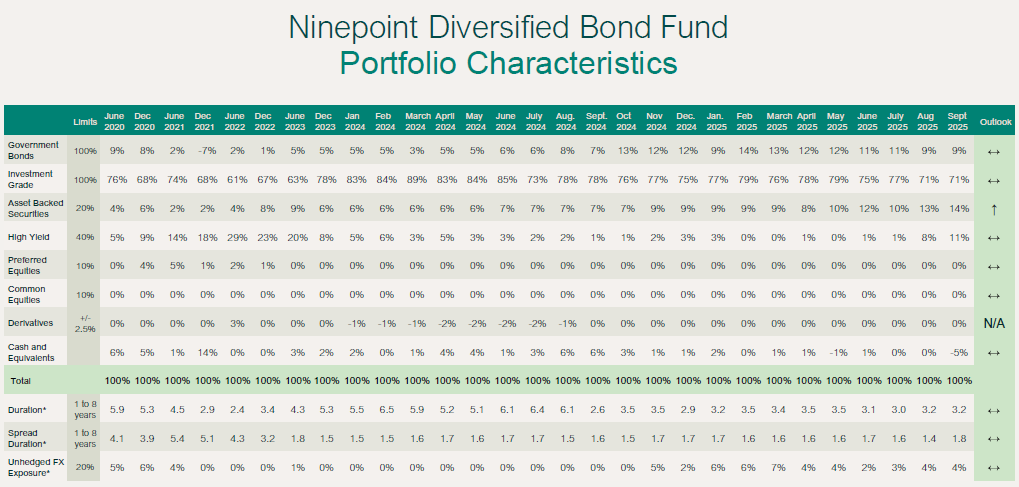

September was a good month for the fund, returning 65 basis points (vs 1.93% for the Canadian index). Our underperformance versus the index stems from our much lower duration (3.2 years vs 7 years). As bonds rallied into the BoC and Fed rate cuts, we trailed index performance. This is to be expected. However, on a full year basis, we remain well ahead (3.57% vs 3.01%).

There were no material changes to the portfolio composition in September, other than a slight uptick in our High Yield weight, where we added hybrid securities that are soon to be called away.

NINEPOINT DIVERSIFIED BOND FUND - COMPOUNDED RETURNS¹ AS OF SEPTEMBER 30, 2025 (SERIES F NPP118) | INCEPTION DATE: AUGUST 5, 2010

1M |

YTD |

3M |

6M |

1YR |

3YR |

5YR |

10YR |

15YR |

Inception |

|

|---|---|---|---|---|---|---|---|---|---|---|

Fund |

0.65% |

3.57% |

1.46% |

1.54% |

4.95% |

5.69% |

1.48% |

2.78% |

3.50% |

3.59% |

Ninepoint Alternative Credit Opportunities Fund

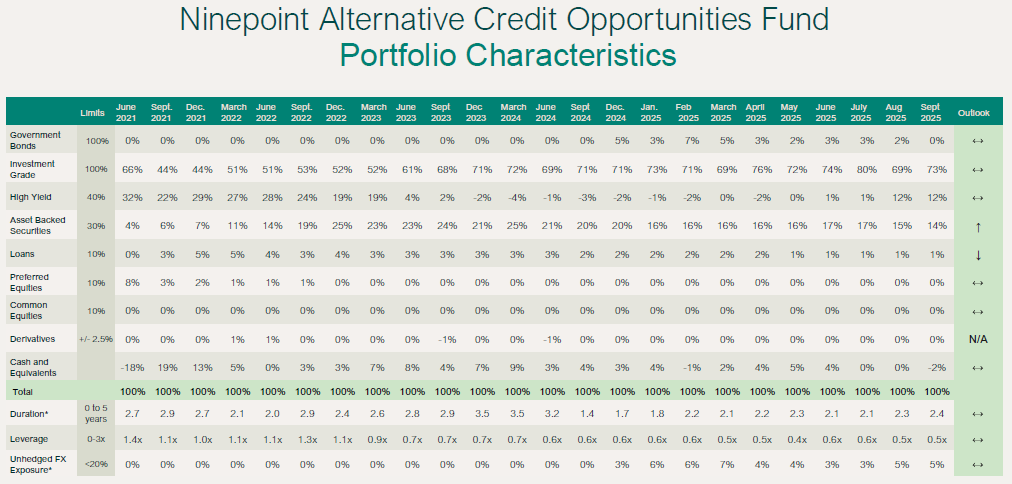

September was a great month for this strategy, returning 88 basis points, taking our YTD total; to 3.78% net of fees (F-class). We increased duration a smidge again this month to 2.4 years (from 2.3). The yield-to-maturity went up to 5.0% (from 4.9%). The average credit quality did decline a notch, but is more than offset by synthetic credit hedges in CDX IG and HY. Leverage remains low at 0.5x.

