Ninepoint Fixed Income Strategy

June 2023 Commentary

Monthly commentary discusses recent developments across the Diversified Bond, Alternative Credit Opportunities and Credit Income Opportunities Funds.

Summary

- The Fed signals two more hikes this year, the market is pricing-in one

- The BoC hiked again in July, and is probably done

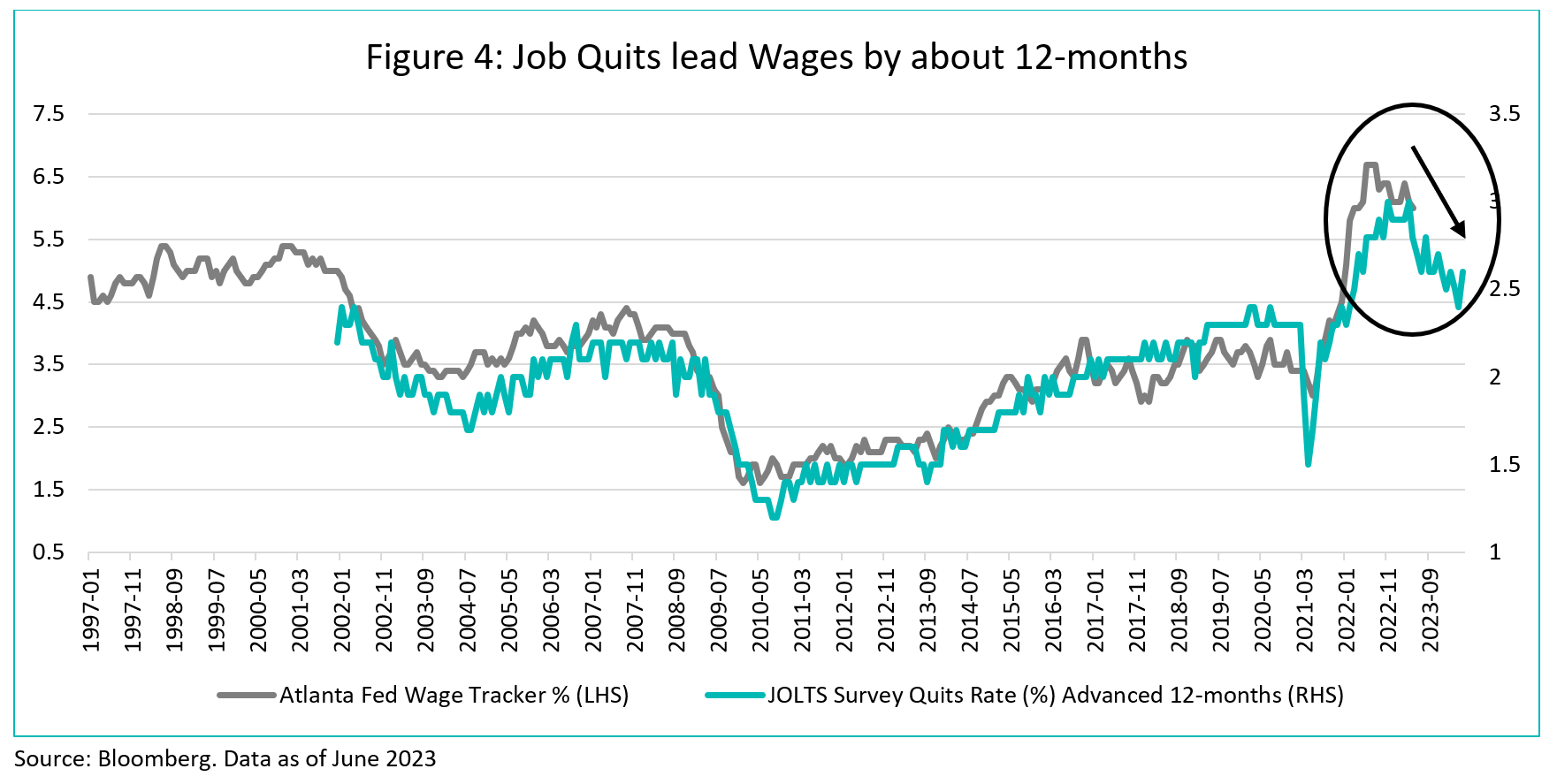

- Overall, the labour markets in North America are showing early signs of softening. The unemployment rate is off cycle lows and wages are decelerating

