Ninepoint Fixed Income Strategy

August 2023 Commentary

Monthly commentary discusses recent developments across the Diversified Bond, Alternative Credit Opportunities and Credit Income Opportunities Funds.

Summary

- The BoC paused again in September, and we expect the Fed to do the same

- Europe and China continue to slow, Canadian GDP contracts in Q2, the U.S. remains solid

- Global long-term bond yields remain elevated, we have increased exposure following the August sell-off

- Risk assets continue to behave as if a soft landing is the likely outcome. We aren’t convinced of this and continue to remain cautious in our positioning

Macro

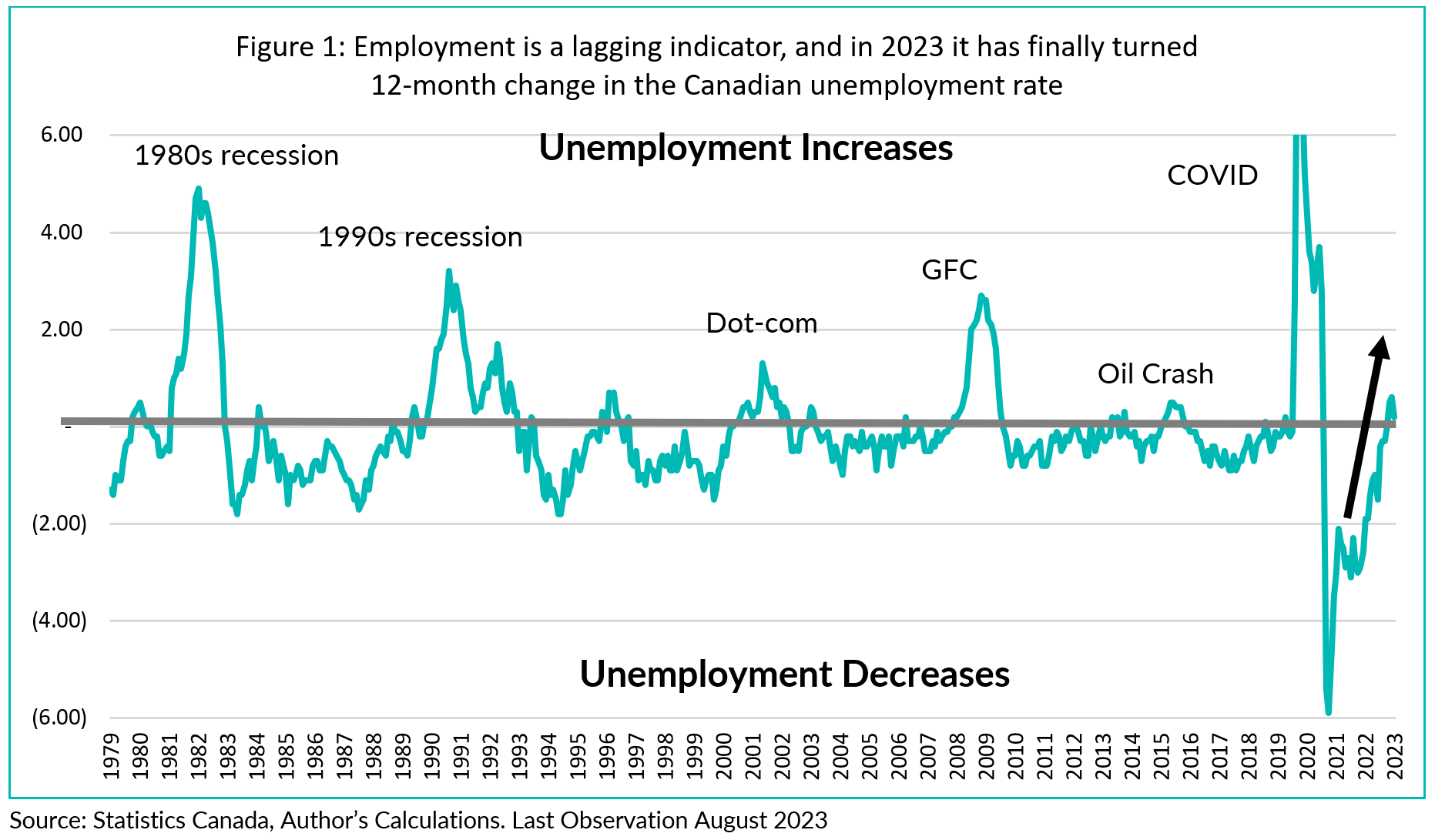

As expected, the BoC paused once again at its September meeting, keeping the overnight rate at 5%. While inflation still remains too high for comfort, the economy has underperformed the BoC’s own expectations, contracting 0.2% in the second quarter. The labor market is also slowly rebalancing, with the unemployment rate up 0.6% from the trough reached last year. As shown in Figure 1 below, the recent trend in the unemployment rate is consistent with past episodes of economic weakness.

