Monthly Update

Year-to-date to September 30, the Ninepoint Global Infrastructure Fund generated a total return of 5.88% compared to the MSCI World Core Infrastructure Index, which generated a total return of 11.72%. For the month, the Fund generated a total return of 3.01% while the Index generated a total return of 2.61%.

Ninepoint Global Infrastructure Fund - Compounded Returns¹ As of September 30, 2025 (Series F NPP356) | Inception Date: September 1, 2011

1M |

YTD |

3M |

6M |

1YR |

3YR |

5YR |

10YR |

Inception |

|

|---|---|---|---|---|---|---|---|---|---|

Fund |

3.01% |

5.88% |

1.87% |

1.95% |

9.25% |

12.24% |

10.52% |

9.18% |

8.34% |

MSCI World Core Infrastructure NR (CAD) |

2.61% |

11.72% |

3.81% |

3.78% |

11.45% |

11.81% |

8.75% |

8.67% |

11.00% |

Markets continued to levitate to new all-time highs in September, as mega-cap tech stocks and the AI-trade garnered more and more attention and capital flows from investors. The disparities between the haves and the have-nots can clearly be seen by examining the S&P 500 and the Equal Weight S&P 500, with returns in the month of 3.53% and 0.90% respectively (according to LSEG). It is beginning to feel like the rally can continue into year-end, but perhaps with greater volatility along the way than what has been experienced over the past few months.

As we head into earnings season, revenue and earnings estimates remain solid, with FactSet looking for Q3 revenue growth of 6.3% and earnings growth of 8.0%, led by the Information Technology, Utilities, Materials, Financials and Industrials sectors. Unlike most years, analysts have raised estimates heading into earnings season, as most industries and companies have yet to experience the impact of inflation and tariffs on profit margins. But we will be closely watching the results and listening to management’s commentaries to assess the outlook over the balance of the year.

After persistent calls for interest rate cuts from some market participants (and most vocally from the President of the United States), on September 17, the US FOMC cut rates by 25 basis points, from 4.5% to 4.25% and (coincidently on the same day) the Bank of Canada cut rates by 25 basis points, from 2.75% to 2.5%. The Federal Reserve also released its Summary of Economic Projections, which suggested another two more cuts of 25 basis points each over the balance of 2025 and at least one more cut of 25 basis points in early 2026. Based on history, hopes for an extended cycle of interest rate cuts are very supportive of continued market gains, at least in the near term.

But now investors must deal with a US government shutdown, which not only affects thousands of people who are on the government’s payroll but also prevents the release of timely economic data, including the critically important inflation and jobs numbers. Despite the information vacuum (though admittedly some private surveys will be made available as usual), the US equity markets remain unconcerned (evidenced by the S&P 500 index level valuation at 22.8x forward earnings compared to the 5-average of 19.9x and the 10-year average of 18.6x, according to FactSet). Given the unusual circumstances and conditions today, it will be very interesting to see how the equity markets perform through the coming earnings season. To be proactive, we have reduced outsized allocations to individual stocks and investment themes while remaining invested in a broadly diversified portfolio, in case a growth scare or some other shock materializes over the next couple of months.

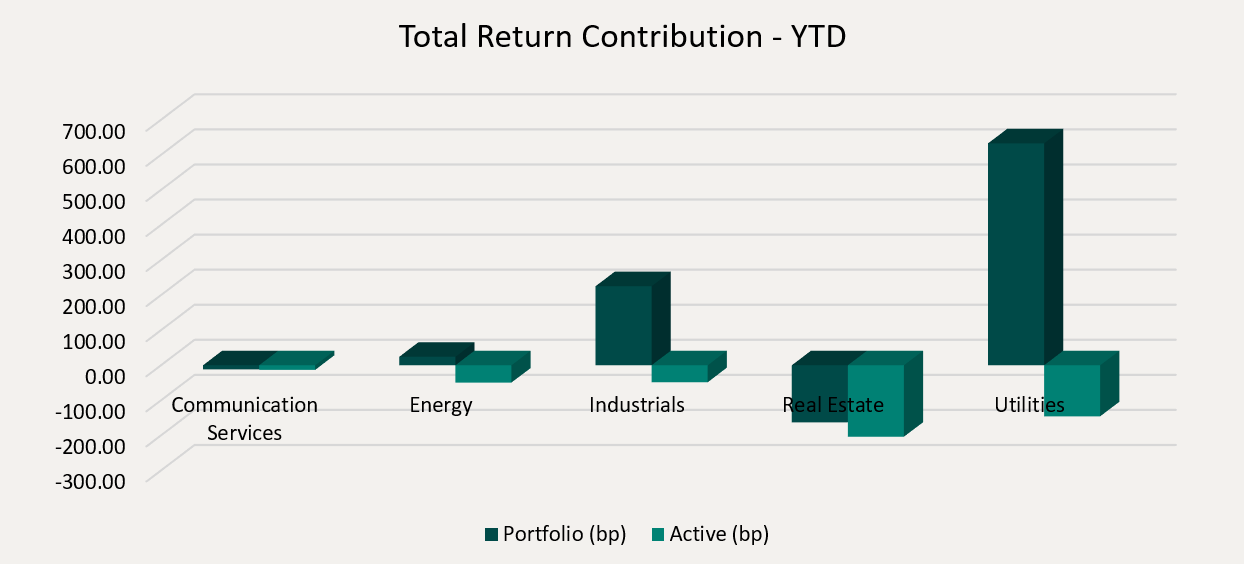

Top contributors to the year-to-date performance of the Ninepoint Global Infrastructure Fund by sector included Utilities (+634 basis points), Industrials (+225 basis points) and Energy (+24 basis points), while the Real Estate (-163 basis points) and Communication Services (-12 basis points) sectors detracted from performance on an absolute basis.