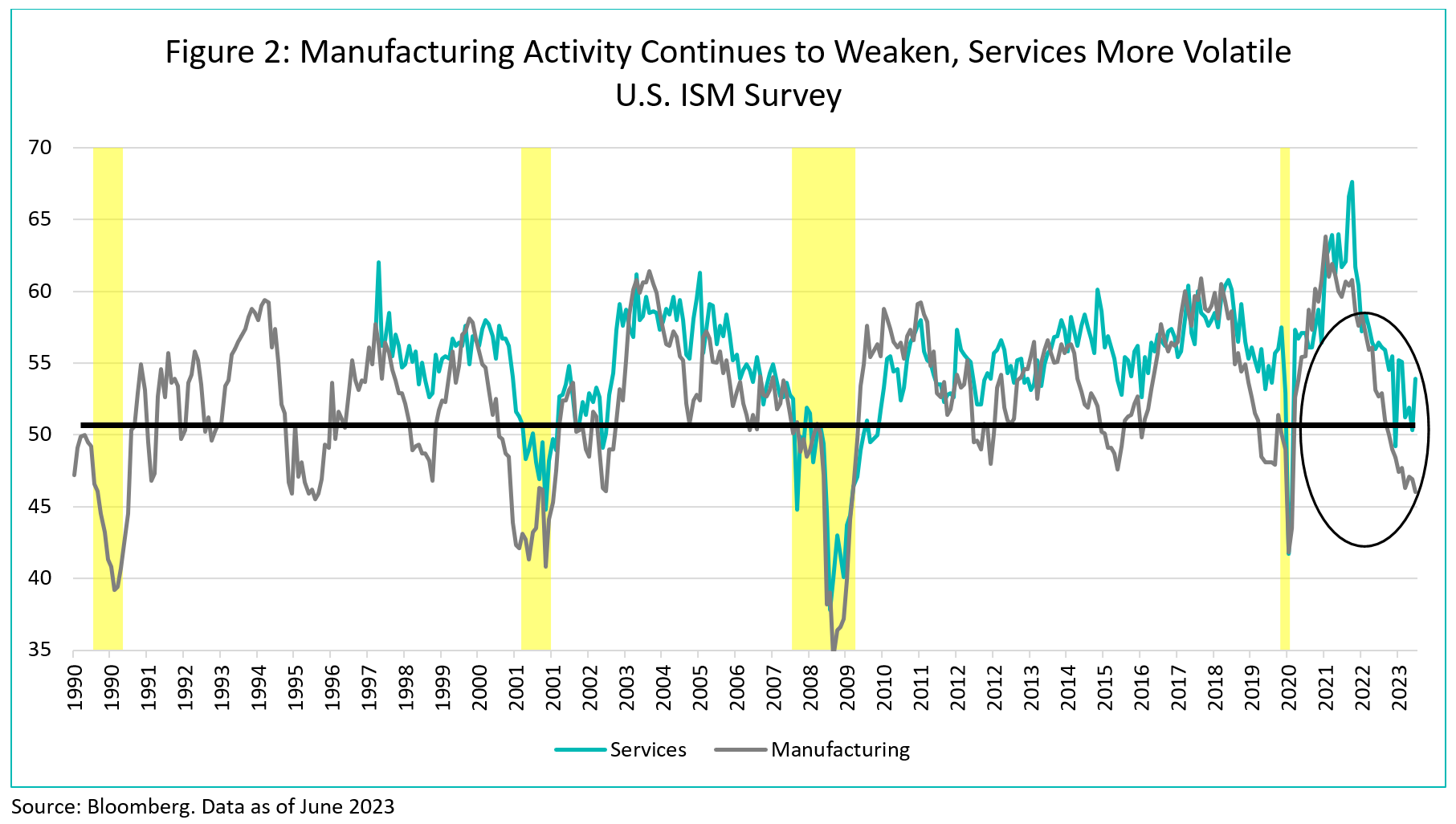

- Manufacturing has been contracting for numerous (8) months now, while services remain more resilient

