Ninepoint Fixed Income Strategy

July 2023 Commentary

Monthly commentary discusses recent developments across the Diversified Bond, Alternative Credit Opportunities and Credit Income Opportunities Funds.

Summary

- The Fed and BoC hiked rates in July, very possibly their last hikes for this cycle

- The labour market continues to slowly soften, reducing the pressure on Central Banks to do more

- A confluence of factors drove a large sell-off in long-term government bonds in July, we expect a reversal in the coming weeks

- Risk assets continue to behave as if a soft landing is the likely outcome. We aren’t convinced of this and continue to remain cautious in our positioning

Macro

As widely anticipated, the BoC and Fed both hiked interest rates at their July meetings. Messaging about future actions is becoming increasingly two-sided, trying to balance the risks of doing too much versus a bit more. This means that central banks are now data dependent; that is, stronger data means a slight upward adjustment to rates, and weaker data, for now, means they can hold rates steady. As we have said all along, given the recent experience with inflation, they will error on the side of caution, and wait for as long as possible before even considering rate cuts.

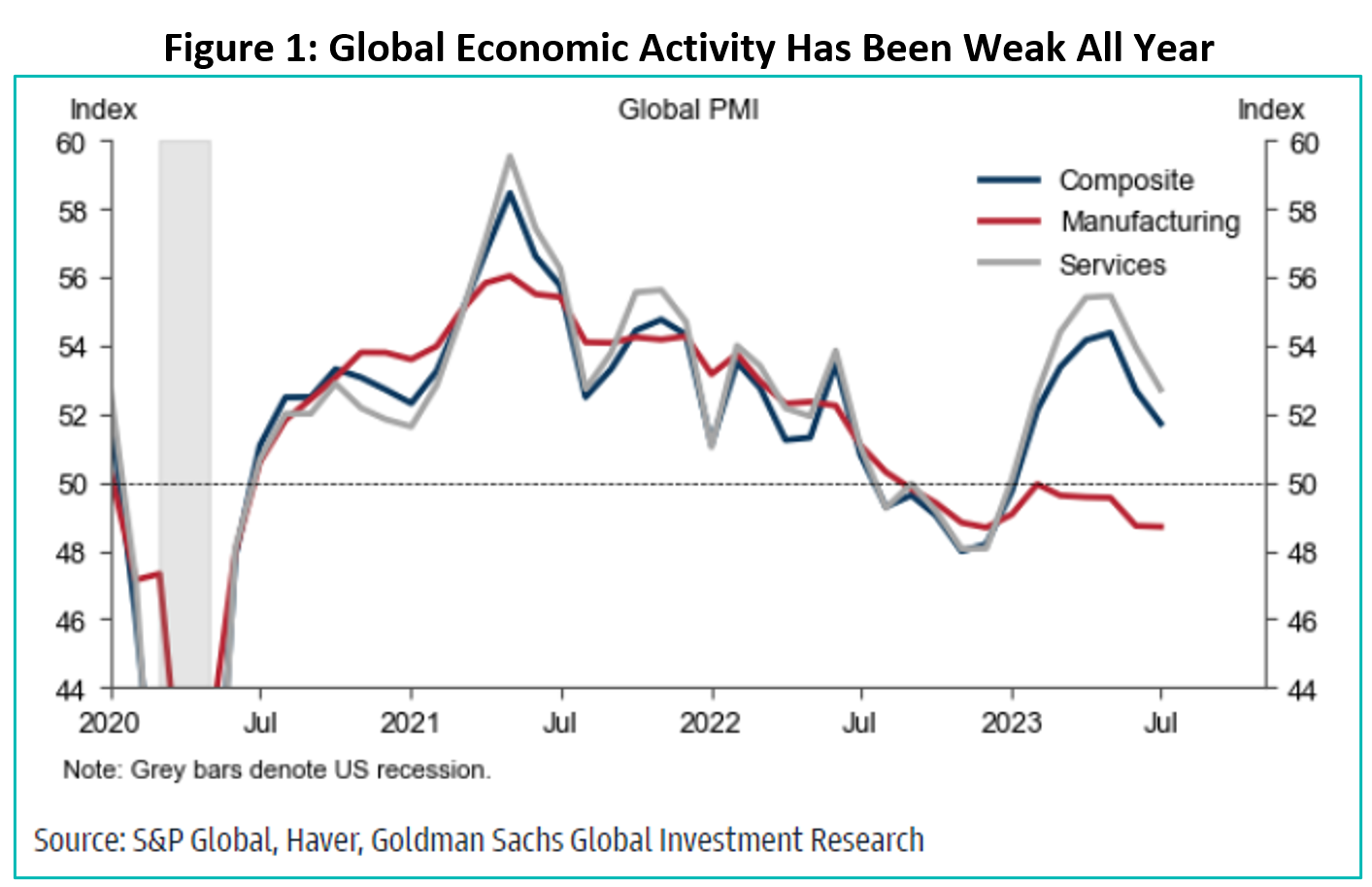

That leaves us playing a waiting game. We (and everyone else) continue to watch the data and hope it is heading in the right direction. For now, it is confirming a slowdown in economic activity, but not a recession. For example, global PMIs (Figure 1 below) are softening.

Manufacturing has been in a lull for the greater part of the year and is showing no sign of picking up. Services was on the bright side in early 2023 but has since also turned down. Geographically, Europe and China have been the weakest (e.g. recession in Germany, China on the verge of deflation), while spending in the services sector in the U.S. has continued to buck the trend surprising to the upside. Nonetheless, for the past several months, the trend has clearly shifted to a slowing global economy.

