The monthly commentary discusses recent developments across the Ninepoint Diversified Bond, Ninepoint Alternative Credit Opportunities and Ninepoint Credit Income Opportunities Funds.

Macro

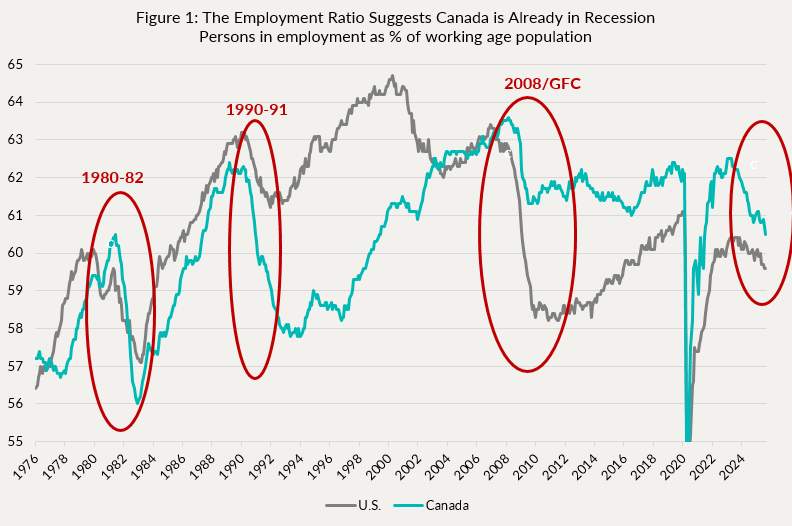

The economic weakness we saw in July continued in August, particularly in the labour market. In Canada and the U.S., the unemployment rate is now making new cycle highs. Because of the many distortions in the employment numbers, due to varying participation rates and drastic changes in immigration policies, we have shown in Figure 1 the employment ratio, sometimes called the employment rate. This represents the number of workers as a percentage of the working age population. It is a much broader definition of employment in the economy, and it currently doesn’t look good. For historical context, the nastiest recessions we have seen in the past half century were: the 1980-82 double dip, 1990-91 and 2008/GFC. At the time, depending on the country and the severity of the recession, the employment ratio declined by a range of 2% (1990-91 in the U.S., and 2008/GFC in Canada) and 5% (2008/GFC in the U.S). In Canada, the employment rate has already declined by 2% from its peak, whereas in the U.S., the decline has been shallower (stronger economy in 2023/2024), but has accelerated lately, and now stands at 0.8%.

There are many dynamics at play. Obviously, there is an increase in people looking for work, but there are also fewer job openings, so people that are out of a job are likely to stay unemployed for longer. There are also discouraged workers, leaving the labour force, which drop out of the unemployment rate, but remain of working age. But overall, the result is fewer and fewer workers as a percentage of the working age population. So, while the worst of the uncertainty related to the trade war is behind us, that doesn’t automatically result in a rebound in labour demand.

Indeed, as discussed last month, U.S. personal consumption (~70% of the economy) is at a standstill, and firms have a hard time passing on the increased costs due to tariffs, leading to margin erosion and less demand for labour. Yes, core inflation remains around 3%, above both central banks targets, but the magnitude and broadening of the deterioration in the economy is harder to ignore. At his annual Jackson Hole speech, Chair Powell clearly shifted his tone, acknowledging the rising downside risks to employment and the need for looser monetary policy.

Central banks are like big cargo ships, they move slowly, and changing direction or speed takes time. But, once a new direction is set, expect them to follow through. The bond market has taken notice, pricing-in a resumption of the cut cycle by the September meeting and a string of further cuts into next year. Still, “terminal” pricing (i.e. where the market thinks central banks will stop cutting) is only around neutral, meaning it doesn’t expect stimulative monetary policy to be required.

With the recent deterioration in the labour market, the lack of consumer spending, tariffs acting as a tax on consumers, and the housing market still in the doldrums, we believe the balance of risks is to the downside. Over the next few months, labour market data will be heavily scrutinised for signs of further deterioration. Downside surprises to the numbers will fuel expectations for further rate cuts, and with that interest rates along the curve will decline. Central banks have been laser-focused on inflation and increasingly “data dependent”, and therefore less forward looking than usual. They might have fallen behind the curve.

