Ninepoint Fixed Income Strategy

September 2023 Commentary

Monthly commentary discusses recent developments across the Ninepoint Diversified Bond, Ninepoint Alternative Credit Opportunities and Ninepoint Credit Income Opportunities Funds.

Summary

- The Fed remains on pause, but shocked markets with its new economic forecasts.

- The global sell-off in long term government bonds accelerated, spreading to risk assets.

- Tighter financial conditions mean that Central Banks are now firmly on hold, potentially no need for further rate hikes.

- As we saw in March, elevated long-term bond yields increase risks to the financial system.

Macro

The sell-off in long term government bonds that had started in August continued in September, turbo charged by what sounded like a hawkish Fed and amplified by investor’s unwillingness to step in and catch the proverbial falling knife. While the Fed did not hike rates (as expected), the message extracted from their new set of economic and interest rate forecasts was resolutely and surprisingly hawkish. Going into the meeting, the consensus among market participants was that given the strength of the U.S. economy and decelerating inflation, the Fed should be able to start cutting rates next year, and therefore the odds of a soft landing are high (regular readers would know that we do not subscribe to this view). It therefore came as a big surprise when the Fed revised their forecasts as follows:

- Lower path for inflation,

- Higher economic growth,

- Lower unemployment rate,

- One more rate hike this year, and much fewer rate cuts next year (i.e. higher for longer).

In other words, the economy is strong (soft landing), inflation is declining, but elevated interest rates will be required (for the foreseeable future). And with inflation going down and nominal rates staying high, the real interest rate (nominal rates minus inflation, what really matters for the economy) will increase, making monetary policy even more restrictive.

