Ninepoint Alternative Health Fund

November 2023 Commentary

Summary

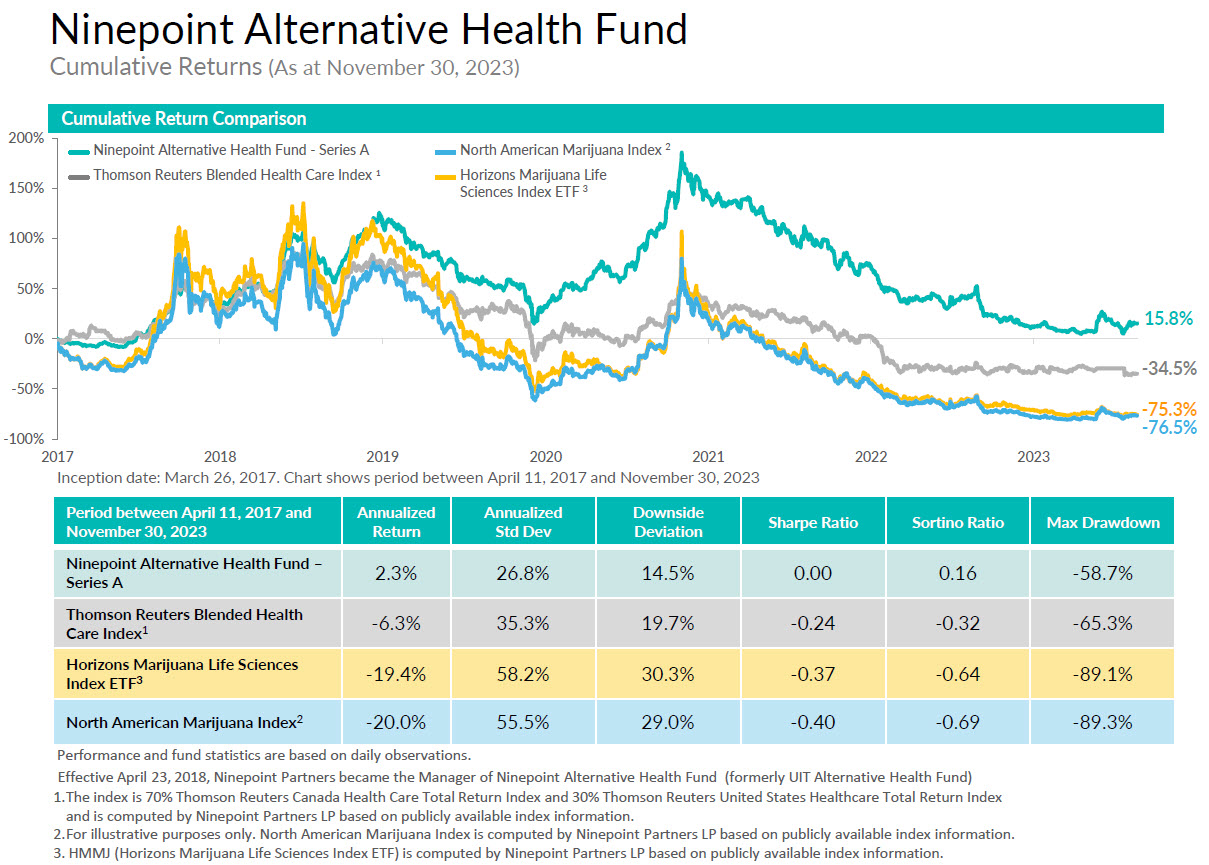

In this month’s commentary, we focus on key topics related to US Cannabis and the global pharmaceutical space. At the end of November, the annual MJBiz cannabis industry conference took place in Las Vegas with participants having cautious optimism about several catalysts that could provide significant upside for US cannabis operators over the next 12-24 months. On the pharmaceutical front, of primary importance is the clinical trial data announced mid-November at the American Heart Association and subsequently published in the New England Journal of Medicine supporting additional medical benefits of GLP-1 clinical trial results completed earlier this year.