It is rare for the unemployment rate to increase meaningfully without the economy being in recession. The next few months will be crucial in assessing the likelihood and severity of a recession in Canada. As regular readers already know, we have been positioning for an economic slowdown. Monetary policy takes time to work its way through the system, and we are starting to see the impacts of last summer’s massive increase in interest rates.

Elsewhere in the world, we have seen growth disappoint in China and Europe. The reopening in China following years of Covid restrictions has been plagued by consumer confidence issues. The real estate bubble there is finally bursting, albeit in slow-motion, sapping consumer confidence. We have seen some easing of policy there, but for now, it seems like the central government is not in the mood to intervene with large stimulus. We therefore expect sluggish growth out of China for the foreseeable future, with a risk of further downside remaining elevated.

Europe (and Germany in particular), has historically had strong economic ties to China through exports. With China sluggish and monetary policy biting, we have seen a notable deterioration in economic activity in the Eurozone, where even services, which had been the bright spot post covid, sinking into contraction territory (Figure 2). While the ECB was a bit late to the rate hiking party, we expect that they are close to done, given the speed at which the transmission of monetary policy has affected its economy.

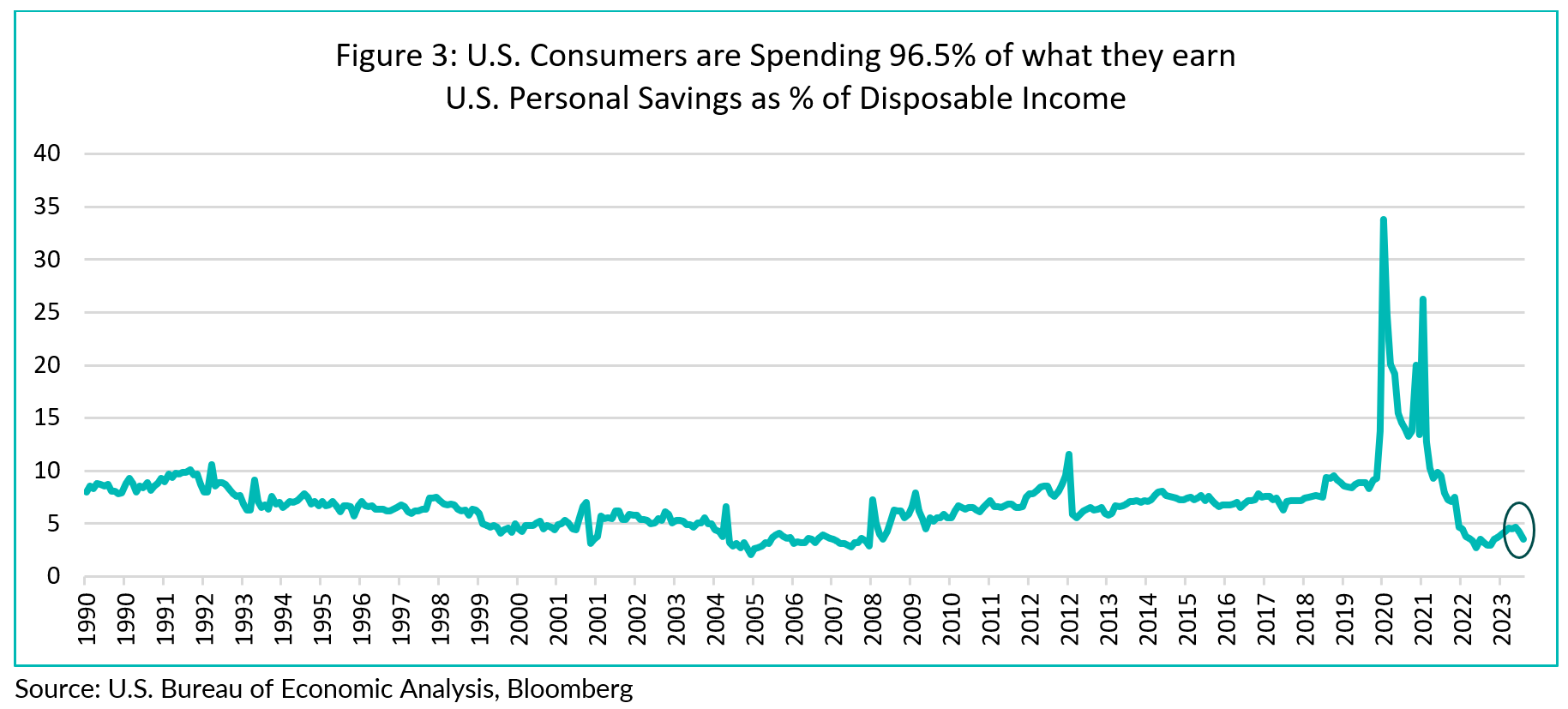

In the U.S., economic activity continues to be surprisingly resilient. Yes, manufacturing PMIs have been in contraction all year, and employment growth has slowed, but spending by households continues to be very strong. Looking under the hood, we see that a lot of this spending has been fueled by consumer credit, which is starting to be harder to get, as banks and other financial institutions tighten the credit taps. This same phenomenon can also be seen by looking at the U.S. savings rate, which has declined sharply since the beginning of the summer (Figure 3). With the pandemic savings now essentially gone, student debt repayments starting this fall, and consumer debt at all time highs (and harder to get), it is hard to imagine that spending can continue at the current pace.