Our funds are positioned to do well in this environment. To express our view on rate cuts, we have greater conviction in short-dated tenors (5-year and less), which are more directly influenced by monetary policy, as opposed to longer-term bonds (10-years and longer), which can behave more adversely should concerns around inflation or deficits resurface.

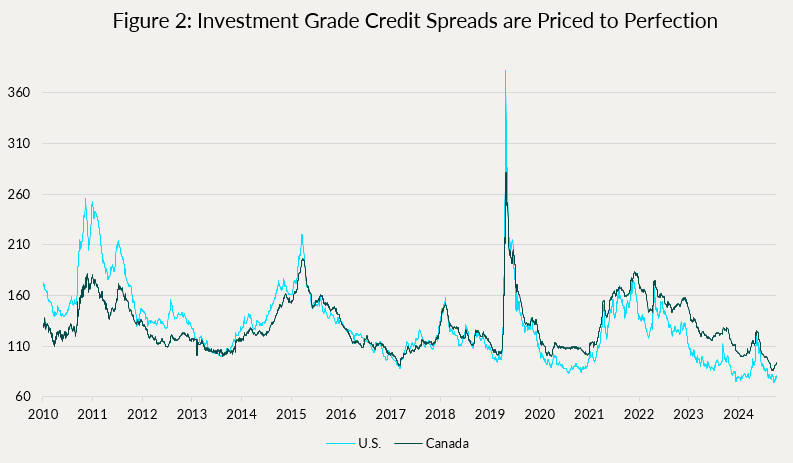

In credit markets, just like with other risk assets such as equities, valuations are stretched. For example, Figure 2 below shows credit spreads on Canadian and U.S. investment grade indices sitting at nosebleed levels (99th percentile since 2010). The same is true for other categories of credit, such as High Yield bonds or Leveraged Loans.

In a slowing and increasingly challenged economic environment, we are not being compensated to take much credit risk. That is why we have remained quite defensively positioned, with higher quality (A- average credit rating across the funds), lots of dry powder and some hedges to add additional ballast.

Additionally, September is usually a very busy month for corporate bond issuance, and with this shaky risk backdrop, greater supply will translate into wider new issue concessions, which then push secondary spreads wider. Already in late August (usually a slow month, but this year with record issuance here in Canada), we saw new issues fail to perform, even tailing wider on the break. Never a good sign of risk appetite.