- In credit, cracks are starting to appear in lower quality securities; we are cautious on high yield and leveraged loans

Macro

The June FOMC meeting was, as usual, the highlight this past month. As widely expected, the Fed did not raise the Fed Funds Rate at the June meeting but delivered as hawkish a “pause” or “skip” as they could. The famous dot-plot showed that FOMC participants now expect 2 more rate increases this year, taking the Funds Rate to 5.6% by year end. This took market participants by surprise. Most, including us, expected one more hike in July to conclude the hiking cycle. Why would the FOMC signal that they are done with the hiking cycle (i.e., signal a pause), when that could lead to a loosening of financial conditions (i.e. stocks higher, bond yields lower)? Maybe to leave the market guessing for as long as possible. Clever move by the Fed. However, it seems that Powell failed to completely convince market participants that this surprise additional hike to 5.6% was anything other than jawboning. Fed Funds Futures at the time of writing were only showing one additional rate hike fully priced-in for 2023.

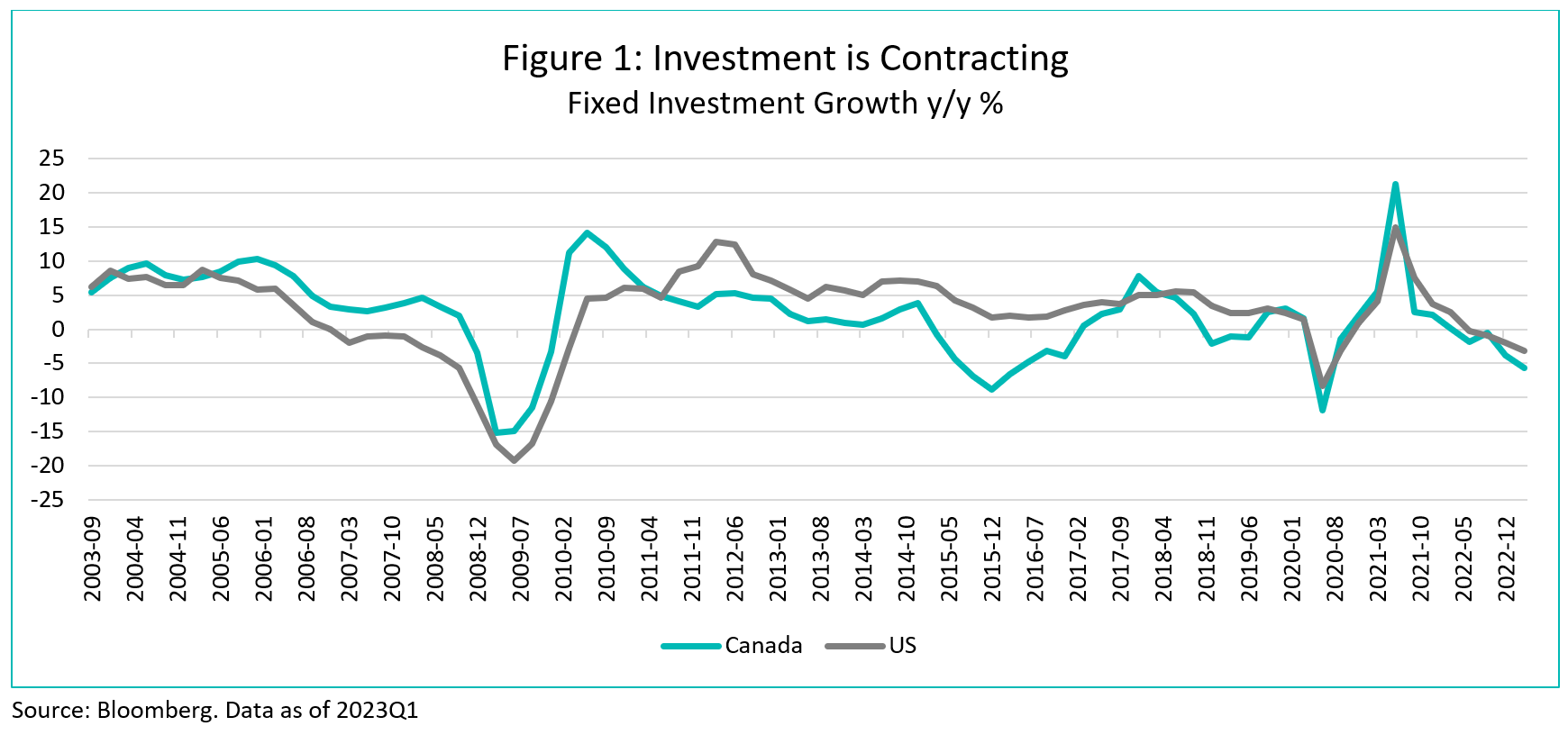

Whether it is one or two more hikes this year, doesn’t really matter. Overall, most of the heavy lifting has already been done by the Fed and BoC, and that is why we are confident that their respective hike cycles are nearing an end. Monetary policy operates with a significant lag, and it is slowly working its way through to the real economy, which was overheating. Yes, consumption in the first quarter has surprised to the upside, leading central bankers to revise their growth estimates for this year. But growth has decelerated meaningfully from the post-pandemic highs and the latest monthly indicators (Personal Consumption) show a measured slowdown in spending by households. Investment (machines, structures, houses, etc.), has been contracting for four quarters now (Figure 1), something we typically only see in periods of overall economic contraction.

By sector, manufacturing is already facing challenging conditions, contracting for the 8th straight month, according to the U.S. Institute for Supply Management (Figure 2). Thus far, demand for services remains strong enough to narrowly avoid a contraction.