With regard to employment, things are also starting to normalize. In Canada, after reaching a cycle low of 4.9% in 2022, the unemployment rate is now at 5.5%, and we have seen net job losses in two of the past three employment reports. In the U.S., non-farm payrolls have surprised market expectations to the downside for the past few months, and past numbers have also been revised down. So overall, the fight against inflation seems to be in the last innings; goods prices are declining, shelter has stabilized, and now the labour market, the last piece of the inflation puzzle, is finally starting to cool down. That is why we are confident enough to suggest that both the Fed and BoC are pretty much done raising rates.

Now, the end of the rate hike cycle doesn’t necessarily mean the end of interest rate volatility. Towards the end of July and the first week of August, the global bond market, and particularly the U.S. treasury market, saw a lot of volatility. Obviously, the middle of summer isn’t the most liquid time of year or well attended, so price action tends to be a bit more volatile. Nonetheless, a ~40bps selloff in 10-year treasuries in about 2 weeks is noteworthy enough in itself. So, what happened?

First off, the Bank of Japan (BoJ) surprised markets by widening the band around their 10-year JGB yield curve control policy. Since last December, the BoJ held a hard cap of 50bps on 10-year government bonds. Recognizing the distortions created by such a policy, the new Governor was widely expected to make adjustments to this policy, but most expected those to be made later this year. In a surprise leak to the press, the BoJ widened the range all the way to 100bps, taking 10-year bond yield 15bps higher overnight and sending shockwaves around the world.

A few days later, the U.S. treasury released its estimate of future borrowing, raising the estimated deficit for 2023 by $300bn, much larger than expected, and then the next day announced large increases in expected issuance of 10 and 30-year bonds, further fuelling the selloff.

Finally, to top it off, Fitch, one of the major rating agencies, decided to downgrade the U.S. government’s rating from AAA to AA+. While it is no secret that the current U.S. fiscal situation is far from enviable (largest post-war budget deficit outside of recessions), the downgrade came as a surprise, and coupled with all the action of the previous few days, contributed further to the sell-off.

