Ninepoint Alternative Health Fund

October 2023 Commentary

Summary

The month of October witnessed subdued equity returns as investors witnessed the effects of higher inflation on consumption and reduced bottom-line profitability. Even in the economically resilient healthcare sector, concerns in the US with respect to the re-determination of Medicaid support is leading to weaker trading volumes. A bright spot for healthcare this year has been the focus on GLP-1 drugs, selling under brand names such as Ozempic, Rybelsus, Wegovy, and Mounjaro treating obesity and type II diabetes. By far these drugs have been a runaway success, in some cases unable to keep up with demand. We note Eli Lilly (LLY) Q3 results in this month’s commentary with 37% YoY growth in revenues. In early November, (LLY) announced that the US Food & Drug Administration (FDA) provided additional approval for its drug Zepbound, an injection for adults with chronic obesity issues. The active ingredient in Zepbound is already approved under the trade name Mounjaro to be used to help improve blood sugar (glucose) in adults with type 2 diabetes. Now the FDA approval allows physicians to prescribe for both chronic ailments. LLY’s drug is the only drug that is currently approved for both treatments.

On the cannabis side, during this reporting period, a new and significant cannabis market has been established with the Ballot Initiative bringing recreational cannabis to the state of Ohio, one of the top ten most populated states in the US. This is a big opportunity for MSOs with operations in the state, and we discuss that opportunity below. In Virginia state voters decided to bring the State Legislature back into Democrat control, which has positive implications for adult use of cannabis over previous Republican control that has been an impediment to legalization initiatives over the last 24 months. We were also pleased to see solid financial results including stabilizing margins, improved cash flows, and stronger balance sheets from our cannabis holdings for Q3. The combination of improving financial results and growth catalysts noted above is positioning the cannabis sector for a strong run.

Another noteworthy event occurred in US cannabis in October, with a legal challenge seeing several MSOs suing the Attorney General of the US over the illegal prohibition of cannabis. Interestingly this is a case that has more merit than might at first appear and will be played out over the next 12-18 months adding further optionality to the sector. During the month, the Fund had contributions from UNH-6%, PG-3.5% and LLY-3%.