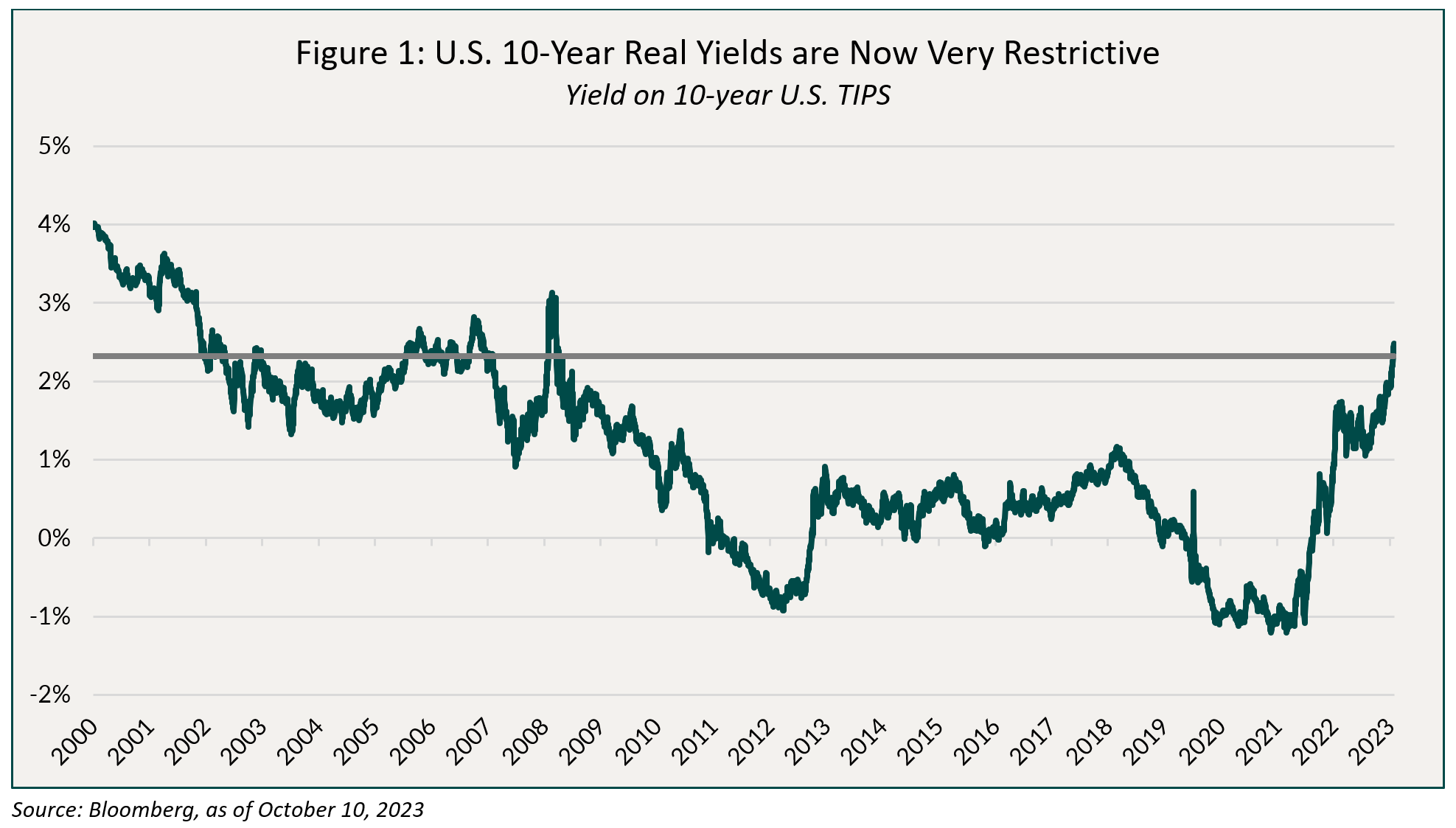

The market’s conclusion was that, implicitly, the Fed is nudging us towards a world where the economy’s neutral rate of interest is much higher and that the economy can sustain a much higher level of rates without decelerating. And that’s what drove the selloff in long term government bonds: real yields surged to levels last seen prior to the GFC (Figure 1) as investors rapidly repriced the long end of the treasury curve for this new reality, triggering a sell-off across other assets (equities, credit, gold, etc.).

We would like to offer a different, maybe more nuanced interpretation of the Fed’s messaging: they will keep rates higher for longer, until something breaks.

As we have argued before, it is inconceivable that the Fed would lower interest rates while inflation is still above target, and the unemployment rate remains near all-time lows. Furthermore, given the recent inflationary experience and the fear of inflation expectations increasing, it is clear that the Fed will err on the side of caution and drag its feet cutting rates, even if the economy were to slow meaningfully. So, this idea that they would cut rates progressively as inflation slowly moderates, while the labour market remains tight, always felt like a fantasy world to us. As soon as the market smells a whiff of rate cuts, then financial conditions loosen, and markets turn. That would be disingenuous to the Fed’s objectives. Better to keep the market guessing, stay on hold until they are certain inflation is back where they want it.

