Ninepoint Fixed Income Strategy

May 2023 Commentary

Monthly commentary discusses recent developments across the Diversified Bond, Alternative Credit Opportunities and Credit Income Opportunities Funds.

Summary

- While inflation is off the highs, recent progress has been slowing, prompting Central Banks to do more rate hikes

- The BoC surprised markets with a hike, odds are on for July increase as well

- As advertised, the Fed skipped June, positioning for what could maybe be their last hike in July

- Consumption remains elevated, still bolstered by excess savings

- Economic data continues to slow, the lagged impact of 2022s rate increases. We expect this trend to continue through the summer

- Credit continues to behave well, bolstered by low primary supply and strong fund flows

Macro

Kudos to the politicians in Washington on resolving the debt ceiling. What could have been a disaster was averted, and with some time to spare. The U.S. Treasury will now be able to issue T-Bills and replenish their “chequing account” at the Fed. This will suck deposits out of the banking system as buyers of treasury bills will do so using cash in their bank accounts. Along with ongoing quantitative tightening in the U.S., Europe and the maturity of a large slice of the Eurozone’s TLTROs (cheap loans to banks), the next few months will see the largest Central Bank liquidity draw-down so far in this tightening cycle.

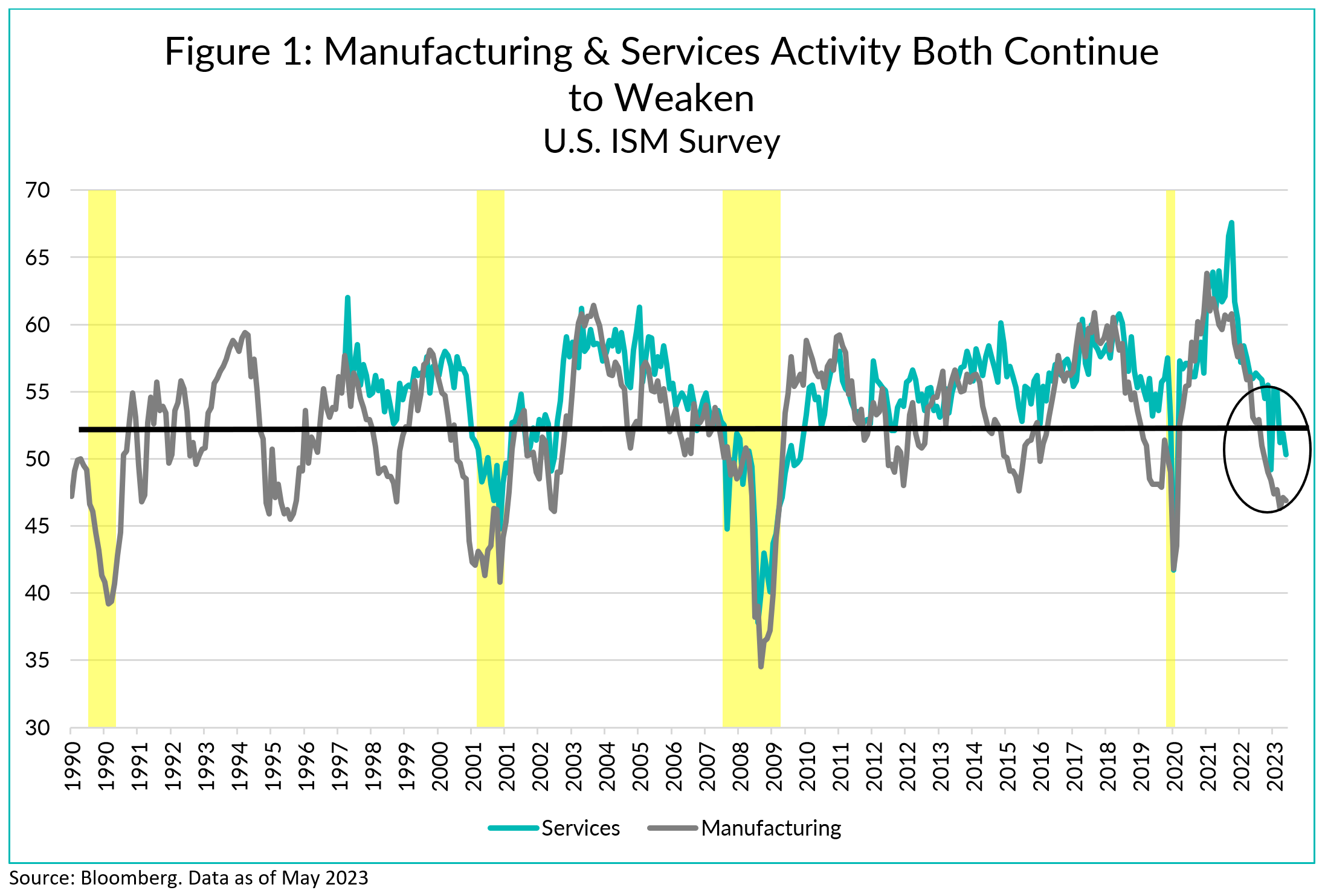

The removal of Central Bank liquidity makes funding more expensive for banks. With borrowers less credit worthy, commercial banks in Canada, the U.S. and Europe are tightening lending standards at a rapid pace, restricting the availability of credit for most types of borrowers (discussed at length in last month’s commentary). In our view, this late cycle dynamic of tighter credit conditions is what is needed to finally see a broad and sustained decline in economic activity. Manufacturing activity has been in contraction for seven months now, but services had managed to hold steady (Figure 1), driven by elevated demand. Last month, the closely followed U.S. ISM Services Index plunged several points to 50.3. Details of the survey were weak, with employment and new orders contracting.

