Canadian Housing Market Whitepaper

Housing Crash? Don’t bet on it.

Canada is a flourishing nation with a developed economy, but it is not necessarily a very efficient market when it comes to the residential real estate sector.

After reaching a trough in Q1 2023, average prices in the Greater Toronto Area (GTA) have begun to rise again. The last few months have seen home sales returning (see Figure 1). Surging demand and low inventories have put sellers in the driver’s seat even though there is less activity in the market than before the pandemic.

Average selling prices still exceed listing prices, and the average days on the market has decreased. The transaction volumes are low but are likely to pick up if there is any indication of a rate hike pause in the near term.

The key question to ask is whether the current elevated house prices are sustainable.

Figure 1 - GTA Home Sales May 2022 - May 2023 ($000)

Source: TREB Market Watch, June 2023

GTA home prices rising, but are they sustainable?

To answer this, we need to examine the main factors influencing the real estate market. Some fear an imminent crash. They point to the adverse macro environment — inflation, rising interest rates, tighter lending criteria and a growing debt burden — exerting downward pressure and making homeownership unaffordable for many. We, on the other hand, foresee prices staying stable or even moving higher, especially should interest rates begin to taper. There simply isn’t enough supply to meet demand, and that demand is growing. Homeownership remains a fundamental societal goal, and would-be homeowners are finding innovative ways to overcome the obstacles in their way.

Let’s take a look at both sides of the argument.

Affordability — or rather, lack thereof

Housing continues to be a core topic of interest for Canadian households, and rightfully so. People are priced out, particularly in metropolitan hubs like Toronto.

Figure 2 - Sales and average price by type of home — May 2023

Source: TREB Market Watch, June 2023

Figure 3 - Downpayment: Months of required saving as of May 2023

Source: National Bank Housing Affordability Monitor

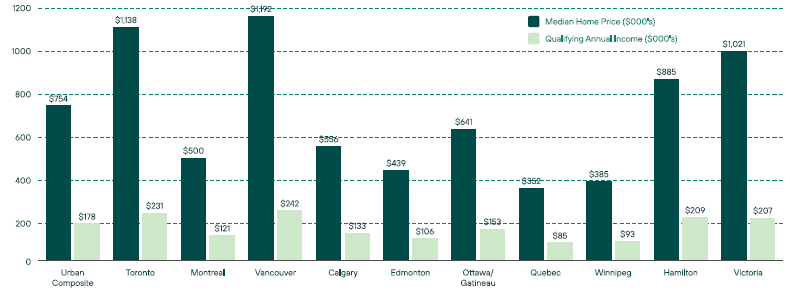

Figure 4 - Qualifying income needed to buy a home

Source: National Bank Housing Affordability Monitor

The average home price in Toronto (inclusive of all property types – detached, semi-detached, townhouses, condominiums) in 2023 was $1.1 million. While that’s down slightly from last year’s average of $1.2 million, it’s still 3.7% higher than year-end 2021. (see Figure 2).

Sales and average price by type of home

Based on median income, saving enough for a down payment for a home in Toronto would take 25 years (see Figure 3).1

Downpayment: Months of Saving

Even where a buyer can afford the downpayment, the annual income needed to qualify for a mortgage in Toronto is astoundingly high — $231,000. Compare that with the rest of the country, where the average home price is $754,000 and qualifying annual income around $178,000 (see Figure 4). Mortgage payment costs as a percentage of income in Toronto are 83% versus 61% in the rest of Canada.2

Figure 5 - Bank of Canada - interest rate hikes

Source: Bank of Canada

Rising interest rates

Elevated interest rates continue to plague potential buyers. In the past 18 months, the Bank of Canada has increased rates to 5.00% from 0.25%, with one or two more hikes potentially on the way.

While there is a chance that some eligible buyers may be priced out if they opt to wait for a downturn in house prices, higher financing costs are still keeping many traditional residential investors away from the market (see Figure 5).

Tighter lending criteria

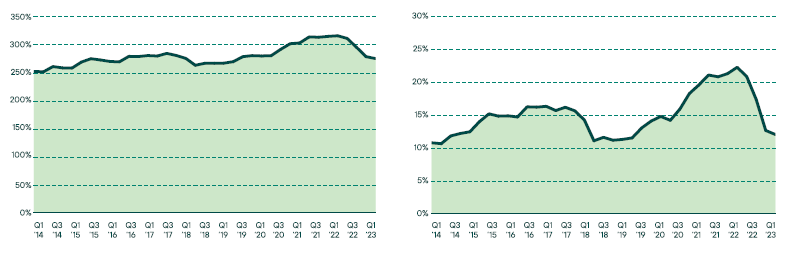

With home prices growing faster than wages, the average household has had to take on more debt to finance their home. As a result, loan-to-income (LTI) ratios have increased.