This most recent episode should serve as a reminder to fiscal authorities in the developed world that the pandemic is over, and unsustainable deficits, even in the world's reserve currency, can lead to rapidly increasing funding costs and financial instability. Following the pandemic and energy shock last year, government around the world have now exhausted their fiscal space. With the global economy softening, their ability to stimulate during the next downturn will be limited. As we have seen with the UK in October 2022 and the U.S. downgrade this year, the Bond Vigilantes are alive and well.

And while it certainly creates unwanted volatility, the price action of the past few weeks in global government bond markets is, in our view, overdone. Given the continued softness in global economic data and inflation, it is a matter of when, not if, global bond markets rally to reflect impending rate cuts.

Credit

Coming off a strong June, Canadian investment grade credit performed well last month. At the benchmark level, credit tightened 8 basis points and now hovers around the yearly tights, retracing all the widening following the U.S. regional banking stress in March. At this juncture, our credit exposure is concentrated in short term corporate bonds (average quality BBB, term to maturity under 3 years). As such, we expect our funds to be less sensitive to credit spreads. Subordinated bank bonds were the top performing sector in July which helped drive performance across the funds given our overweight exposure. We also trimmed some autos since they are the best performing sector year-to-date and screen quite rich on a relative value basis.

July issuance was light as expected given the summer slowdown, with many issuers in blackout periods prior to their Q2 earnings releases. Across all funds, we participated in the CIBC new issue given its short tenor, attractive coupon, and high credit quality. Broadly speaking, new issue concessions were fair, and all deals were very well absorbed by investors with strong books.

Ninepoint Diversified Bond Fund (DBF)