For the month end November, US cannabis names ended up about 20% on average vs 9% for the S&P 500 and the Russell 2000, and 11% for the Nasdaq 100. Our portfolio was led by US cannabis companies; Verano Holdings (VRNO) up +30% MoM, Green Thumb Industries (GTI) +28% and Trulieve Cannabis (TRUL) +20%.

Update on US Cannabis Legislation

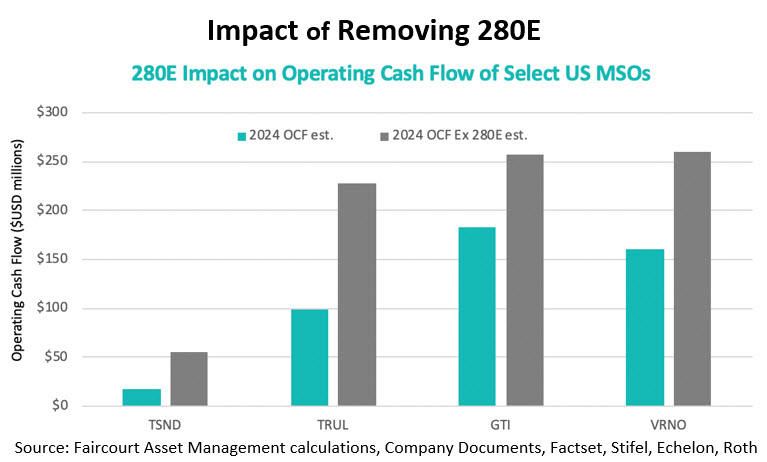

After the August announcement from Dept of Health & Human Services (HHS) that recommends the re-scheduling of cannabis to Schedule III from its current Schedule I designation, investors are analyzing the near-term prospects of the next regulatory steps in the re-scheduling process. The Drug Enforcement Agency (DEA) announcement corroborating or differing from HHS is expected by industry insiders anytime between now and April 2024. The decision on rescheduling is the industry’s next big catalyst; if the DEA follows HHS’ Schedule III recommendation, then the IRS 280E punitive tax regime goes away, and the industry should see enhanced cash flow hitting the bottom line. Below we illustrate the effect of the elimination of 280E on our largest US cannabis positions.