US Cannabis Regulatory Changes

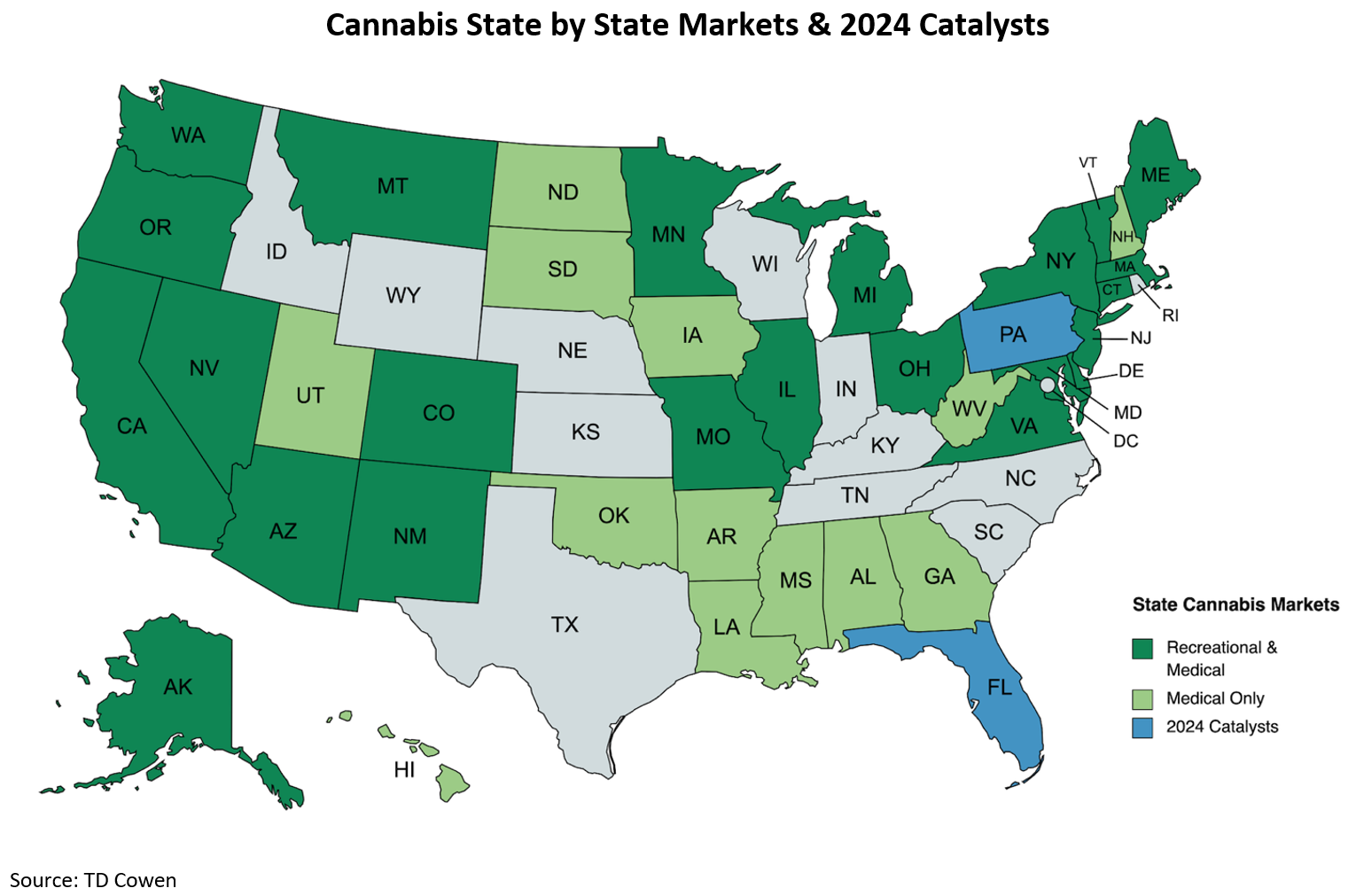

Ohio Passes Ballot Initiative

On November 7th, Ohio residents voted in favour of legalizing recreational cannabis, becoming the 24th legal market in the US, allowing for cultivation, production and sales of adult-use cannabis. Based on Ohio rulings, dates are embedded in the ballot with adult-use sales beginning on August 7, 2024. Under the approved measure, legalization will become effective on December 7th and will create a 10 percent sales tax to be imposed on cannabis sales. Officials must get rules in place to start approving licensed retailers within nine months of the effective date. As mentioned in a previous commentary, Ohio holds strategic value as it is a top ten state in terms of population with over ten million residents representing a large potential recreational market. Given the number of residents in the state, it would take the total US population living in legal recreational markets from 49% to over 53% of the American population. OH, is also important as it is a Republican-dominated state and bringing a “Red” state into the cannabis market results in additional Republicans in the US Congress that would see the benefits of job growth and state tax generation from the cannabis industry. Finally, Ohio puts pressure on Pennsylvania to look at its own cannabis market as PA will now be encircled by recreational markets on all sides with Ohio, Maryland, New York and New Jersey all potentially taking tax revenues away from PA tax collection.

From an operational perspective, Ohio offers a great opportunity for those MSOs operating in this limited license state with only 40 cultivation licenses and 50 retail licenses. Ohio will join a growing list of midwestern states like Illinois, Michigan, Missouri and Minnesota that have approved retail sales of adult-use cannabis which could create more pressure on the federal government to move forward with measures like Re-scheduling. Fund holdings that have the leverage to this new recreational state include Green Thumb Industries (GTI), Verano Holdings (VRNO), Trulieve Cannabis (TRUL), Cresco Labs (CL).

MSOs File Lawsuit Against US Attorney General

A coalition of marijuana businesses have filed a lawsuit against US Attorney General Marrick Garland seeking to stop the federal government from enforcing cannabis prohibition that is justified by the Controlled Substances Act. At its core, the lawsuit alleges that it is unconstitutional to have federal prohibition against legal state activities, at a time when the federal government no longer enforces such prohibition. In addition, the CSA and federal laws create public safety risks in addition to precluding legal marijuana businesses from accessing financial services and tax deductions that are available to other industries.

It is important to mention that a similar case failed in 2005, however, there are material changes that have transpired in the 18 years since, including the way the federal government has de-funded the Dept of Justice from interfering in state-legal cannabis industries. Also, comments from Supreme Court Justice Clarence Thomas, in 2021, suggested that national prohibition may be unconstitutional. The lawsuit argues this point when it asserts that the federal government has abandoned its goal to outlaw cannabis via the Controlled Substances Act because Congress has blocked enforcement of the law and law enforcement is ignoring the law. In addition, the suit contends that there is no interstate commerce involved with the current operations of US multi-state operators; cannabis is grown, processed and sold within each state market. And state legal cannabis reduces the amount of illegal interstate commerce of cannabis. This means there is no federal interest to justify federal authority.

The group is represented by the law firm of Boies, Schiller Flexner, with partner David Boies succeeding in leading the US government's successful prosecution of Microsoft, and for his successful representation of the plaintiff in the case which invalidated California Proposition 8, banning same-sex marriage. The suit has been filed by several MSOs including Ascend Wellness Holdings, TerrAscend, Green Thumb Industries, and several private US cannabis funds.

The case against the federal government's power to regulate commerce is based on the Interstate Commerce Clause of the Constitution, represented in this case by The Controlled Substances Act. The lawsuit focusses on the original intention of the Controlled Substances Act, relative to what has developed over the last 50 years in the United States. The CSA originally banned marijuana as a way to eliminate interstate commerce of an illegal substance and originally provided funding for the legal enforcement of eradicating cannabis use in the United States.

However, over the last 15-20 years, federal and state lawmakers in addition to the executive branch (The President and various departments of the Administration including the DEA and HHS) have since “abandoned” that mission as more states have enacted legalization. To this end, Congress has annually renewed an appropriations rider barring the Justice Department from using federal funds to intervene in state legal medical cannabis programs, while attorneys general in both Republican and Democrat Administrations have spoken of a lack of interest in criminalizing people over marijuana-related activity that’s sanctioned by the states. In fact, last October, President Biden initiated a pardon of federal prisoners of non-violent cannabis related offenses.