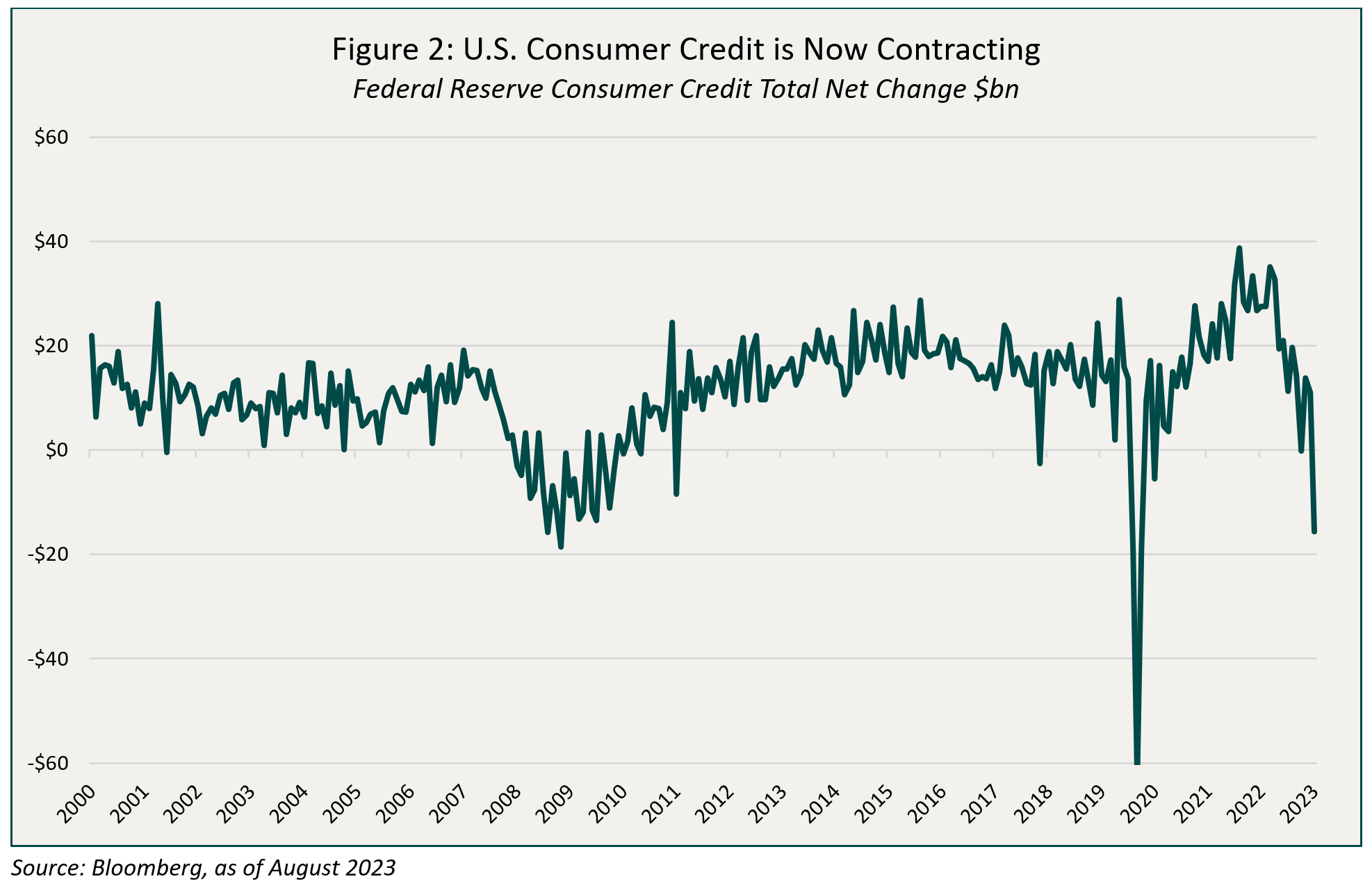

But, after 15 years of interest rates stuck at 0% and the largest fiscal stimulus package ever, quickly followed by the fastest and largest rate hike cycle since the 1980s, with real interest rates that are now at the highest in a generation, we would argue that the passage of time is all that’s needed to see the cracks appear. We already saw some of this in March, with the demise of a few super-regional banks. We are also seeing more cracks in the commercial real estate sector. We know that households are running out of accumulated stimulus savings, and that consumer credit is now contracting (Figure 2). The housing market is on hold, with no one wanting to refinance their mortgage at the highest rate since 2000.

It takes time for monetary policy to make its way through the banking system and the economy, and the Fed has just told us they will be patient, waiting for something to break, as it always does. Of course, they don’t publish forecasts of cuts and or a recession. They never have and never will. That would be self-fulfilling.

It is our view now that the Fed, BoC and ECB are on hold, unless we see a meaningful reacceleration in core inflation (they will gloss over energy prices for now). We are now playing the waiting game.

The sell-off we experienced in the bond market (+80bps increase in 10-year and 30-year bond yields over 2 months) was extremely overdone, but until we get bad economic data or a geopolitical event, it will be hard to see a meaningful retracement. We expect all risk assets to remain vulnerable to this elevated level of real yields. Our positioning in credit is and will remain very defensive (short term corporate bonds, layered with some credit hedges).