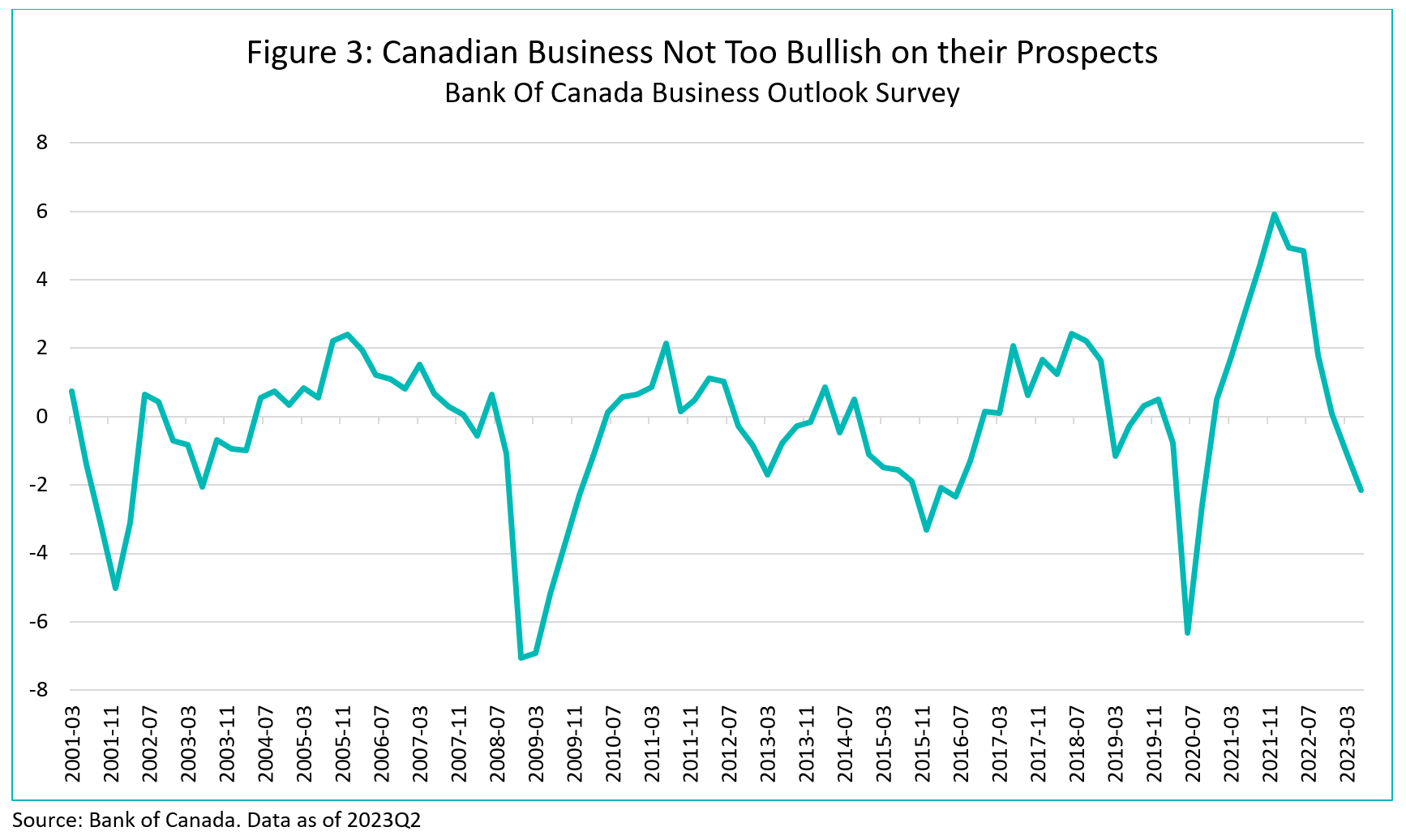

In Canada, the BoC’s recently released the Business Outlook Survey (2023Q2) which is also pointing to a contraction, posting a level last seen during the 2015-2016 oil-fuelled recession (Figure 3).

And the last piece of the inflation puzzle, labour markets, are finally normalizing. The unemployment rates in both Canada and the U.S. are up from their cycle lows and, judging by the pace at which Americans are quitting their jobs (the quits rate), U.S. wage growth is about to slow meaningfully (Figure 4).

So overall, the economy is broadly moving in the right direction, which should reassure policy makers. It simply takes time. With the Fed and BoC now fine tuning their respective benchmark rates to reflect the evolution of the economy and slowing inflation, this leaves market participants in a hyper data-dependent mode. Economic releases are often volatile, and rarely all go in a straight line. What matters most is the trend. With central bank policy at the cusp of a change of direction (i.e., permanent pause), every single release has an added measure of importance, leading to increased market volatility. As we like to say, we do not have a crystal ball, but strive to be directionally accurate in our views and positioning. At this point in the cycle most of the leading indicators that we follow, are heading in the direction of a slowdown in economic activity and a looming recession.

Credit

Investment Grade Credit aggregates performed well in June, driven by strong investor demand. Supply picked up this month and was generally well absorbed. Our overweight to large-cap banks (Canadian and U.S.) is finally paying off, with that sector outperforming. Given our view of a deteriorating economic outlook, we find overall credit spreads marginally unattractive at current levels. At this juncture, our credit exposure is concentrated in corporate bonds (average quality BBB) with term to maturity generally under 3 years. As such, we expect our funds to be less sensitive to a general widening in credit spreads.

We expect the new issue market to slow in the summer months, Q3 is generally very light. At the time of writing, total YTD Canadian issuance stands at $57.5bn, down 18% from the same time last year.