NINEPOINT ALTERNATIVE CREDIT OPPORTUNITIES FUND - COMPOUNDED RETURNS¹ AS OF SEPTEMBER 30, 2025 (SERIES F NPP931) | INCEPTION DATE: APRIL 30, 2021

1M |

YTD |

3M |

6M |

1YR |

3YR |

Inception |

|

|---|---|---|---|---|---|---|---|

Fund |

0.88% |

3.78% |

2.07% |

2.32% |

5.62% |

7.29% |

2.92% |

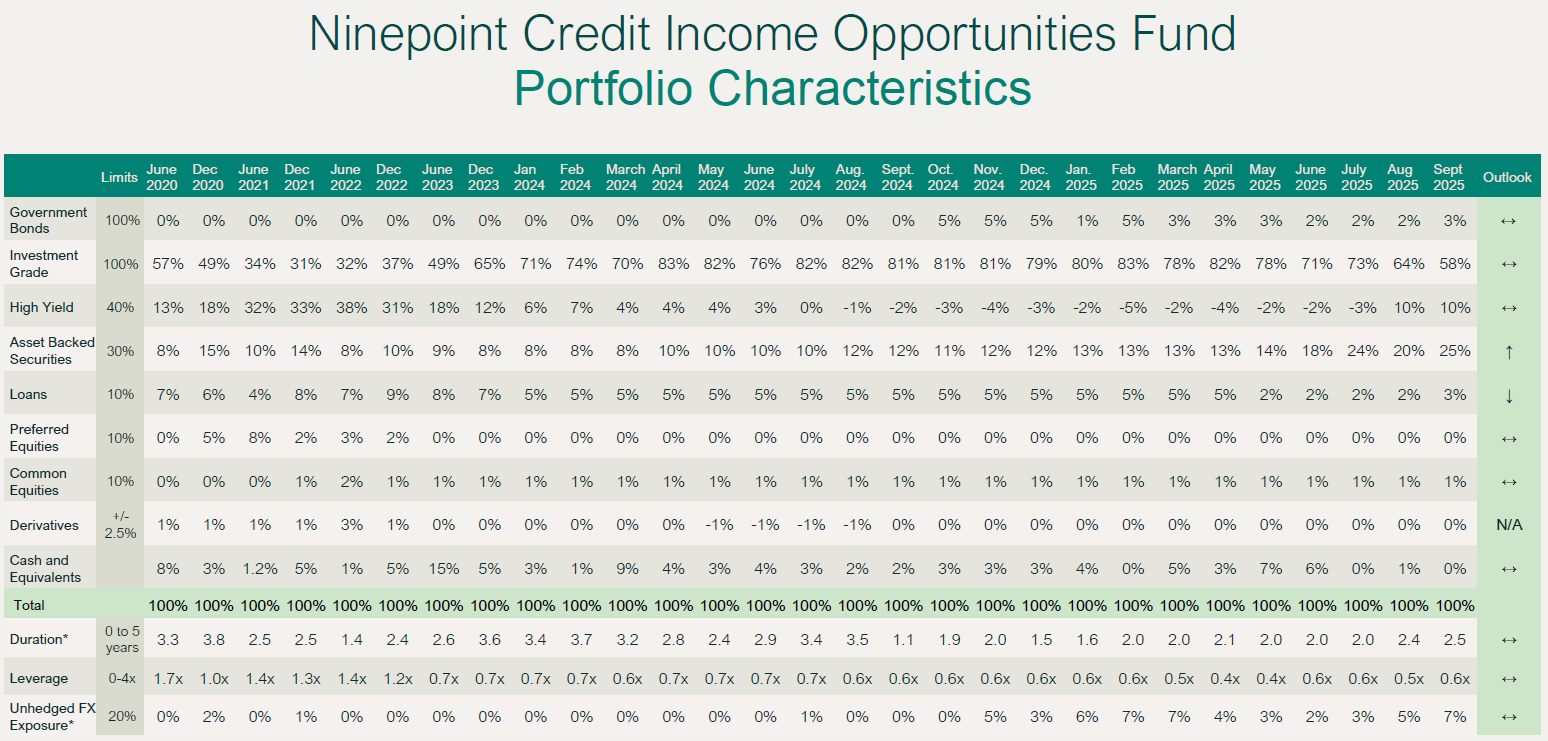

Ninepoint Credit Income Opportunities Fund

Other than returning 0.98% vs 0.88% (and 3.97% vs 3.78% YTD) for the Ninepoint Alternative Credit Opportunities fund, the discussion for the Credit Income Opportunities fund is essentially the same, so we would refer readers to the previous section. These two funds are managed to basically the same strategy.

NINEPOINT CREDIT INCOME OPPORTUNITIES FUND - COMPOUNDED RETURNS¹ AS OF SEPTEMBER 30, 2025 (SERIES F NPP507) | INCEPTION DATE: JULY 1, 2015

1M |

YTD |

3M |

6M |

1YR |

3YR |

5YR |

10YR |

Inception |

|

|---|---|---|---|---|---|---|---|---|---|

Fund |

0.98% |

3.97% |

2.18% |

2.45% |

5.71% |

7.27% |

5.05% |

5.26% |

5.01% |

Conclusion

Never a dull moment! Happy Thanksgiving and thank you for your support.

Until next month,

Mark, Etienne & Nick

As always, please feel free to reach out to your product specialist if you have any questions.

September 30, 2025

September 30, 2025