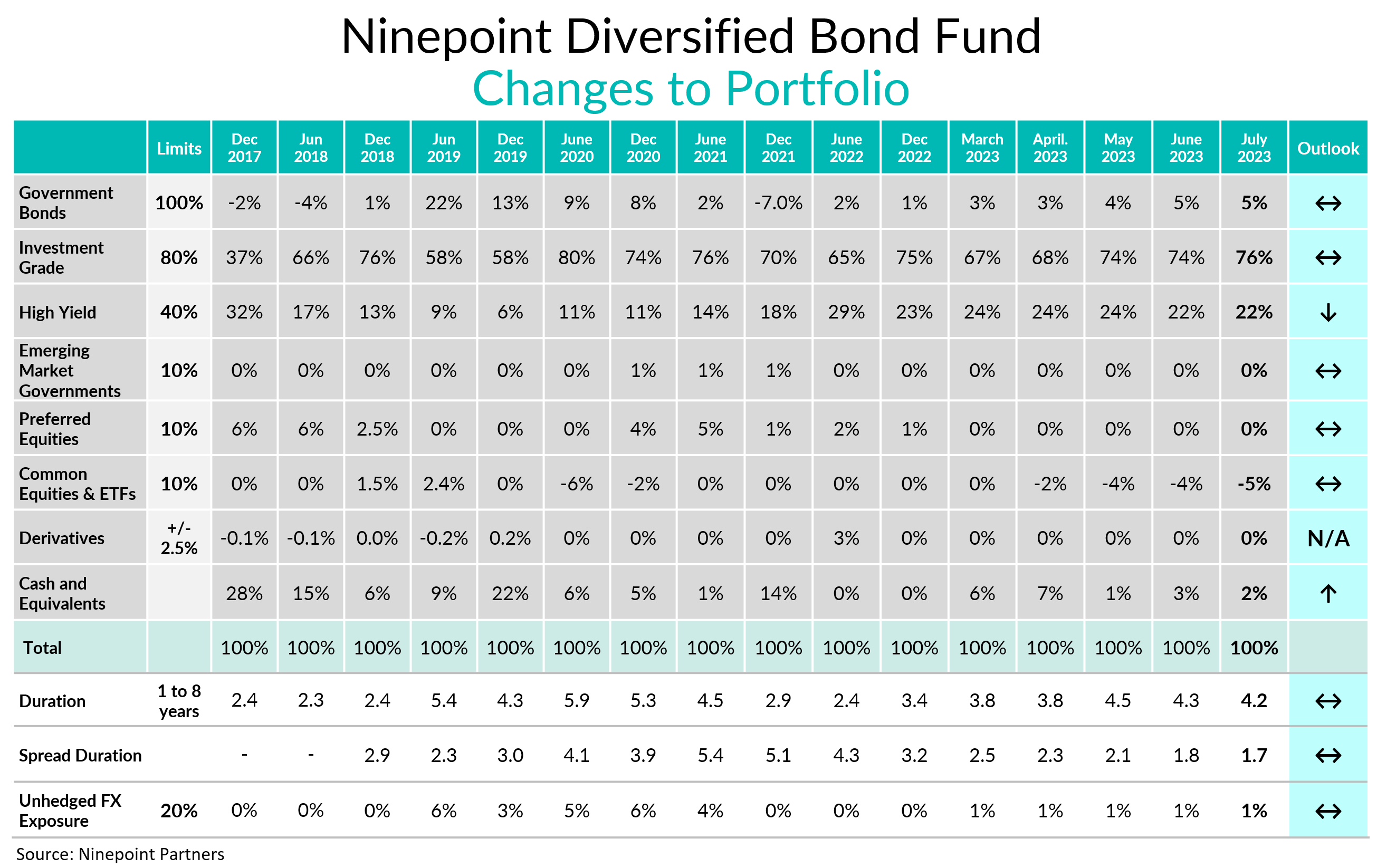

Given our macroeconomic outlook, the portfolio remains defensively positioned, while still offering a very attractive yield-to-maturity of 7.8%, down slightly from 8.0% as of June month-end. Duration moved down 0.1 years and now sits at 4.2 years. Additionally, spread duration continued to edge lower and ended the month at 1.7 years, a function of the inverse yield curve and our desire to insulate the portfolio from potentially wider credit spreads. In terms of liquidity, ~30% of the portfolio matures within the next 12 months. We expect our High Yield exposure to continue to gradually drift lower as our very short dated HY bonds mature. Our short position in HYG (used for credit hedging purposes) remains at our target of -5% (subtracting from duration and spread duration).

Ninepoint Alternative Credit Opportunities Fund (NACO)