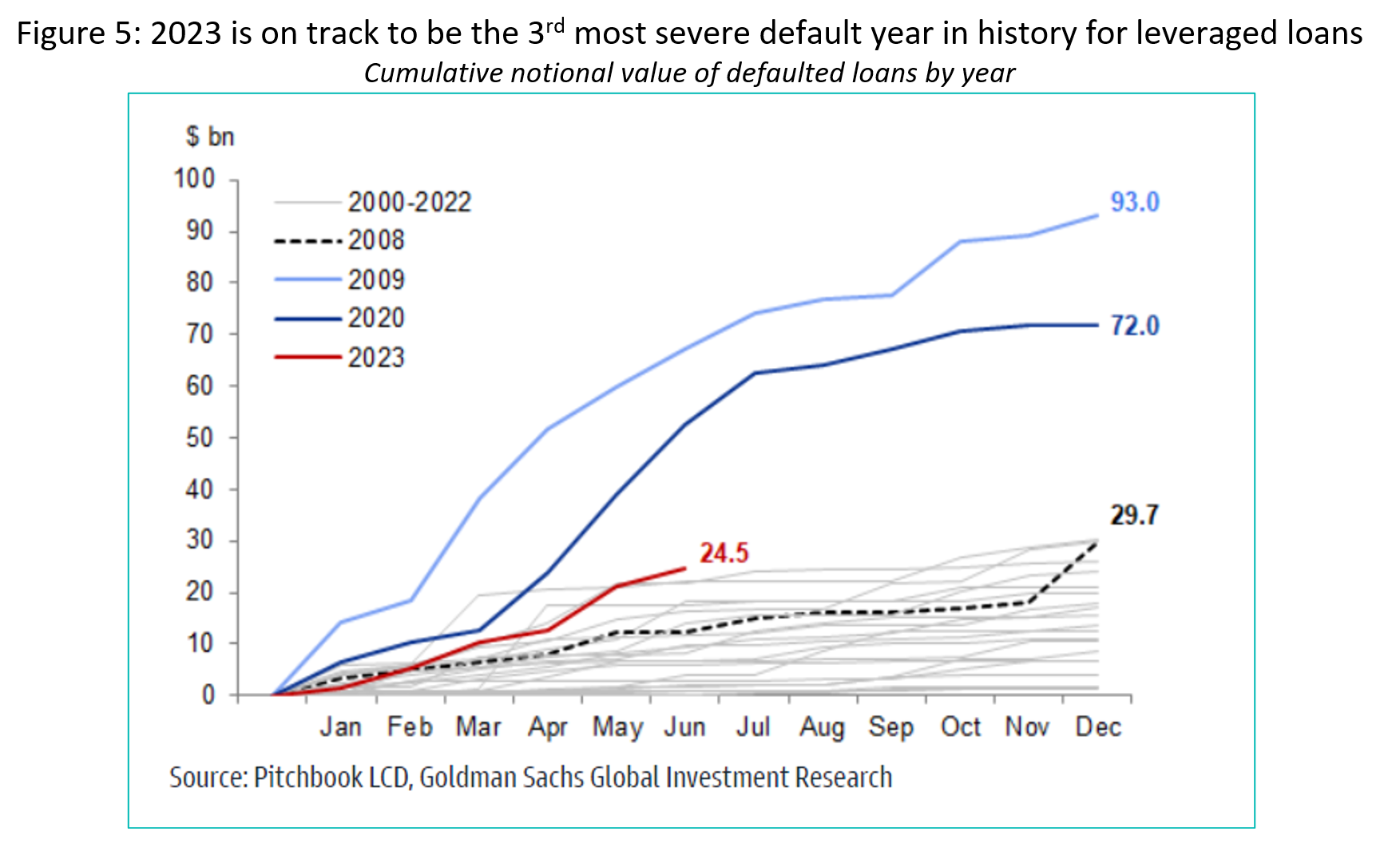

While broad credit markets (and equities) are still behaving quite well, some corners of the credit markets are starting to reflect the more challenging macroeconomic environment. Leveraged Loans, which are floating rate senior-secured loans to highly levered companies (often Private Equity sponsored), have been a fast-growing corner of the leveraged credit markets. Over the past several years, the U.S. Leveraged Loan market has caught up to the High Yield market and is now of about the same size. Because they pay a floating coupon, companies borrowing in that market have felt the full effect of the past 500bps of rate increases in the US. We borrowed Figure 5 below from Goldman Sachs Investment Research. It shows the cumulative value of loans having defaulted per year. At the current pace, 2023 will be the third worst year for leveraged loan defaults since 2000.