Meanwhile, headline employment continues to perform extremely well, but the May releases have showed some signs of slowing. In the U.S., while the non-farm payroll numbers came in very strong, the household survey (where the unemployment rate comes from) showed net job losses for the month, resulting in an increase in the unemployment rate to 3.7% from 3.4%. Similarly in Canada, the employment numbers were weak, with a net loss (all full-time) of 17 thousand jobs, driving the unemployment rate up 0.2% to 5.2%. Wage growth also decelerated and so did hours worked.

Monetary policy is working but with its usual lag. Investment is declining, credit is harder to get for the purchase of big-ticket items and firms are starting to see their margins compress, leading to layoffs. Anecdotally, the Big 6 Banks’ Q2 earnings were a microcosm of what is happening in the economy. Their revenues are slowing because the cost of their liabilities is growing faster than what they earn on their assets. Provisions for credit losses are creeping up, expenses are also growing too fast. As they always do, we expect the banks to restructure, laying off excess workers and right sizing their units. Typically, weakness in the economy always shows up last in employment.

A lot of heavy lifting has already been done by central banks, and both the Fed and BoC are very close to being done. One more hike here or there to fine tune the terminal rate and make sure people do not take a “pause” as a signal that cuts are coming (cuts will eventually come, but we need to see real pain first). If we see a further deterioration in the employment picture, it will likely be enough to signal a lasting pause for central bankers, as they consider the lagged impacts of this entire rate hike cycle, the fastest and largest since the early 1980s.

Credit

The rally in credit spreads that began in late March and throughout all of April took a breather in May. The Bloomberg Canada Corporate Bond Index was one basis point wider on the month, although June has experienced tightening thus far. While March and April had very clear winners and losers in terms of sectors, May was much more balanced. All non-financial sectors tightened, but banks widened a bit, and given they make up a big portion of the index, spreads ended wider at the benchmark level.

