Ninepoint-Monroe U.S. Private Debt Fund - Canadian $ Hedged

Fund Highlights

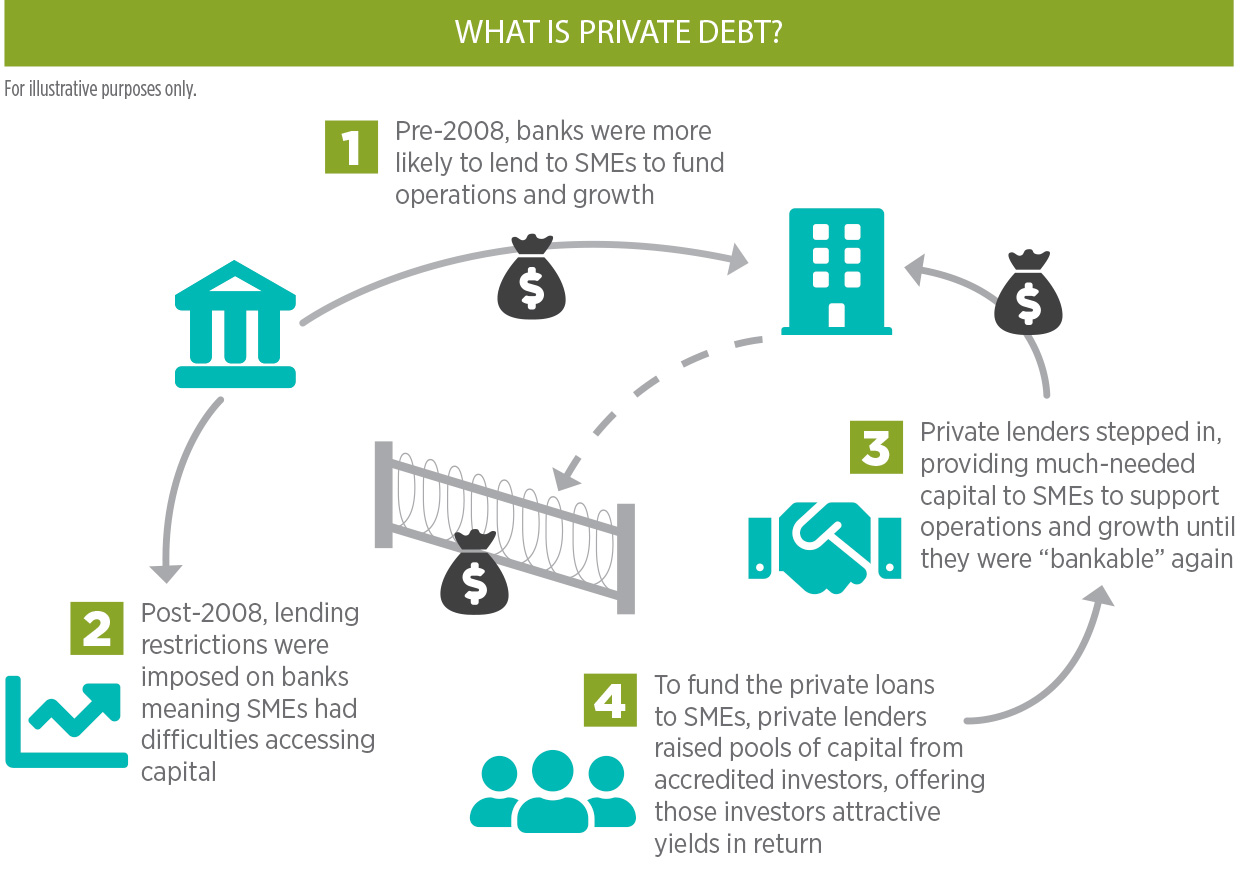

- U.S. Direct Lending – Primarily cash flow based loans to U.S. lower mid-market companies with floating interest rates over LIBOR with an interest rate floor to hedge against interest rate risk.

- Credit First, Zero Loss Mentality – Focus on structure, downside risk and principal protection.

- Senior Secured – Security interests are primarily 1st lien and at the top of the capital structure.