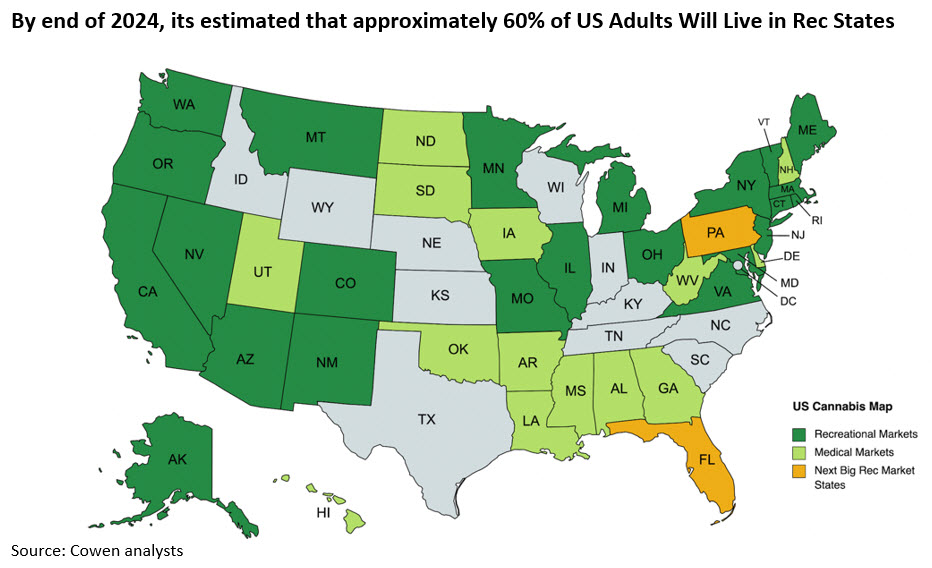

But that is not all. The potential rescheduling of cannabis by the DEA represents a significant milestone for the industry as it potentially opens the door to broader acceptance, expanded consumer access, increased R&D, and product innovation in addition to enhanced integration into mainstream commerce. Looking at the big picture, the executive branch of the US government (the Biden White House) is in the process of easing its policies on marijuana for the first time in 50 years. The precise timing of the decision is less important, it could be Dec 18, Jan 10 or March 22, what matters more is that this process is happening. Looking ahead, a policy change should be considered a material event and positive for the sector.

We believe that the leading US cannabis companies are at an inflection point as short-term catalysts are significant, yet the low valuations continue to be underappreciated by investors. It is understandable given the last few years of promises of US federal reform that have fallen short, however, given the impact of re-scheduling that is to be announced within the next 4-5 months, we see the prospect of significant upside. The current valuation range for the sector is around 6.5X 2023 EBITDA, and when compared to tobacco at 7.1x EBITDA we believe cannabis should see a higher multiple as tobacco is a declining industry while cannabis continues to open new markets. Relative to the alcohol sector at 13X with relatively flat or stable sales we see more upside for cannabis as state tax revenues continue to show a switch over from alcohol consumption to cannabis. A final baseline to analyze is the comparison of US Cannabis being in line with the grocery sector at 6.6X EBITDA, despite cannabis having 2X the revenue growth. In addition to adjustments in tax policy, new state markets continue to open which leads to a growing customer base for MSO’s. Our positioning has been cautious and we have said in the past that one reason to be adding risk is when the tone in Washington is perceived to be improving, and we appear to be knocking on that door with certain catalysts.

We suggest that specific US cannabis companies where there is a focus on high-quality products and brand value be considered similar to consumer product companies that have sustainable margins. Yes, there are cannabis companies that have not been able to differentiate themselves either from a brand or quality standpoint and as a result should only attract a lower commoditized valuation multiple. However, when one considers well-run producers of branded products such as Terrascend (TSND) with Gage and exclusive Cookies brand distribution agreements or Green Thumb (GIT) with Dogwalkers or Verano Holdings (VRNO) MUV brands, one can appreciate higher margins and higher multiples.