The Canadian primary market heated up in May after a very slow April. Many different types of issuers printed deals ranging from financials to real estate and industrials, to name a few. Order books were generally healthy which resulted in solid performance once the bonds started trading in the secondary market. As we always do, we took advantage of the new issue market to proactively add to credits we like, especially when the deal comes with a reasonable new issue concession. Some examples of new issues we participated in were CN Rail, AltaGas and TD Bank. We expect the new issue market to slow as Q3 is generally light given the quieter summer months. At the time of writing, total YTD Canadian issuance stands at $42.6bln, down 37% from the same time last year. Interestingly, bank issuance is 62% below 2022 YTD levels while corporate issuance is up 48%.

Ninepoint Diversified Bond Fund (DBF)

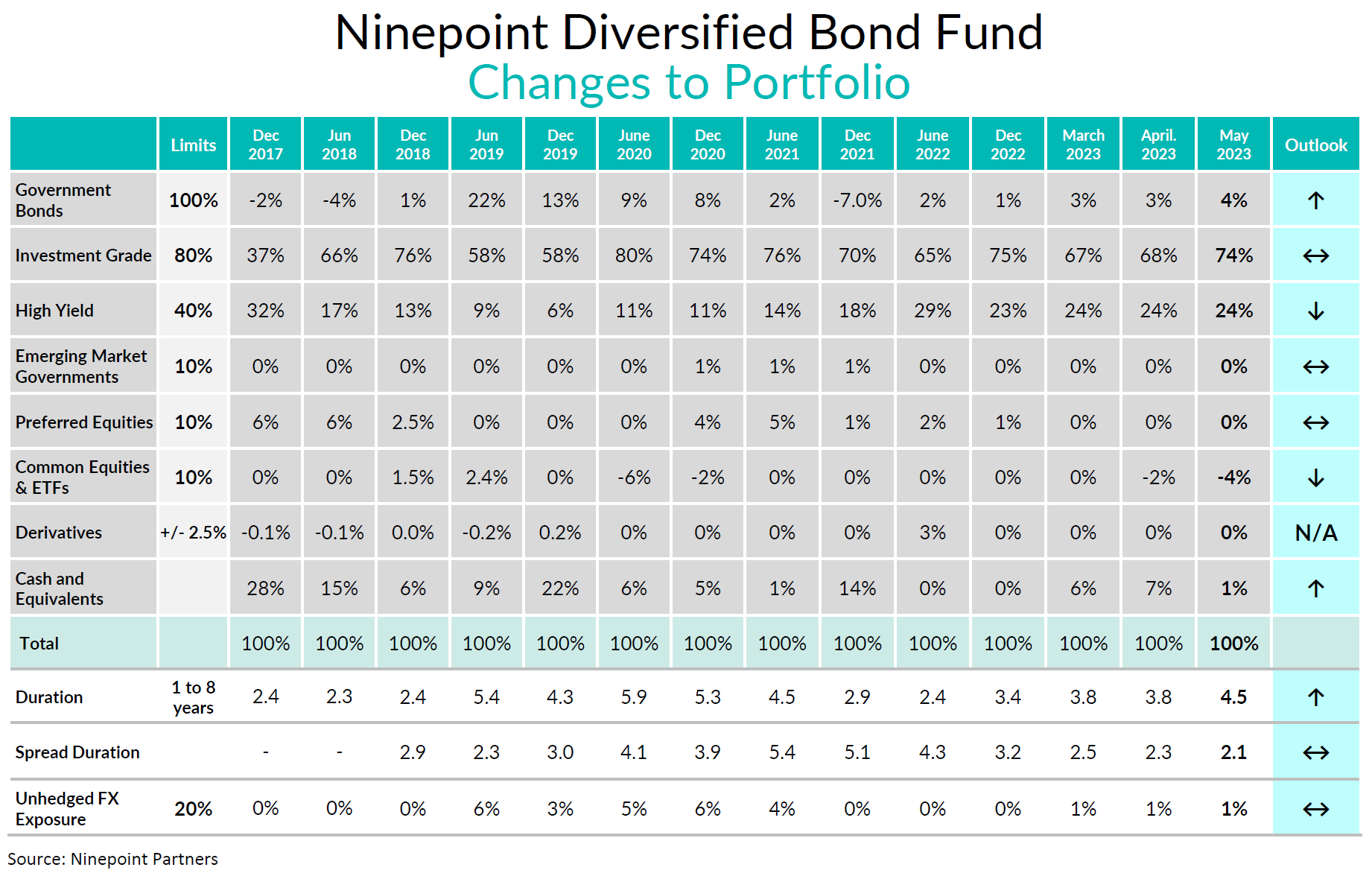

Given our macroeconomic outlook, the portfolio remains defensively positioned, while still offering a very attractive yield-to-maturity of 7.9%. As we have been discussing for months, duration continues to move higher and now sits at 4.5 years (vs 3.9 years last month). Do not expect us to move much beyond 5 years of duration. Additionally, spread duration continues to move down and ended the month at 2.1 years, which showcases the portfolio’s resiliency from potentially wider credit spreads. In terms of liquidity, 30% of the portfolio matures within the next 12 months. We sold some high yield securities this month and expect that weight to gradually drift lower as our very short dated HY bonds mature. We increased our hedging short position in HYG, which now stands at -4% (target -5%).

Ninepoint Alternative Credit Opportunities Fund (NACO)