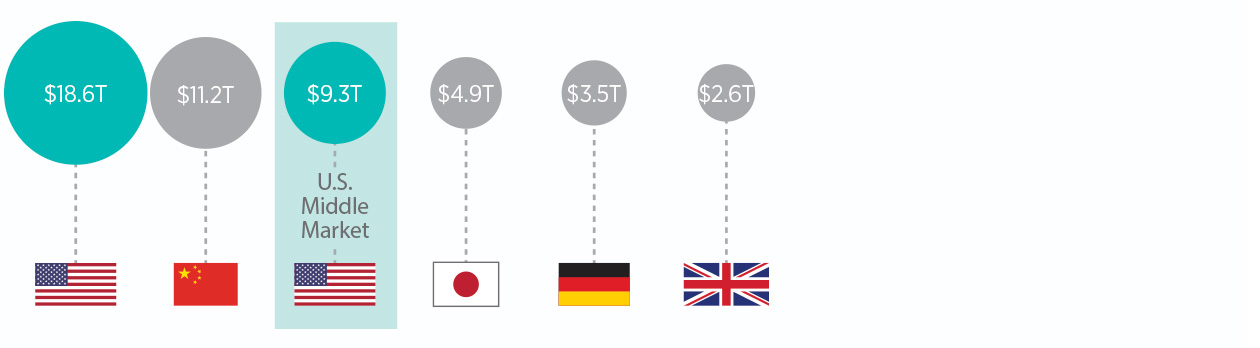

- Access to U.S. Mid-Market– U.S. mid-market businesses generate USD$6.0 trillion equating to the world’s 3rd largest economy with loans exhibiting lower default rates and better recoveries when compared to traditional broadly syndicated markets.