We remain of the view that this highly unusual economic and monetary cycle will resolve itself in the usual fashion. Highly restrictive monetary policy is starting to have its impact, exposing those that have been swimming naked. And while they continue to refuse to admit it, the Fed’s own forecast of a 4.5% unemployment rate by the end of next year, from 3.5% currently, implies a recession.

We are patiently waiting for opportunities to surface, all the while earning strong carry by exploiting the inverted yield curve (i.e. short term corporate bonds are incredibly attractive) and hedging our portfolios with long-term government bonds and a short position in high yield (the most vulnerable part of the market). Following the spike in long-term yields in August, we increased our net exposure to government bonds, increasing duration across the funds by 0.4 to 0.5 years.

Credit

After a very solid June and July, Canadian investment grade credit spreads widened by 6bps in August. Recall that spreads have performed very well, closing the month 25bps tighter from the March 2023 wides. August saw US equities move lower and government bond yields jump higher, so it is no surprise that credit was also on the softer side. Given our defensive stance on credit, performance across all three funds was positive even in the face of generally wider credit spreads and higher bond yields. Subordinated Canadian bank bonds were the best performing sector in August, helping our performance given our high allocation. As expected, August was a very light month in terms of corporate issuance with only ~$5bln being issued. As of month end, year to date Canadian corporate bond issuance trails last year by 19%, but so far, the first week of September has been very active with TD, Telus, and Rogers all issuing large deals (collectively more than August as a whole). The primary market tends to ramp up this time of year, and so far equities have also been soft, so this could prove a tricky month for credit generally.