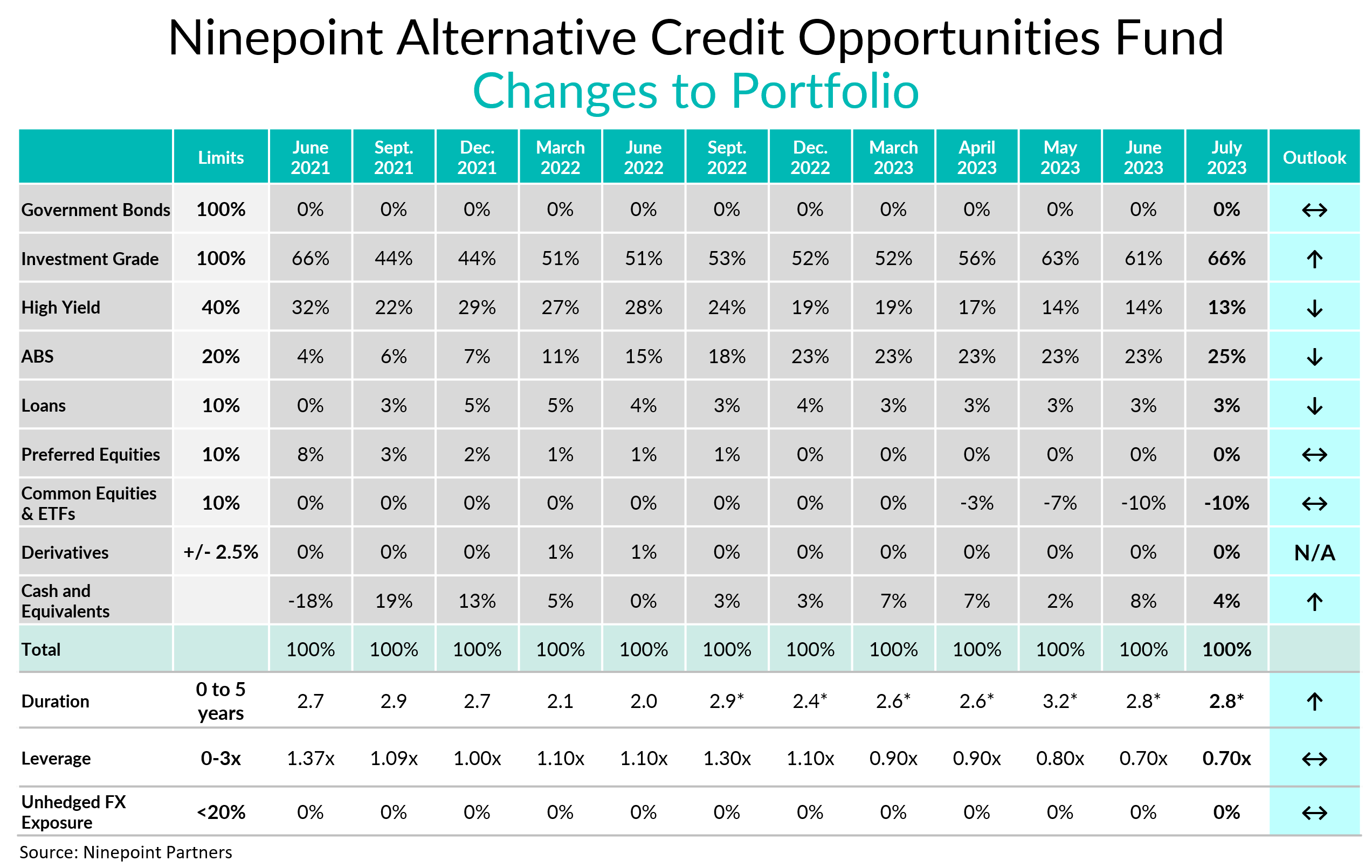

Given our macroeconomic outlook, the portfolio remains defensively positioned but still offers a very attractive yield-to-maturity of 9.7% (down slightly from last month at 9.9%). Duration remained unchanged at 2.8 years month over month while leverage was also unchanged and conservatively sits at 0.7x. Expect duration to drift a little higher as we add to our TLT options position given the big back up in yields experienced recently. Spread duration edged slightly lower as we continue to find attractive retractions given the inverted yield curve. In terms of liquidity, ~30% of the portfolio matures within the next 12 months. Our short HYG position (used for credit hedging purposes) remains at our target of -10% (subtracting from duration and spread duration).

Ninepoint Credit Income Opportunities Fund (Credit Ops)