Click the image above to view larger

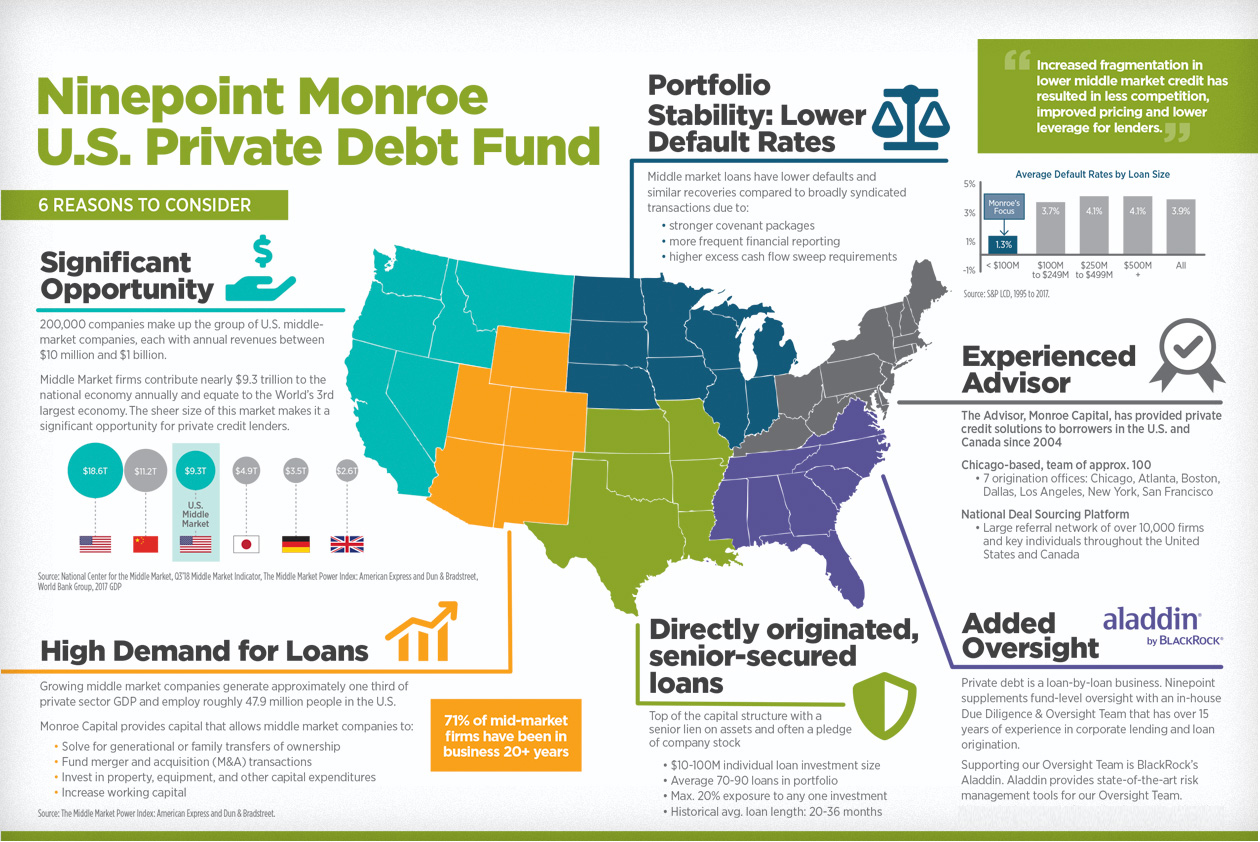

6 Reasons to Consider Monroe U.S. Private Debt Fund

1. Significant Opportunity

200,000 companies make up the group of U.S. middle-market companies, each with annual revenues between $10 million and $1 billion.

Middle Market firms contribute nearly $9.3 trillion to the national economy annually and equate to the World’s 3rd largest economy. The sheer size of this market makes it a significant opportunity for private credit lenders.

Source: National Center for the Middle Market, Q3’18 Middle Market Indicator, The Middle Market Power Index: American Express and Dun & Bradstreet, World Bank Group, 2017 GDP

2. High Demand for Loans

Growing middle market companies generate approximately one third of private sector GDP and employ roughly 47.9 million people in the U.S. Monroe Capital provides capital that allows middle market companies to:

- Solve for generational or family transfers of ownership

- Fund merger and acquisition (M&A) transactions

- Invest in property, equipment, and other capital expenditures

- Increase working capital

71% of mid-market firms have been in business 20+ years

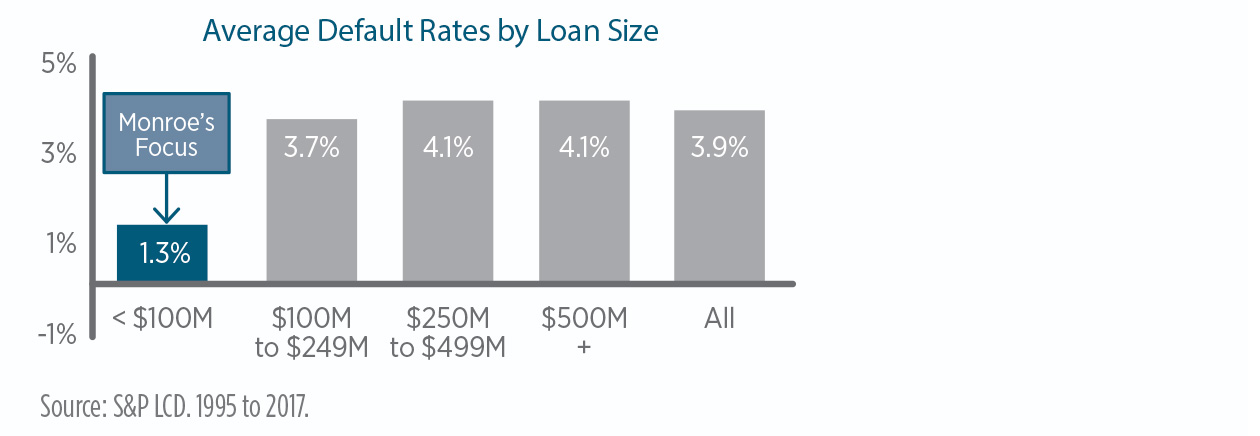

3. Portfolio Stability: Lower Default Rates

Middle market loans have lower defaults and similar recoveries compared to broadly syndicated transactions due to:

- Stronger covenant packages

- More frequent financial reporting

- Higher excess cash flow sweep requirements

Increased fragmentation in lower middle market credit has resulted in less competition, improved pricing and lower leverage for lenders.