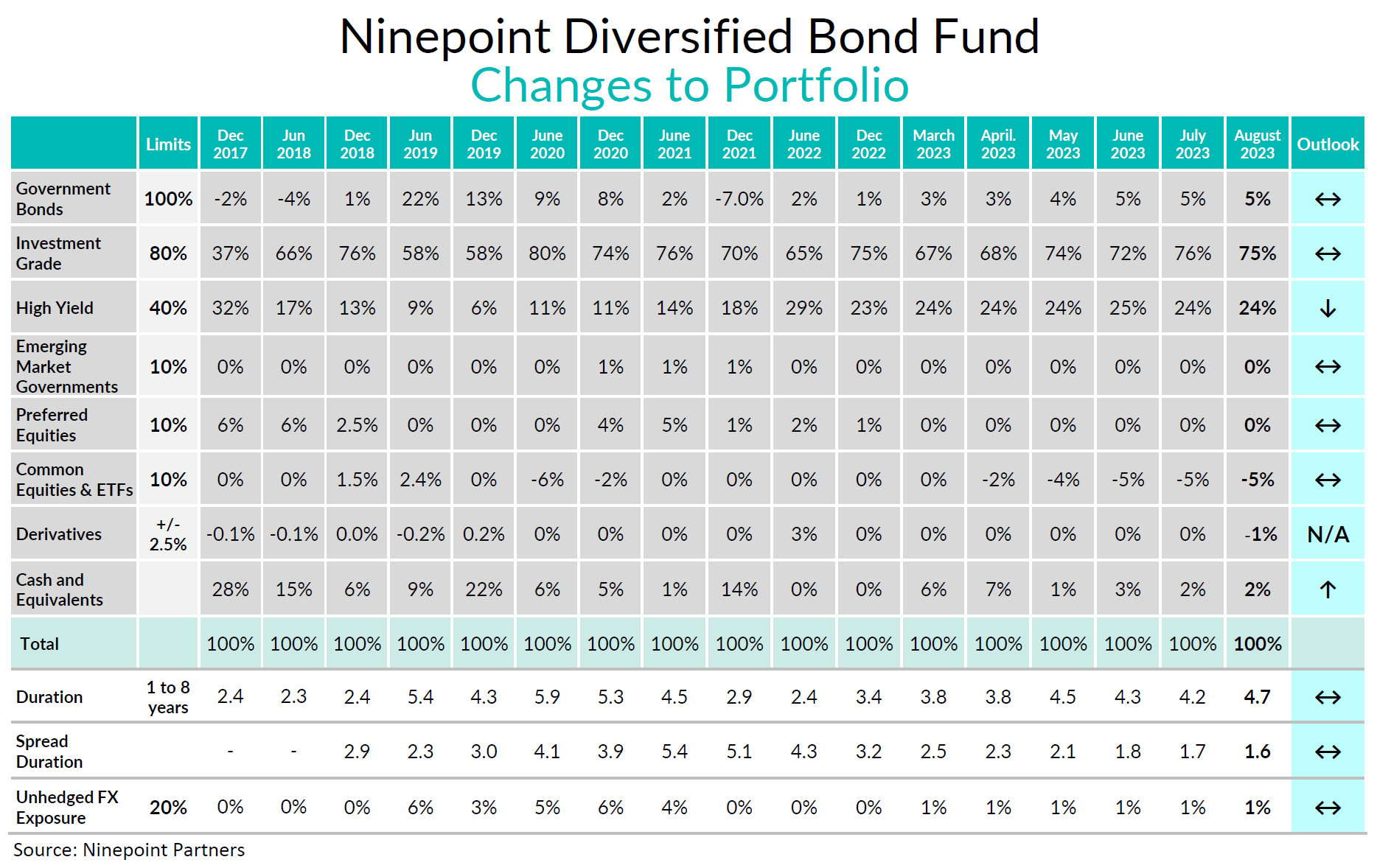

Ninepoint Diversified Bond Fund (DBF)

As we have been defensively positioned for some time now, there were no material changes to the portfolio other than duration moving higher by 0.5 years since we took advantage of the backup in government bond yields in August (recall, we alluded to this in our July 2023 commentary). As of month-end, duration stood at 4.7 years while still offering a very attractive yield-to-maturity of 8.0% (vs 7.8% one month prior). The portfolio has plenty of liquidity, especially this September as many bonds mature this month (both HY and IG). We have been sharpening our pencils on how best to deploy this liquidity, but rest assured we will remain in a defensive posture. Our short position in HYG (used for credit hedging purposes) remains at our target of -5%.