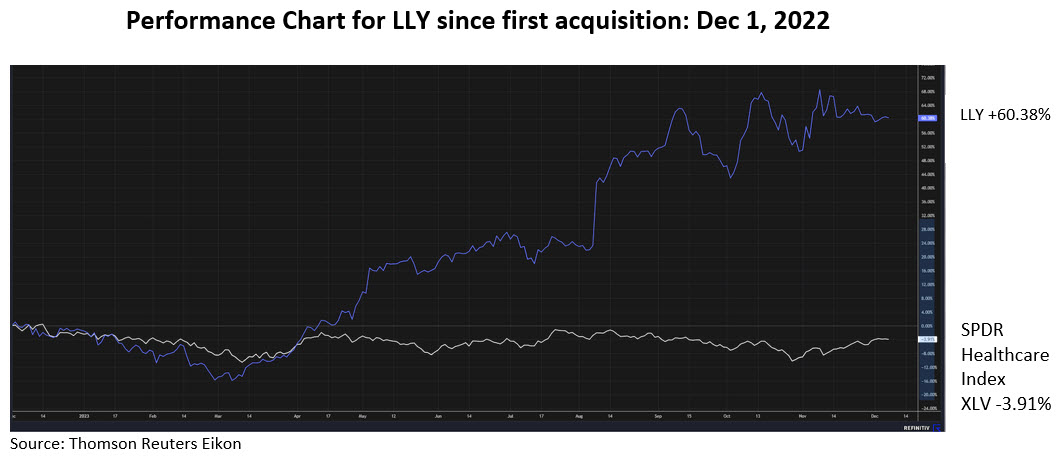

GLP-1 Drugs: The AI Effect on Pharma

As we have seen in 2023, discussion around artificial intelligence (AI) has led to significant growth for the largest technology stocks leading the S&P500. We believe that GLP-1 drugs have the same effect on pharma stocks as AI has on large tech stocks. GLP-1 drugs are injectable glucose-lowering medications approved by the FDA for the treatment of adult patients with type II diabetes. In addition, GLP-1’s has been identified in trials to reduce cardiovascular disease events in adults with type II diabetes. The Fund established a position in Eli Lilly & Co. over a year ago to participate in this area and has achieved over 60% growth from this position. We believe the growth drivers long term for the GLP-1 drugs include continued growth in chronic disease among Americans, increased R&D into therapeutics, and heightened awareness about treatments.

According to the World Health Organization WHO, 1 billion people are categorized as obese across the world; 650 million adults and 340 million adolescents. There are approx. 150 million people in the US who are overweight or more severely categorized as obese. These breakthrough medications could be seen to treat 30-40% of these patients at any given time (for 3 to 6 months at a time). More than 37 million Americans have diabetes (approx. 10%), and approximately 90-95% of that group have type 2 diabetes. The GLP-1 receptor agonist market was estimated at USD $22.4 billion in 2022 and with an estimated 2-4% penetration rate (source: Cowen) suggests growth at a CAGR of around 9.6% during the forecast 10-year period, to $55 billion. The key for these drugs is to continue clinical trials into secondary endpoints such as MACE so that the upfront cost of medication can be balanced against the long-term costs associated with more severe medical interventions including heart surgery, etc. Currently, the GLP-1 drugs are being analyzed as effective additional treatments for sleep apnea and various liver disease complications.

In mid-November, Novo Nordisk (NOVO) presented findings at the American Heart Association (AHA) Annual Scientific Sessions event detailing the results of their phase III cardiovascular outcomes trial. The data supports additional benefits of GLP-1 medications, not only in dealing with weight loss or type II diabetes. The secondary endpoints of the trial showed a significant reduction in the likelihood of major adverse cardiac events (MACE) in those patients treated with drugs known as Ozempic and Wegovy. This is the largest trial analyzing GLP-1 drugs, operating in 41 countries, and involving over 17,000 patients in 800 sites.

Option Strategy

Since the inception of the option writing program in September 2018, the Fund has generated significant income from options premium of approximately $4.88 million. We will continue to utilize our options program to look for attractive opportunities given the above average volatility in the sector as we strongly believe that option writing can continue to add incremental value going forward.

During the month we used our options strategy to assist in rebalancing the portfolio in favor of names we prefer while generating approximately $16,000 in options income. We continue to write short dated covered calls on names we feel are range bound near term and from which we could receive above average premiums which included HCA Holdings Inc. (HCA). We also continue to write short, dated cash secured puts out of the money at strike prices that offered opportunities to increase our exposure, at more attractive prices, to names already in the Fund including UnitedHealth Group Inc. (UNH) and Merck & Co Inc. (MRK).

The Ninepoint Alternative Health Fund, launched in March of 2017 is Canada’s first actively managed mutual fund with a focus on the cannabis sector and remains open to new investors, available for purchase daily.