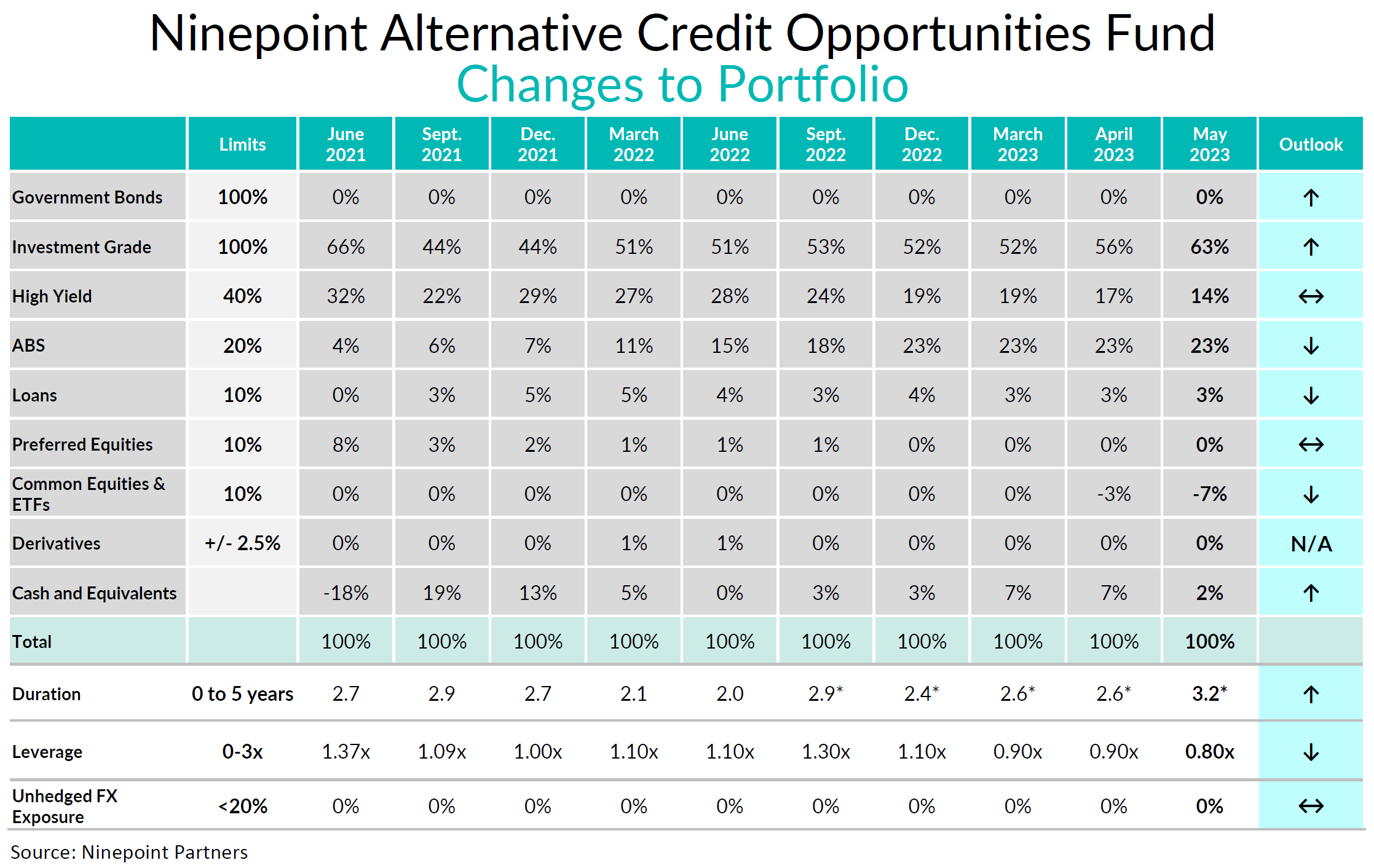

Given our macroeconomic outlook, the portfolio remains defensively positioned but still offers a very attractive yield-to-maturity of 10.0%. As we have been alluding to for months now, duration moved up 0.6 years and now sits at 3.2 years while spread duration moved down 0.8 years and sits at 4.8 years. Expect duration to keep drifting higher as we add to our TLT options position. We brought down leverage during the month and as of month-end was 0.8x (vs 0.9x last month). Given the yield curve is the most inverted it has been all year, we are finding many attractive opportunities in the front end, both outright and in switch. For example, we sold a Nissan bond maturing in 2025 to buy a Nissan bond maturing in 2024 and picked up almost 50bps in all-in yield. We also trimmed select high yield securities while moving into high quality short dated corporate bonds. In terms of liquidity, 30% of the portfolio matures within the next 12 months. Our HYG hedge now stands at -7%, with a target of -10%.