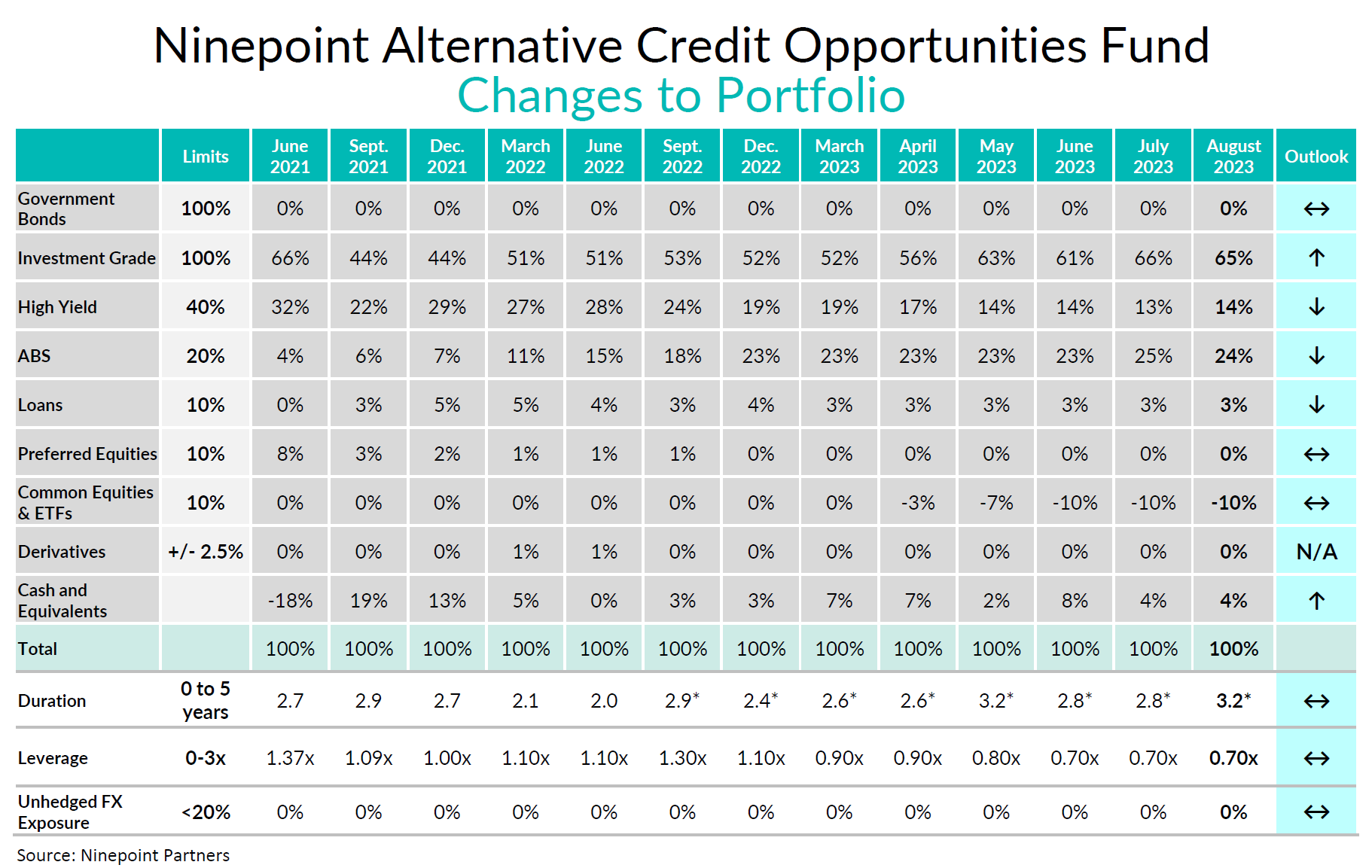

Ninepoint Alternative Credit Opportunities Fund (NACO)

As we have been defensively positioned for some time now, there were no material changes to the portfolio other than duration moving higher by 0.4 years since we took advantage of the backup in government bond yields in August (recall, we alluded to this in our July 2023 commentary). As of month-end, duration stood at 3.2 years while still offering a very attractive yield-to-maturity of 9.8% (vs 9.7% one month prior). The portfolio has plenty of liquidity, especially this September as many bonds mature this month (both HY and IG). We have been sharpening our pencils on how best to deploy this liquidity, but rest assured we will remain in a defensive posture. Leverage is very low based on our historical standards and remained at 0.7x in August. Our short position in HYG (used for credit hedging purposes) remains at our target of -10%.