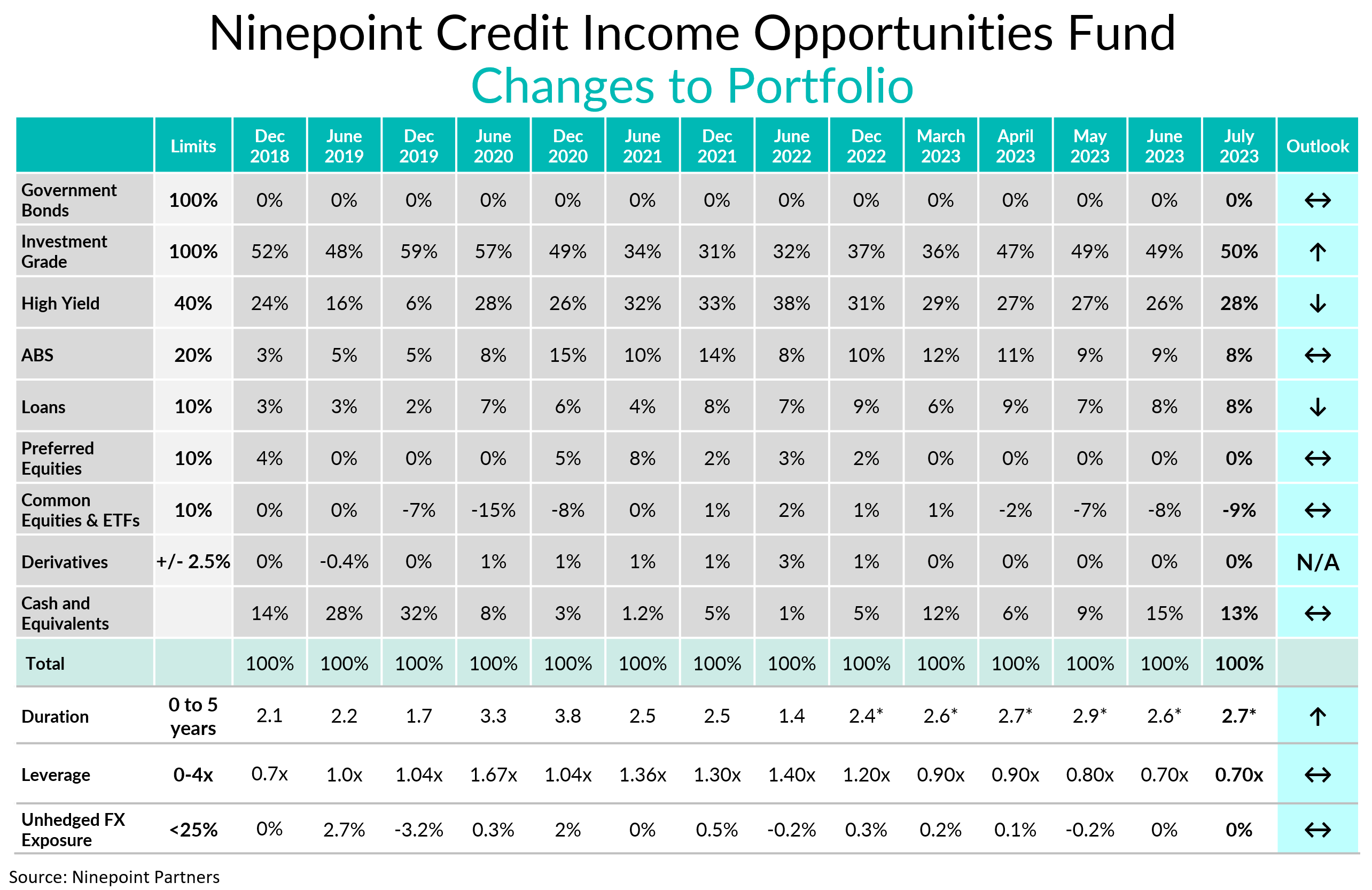

Given our macroeconomic outlook, the portfolio remains defensively positioned but still offers a very attractive yield-to-maturity of 10.5% (down slightly from last month at 10.8%). Duration edged slightly up over the month and now sits at 2.7 years while leverage remained unchanged conservatively sitting at 0.7x. Expect duration to drift a little higher as we add to our TLT options position given the big back up in yields experienced recently. Spread duration edged slightly lower as we continue to find attractive retractions given the inverted yield curve. In terms of liquidity, ~30% of the portfolio matures within the next 12 months. Our short HYG position (used for credit hedging purposes) remains at our target of 10% (subtracting from duration and spread duration).

Until next month,

Mark, Etienne & Nick

Ninepoint Partners

1 All Ninepoint Diversified Bond Fund returns and fund details are a) based on Series F units; b) net of fees; c) annualized if period is greater than one year; d) as at July 31, 2023 1 All Ninepoint Credit Income Opportunities Fund returns and fund details are a) based on Class F units; b) net of fees; c) annualized if period is greater than one year; d) as at July 31, 2023. 1 All Ninepoint Alternative Credit Opportunities Fund returns and fund details are a) based on Class F units; b) net of fees; c) annualized if period is greater than one year; d) as at July 31, 2023.