Across the funds, we remain long 30-year Canadian and US government bonds. Our US exposure was structured using options, selling put spreads to fund call spreads. If the current sell-off deepens, we should feel a lot less downside participation going forward. Year-to-date, our position in government bonds has been a detractor to performance (~2.5% for DBF, 2% for Ops and Alts), but given the environment we believe its prudent to own them. And at some point, we anticipate a reversal in interest rates as our thesis plays out.

Credit

Credit spreads in Canada were flat on the month, despite some movement intra-month driven by the overall risk off tone. Given the large move higher in Canadian government bond yields coupled with the busiest September on record in the new issue market, unchanged credit spreads is impressive any way you cut it (especially when considering US credit spreads widened along with synthetic credit spreads). Contributing factors include continued inflows into bond funds, attractive all-in yields and September issuance being very well telegraphed to the investor base. Issuance was extremely well absorbed by the market with robust book stats and decent secondary market trading. Issuance was drastically skewed to non-financial sectors and covered most industries. We had many maturities in September, which we recycled into attractive new issues such as Canadian Tire (given its very defensive attributes) and West Edmonton Mall (3-year, 7.79% coupon, AA- rated senior secured first lien bond). As regular readers are aware, we always remain judicious in our participation in the primary market and always weigh the risk/reward vs alternatives in the secondary market. A great example is the recent Enbridge Inc hybrid issuance which we did not participate in because the existing Enbridge hybrids we own have a shorter call date, significantly lower price and an immaterial difference in all-in-yield.

Ninepoint Diversified Bond Fund (DBF)