As the plaintiffs state “Despite these changes, the federal criminal prohibition on intrastate marijuana remains in place, an unjustified vestige of a long-abandoned policy,”…“This unjustified intrusion of federal power harms Plaintiffs, threatens the communities they serve, and lacks any rational purpose.” The existing ban on cannabis under the CSA results in an “unconstitutional imposition on state sovereignty,” attorneys said.

As Justice Thomas has stated on the 2005 case, “the Federal Government’s current approach to marijuana bears little resemblance to the watertight nationwide prohibition that a closely divided Court found necessary to justify the Government’s blanket prohibition ... If the Government is now content to allow States to act ‘as laboratories’ ‘and try novel social and economic experiments,’… then it might no longer have authority to intrude ... [and] a prohibition on intrastate use or cultivation of marijuana may no longer be necessary.”

Terrascend (TSND) TSX Investor Day

Top ten Fund holding Terrascend (TSND) hosted an Investor Day on October 13 at the TSX in Toronto as a way to commemorate its up-listing. Recall that TSND is the first US multi state operator to list on a senior exchange, taking place July 4th. Management took the opportunity to provide investors with an operational update that featured double-digit top line revenue growth as well as improvements in margin and cash flow. Chairman Jason Wild discussed the company’s sales growth and operational improvements in New Jersey, Michigan, and Maryland, while raising guidance for revenue reaching $317 million for 2023 (YoY growth of 27.5%) making TerrAscend the fastest-growing MSO among large- and mid-caps in 2023. CFO Keith Staufer also announced a 62% YoY increase in Adj EBITDA to $63 million from $39 million last year driven by continued success in NJ and further retail expansion in MI.

TSND is focused on a select number of states, with deep operational penetration in NJ, MD, PA and MI. According to BDSA data, the company had the #2 market share position in NJ in August and continues to make inroads with its new Wana Brands distribution agreement in NJ and MD. Another growth opportunity is the opening of MD as a recreational market which began in July, along with the prospect of PA going rec through legislative change during the next 12 months. Key to operational success has been management’s focus on debt reduction, operational efficiency, and a marketing strategy that has been effective in enhancing its brands leading to increased distribution. Of note is that gross margins are exceeding 50% and + free cash flow is expected during this second half of 2023 driven by improvements in MI and PA. In addition, it is noteworthy that barring entry to a new state market, TSND does not have significant cap exp in the near term.

Pharmaceutical Industry Updates

GLP-1 Drug Trials: Successful Treatment Against Kidney Failure

We continue to see significant upside in the development of solutions for chronic ailments related to type II diabetes and obesity. Mid-month Novo Nordisk (NOVO) announced that it was stopping a trial studying Ozempic to treat kidney failure in diabetes patients ahead of schedule because it was clear from analysis of trial patients that the treatment had enough positive results to illustrate treatment success. The trial was designed to test Ozepmic and whether the widely used diabetes drug could delay the progression of chronic kidney disease and lower the risk of death from kidney and heart problems.

The clinical trial was halted a year early based on guidance from the independent Board that is monitoring the data from the study. Although it does not happen frequently, independent monitors can recommend stopping a trial early if there is clear evidence that a drug is going to succeed or fail. The study enrolled more than 3,500 patients worldwide and administered semaglutide as an adjunct to standard of care. The company expects to release the data in the first half of 2024.