The Bank of Canada has done a respectable job of tightening lending criteria (higher stress testing) to restrict new mortgages with an LTI of 450% or more and prevent homeowners from borrowing beyond their capabilities. Combined with rising home prices, this has allowed property loan-to-value (LTV) ratios to remain conservative (see Figure 6).3

Figure 6:

All Mortgages – Median LTI New Mortgages – LTI above 450%

Average Loan-to-Value Ratio (%), All Mortgages

Source: Regulatory filings of Canadian banks, TransUnion, and Bank of Canada calculations

Figure 7:

Household Debt as a Share of GDP

Debt to Disposable Income

Debt fueled rally?

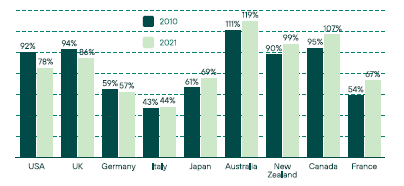

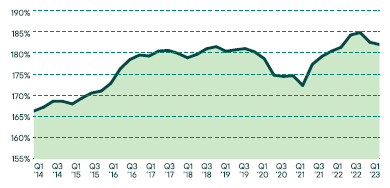

Canada’s household debt relative to GDP stands at 107%, second highest among the G7 countries and much higher than the G7 average of 81%. As of January 2023, total Canadian residential mortgage debt stood at $2.1 trillion, up 6% from last year.4

In addition, mortgage debt as a percentage of disposable income has increased to around 180% — further evidence of the growing burden to afford a home.

Reasons for optimism

While the downward pressures discussed above are sizeable, we believe the upward pressures are greater still. For one thing, it appears that interest rates may begin to taper in the near future (see Figure 8).

A closer look at the components of inflation suggests that we may be nearing the end of interest rate tightening. Mortgage costs account for onethird of total inflation (0.9% growth out of the total 3.4% growth in May 2023).5 Without mortgage costs, inflation sits at 2.5%. Coupling this with the fact that interest rate hikes take 12 to 18 months to show their full impact on inflation, the Bank of Canada may have already taken appropriate action. Further tightening could lead to a harder landing than anticipated for the economy.

Figure 8 - Interest Rate Forecast

Source: TD Economics

Figure 9 - Monthly and yearly trends: sales, listings, prices

Source: TREB Market Watch, June 2023

The latest monthly and yearly trends would seem to support our view of sustained higher prices over the medium term. Most markets grew month-over-month, suggesting an uptick in demand. And the yearly trend suggests that sales are recovering as prices soften from peak 2022 levels (see Figure 9).

Ultimately, it comes down to a question of supply and demand. There simply are not enough houses to meet demand.

Lack of supply

Canada’s housing supply issues continue to plague new home buyers. The supply of residential homes is not enough to satisfy the existing population, let alone a growing population. There is a general lack of homes coming to market, and builders are slowing new projects in the unfavorable interest rate environment.

To estimate the dynamics, we can assess months of inventory (MOI), defined as the time to sell all current listings without any new listings entering the market. The long-term average for this measure is five months. As of May 2023, there was just 1.5 months inventory of single detached homes in Toronto, 0.8 months inventory of semi-detached homes, and 1.8 month’s inventory of condominiums.6 This deficit indicates a severe housing shortage.

In a more balanced market, homes typically spend more time on the market as buyers take longer to evaluate purchases, and sellers have less leverage. Current metrics suggest a seller’s market for a prolonged period.

Record-level immigration 7

More and more immigrants are bringing their savings to Canada and becoming early entrants to the housing market, further pushing up demand. In 2022, Canada welcomed 437,000 new immigrants, higher than its initial target of 411,000. These figures exceeded previous forecasts and actuals, so it is fair to expect even higher numbers going forward. The government has already revised the 2023 immigration target twice, up 6% and then up another 4%. The net effect in revised projections is 10%, to 465,000 from 421,000. While not all immigrants have the ability to purchase properties right away, they need a place to stay, and the number of newcomers vastly outnumbers existing and incoming supply.

Moreover, the immigration system has encouraged the entry of a new league of financially wellto- do immigrants. These newcomers have good jobs, post-secondary education, at least one official language, and earn a median wage higher than the Canadian median. They are typically ready to finance their first home within one to two years of entering the country.

Ineffective foreign policy

To address the housing situation in Canada, the federal government implemented the Prohibition on the Purchase of Residential Property by Non-Canadians Act in January 2023. Initially, the ban prevented commercial enterprises and individuals outside of Canada from buying residential properties. However, subsequent amendments have relaxed the initial act:

- The ban no longer applies to vacant land already zoned for residential and mixed use.

- Foreigners are allowed to buy residential property for the purpose of housing development.

- Work-permit holders are eligible to purchase residential property provided their work permit/authorization is valid for 183 days or more at the time of purchase and have not purchased more than one residential property.