Individual Fund Discussion

Ninepoint Diversified Bond Fund

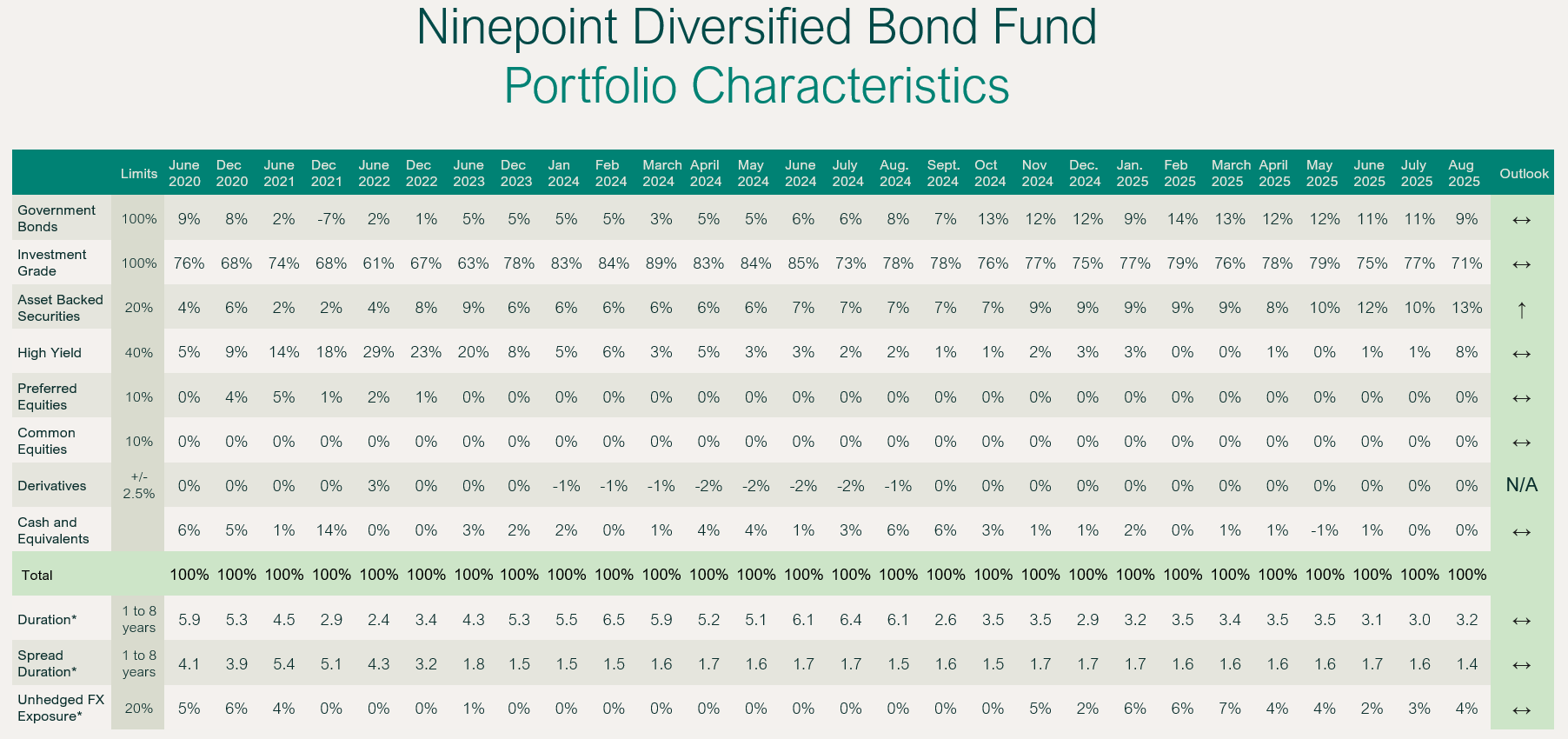

August was an excellent month for the fund, with a return of 62bps (vs 32bps for the Canadian index), taking our YTD total to 2.90% net of fees (F-class). We increased duration a bit to 3.2 years (from 3.0), mostly through U.S. rates exposure, as we see more potential for rate cuts there. The yield to maturity remains stable at 4.5%.

We have altered our credit hedges, closing our HYG short and replacing it with CDX IG and HY options. Why? As the Fed embarks on the next leg of the rate cut cycle, it makes more sense to own protection in “pure” credit, as opposed to credit plus rates (as in a cash product like HYG). Put differently, we wouldn’t want rates to go down, credit spreads up, and see the price of our hedge flat.

NINEPOINT DIVERSIFIED BOND FUND - COMPOUNDED RETURNS¹ AS OF AUGUST 31, 2025 (SERIES F NPP118) | INCEPTION DATE: AUGUST 5, 2010