On a relative basis, negative contributions from the Real Estate (-204 basis points), Utilities (-146 basis points) and Energy (-49 basis points) sectors detracted from performance.

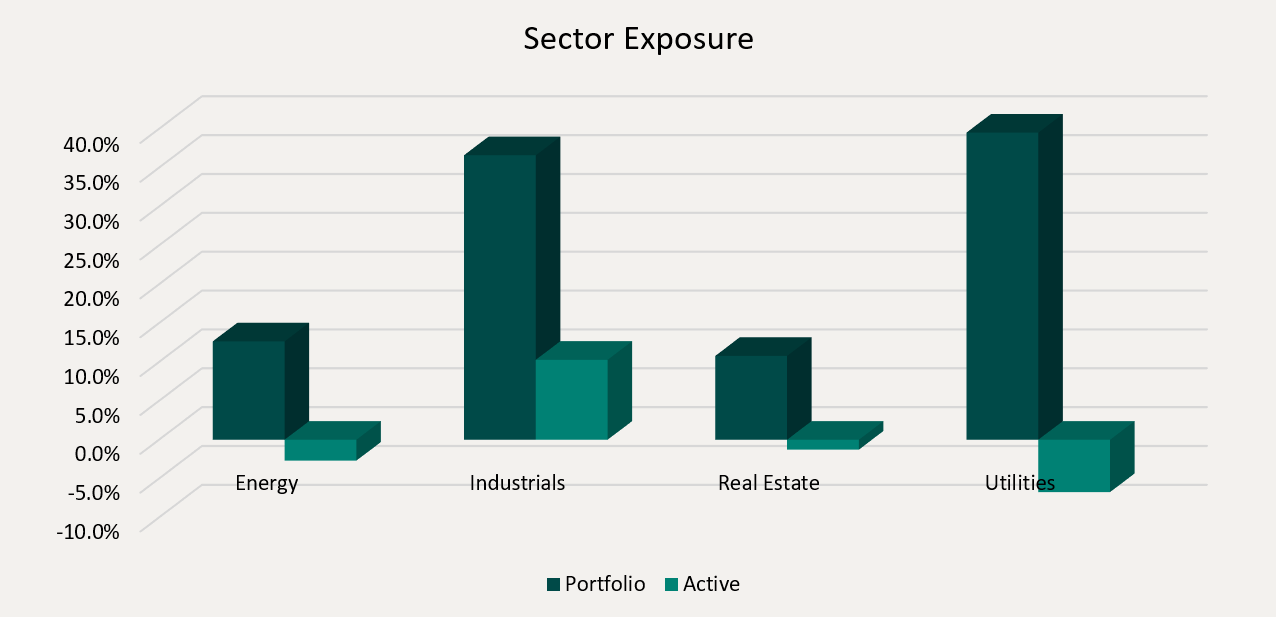

We are currently overweight the Industrials sector and underweight the Utilities, Energy and Real Estate sectors. As the market continues to make new all-time highs, we are wary of any potential exogenous shocks, while weighing the probability of supportive rate cuts through the balance of the year. To mitigate the risks, we remain focused on high-quality, dividend-paying infrastructure equities that have demonstrated the ability to consistently generate revenue, cash flow and earnings growth through the business cycle.

We continue to believe that the infrastructure asset class is ideally positioned to benefit from the electrification of the global economy and increased fiscal spending on infrastructure in Canada, the US and Europe. Importantly, electricity demand is expected to accelerate dramatically, led primarily by the construction of AI-focused data centers globally and the onshoring of industrial manufacturing in the US. Therefore, we are comfortable having exposure to various infrastructure sub-sectors or sub-industries in the Ninepoint Global Infrastructure Fund that are positioned to benefit from these themes, including traditional energy investments, electrical, natural gas, nuclear & multi-utilities and engineering & construction contractors.

The Ninepoint Global Infrastructure Fund was concentrated in 30 positions as at September 30, 2025, with the top 10 holdings accounting for approximately 37.7% of the fund. Over the prior fiscal year, 23 out of our 30 holdings have announced a dividend increase, with an average hike of 8.3% (median hike of 5.8%). Using a total infrastructure approach, we will continue to apply a disciplined investment process, balancing valuation, growth, and yield in an effort to generate solid risk-adjusted returns.

Jeffrey Sayer, CFA

Ninepoint Partners

September 30, 2025

September 30, 2025