- The foreign corporation control threshold was increased to 10% from 3%.

As a result, the Act has had negligible overall impact on demand. Instead, demand has simply shifted to the allowed categories.

Creative financing

Owning a home is often viewed as a societal goal. Rather than waiting for the market to change, buyers are getting creative in response to higher borrowing costs. Spending has shifted from consumer goods to necessities like housing. Buyers are making larger down payments and using some of their savings from the pandemic period. Household savings rose $350 billion above pre-pandemic levels, and while government transfer programs have faded, the pile of savings has yet to notably shrink.8

Borrowers are also turning to an alternative lending source: their parents. The average gift for first-time homebuyers in Toronto is estimated at $130,000.9

In addition to rethinking how to come up with a down payment, buyers are changing their mortgage strategy. Key trends emerging include a conscious move towards short-term fixed rates and longer amortizations.

Figure 10 - Share of mortgage market by length of term

Source: Canadian Mortgage and Housing Corporation

Shorter terms, longer amortizations

While conventional variable rates were once the most desired product, more home buyers are selecting fixed-rate mortgages of one to three years (see Figure 10).

In the past, there was a noticeable spread between five-year mortgage rates and the rate for one-year and three-year mortgages. However, given the rapid rise in rates, this spread has become marginal. As of June 2023, a conventional one-year mortgage rate was 6.94%, higher than the five-year rate of 6.49%. Three-year rates sat at 6.40% (Figure 11).10

Buyers can either choose short-term rates and hope for future rate cuts or opt for stability by locking into a longer term. Regardless of the decision, ultra-low rates are unlikely to return soon. Borrowers are willing to pay more for a one-year or three-year mortgage to avoid the current uncertainty around interest rates over the next one to three years, especially as the Bank of Canada may look to hike rates further in the near future.

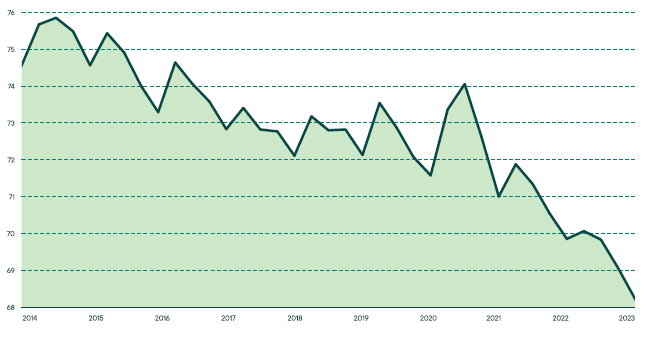

Buyers are able to afford these higher interest rates by extending amortization beyond the typical 20 to 25 years. Almost 33% of borrowers are selecting 30-year amortization periods over the once-standard 25 years.11 Longer amortization periods result in greater attribution to interest than principal in the initial years of the mortgage, but they also lower monthly mortgage payments. As a result, mortgage delinquencies have stayed low across Canada, and we expect them not to change materially going forward (Figure 12).

Figure 11 - Mortgage rates — spreads shrinking

Source: Canadian Mortgage and Housing Corporation

Figure 12 - Mortgage delinquencies

Source: Equifax

Conclusion

Analyzing the latest monthly and yearly trends across cities reinforces our view of sustained higher prices over the medium term:

- The last few months have seen home sales returning. Most markets grew month-over-month in all three metrics – sales, listing volumes, and prices, suggesting an uptick in demand.

- Surging demand and low inventories have put sellers in the driver’s seat even though there is less activity than before the pandemic. Rising prices may spur more sellers into action over time. Tentative indicators flashed in April 2023 as home resales jumped 27%.12

- While lower prices in Q4 2022 and Q1 2023 improved affordability somewhat, limited supply and high immigration will prevent the pendulum from swinging to a buyer’s market in the short-to-medium term. This is particularly the case in expensive and constrained markets like Toronto.

- Some buyers are regaining purchasing confidence, especially as they perceive that interest rate hikes are nearing an end. It’s a case of “jump in or be priced out” — buyers may lose their chance to own a home once policy shifts and rates begin to ease.

- As monetary policy shifts, we can expect renewed interest from developers to add supply to meet the ever-increasing demand for housing in Canada over the next five to 10 years.

By no means does any of this suggest housing affordability, particularly in the GTA. However, it does suggest a robust housing market in spite of economic and monetary uncertainty.

1 National Bank: Housing Affordability Monitor

2 National Bank: Housing Affordability Monitor

3 Bank of Canada

4 Canada Mortgage and Housing Corporation.

5 Statistics Canada

6 TREB Market Conditions

7 Government of Canada:

Longitudinal Survey of Immigrants

8 RBC Proof Point

9 CIBC

10 Bank of Canada

11 BNN Bloomberg

12 RBC Housing Market Update