The Risks associated worth investing in a Fund depend on the securities and assets in which the Funds invests, based upon the Fund's particular objectives. There is no assurance that any Fund will achieve its investment objective, and its net asset value, yield and investment return will fluctuate from time to time with market conditions. There is no guarantee that the full amount of your original investment in a Fund will be returned to you. The Funds are not insured by the Canada Deposit Insurance Corporation or any other government deposit insurer. Please read a Fund's prospectus or offering memorandum before investing.

Ninepoint Credit Income Opportunities Fund is offered on a private placement basis pursuant to an offering memorandum and are only available to investors who meet certain eligibility or minimum purchase amount requirements under applicable securities legislation. The offering memorandum contains important information about the Funds, including their investment objective and strategies, purchase options, applicable management fees, performance fees, other charges and expenses, and should be read carefully before investing in the Funds. Performance data represents past performance of the Fund and is not indicative of future performance. Data based on performance history of less than five years may not give prospective investors enough information to base investment decisions on. Please contact your own personal advisor on your particular circumstance. This communication does not constitute an offer to sell or solicitation to purchase securities of the Fund.

Ninepoint Partners LP is the investment manager to the Ninepoint Funds (collectively, the “Funds”). Commissions, trailing commissions, management fees, performance fees (if any), other charges and expenses all may be associated with mutual fund investments. Please read the prospectus carefully before investing. The indicated rate of return for series F units of the Fund for the period ended July 31, 2023 is based on the historical annual compounded total return including changes in unit value and reinvestment of all distributions and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The information contained herein does not constitute an offer or solicitation by anyone in the United States or in any other jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. Prospective investors who are not resident in Canada should contact their financial advisor to determine whether securities of the Fund may be lawfully sold in their jurisdiction.

The opinions, estimates and projections (“information”) contained within this report are solely those of Ninepoint Partners LP and are subject to change without notice. Ninepoint Partners makes every effort to ensure that the information has been derived from sources believed to be reliable and accurate. However, Ninepoint Partners assumes no responsibility for any losses or damages, whether direct or indirect, which arise out of the use of this information. Ninepoint Partners is not under any obligation to update or keep current the information contained herein. The information should not be regarded by recipients as a substitute for the exercise of their own judgment. Please contact your own personal advisor on your particular circumstances. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds managed by Ninepoint Partners LP. Any reference to a particular company is for illustrative purposes only and should not to be considered as investment advice or a recommendation to buy or sell nor should it be considered as an indication of how the portfolio of any investment fund managed by Ninepoint Partners LP is or will be invested. Ninepoint Partners LP and/or its affiliates may collectively beneficially own/control 1% or more of any class of the equity securities of the issuers mentioned in this report. Ninepoint Partners LP and/or its affiliates may hold short position in any class of the equity securities of the issuers mentioned in this report. During the preceding 12 months, Ninepoint Partners LP and/or its affiliates may have received remuneration other than normal course investment advisory or trade execution services from the issuers mentioned in this report.

Ninepoint Partners LP: Toll Free: 1.866.299.9906. DEALER SERVICES: CIBC Mellon GSSC Record Keeping Services: Toll Free: 1.877.358.0540

Related Funds

Historical Commentary

- Fixed Income Strategy 12/2023

- Fixed Income Strategy 11/2023

- Fixed Income Strategy 10/2023

- Fixed Income Strategy 09/2023

- Fixed Income Strategy 08/2023

- Fixed Income Strategy 06/2023

- Fixed Income - H1 2023 Market Review and Outlook

- Fixed Income Strategy 05/2023

- Fixed Income Strategy 04/2023

- Fixed Income Strategy 03/2023

- Fixed Income Strategy 02/2023

- Fixed Income Strategy 01/2023