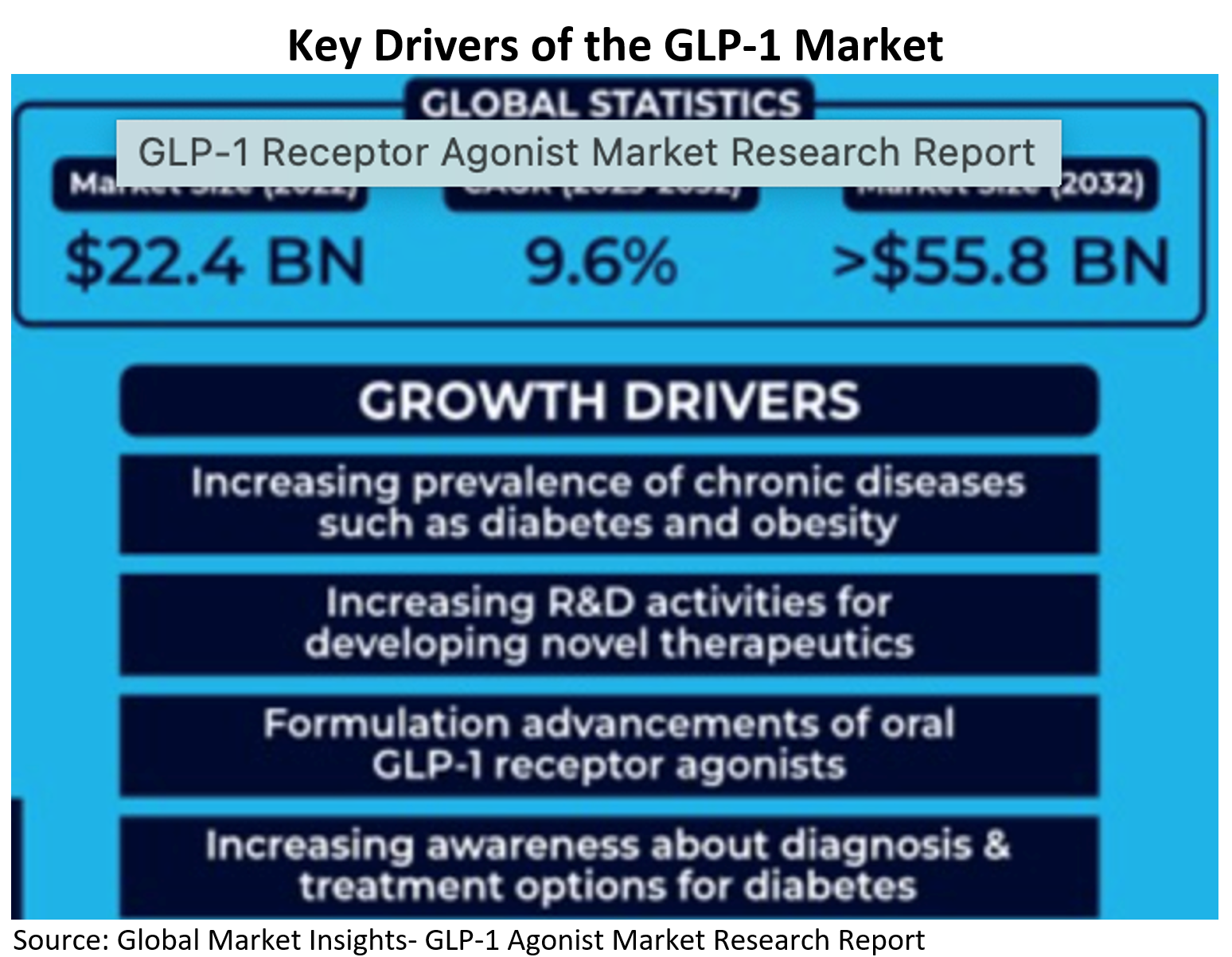

The GLP-1 therapy market is projected to grow from $22 billion in 2022 to $55 billion by 2034 estimated by Global Market Insights. NOVO and Fund holding Eli Lilly & Co (LLY) are leaders in the GLP-1 space. LLY is expected to receive full FDA approval for tirzepatide, an obesity medication, marketed as Mounjaro for Type 2 diabetes and obesity, and two other medications, including an oral experimental drug called orforglipron for similar obesity treatment.

It is estimated that over 100 million adult Americans are categorized as overweight/obese with a BMI of +30 leading to significant growth of the GLP-1 market over the next decade. Among the key drivers of growth for GLP-1 drug demand are; a growing number of adults that are less active while adding caloric intake to their diets; stress; weight gain and increase in chronic diseases; increased awareness about diagnosis and treatment options for diabetes; increased R&D leading to new drug development; advances in GLP-1 agonists, changes in dosing and delivery.

It has been shown that those people dealing with chronic health challenges have higher annual health care costs relative to normal weight range Americans. The reason for higher costs is due to the various complications in health that are caused by obesity such as high blood pressure, risk of heart attack, Type II Diabetes, osteoarthritis, and sleep apnea among other ailments all requiring visits with specialists. Given these increased costs and the allocation of resources in the system, the Congressional Budget Office has begun to study potential savings in Medicare given reduction of obesity rates and reduction of various doctor and/or hospital visits due to reduction in obesity rates.

Financial Results

Green Thumb Industries (GTI), a top fund position, is one of the largest MSOs by sales and one of the most profitable measured by EBITDA, while also managing a sound balance sheet. It has operations in 15 states with 86 retail locations in states like Connecticut, Maryland, New Jersey, Rhode Island, Ohio which only recently went rec, and other states with rec optionality including Pennsylvania, Florida, Minnesota and Virginia (the last two have legalized but not yet started adult use sales.

The company released its Q3-23 results beating consensus by a wide margin with revenues of $275 million, increasing 9% QoQ and 5% YoY. The increase in revenue was primarily driven by company readiness and execution in the Maryland recreational market that opened on July 1st. The growth in MD was driven by both retail RISE locations as well as expansion of its wholesale (consumer packaged goods) division. At a time when many MSOs are finding reduced opportunities in wholesale distribution, GTI saw the expansion of revenues in Q3 wholesale of 18% YoY. Gross profit for Q3 was impacted slightly by price compression in select markets however it still reached 48.6% or $133.8 million. Adjusted EBITDA was $83 million beating consensus at 30% of revenue. For the YTD, nine-month period GTI has generated $154 million in cash flow from operations while ending Q3 with a strong balance sheet with over $137 million in cash; total assets of $320 million and total debt outstanding is $298 million. Net income for the quarter under US GAAP was $11 million or $0.05 per share. GTI is the first cannabis company to have the financial strength to announce a share buyback this past summer and utilized its strength to repurchase 2.5 million shares for $25 million in September, with another $25 million available for further share repurchases.