Charles Taerk & Douglas Waterson

The Portfolio Team

Faircourt Asset Management

Sub-Advisor to the Ninepoint Alternative Health Fund

Ninepoint Alternative Health Fund - Compounded Returns¹ as of November 30, 2023 (Series F NPP5421) | Inception Date - August 8, 2017

| MTD | YTD | 3MTH | 6MTH | 1YR | 3YR | 5YR | INCEPTION (ANNUALIZED) |

|

|---|---|---|---|---|---|---|---|---|

| FUND | 7.5% | -5.5% | -0.8% | 6.4% | -19.3% | -16.7% | -7.3% | 4.2% |

| TR CAN/US HEALTH CARE BLENDED INDEX | 4.4% | -0.0% | -6.9% | -6.1% | -9.5% | -18.2% | -15.8% | -7.1% |

Statistical Analysis

| FUND | TR CAN/US HEALTH CARE BLENDED INDEX | |

|---|---|---|

| Cumulative Returns | 29.9% | -37.7% |

| Standard Deviation | 27.3% | 28.8% |

| Sharpe Ratio | 0.07 | -0.32 |

1 All returns and fund details are a) based on Series F units; b) net of fees; c) annualized if period is greater than one year; d) as at November 30, 2023. The index is 70% Thomson Reuters Canada Health Care Total Return Index and 30% Thomson Reuters United States Healthcare Total Return Index and is computed by Ninepoint Partners LP based on publicly available index information.

The Fund is generally exposed to the following risks. See the prospectus of the Fund for a description of these risks: Cannabis sector risk; Concentration risk; Currency risk; Cybersecurity risk; Derivatives risk; Exchange traded fund risk; Foreign investment risk; Inflation risk; Market risk; Regulatory risk; Securities lending, repurchase and reverse repurchase transactions risk; Series risk; Specific issuer risk; Sub-adviser risk; Tax risk.

Ninepoint Partners LP is the investment manager to the Ninepoint Funds (collectively, the “Funds”). Commissions, trailing commissions, management fees, performance fees (if any), and other expenses all may be associated with investing in the Funds. Please read the prospectus carefully before investing. The indicated rate of return for series F shares of the Fund for the period ended November 30, 2023 is based on the historical annual compounded total return including changes in share value and reinvestment of all distributions and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The information contained herein does not constitute an offer or solicitation by anyone in the United States or in any other jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. Prospective investors who are not resident in Canada should contact their financial advisor to determine whether securities of the Fund may be lawfully sold in their jurisdiction.

The opinions, estimates and projections (“information”) contained within this report are solely those of Ninepoint Partners LP and are subject to change without notice. Ninepoint Partners makes every effort to ensure that the information has been derived from sources believed to be reliable and accurate. However, Ninepoint Partners assumes no responsibility for any losses or damages, whether direct or indirect, which arise out of the use of this information. Ninepoint Partners is not under any obligation to update or keep current the information contained herein. The information should not be regarded by recipients as a substitute for the exercise of their own judgment. Please contact your own personal advisor on your particular circumstances. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds managed by Ninepoint Partners. Any reference to a particular company is for illustrative purposes only and should not to be considered as investment advice or a recommendation to buy or sell nor should it be considered as an indication of how the portfolio of any investment fund managed by Ninepoint Partners is or will be invested. Ninepoint Partners LP and/or its affiliates may collectively beneficially own/control 1% or more of any class of the equity securities of the issuers mentioned in this report. Ninepoint Partners LP and/or its affiliates may hold short position in any class of the equity securities of the issuers mentioned in this report. During the preceding 12 months, Ninepoint Partners LP and/or its affiliates may have received remuneration other than normal course investment advisory or trade execution services from the issuers mentioned in this report.

Ninepoint Partners LP: Toll Free: 1.866.299.9906. DEALER SERVICES: CIBC Mellon GSSC Record Keeping Services: Toll Free: 1.877.358.0540

Related Funds

Historical Commentary

- Alternative Health Fund 12/2023

- Alternative Health Fund 10/2023

- Alternative Health Fund 09/2023

- Alternative Health Fund 08/2023

- Alternative Health Fund 07/2023

- Alternative Health Fund 06/2023

- Alternative Health Fund 05/2023

- Alternative Health Fund 04/2023

- Alternative Health Fund 03/2023

- Alternative Health Fund 02/2023

- Alternative Health Fund 01/2023