Ninepoint Gold & Precious Minerals Fund

Q3 2023 Commentary

Bullion Emerges Unscathed Despite the Bonfire of Bonds

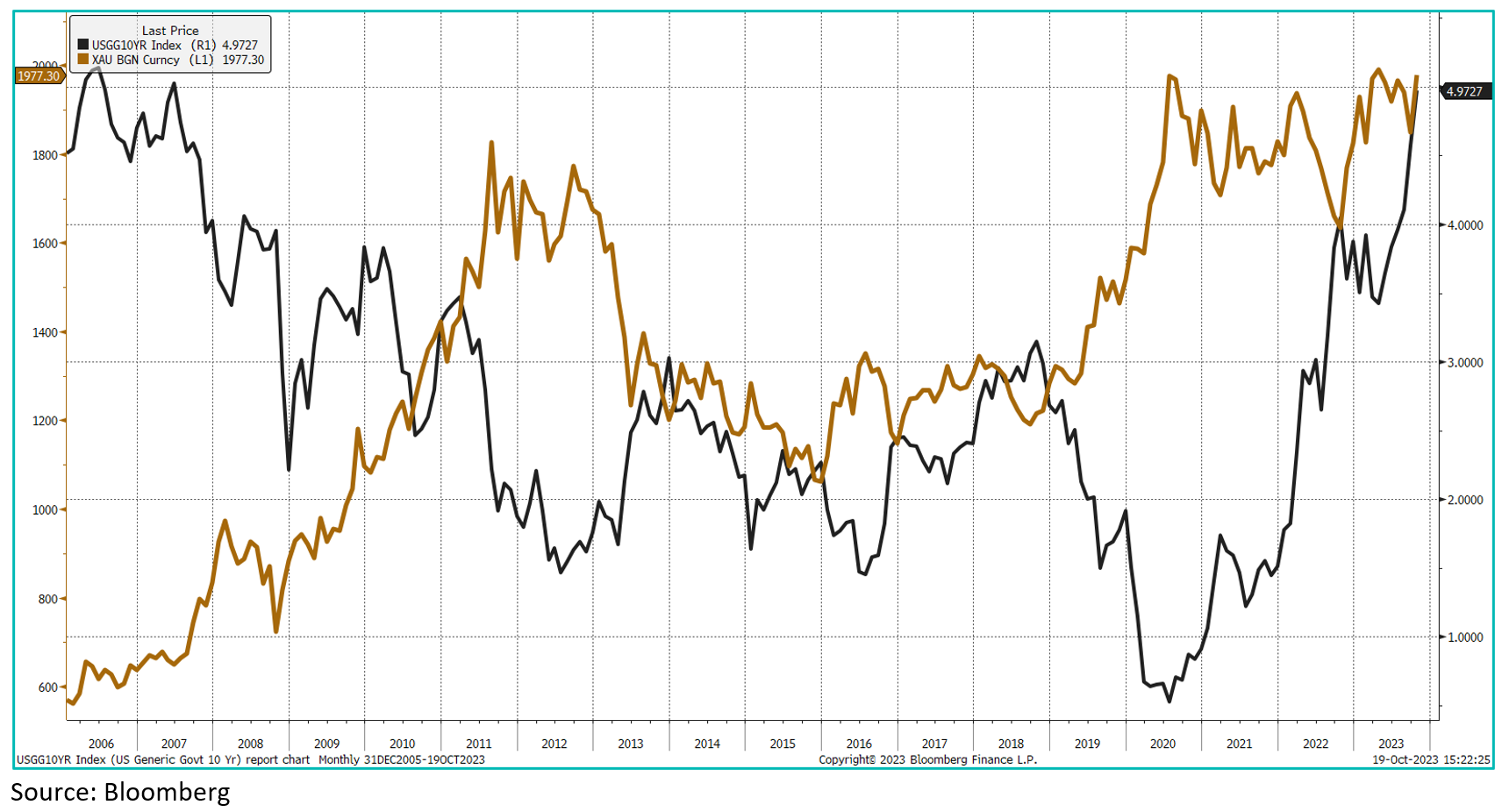

There has been a belief that the price of gold is dictated by yields. There have been periods of correlation between yields and gold, but this correlation becomes increasingly spurious as the period of measurement increases. At the time of writing, the US 10-year treasury yields are a hair away from reaching 5% while the price of gold is attempting yet again to cross the $2000/oz threshold. The last time we had the US 10-year treasuries yielding 5% was near the end of June 2007 and the price of gold was ~$650/oz. If you observe the price of gold over the past twenty years, it has gone up when yields have gone up and down when yields have gone down.