Following up on the successful Investor Day Terrascend Corp (TSND) held mid-October where it provided an operational update and announced increased guidance, the company released Q3-23 results in early November that once again topped expectations. Net revenues reached $89.2 million, an increase of 34.7% vs Q3-22 and an industry-leading growth rate of 23.7% vs Q3 vs Q2-23. Revenues were driven by New Jersey sales growth and the Maryland adult use market opening, with retail sales growth of 13.5% QoQ to $66.1 million and wholesale growth of 66.5% QoQ to $23.1 million. While growing topline revenue, management has worked on improved cultivation yields over the last 24 months resulting in gross profit margin of 53.6%, a 340-basis point improvement from 50.2% in Q2-23. Adjusted EBITDA was 27.1% or $24.2 million, an increase of 89% QoQ while cash flow from operations reached $9 million.

We believe TSND’s focus on high-quality cultivation in adult-use markets has enabled the company to team up with leading brands such as COOKIES and Wana Brands delivering well-known high-quality products in new markets. The momentum seen in Q3 has resulted in management providing increased 2023 guidance for revenue and adjusted EBITDA from continuing operations to $320 million and $73 million versus previous guidance of $317 million and $63 million, representing 29% and 87% growth year-over-year. For 2024, the company looks to grow through an expansion of its wholesale business in NJ, continued expansion in Maryland and wholesale growth in PA where Q3 increased 20% QoQ. Management stated it is currently analyzing M&A opportunities in both existing states as well as potentially entering new markets such as Ohio, Virginia and Delaware where adult use has been legalized but not yet started.

Verano Holdings (VRNO) is a top fund holding given our belief in the strong growth drivers VRNO has with leverage to recently opened recreational markets CT, MD, OH while also offering leverage to rec markets that may open within the next 12 months including PA and FL. The company announced Q3-23 results of $240 million in revenue up 5% from $228 million in Q3-22, and up 3% from Q2-23 with approximately 2/3rds of revenues coming from retail operations relative to wholesale distribution. Revenues in the quarter were driven by wholesale adult-use sales in Connecticut where recreational sales began on Jan-23 in addition to operations in the recreational market in Maryland where legalized sales began on July 1st. The company produced strong gross margins of 55% or $133 million vs 54% in Q3-22, while maintaining SG&A expenses flat at 36%. Adjusted EBITDA increased in Q3 to $89 million or 37% of revenue, up from $82 million or 36% of revenue for the third quarter of 2022, and up from $72 million or 31% of revenue for the second quarter of 2023. Net cash from operations for the nine months ended September 30, 2023 was $77 million, up from $65 million in the nine-month period in 2022 while free cash flow for the nine months to Q3-23 end was $51 million, up from $(44) million in the prior year period. Management raised its guidance for free cash flow for the year to a range of $72-76 million which includes the payment of taxes during 2023, YTD including $115 million.

The company operates across 13 states with 132 dispensaries and 1.1 million square feet of cultivation and processing focussed on limited-license markets, with Florida, New Jersey and Illinois being its most important states from a sales perspective. Also noteworthy from an organic growth perspective is the fact that the company has leverage to newly opened recreational markets in Maryland and Ohio, while also having a strong presence in Pennsylvania and Florida, the next large medical only markets that could transition to recreational over the next 12 months. During its Q3-23 call, VRNO announced that it is disclosing state-level sales data, the first MSO to do so, which further enhances its standing among institutional investors, providing improved disclosure and transparency. This goes along with its recent move to up-list to Cboe Canada, which provides access to US investors through the integrated markets of Cboe global networks and positions the company well for early leadership once US listings are fully open to US investors.

Trulieve Cannabis (TRUL) announced top-line results that surpassed expectations with revenues of $275 million vs consensus of $269 million. Despite the market environment with inflationary headwinds eating into consumer wallets, TRUL was able to achieve a U.S. GAAP gross margin of 52%, with a gross profit of $143 million while also seeing SG&A expenses lowered by $2 million QoQ to $94 million. Key to its operations is increased efficiency from its JeffCo cultivation facility in northern FL which is increasing margin with higher quality outputs while enabling the company to maintain reduced overall inventory. As a result, adjusted EBITDA came in at $78 million, or 28% of revenue. Cash as of September 30, 2023 reached approx. $200 million while the company was able to generate cash flow from operations of $93 million and free cash flow of $87 million. Given the strong cash showing, TRUL recently announced the purchase/redemption of $57 million in face value of senior secured 2026 notes for USD $47.6 million in September, a 16.5% discount to par, plus accrued interest. Then subsequent to quarter end, TRUL announced the redemption of $130 million of senior secured notes due June 18, 2024, to be completed December 1, 2023.