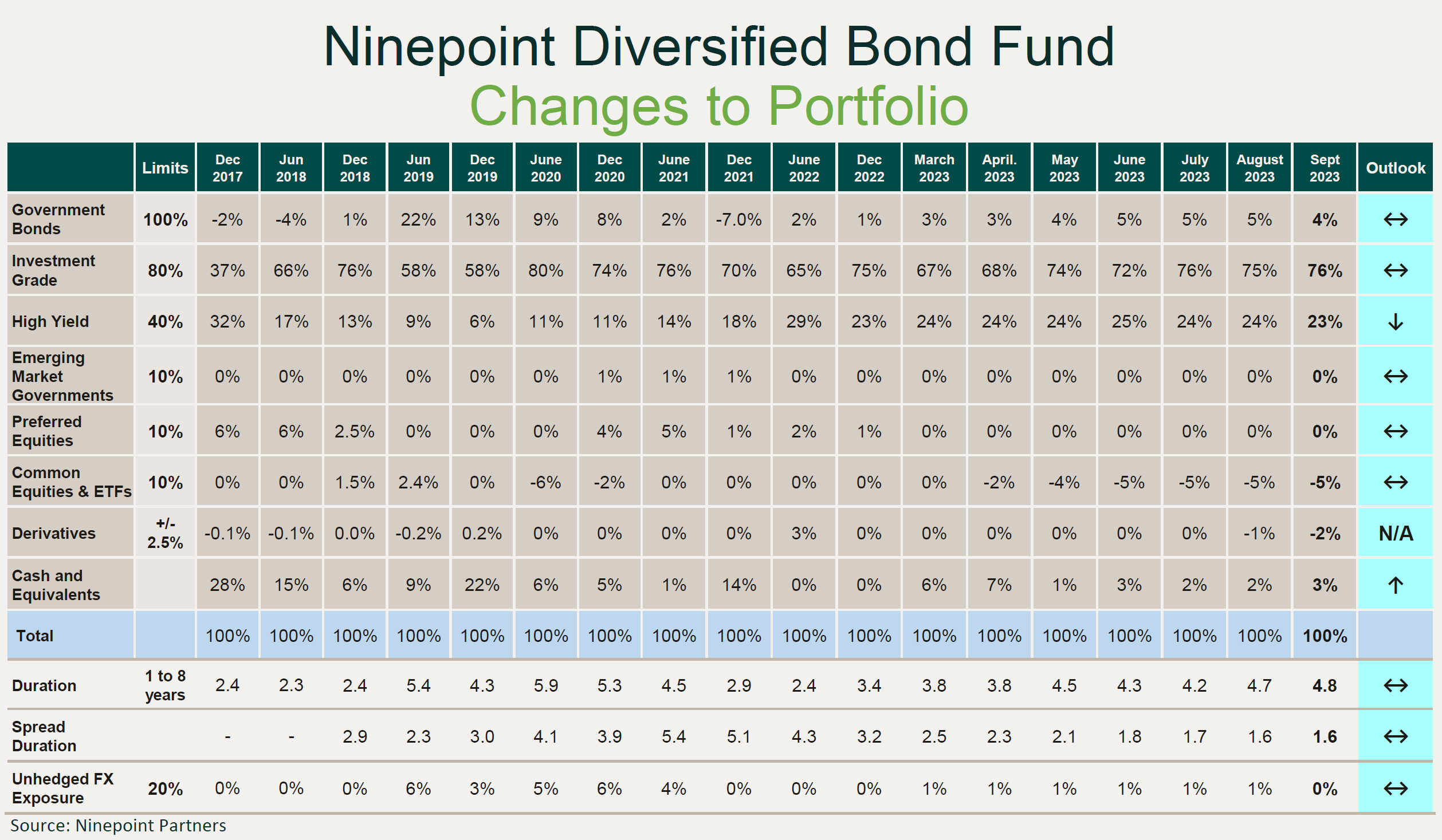

September was the month of material maturities in the Ninepoint Diversified Bond Fund. Numerous lines matured (both IG and HY), which we re-deployed across a variety of bonds (both in the primary and secondary market) at very attractive valuations. Heading into calendar year end, the portfolio continues to have plenty of maturities (i.e. liquidity) which we will continually recycle into the best opportunity set available at the time (short-term IG bonds currently). As of month-end, duration moved up 0.1 years to 4.8 years while the yield-to-maturity moved 20bps higher to 8.2%. Average credit quality has trended higher over the last few months and remains at BBB+, comfortably within investment grade. Our short position in HYG (used for credit hedging purposes) remains at our target of -5%.

Ninepoitn Alternative Credit Opportunities Fund (NACO)