4. Experienced Advisor

The Advisor, Monroe Capital, has provided private credit solutions to borrowers in the U.S. and Canada since 2004

Chicago-based, team of approx. 100

- 7 origination offices: Chicago, Atlanta, Boston, Dallas, Los Angeles, New York, San Francisco

National Deal Sourcing Platform

- Large referral network of over 10,000 firms and key individuals throughout the United States and Canada

5. Directly originated, senior-secured loans

Top of the capital structure with a senior lien on assets and often a pledge

of company stock

- $10-100M individual loan investment size

- Average 70-90 loans in portfolio

- Max. 20% exposure to any one investment

- Historical avg. loan length: 20-36 months

6. Added Oversight

Private debt is a loan-by-loan business. Ninepoint supplements fund-level oversight with an in-house Due Diligence & Oversight Team that has over 15 years of experience in corporate lending and loan origination.

Supporting our Oversight Team is BlackRock’s Aladdin. Aladdin provides state-of-the-art risk management tools for our Oversight Team.

All returns and fund details are a) based on Class F units; b) net of fees; c) annualized if period is greater than one year.

For accredited investor requirements please consult a financial advisor or the Fund’s offering documents.

The Ninepoint-Monroe U.S. Private Debt Fund (the “Fund”) is generally exposed to the following risks. See the offering memorandum of the Fund for a description of these risks: overall risk; not a complete investment program; general investment risk; limited operating history; changes in investment strategy; limited ability to liquidate investment; capital depletion risk; redemptions; Foreign currency risk exposure to class FH Units; fluctuations in net asset value and valuation of the Master Fund’s investments; unitholders not entitled to participate in management; reliance on the Advisor; dependence of the Advisor on key personnel; taxation of the Fund; no ownership interest in the Portfolio; distributions; potential indemnification obligations; liability of unitholders; lack of independent experts representing unitholders; no involvement of unaffiliated selling agent; not a public mutual fund; charges to the Fund; All Risks associated with the Master Fund and investments by the Master Fund.

Ninepoint Partners LP is the investment manager to the Ninepoint Funds (collectively, the “Funds”). The Ninepoint-Monroe U.S. Private Debt Fund is offered on a private placement basis pursuant to an offering memorandum and is only available to investors who meet certain eligibility or minimum purchase amount requirements under applicable securities legislation. The offering memorandum contains important information about the Fund including its investment objective and strategies, purchase options, applicable management fees, performance fees, other charges and expenses, and should be read carefully before investing. Performance data represents past performance of the Fund and is not indicative of future performance. Data based on performance history of less than five years may not give prospective investors enough information to base investment decisions on. Please contact your own personal advisor on your particular circumstance. This communication does not constitute an offer to sell or solicitation to purchase securities of the Fund. The information contained herein does not constitute an offer or solicitation by anyone in the United States or in any other jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. Prospective investors who are not resident in Canada should contact their financial advisor to determine whether securities of the Fund may be lawfully sold in their jurisdiction.

* $150,000 for non-individual.

†Fund returns between 7% and 8.75% are payable to the General Partner as a Performance Allocation plus applicable taxes. In addition. 20% of returns in excess of 8.75% are payable to the General Partner as a Performance Allocation.

Are You An Accredited Investor?

An investment in this Fund requires the financial ability and willingness to accept the high risks and lack of liquidity inherent in this type of an investment. Investors in the Fund must be prepared to bear such risks for an extended period of time and should review suitability with their Investment Advisor.

The minimum subscription amount is $150,000.00 in all jurisdictions, unless you meet the definition of "accredited investor" under National Instrument 45-106 Prospectus and Registration Exemptions.

If you meet the definition "accredited investor" (see below), you may invest a minimum of $25,000. Please consult the Offering Memorandum to determine your qualification status. Investment Advisors should consult their company's internal policies.