TRUL growth markets include Maryland, where the new adult use market realized a 235% increase in traffic in Q3 for TRUL from its 3 dispensaries to its medical distribution leadership in the medical market of Georgia, where medical cannabis is beginning to be sold in pharmacies. There are significant catalysts are on the horizon for TRUL as key markets such as Pennsylvania and Florida see adult-use transition potential over the next 12 months. In addition, the recent Ohio ballot initiative provides an upside with 1 open dispensary and 3 additional locations near term. TRUL currently operates 190 retail dispensaries and over 4 million square feet of cultivation and processing capacity in the United States.

Top ten fund holding Johnson & Johnson (JNJ) released solid Q3-23 results led by medical technology and its results related to new cancer treatments. For the quarter, JNJ generated $21.35 billion in global revenues that beat analyst estimates with earnings per share reaching $2.66/sare vs estimates of $2.52. This was the first quarter JNJ was reporting subsequent to its spin out of its former consumer healthcare division, Kenvue (KVUE) back in July with the goal of unleashing the growth of its med-tech and pharmaceutical pipeline. Revenues were up 6.8% while earnings were up 14% while EPS was up 19%. Areas of growth were seen in its Innovative Medicine Division, (pharma) focused on developing drugs across different disease areas, resulting in divisional revenues of $13.89 billion, a 4.4% growth compared with Q3-22. Growth was seen in oncology solutions including Carvykti; a medicine used to treat adults with multiple myeloma, cancer of the bone marrow when cancer has relapsed, as well as Talvey which brings cancer cells and T cells together activating the T cells, then killing multiple myeloma cells.

Another contributor to growth is JNJ’s psoriasis treatment Stelara, J&J’s best-selling single drug bringing in more than $2.8 billion worldwide in the quarter. Stelara is also approved for psoriatic arthritis, ulcerative colitis and Crohn’s disease. This was followed by the multiple myeloma medicine Darzalex, which made nearly $2.5 billion. On the spin off of KVUE, JNJ brought in $13 billion in cash which will be a good source of capital for acquisition and drug development. We believe JNJ is well positioned for 2024 as management raised its guidance above previous estimates while still recognizing the current headwinds faced by a strong USD relative to global revenue generation.

A core fund holding UnitedHealth Group (UNH) reported another strong quarter with double-digit revenue growth that focussed on providing health coverage in more convenient and accessible platforms. As an integrated insurance provider, UNH provides services to corporations as well as individuals on many different levels. Primarily an insurer, the company claims over 147 million customers worldwide, operating out of two divisions: UnitedHealthcare, its benefits arm, and Optum, which encompasses three medical service sectors: Optum Rx, a mail-order pharmacy; Optum Health, which operates health savings accounts; and Optum Insight, a payment processor for healthcare providers. Third quarter ‘23 revenues grew 14% YoY to $92.4 billion, including double-digit growth at both Optum and UnitedHealthcare. Third quarter 2023 earnings from operations were $8.5 billion, an increase of 14%. Cash flow from operations was $6.9 Billion while earnings reached $6.24/share.

A key operating metric for health insurance operators is the Medical Loss Ratio (MLR), a profitability measure examining the percentage of insurance premiums that cover the cost of medical claims. A lower MLR indicates better profitability of the company. The Q3-23 ratio was up slightly to 82.3%, compared to 83.2% in Q2-23 and 81.6% vs Q3-22, with slightly higher costs related to outpatient care serving seniors. This was anticipated as UNH has made a push into value-based care arrangements, building out its home-based care capabilities given the pending acquisition of Amedisys (AMED) and its purchase February purchase of the home health and hospice provider LHC Group, which closed in February. Our outlook remains positive for UNH as management has strengthened its full-year 2023 net earnings outlook to $23.75 per share and adjusted net earnings to $25.00 per share.

Eli Lilly & Co (LLY) released quarterly revenue that increased 37% from a year ago, beating estimates with revenues of $9.5 billion vs consensus of $9.0 billion. The growth in revenues was driven by Mounjaro, LLY’s GLP-1 diabetes and obesity drug; Verzenio in the treatment of metastatic breast cancer and Jardiance which focuses on type II diabetes in children under 10 years old. Additional top-line revenues were aided from the sale of rights for the olanzapine portfolio (Zyprexa), an anti-psychotic. As mentioned, GLP-1 revenues were a significant contributor with Mounjaro providing global revenue of $1.4 billion, of which 90% were sales from the US. The FDA approved Mounjaro injections in 2022 to treat type II diabetes related to obesity from clinical trials based on evidence from nine different trials with a total of 7,769 patients. When used in conjunction with standard care, clinical trials showed an average weight loss of 23 pounds over a number of months. Going forward LLY is one of the leaders in the GLP-1 space with an oral version in current trials, in addition to a pipeline of drugs in development that provide growth opportunities. The company did not update previously communicated guidance and the belief is that once pending FDA approvals are known with Tirzepatide (newer obesity drug) and Donanemab (Alzheimer’s) then LLY will have better earnings visibility that will enable updated guidance for 2024-25. Management stated in their call that they have confidence in long term revenues related to Mounjaro sales since unlike other chronic drugs where stopping treatment has no symptoms, stopping obesity drugs will lead to weight gain.