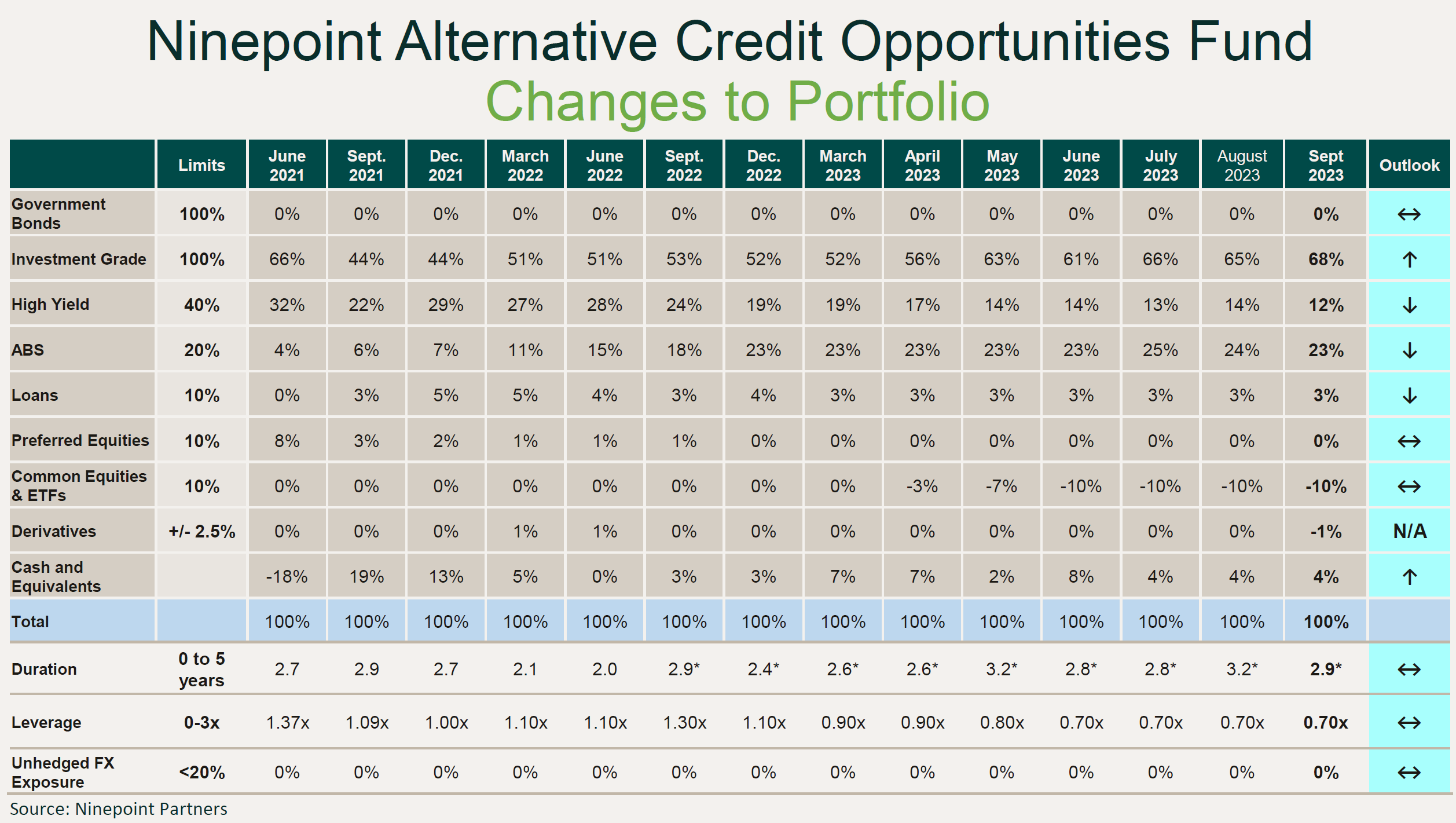

September was the month of material maturities in the portfolio. Numerous lines matured (both IG and HY) which we re-deployed across a variety of bonds (both in the primary and secondary market) at very attractive valuations. We also used some of this liquidity to bring down leverage in the fund. Heading into calendar year end, the portfolio continues to have plenty of maturities (i.e. liquidity) which we will continually recycle into the best opportunity set at the time (short-term IG bonds currently). As of month-end, duration moved down a touch to 2.9 years while the yield-to-maturity moved 30bps higher to 10.1%. Leverage remains low at 0.7x and we do not expect material changes in the near-term. Our short position in HYG (used for credit hedging purposes) remains at our target of -10%.