The Subscriber, or one or more beneficial purchasers for whom the Subscriber is acting, is (i) a resident of, or the purchase and sale of securities to the Subscriber is otherwise subject to the securities legislation of one of the following: British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, Québec, Newfoundland and Labrador, Nova Scotia, New Brunswick, Prince Edward Island, North West Territories, or Nunavut, and the Subscriber is (and will at the time of acceptance of the Subscription be) an accredited investor within the meaning of National Instrument 45-106 Prospectus and Registration Exemptions ("NI 45-106") because the Subscriber is one of the following:

| (a) | a Canadian financial institution, or a Schedule III bank; |

| (b) | the Business Development Bank of Canada incorporated under the Business Development Bank of Canada Act (Canada); |

| (c) | a subsidiary of any person referred to in paragraphs (a) or (b), if the person owns all of the voting securities of the subsidiary, except the voting securities required by law to be owned by directors of that subsidiary; |

| (d) | a person registered under the securities legislation of a jurisdiction of Canada as an adviser or dealer, other than a person registered solely as a limited market dealer under one or both of the Securities Act (Ontario) or the Securities Act (Newfoundland and Labrador); |

| (e) | an individual registered or formerly registered under the securities legislation of a jurisdiction of Canada as a representative of a person referred to in paragraph (d); |

| (f) | the Government of Canada or a jurisdiction of Canada, or any crown corporation, agency or wholly owned entity of the Government of Canada or a jurisdiction of Canada; |

| (g) | a municipality, public board or commission in Canada and a metropolitan community, school board, the Comité de gestion de la taxe scolaire de l'île de Montréal or an intermunicipal management board in Québec; |

| (h) | any national, federal, state, provincial, territorial or municipal government of or in any foreign jurisdiction, or any agency of that government; |

| (i) | a pension fund that is regulated by the Office of the Superintendent of Financial Institutions (Canada), a pension commission or similar regulatory authority of a jurisdiction of Canada; |

| (j) | an individual who, either alone or with a spouse, beneficially owns financial assets having an aggregate realizable value that before taxes, but net of any related liabilities, exceeds $1,000,000; |

| (k) | an individual whose net income before taxes exceeded $200,000 in each of the 2 most recent calendar years or whose net income before taxes combined with that of a spouse exceeded $300,000 in each of the 2 most recent calendar years and who, in either case, reasonably expects to exceed that net income level in the current calendar year; (Note: If individual accredited investors wish to purchase through wholly-owned holding companies or similar entities, such purchasing entities must qualify under section (t) below, which must be initialled.) |

| (l) | an individual who, either alone or with a spouse, has net assets of at least $5,000,000; |

| (m) | a person, other than an individual or investment fund, that has net assets of at least $5,000,000 as shown on its most recently prepared financial statements; |

| (n) | an investment fund that distributes or has distributed its securities only to:

|

| (o) | an investment fund that distributes or has distributed securities under a prospectus in a jurisdiction of Canada for which the regulator or, in Québec, the securities regulatory authority, has issued a receipt; |

| (p) | a trust company or trust corporation registered or authorized to carry on business under the Trust and Loan Companies Act (Canada) or under comparable legislation in a jurisdiction of Canada or a foreign jurisdiction, acting on behalf of a fully managed account managed by the trust company or trust corporation, as the case may be; |

| (q) | a person acting on behalf of a fully managed account managed by that person, if that person:

|

| (r) | a registered charity under the Income Tax Act (Canada) that, in regard to the trade, has obtained advice from an eligibility adviser or an adviser registered under the securities legislation of the jurisdiction of the registered charity to give advice on the securities being traded; |

| (s) | an entity organized in a foreign jurisdiction that is analogous to any of the entities referred to in paragraphs (a) to (d) or paragraph (i) in form and function; |

| (t) | a person in respect of which all of the owners of interests, direct, indirect or beneficial, except the voting securities required by law to be owned by directors, are persons that are accredited investors; |

| (u) | an investment fund that is advised by a person registered as an adviser or a person that is exempt from registration as an adviser, or; |

| (v) | a person that is recognized or designated by the securities regulatory authority or, except in Ontario and Québec, the regulator as an accredited investor. |

Advisor Use Only

This commentary is for Advisor use only. If you are an Advisor, please contact your Ninepoint Product Specialist for access.