Kenvue (KVUE) a consumer healthcare top ten holding is the world’s largest pure-play consumer health company by revenue. This quarter represents the first full quarter where KVUE reported quarterly results independent of its parent company, Johnson & Johnosn (JNJ) which spun out the business this past summer. Net sales increased 3.3% vs the prior year period to $3.9 billion, with market softness in China contributing to reduced volumes. Growth was fueled by Self Care products with cough and cold brands such as Benylin, Benadryl and Reactine, Tylenol, Motrin and Nicorette leading the way. Skin Health & Beauty products such as Neutragena, Aveeno, Lubriderm had a strong summer sun season with strength across Latin America (“LATAM”) and Europe, Middle East and Africa (“EMEA”). Gross profit margin was 57.5% vs 56.1% in the prior year period, however, higher inflationary pressures and foreign currency headwinds led to a 1% reduction in operating costs. Net income for Q3 was $438 million vs $586 million in the same period last year while earnings per share was $0.23. While share performance since its spin-out has been disappointing, KVUE holds an enviable stable of brands and is well-positioned for continued growth in a stable consumer sector.

Option Strategy

Since the inception of the option writing program in September 2018, the Fund has generated significant income from options premium of approximately $4.86 million. We will continue to utilize our options program to look for attractive opportunities given the above average volatility in the sector as we strongly believe that option writing can continue to add incremental value going forward.

During the month we used our options strategy to assist in rebalancing the portfolio in favor of names we prefer while generating approximately $9,000 in options income. We continue to write covered calls on names we feel are range bound near term and from which we could receive above average premiums. We also continue to write cash secured puts out of the money at strike prices that offered opportunities to increase our exposure, at more attractive prices, to names already in the Fund including UnitedHealth Group Inc. (UNH).

The Ninepoint Alternative Health Fund, launched in March of 2017 is Canada’s first actively managed mutual fund with a focus on the cannabis sector and remains open to new investors, available for purchase daily.