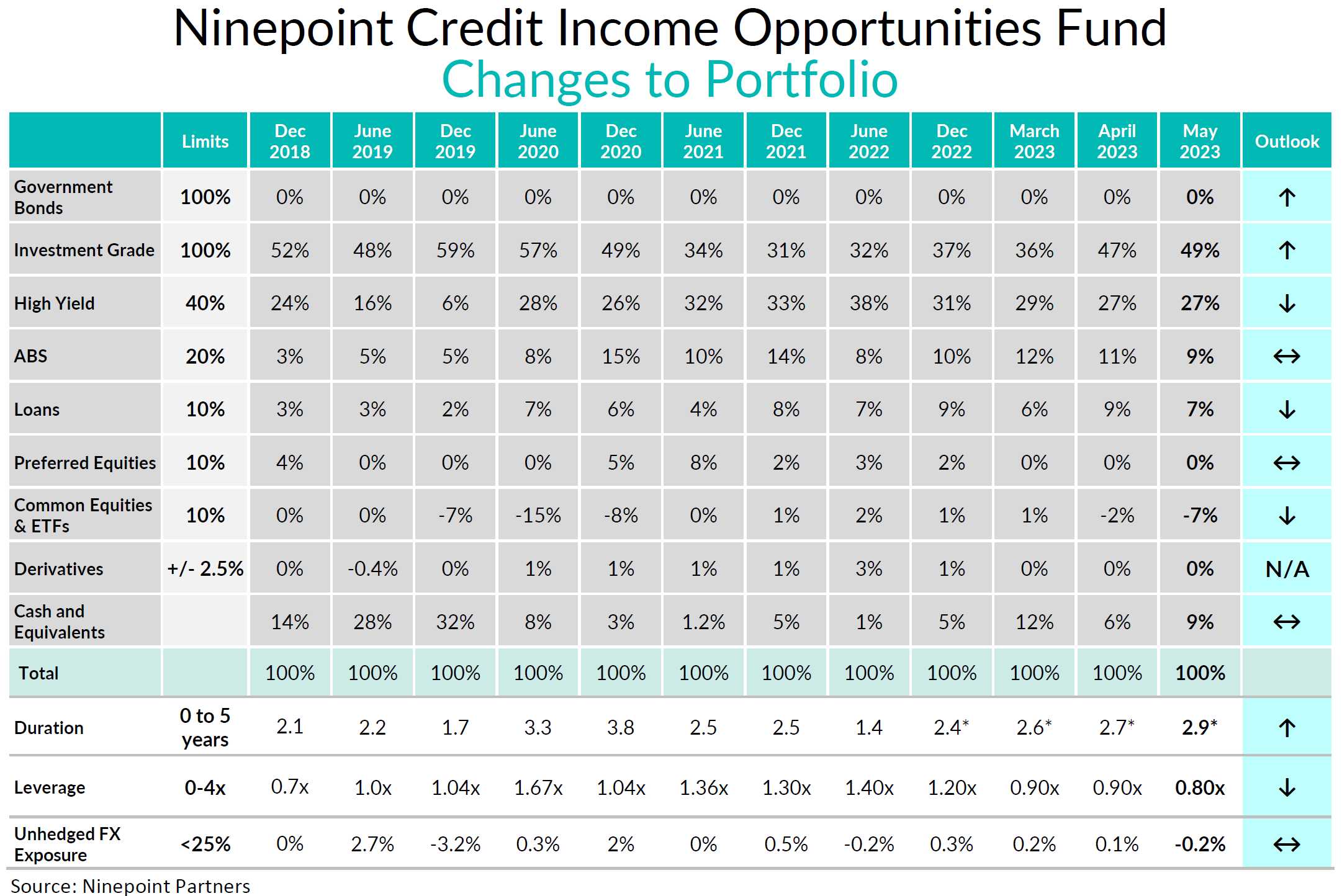

Ninepoint Credit Income Opportunities Fund (Credit Ops)

Given our macroeconomic outlook, the portfolio remains defensively positioned but still offers a very attractive yield-to-maturity of 10.8%. As we have been alluding to for months now, duration moved up 0.2 years and now sits at 2.9 years while spread duration moved down 0.7 years and sits at 4.7 years. Expect duration to keep drifting higher as we add to our TLT options position. We trimmed some securities that have had a good run which resulted in leverage ticking down to 0.8x (vs 0.9x last month). At the margin we also sold some high yield securities to further de-risk the portfolio. In terms of liquidity, 30% of the portfolio matures within the next 12 months. Our HYG hedge now stands at -8%, with a target of -10%.

Conclusion

Given the magnitude of the rate increases over the past 18 months, our base case remains a recession sometime later in 2023 or earlier 2024. While they will never admit it, Messrs. Macklem and Powell know full well that a recession is the only way flush out excess demand and bring the economy and inflation back into balance. The Fed or BoC will never cut rates until the labour market has rebalanced, and for that to happen, we need to see a higher unemployment rate.

Therefore, we continue to add to our defensive positioning across all the funds. Investing in short term corporate bonds (and being paid handsomely to do so right now), layered with some credit hedges, and an allocation to long term government bonds. This is the same playbook we employed in 2019 and early 2020, and it served our clients well, allowing us to act from a position of strength once the recession finally started.

Enjoy the summer, it’s always too short!

Until next month,

Mark, Etienne & Nick

Ninepoint Partners

1 All Ninepoint Diversified Bond Fund returns and fund details are a) based on Series F units; b) net of fees; c) annualized if period is greater than one year; d) as at May 31, 2023 1 All Ninepoint Credit Income Opportunities Fund returns and fund details are a) based on Class F units; b) net of fees; c) annualized if period is greater than one year; d) as at May 31, 2023. 1 All Ninepoint Alternative Credit Opportunities Fund returns and fund details are a) based on Class F units; b) net of fees; c) annualized if period is greater than one year; d) as at May 31, 2023.