1M |

YTD |

3M |

6M |

1YR |

3YR |

5YR |

10YR |

15YR |

Inception |

|

|---|---|---|---|---|---|---|---|---|---|---|

Fund |

0.62% |

2.90% |

1.15% |

1.16% |

6.26% |

5.02% |

1.42% |

2.66% |

3.55% |

3.56% |

Ninepoint Alternative Credit Opportunities Fund

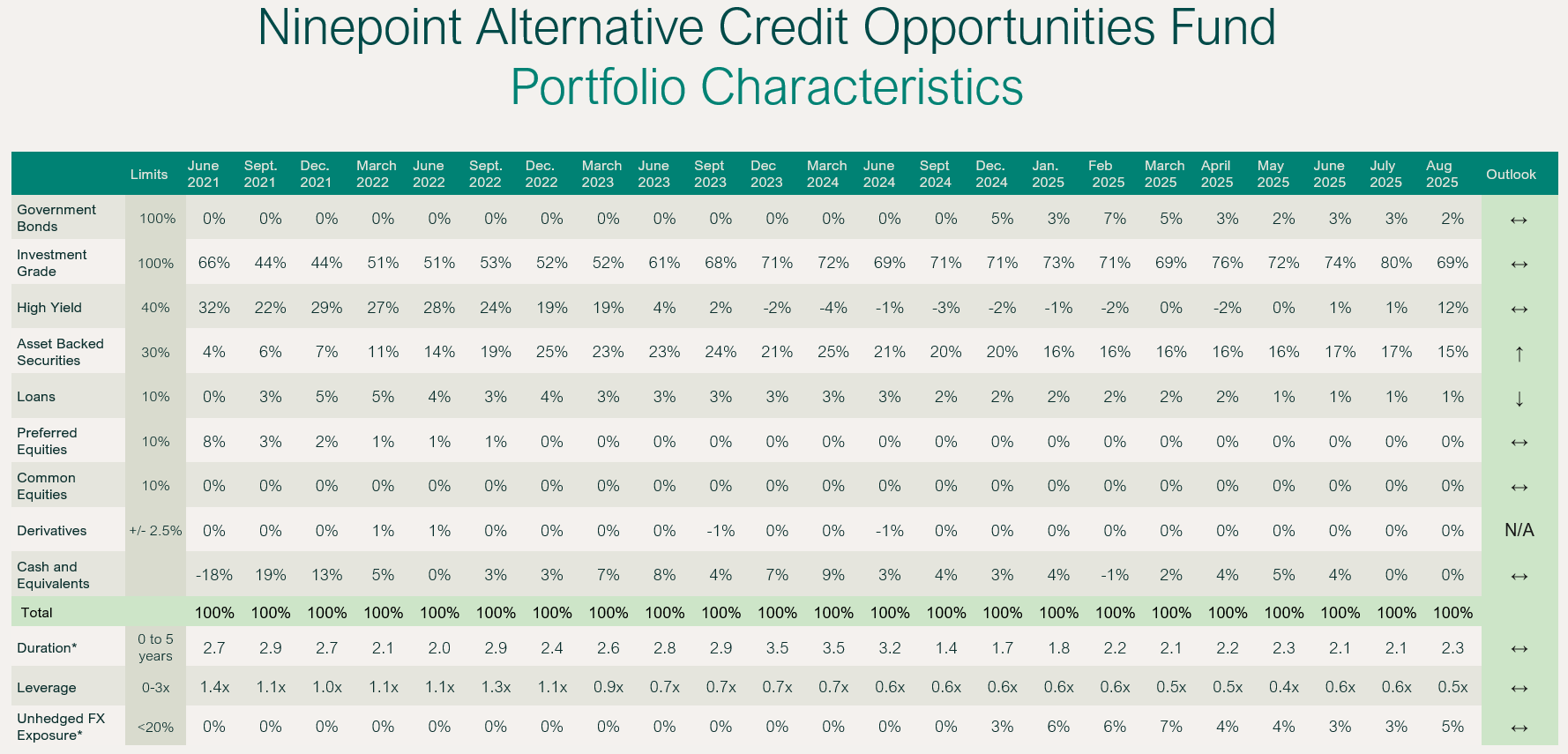

August was a good month for the fund, with a return of 66bps, taking our YTD total to 2.88% net of fees (F-class). We increased duration a bit to 2.3 years (from 2.1), mostly through U.S. rates exposure as we see more potential rate cuts there. The yield to maturity remains stable at 4.9%.

We made the same changes to our credit hedges as described in the Diversified Bond Fund section. In addition, a relative value hedge has started to perform again, with credit spreads on long term corporate bonds underperforming provincial bonds (we benefit when the basis widens). As the environment deteriorates and companies issue more bonds this Fall, we expect this basis to widen even further.

NINEPOINT ALTERNATIVE CREDIT OPPORTUNITIES FUND - COMPOUNDED RETURNS¹ AS OF AUGUST 31, 2025 (SERIES F NPP931) | INCEPTION DATE: APRIL 30, 2021