Charles Taerk & Douglas Waterson

The Portfolio Team

Faircourt Asset Management

Sub-Advisor to the Ninepoint Alternative Health Fund

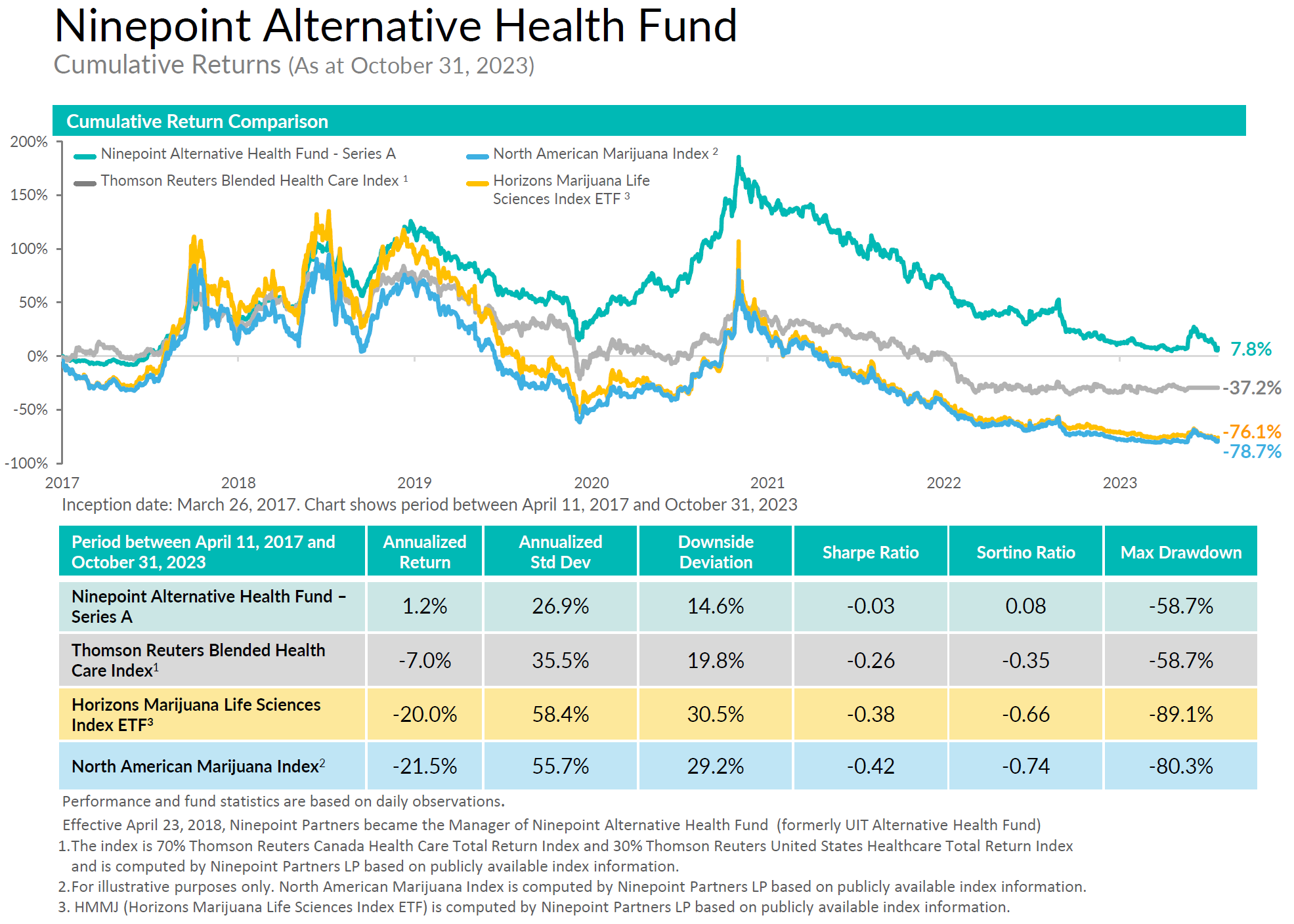

Ninepoint Alternative Health Fund - Compounded Returns¹ as of October 31, 2023 (Series F NPP5421) | Inception Date - August 8, 2017

| MTD | YTD | 3MTH | 6MTH | 1YR | 3YR | 5YR | INCEPTION (ANNUALIZED) |

|

|---|---|---|---|---|---|---|---|---|

| FUND | -9.1% | -12.1% | 1.4% | -5.3% | -23.8% | -13.3% | -9.0% | 3.1% |

| TR CAN/US HEALTH CARE BLENDED INDEX | -8.6% | -4.2% | -14.5% | 12.1% | -11.5% | -13.4% | -16.7% | -7.8% |

Statistical Analysis

| FUND | TR CAN/US HEALTH CARE BLENDED INDEX | |

|---|---|---|

| Cumulative Returns | 20.8% | -39.8% |

| Standard Deviation | 27.4% | 28.9% |

| Sharpe Ratio | 0.04 | -0.34 |

1 All returns and fund details are a) based on Series F units; b) net of fees; c) annualized if period is greater than one year; d) as at October 31, 2023. The index is 70% Thomson Reuters Canada Health Care Total Return Index and 30% Thomson Reuters United States Healthcare Total Return Index and is computed by Ninepoint Partners LP based on publicly available index information.

The Fund is generally exposed to the following risks. See the prospectus of the Fund for a description of these risks: Cannabis sector risk; Concentration risk; Currency risk; Cybersecurity risk; Derivatives risk; Exchange traded fund risk; Foreign investment risk; Inflation risk; Market risk; Regulatory risk; Securities lending, repurchase and reverse repurchase transactions risk; Series risk; Specific issuer risk; Sub-adviser risk; Tax risk.

Ninepoint Partners LP is the investment manager to the Ninepoint Funds (collectively, the “Funds”). Commissions, trailing commissions, management fees, performance fees (if any), and other expenses all may be associated with investing in the Funds. Please read the prospectus carefully before investing. The indicated rate of return for series F shares of the Fund for the period ended October 31, 2023 is based on the historical annual compounded total return including changes in share value and reinvestment of all distributions and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The information contained herein does not constitute an offer or solicitation by anyone in the United States or in any other jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. Prospective investors who are not resident in Canada should contact their financial advisor to determine whether securities of the Fund may be lawfully sold in their jurisdiction.

The opinions, estimates and projections (“information”) contained within this report are solely those of Ninepoint Partners LP and are subject to change without notice. Ninepoint Partners makes every effort to ensure that the information has been derived from sources believed to be reliable and accurate. However, Ninepoint Partners assumes no responsibility for any losses or damages, whether direct or indirect, which arise out of the use of this information. Ninepoint Partners is not under any obligation to update or keep current the information contained herein. The information should not be regarded by recipients as a substitute for the exercise of their own judgment. Please contact your own personal advisor on your particular circumstances. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds managed by Ninepoint Partners. Any reference to a particular company is for illustrative purposes only and should not to be considered as investment advice or a recommendation to buy or sell nor should it be considered as an indication of how the portfolio of any investment fund managed by Ninepoint Partners is or will be invested. Ninepoint Partners LP and/or its affiliates may collectively beneficially own/control 1% or more of any class of the equity securities of the issuers mentioned in this report. Ninepoint Partners LP and/or its affiliates may hold short position in any class of the equity securities of the issuers mentioned in this report. During the preceding 12 months, Ninepoint Partners LP and/or its affiliates may have received remuneration other than normal course investment advisory or trade execution services from the issuers mentioned in this report.

Ninepoint Partners LP: Toll Free: 1.866.299.9906. DEALER SERVICES: CIBC Mellon GSSC Record Keeping Services: Toll Free: 1.877.358.0540

Related Funds

Historical Commentary

- Alternative Health Fund 12/2023

- Alternative Health Fund 11/2023

- Alternative Health Fund 09/2023

- Alternative Health Fund 08/2023

- Alternative Health Fund 07/2023

- Alternative Health Fund 06/2023

- Alternative Health Fund 05/2023

- Alternative Health Fund 04/2023

- Alternative Health Fund 03/2023

- Alternative Health Fund 02/2023

- Alternative Health Fund 01/2023