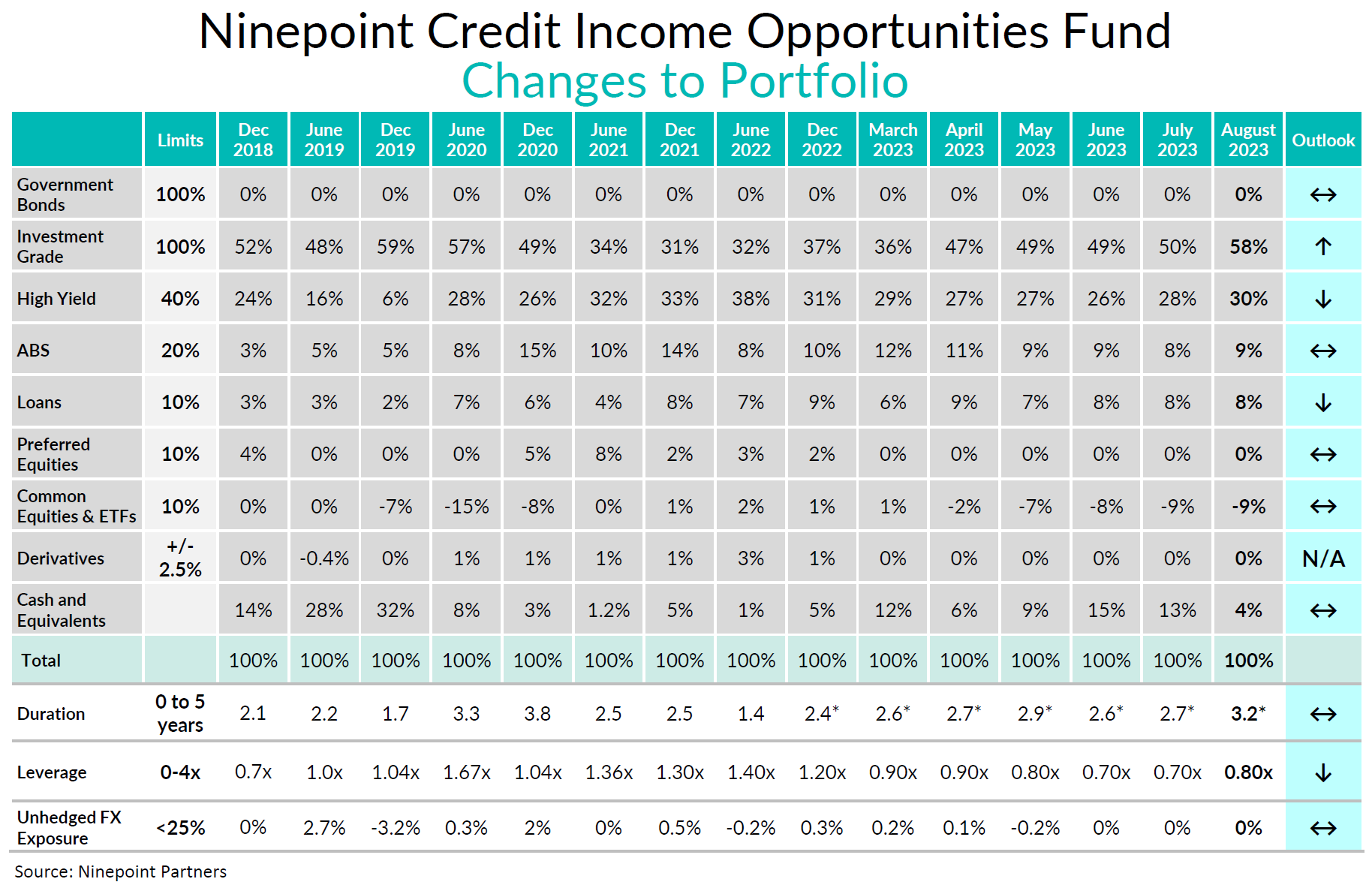

Credit Income Opportunities Fund (Credit Ops)

As we have been defensively positioned for some time now, there were no material changes to the portfolio other than duration moving higher by 0.5 years since we took advantage of the backup in government bond yields in August (recall, we alluded to this in our July 2023 commentary). As of month-end, duration stood at 3.2 years while still offering a very attractive yield-to-maturity of 10.8% (vs 10.5% one month prior). The portfolio has plenty of liquidity, especially this September as many bonds mature this month (both HY and IG). We have been sharpening our pencils on how best to deploy this liquidity, but rest assured we will remain in a defensive posture. Leverage remains very low based on our historical standards but did rise 0.1x to 0.8x in August. This is by design since numerous bonds mature this month in the portfolio helping bring down net leverage organically. Our short position in HYG (used for credit hedging purposes) remains at our target of -10%.