1M |

YTD |

3M |

6M |

1YR |

3YR |

Inception |

|

|---|---|---|---|---|---|---|---|

Fund |

0.66% |

2.88% |

1.60% |

1.54% |

6.10% |

6.29% |

2.77% |

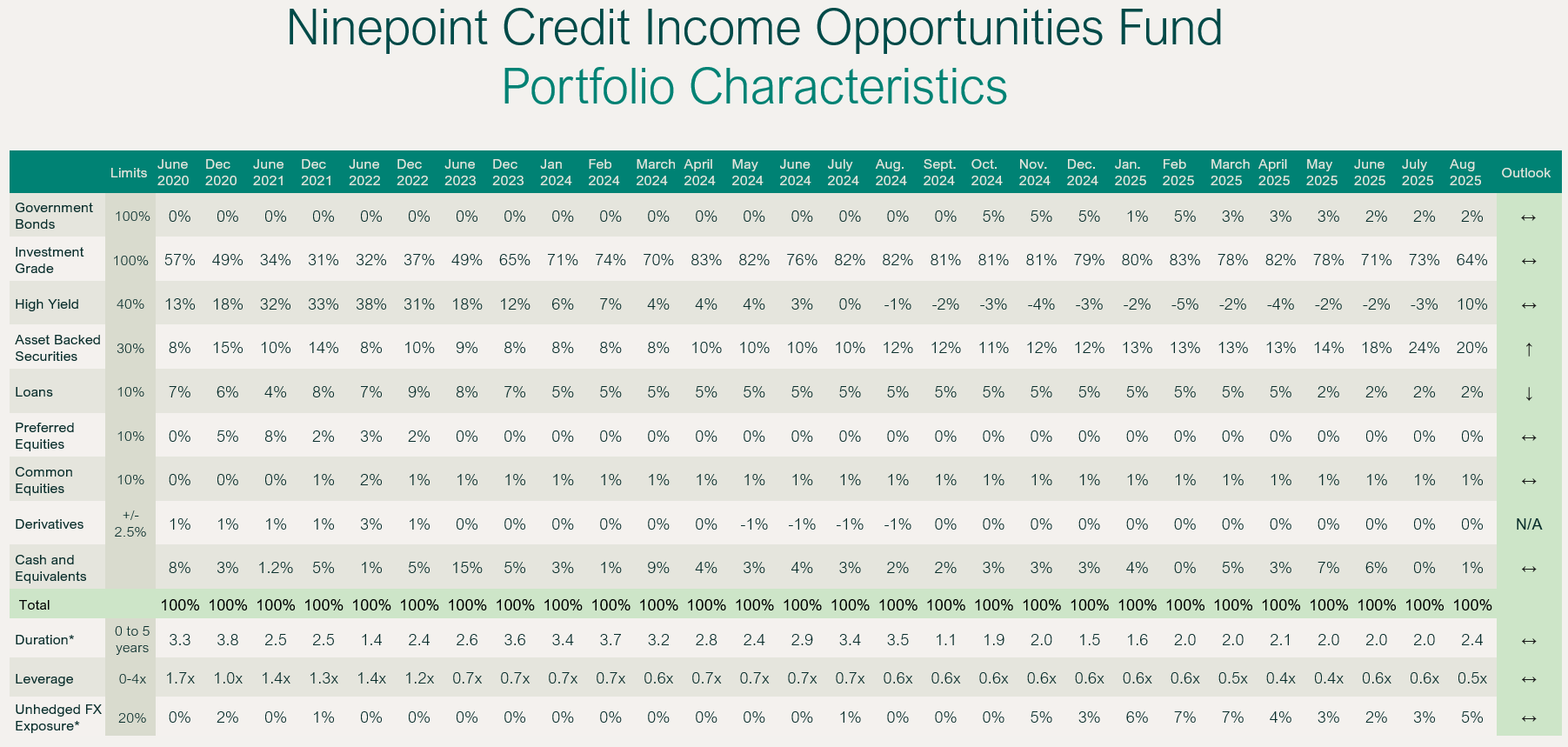

Ninepoint Credit Income Opportunities Fund

Other than returning 0.80% vs 0.66% (and 2.97% vs 2.88% YTD) for the Ninepoint Alternative Credit Opportunities Fund, the discussion for the Ninepoint Credit Income Opportunities Fund is essentially the same, so we would refer readers to the previous section. These two funds are managed to basically the same strategy.

NINEPOINT CREDIT INCOME OPPORTUNITIES FUND - COMPOUNDED RETURNS¹ AS OF AUGUST 31, 2025 (SERIES F NPP507) | INCEPTION DATE: JULY 1, 2015

1M |

YTD |

3M |

6M |

1YR |

3YR |

5YR |

10YR |

Inception |

|

|---|---|---|---|---|---|---|---|---|---|

Fund |

0.80% |

2.97% |

1.56% |

1.39% |

5.94% |

6.29% |

4.85% |

5.11% |

4.96% |

Conclusion

The weather is changing, and so is the tone surrounding the economy. It feels as though we have reached an economic inflection point, and with the long and variable lags surrounding monetary policy, the Fed in particular, seems behind the curve.

Until next month,

Mark, Etienne & Nick

As always, please feel free to reach out to your product specialist if you have any questions.

August 31, 2025

August 31, 2025