We are entering a period of exceptional uncertainty. With rising rates and rising uncertainty, assets such as gold are insurance. Bullion has no counterparty risk. If you own quality bullion, you are not worrying about whether it will get debased, corrupted or your bullion declared no good by a third party. The latter happened with the foreign exchange reserves held by Russia. Central banks recognize this, and central banks have been accumulating gold at an accelerated pace in the past year. Gold imports into non-Western countries have been strong. Western investors, on the other hand, are busy liquidating their gold holdings. Perhaps, they are speculating on the value of their fiat currency, or they are aware of an imminent discovery of El Dorado. We will never know. What we do know is that over the past two years, investors have redeemed nearly 22% of their gold holdings while the performance of bullion has been one of the bright spots as multiple asset classes have struggled to post gains.

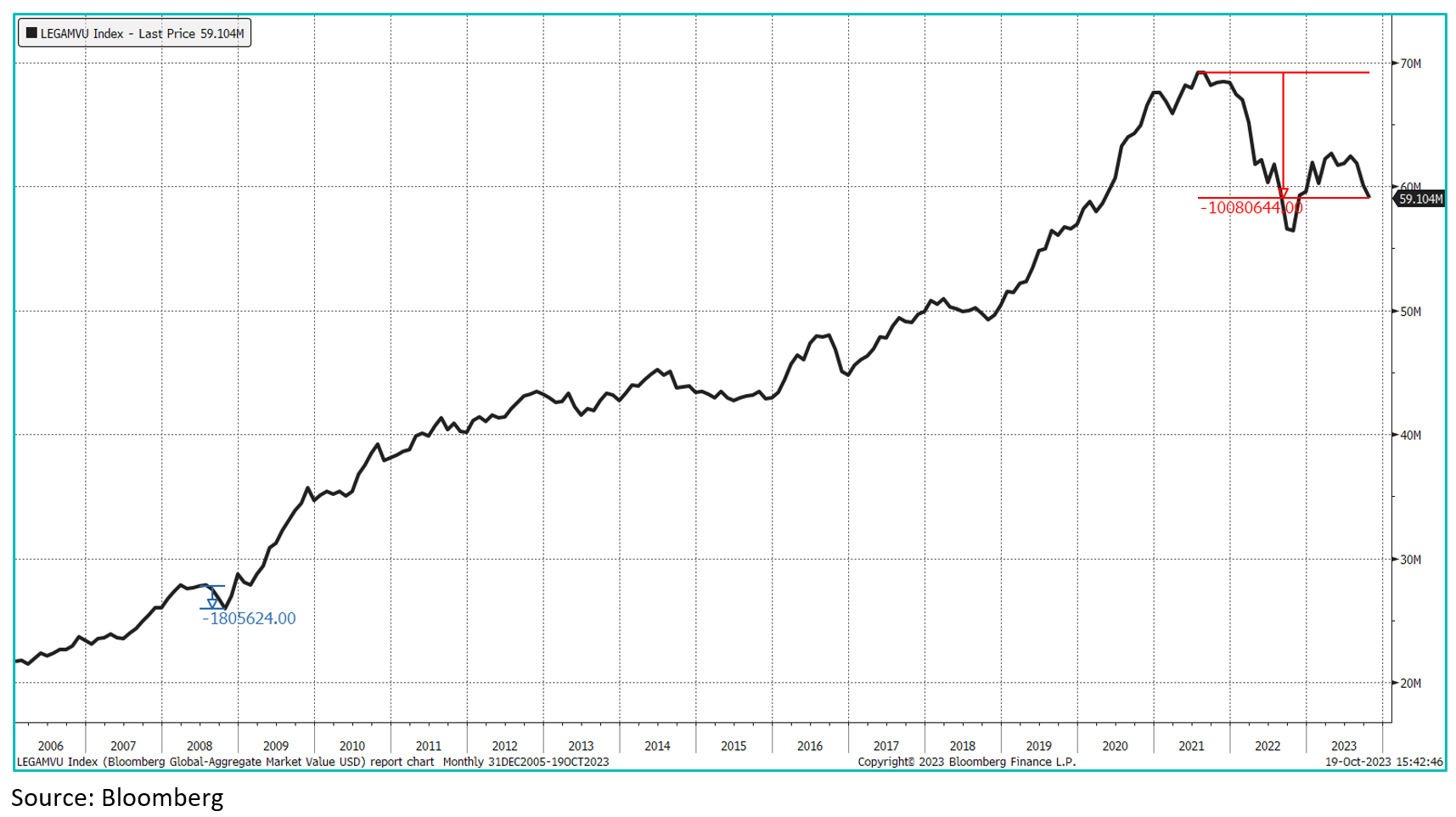

We started this note by mentioning yields so we would be remiss to not mention the carnage that rising yields have caused on the fixed-income market. In particular, the bonfire of bonds that resulted in over ten trillion dollars of market value being wiped off the Bloomberg Global Aggregate Bond Index. To put this enormous number into context, the market value loss experienced during the 2008/09 crash was under two trillion. We may not be in a recession yet, but there is panic setting into the fixed-income market.