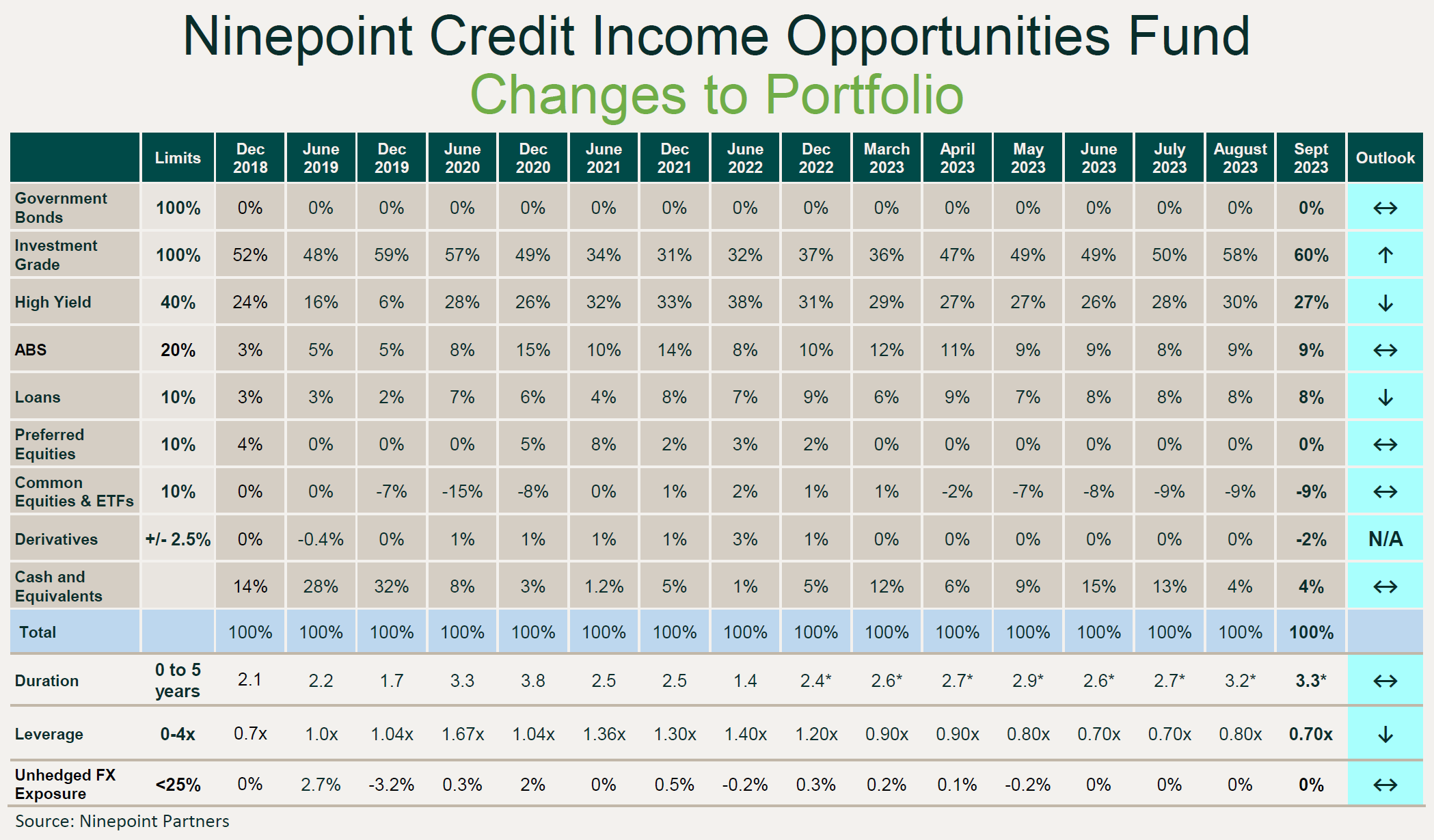

Ninepoint Credit Income Opportunities Fund (Credit Ops)

September was the month of material maturities in the portfolio. Numerous lines matured (both IG and HY) which we re-deployed across a variety of bonds (both in the primary and secondary market) at very attractive valuations. We also used some of this liquidity to bring down leverage in the fund. Heading into calendar year end, the portfolio continues to have plenty of maturities (i.e. liquidity) which we will continually recycle into the best opportunity set at the time (short-term IG bonds currently). As of month-end, duration moved up a touch to 3.3 years while the yield-to-maturity moved 10bps higher to 10.9%. Leverage remains low at 0.7x and we do not expect material changes in the near-term. Our short position in HYG (used for credit hedging purposes) remains at our target of -10%.

Until next month,

Mark, Etienne & Nick

Ninepoint Partners

1 All Ninepoint Diversified Bond Fund returns and fund details are a) based on Series F units; b) net of fees; c) annualized if period is greater than one year; d) as at September 30, 2023 1 All Ninepoint Credit Income Opportunities Fund returns and fund details are a) based on Class F units; b) net of fees; c) annualized if period is greater than one year; d) as at September 30, 2023. 1 All Ninepoint Alternative Credit Opportunities Fund returns and fund details are a) based on Class F units; b) net of fees; c) annualized if period is greater than one year; d) as at September 30, 2023.