The Risks associated worth investing in a Fund depend on the securities and assets in which the Funds invests, based upon the Fund's particular objectives. There is no assurance that any Fund will achieve its investment objective, and its net asset value, yield and investment return will fluctuate from time to time with market conditions. There is no guarantee that the full amount of your original investment in a Fund will be returned to you. The Funds are not insured by the Canada Deposit Insurance Corporation or any other government deposit insurer. Please read a Fund's prospectus or offering memorandum before investing.

Ninepoint Credit Income Opportunities Fund is offered on a private placement basis pursuant to an offering memorandum and are only available to investors who meet certain eligibility or minimum purchase amount requirements under applicable securities legislation. The offering memorandum contains important information about the Funds, including their investment objective and strategies, purchase options, applicable management fees, performance fees, other charges and expenses, and should be read carefully before investing in the Funds. Performance data represents past performance of the Fund and is not indicative of future performance. Data based on performance history of less than five years may not give prospective investors enough information to base investment decisions on. Please contact your own personal advisor on your particular circumstance. This communication does not constitute an offer to sell or solicitation to purchase securities of the Fund.

Ninepoint Partners LP is the investment manager to the Ninepoint Funds (collectively, the “Funds”). Commissions, trailing commissions, management fees, performance fees (if any), other charges and expenses all may be associated with mutual fund investments. Please read the prospectus carefully before investing. The indicated rate of return for series F units of the Fund for the period ended May 31, 2023 is based on the historical annual compounded total return including changes in unit value and reinvestment of all distributions and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The information contained herein does not constitute an offer or solicitation by anyone in the United States or in any other jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. Prospective investors who are not resident in Canada should contact their financial advisor to determine whether securities of the Fund may be lawfully sold in their jurisdiction.

The opinions, estimates and projections (“information”) contained within this report are solely those of Ninepoint Partners LP and are subject to change without notice. Ninepoint Partners makes every effort to ensure that the information has been derived from sources believed to be reliable and accurate. However, Ninepoint Partners assumes no responsibility for any losses or damages, whether direct or indirect, which arise out of the use of this information. Ninepoint Partners is not under any obligation to update or keep current the information contained herein. The information should not be regarded by recipients as a substitute for the exercise of their own judgment. Please contact your own personal advisor on your particular circumstances. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds managed by Ninepoint Partners LP. Any reference to a particular company is for illustrative purposes only and should not to be considered as investment advice or a recommendation to buy or sell nor should it be considered as an indication of how the portfolio of any investment fund managed by Ninepoint Partners LP is or will be invested. Ninepoint Partners LP and/or its affiliates may collectively beneficially own/control 1% or more of any class of the equity securities of the issuers mentioned in this report. Ninepoint Partners LP and/or its affiliates may hold short position in any class of the equity securities of the issuers mentioned in this report. During the preceding 12 months, Ninepoint Partners LP and/or its affiliates may have received remuneration other than normal course investment advisory or trade execution services from the issuers mentioned in this report.

Ninepoint Partners LP: Toll Free: 1.866.299.9906. DEALER SERVICES: CIBC Mellon GSSC Record Keeping Services: Toll Free: 1.877.358.0540

Related Funds

Historical Commentary

- Fixed Income Strategy 12/2023

- Fixed Income Strategy 11/2023

- Fixed Income Strategy 10/2023

- Fixed Income Strategy 09/2023

- Fixed Income Strategy 08/2023

- Fixed Income Strategy 07/2023

- Fixed Income Strategy 06/2023

- Fixed Income - H1 2023 Market Review and Outlook

- Fixed Income Strategy 04/2023

- Fixed Income Strategy 03/2023

- Fixed Income Strategy 02/2023

- Fixed Income Strategy 01/2023