Speculators in the gold futures market have been busy using their myopically focused computer algorithms to keep pressing their shorts on bullion. To a computer algorithm, rising yields and a rising dollar are negative to gold. You put a few of these machines together and you create a short-selling stampede into gold. This is precisely what has been playing out and in fact, the short positioning in gold was highly extended going into the events transpiring in the Middle East. The rally we have witnessed in gold over the past few days smells very much like shorts being skewered.

Between now and the next few months, we can count on a few things. Deficits will widen. Debt loads will keep marching higher. The cost to service the debt will remain high. Global central banks will continue choosing gold over Western IOUs. What will happen when the economy finally starts to buckle under the collective weight of debt and high interest? As we have seen time and again, the Fed, the ECB and the BoC will ride in again to save their economies by sacrificing their fiat. The setup for gold, silver and most hard assets is brighter than ever. The uncertainty to me is how high can gold rise when investors stop using broken algorithms to price gold and start buying gold for what it is – an incorruptible insurance against the increasingly flaccid fiat currencies.

Today, under 1% of all investable assets are held in the form of gold. I will leave you with one question – are there more buyers of gold at $2000/oz or $5000/oz?

Shree Kargutkar

Sprott Asset Management

Sub-advisor to the Ninepoint Gold & Precious Minerals Fund,

Ninepoint Gold Bullion Fund and the Ninepoint Silver Fund

1All Ninepoint Gold & Precious Minerals Fund returns and fund details are a) based on Series F units; b) net of fees; c) annualized if period is greater than one year; d) as at September 30, 2023. The index is 100% S&P/TSX Global Gold Total Return Index and is computed by Ninepoint Partners LP based on publicly available index information. 1All Ninepoint Gold Bullion Fund returns and fund details are a) based on Series F units; b) net of fees; c) annualized if period is greater than one year; d) as at September 30, 2023. The index is 100% Global Spot (CAD) Index and is computed by Ninepoint Partners LP based on publicly available index information. 1All Ninepoint Silver Bullion Fund returns and fund details are a) based on Series F units; b) net of fees; c) annualized if period is greater than one year; d) as at September 30, 2023;. The index is 100% Silver Spot (CAD) Index and is computed by Ninepoint Partners LP based on publicly available index information.

The risks associated with investing in a Fund depend on the securities and assets in which the Fund invests, based upon the Fund’s particular objectives. There is no assurance that any Fund will achieve its investment objective, and its net asset value, yield and investment return will fluctuate from time to time with market conditions. There is no guarantee that the full amount of your original investment in a Fund will be returned to you. The Funds are not insured by the Canada Deposit Insurance Corporation or any other government deposit insurer. Please read a Fund’s prospectus or offering memorandum before investing.

Ninepoint Partners LP is the investment manager to the Ninepoint Funds (collectively, the “Funds”). Commissions, trailing commissions, management fees, performance fees (if any), other charges and expenses all may be associated with mutual fund investments. Please read the prospectus carefully before investing. The indicated rate of return for series F units of the Fund for the period ended September 30, 2023 is based on the historical annual compounded total return including changes in unit value and reinvestment of all distributions and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The information contained herein does not constitute an offer or solicitation by anyone in the United States or in any other jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. Prospective investors who are not resident in Canada should contact their financial advisor to determine whether securities of the Fund may be lawfully sold in their jurisdiction.

The opinions, estimates and projections (“information”) contained within this report are solely those of Ninepoint Partners LP and are subject to change without notice. Ninepoint Partners makes every effort to ensure that the information has been derived from sources believed to be reliable and accurate. However, Ninepoint Partners assumes no responsibility for any losses or damages, whether direct or indirect, which arise out of the use of this information. Ninepoint Partners is not under any obligation to update or keep current the information contained herein. The information should not be regarded by recipients as a substitute for the exercise of their own judgment. Please contact your own personal advisor on your particular circumstances. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds managed by Ninepoint Partners. Any reference to a particular company is for illustrative purposes only and should not to be considered as investment advice or a recommendation to buy or sell nor should it be considered as an indication of how the portfolio of any investment fund managed by Ninepoint Partners is or will be invested. Ninepoint Partners LP and/or its affiliates may collectively beneficially own/control 1% or more of any class of the equity securities of the issuers mentioned in this report. Ninepoint Partners LP and/or its affiliates may hold short position in any class of the equity securities of the issuers mentioned in this report. During the preceding 12 months, Ninepoint Partners LP and/or its affiliates may have received remuneration other than normal course investment advisory or trade execution services from the issuers mentioned in this report.

Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds managed by Ninepoint Partners LP. These views are not to be considered as investment advice nor should they be considered a recommendation to buy or sell.

Ninepoint Partners LP: Toll Free: 1.866.299.9906. DEALER SERVICES: CIBC Mellon GSSC Record Keeping Services: Toll Free: 1.877.358.0540