The Risks associated worth investing in a Fund depend on the securities and assets in which the Funds invests, based upon the Fund's particular objectives. There is no assurance that any Fund will achieve its investment objective, and its net asset value, yield and investment return will fluctuate from time to time with market conditions. There is no guarantee that the full amount of your original investment in a Fund will be returned to you. The Funds are not insured by the Canada Deposit Insurance Corporation or any other government deposit insurer. Please read a Fund's prospectus or offering memorandum before investing.

Ninepoint Credit Income Opportunities Fund is offered on a private placement basis pursuant to an offering memorandum and are only available to investors who meet certain eligibility or minimum purchase amount requirements under applicable securities legislation. The offering memorandum contains important information about the Funds, including their investment objective and strategies, purchase options, applicable management fees, performance fees, other charges and expenses, and should be read carefully before investing in the Funds. Performance data represents past performance of the Fund and is not indicative of future performance. Data based on performance history of less than five years may not give prospective investors enough information to base investment decisions on. Please contact your own personal advisor on your particular circumstance. This communication does not constitute an offer to sell or solicitation to purchase securities of the Fund.

Ninepoint Partners LP is the investment manager to the Ninepoint Funds (collectively, the “Funds”). Commissions, trailing commissions, management fees, performance fees (if any), other charges and expenses all may be associated with mutual fund investments. Please read the prospectus carefully before investing. The indicated rate of return for series F units of the Fund for the period ended September 30, 2023 is based on the historical annual compounded total return including changes in unit value and reinvestment of all distributions and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The information contained herein does not constitute an offer or solicitation by anyone in the United States or in any other jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. Prospective investors who are not resident in Canada should contact their financial advisor to determine whether securities of the Fund may be lawfully sold in their jurisdiction.

The opinions, estimates and projections (“information”) contained within this report are solely those of Ninepoint Partners LP and are subject to change without notice. Ninepoint Partners makes every effort to ensure that the information has been derived from sources believed to be reliable and accurate. However, Ninepoint Partners assumes no responsibility for any losses or damages, whether direct or indirect, which arise out of the use of this information. Ninepoint Partners is not under any obligation to update or keep current the information contained herein. The information should not be regarded by recipients as a substitute for the exercise of their own judgment. Please contact your own personal advisor on your particular circumstances. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds managed by Ninepoint Partners LP. Any reference to a particular company is for illustrative purposes only and should not to be considered as investment advice or a recommendation to buy or sell nor should it be considered as an indication of how the portfolio of any investment fund managed by Ninepoint Partners LP is or will be invested. Ninepoint Partners LP and/or its affiliates may collectively beneficially own/control 1% or more of any class of the equity securities of the issuers mentioned in this report. Ninepoint Partners LP and/or its affiliates may hold short position in any class of the equity securities of the issuers mentioned in this report. During the preceding 12 months, Ninepoint Partners LP and/or its affiliates may have received remuneration other than normal course investment advisory or trade execution services from the issuers mentioned in this report.

Ninepoint Partners LP: Toll Free: 1.866.299.9906. DEALER SERVICES: CIBC Mellon GSSC Record Keeping Services: Toll Free: 1.877.358.0540

Related Funds

Historical Commentary

- Fixed Income Strategy 12/2023

- Fixed Income Strategy 11/2023

- Fixed Income Strategy 10/2023

- Fixed Income Strategy 08/2023

- Fixed Income Strategy 07/2023

- Fixed Income Strategy 06/2023

- Fixed Income - H1 2023 Market Review and Outlook

- Fixed Income Strategy 05/2023

- Fixed Income Strategy 04/2023

- Fixed Income Strategy 03/2023

- Fixed Income Strategy 02/2023

- Fixed Income Strategy 01/2023