Until next month,

Mark, Etienne & Nick

Ninepoint Partners

1 All Ninepoint Diversified Bond Fund returns and fund details are a) based on Series F units; b) net of fees; c) annualized if period is greater than one year; d) as at August 31, 2023 1 All Ninepoint Credit Income Opportunities Fund returns and fund details are a) based on Class F units; b) net of fees; c) annualized if period is greater than one year; d) as at August 31, 2023. 1 All Ninepoint Alternative Credit Opportunities Fund returns and fund details are a) based on Class F units; b) net of fees; c) annualized if period is greater than one year; d) as at August 31, 2023.

The Risks associated worth investing in a Fund depend on the securities and assets in which the Funds invests, based upon the Fund's particular objectives. There is no assurance that any Fund will achieve its investment objective, and its net asset value, yield and investment return will fluctuate from time to time with market conditions. There is no guarantee that the full amount of your original investment in a Fund will be returned to you. The Funds are not insured by the Canada Deposit Insurance Corporation or any other government deposit insurer. Please read a Fund's prospectus or offering memorandum before investing.

Ninepoint Credit Income Opportunities Fund is offered on a private placement basis pursuant to an offering memorandum and are only available to investors who meet certain eligibility or minimum purchase amount requirements under applicable securities legislation. The offering memorandum contains important information about the Funds, including their investment objective and strategies, purchase options, applicable management fees, performance fees, other charges and expenses, and should be read carefully before investing in the Funds. Performance data represents past performance of the Fund and is not indicative of future performance. Data based on performance history of less than five years may not give prospective investors enough information to base investment decisions on. Please contact your own personal advisor on your particular circumstance. This communication does not constitute an offer to sell or solicitation to purchase securities of the Fund.

Ninepoint Partners LP is the investment manager to the Ninepoint Funds (collectively, the “Funds”). Commissions, trailing commissions, management fees, performance fees (if any), other charges and expenses all may be associated with mutual fund investments. Please read the prospectus carefully before investing. The indicated rate of return for series F units of the Fund for the period ended August 31, 2023 is based on the historical annual compounded total return including changes in unit value and reinvestment of all distributions and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The information contained herein does not constitute an offer or solicitation by anyone in the United States or in any other jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. Prospective investors who are not resident in Canada should contact their financial advisor to determine whether securities of the Fund may be lawfully sold in their jurisdiction.

The opinions, estimates and projections (“information”) contained within this report are solely those of Ninepoint Partners LP and are subject to change without notice. Ninepoint Partners makes every effort to ensure that the information has been derived from sources believed to be reliable and accurate. However, Ninepoint Partners assumes no responsibility for any losses or damages, whether direct or indirect, which arise out of the use of this information. Ninepoint Partners is not under any obligation to update or keep current the information contained herein. The information should not be regarded by recipients as a substitute for the exercise of their own judgment. Please contact your own personal advisor on your particular circumstances. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds managed by Ninepoint Partners LP. Any reference to a particular company is for illustrative purposes only and should not to be considered as investment advice or a recommendation to buy or sell nor should it be considered as an indication of how the portfolio of any investment fund managed by Ninepoint Partners LP is or will be invested. Ninepoint Partners LP and/or its affiliates may collectively beneficially own/control 1% or more of any class of the equity securities of the issuers mentioned in this report. Ninepoint Partners LP and/or its affiliates may hold short position in any class of the equity securities of the issuers mentioned in this report. During the preceding 12 months, Ninepoint Partners LP and/or its affiliates may have received remuneration other than normal course investment advisory or trade execution services from the issuers mentioned in this report.

Ninepoint Partners LP: Toll Free: 1.866.299.9906. DEALER SERVICES: CIBC Mellon GSSC Record Keeping Services: Toll Free: 1.877.358.0540

Related Funds

Historical Commentary

- Fixed Income Strategy 12/2023

- Fixed Income Strategy 11/2023

- Fixed Income Strategy 10/2023

- Fixed Income Strategy 09/2023

- Fixed Income Strategy 07/2023

- Fixed Income Strategy 06/2023

- Fixed Income - H1 2023 Market Review and Outlook

- Fixed Income Strategy 05/2023

- Fixed Income Strategy 04/2023

- Fixed Income Strategy 03/2023

- Fixed Income Strategy 02/2023

- Fixed Income Strategy 01/2023