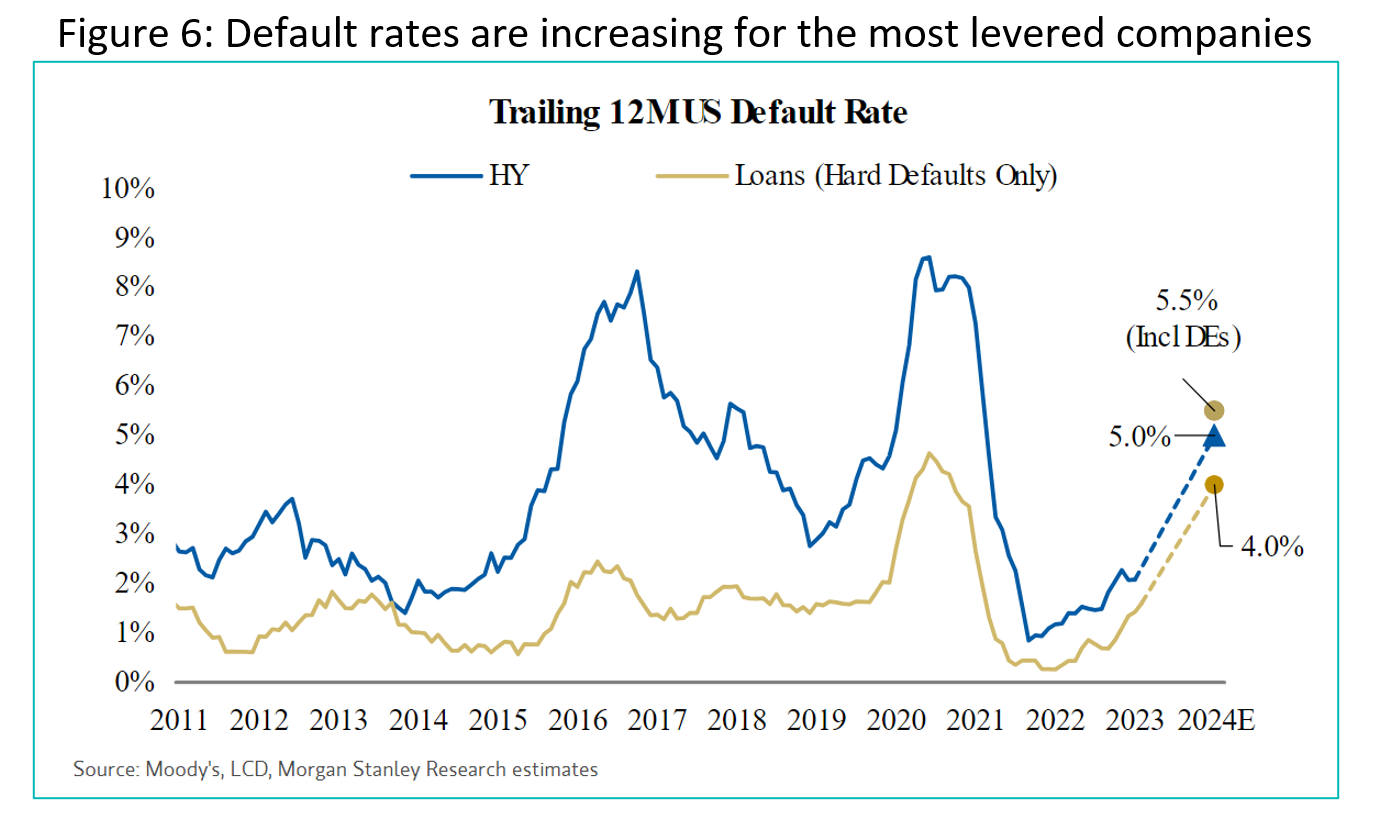

Similarly, in Figure 6 below, Morgan Stanley Research shows that HY and Loan default rates have picked up substantially this year, and forecast defaults in both asset classes to continue to increase.

Along with tightening credit conditions at banks, which typically lead to loan losses (Figure 7 below) (see our April commentary for a longer discussion of these dynamics), the developments year-to-date in the higher risk corners of the credit markets point to the start of a new credit cycle. There is already financial stress for the most highly leveraged companies, and the longer interest rates hold, the tougher it will be for those that took on too much leverage when the times were good. And that is why, at this point in the cycle, we are avoiding lower quality corporates, and focus on high quality companies with solid balance sheets. The current risk-reward simply isn’t there for us.

Ninepoint Diversified Bond Fund (DBF)

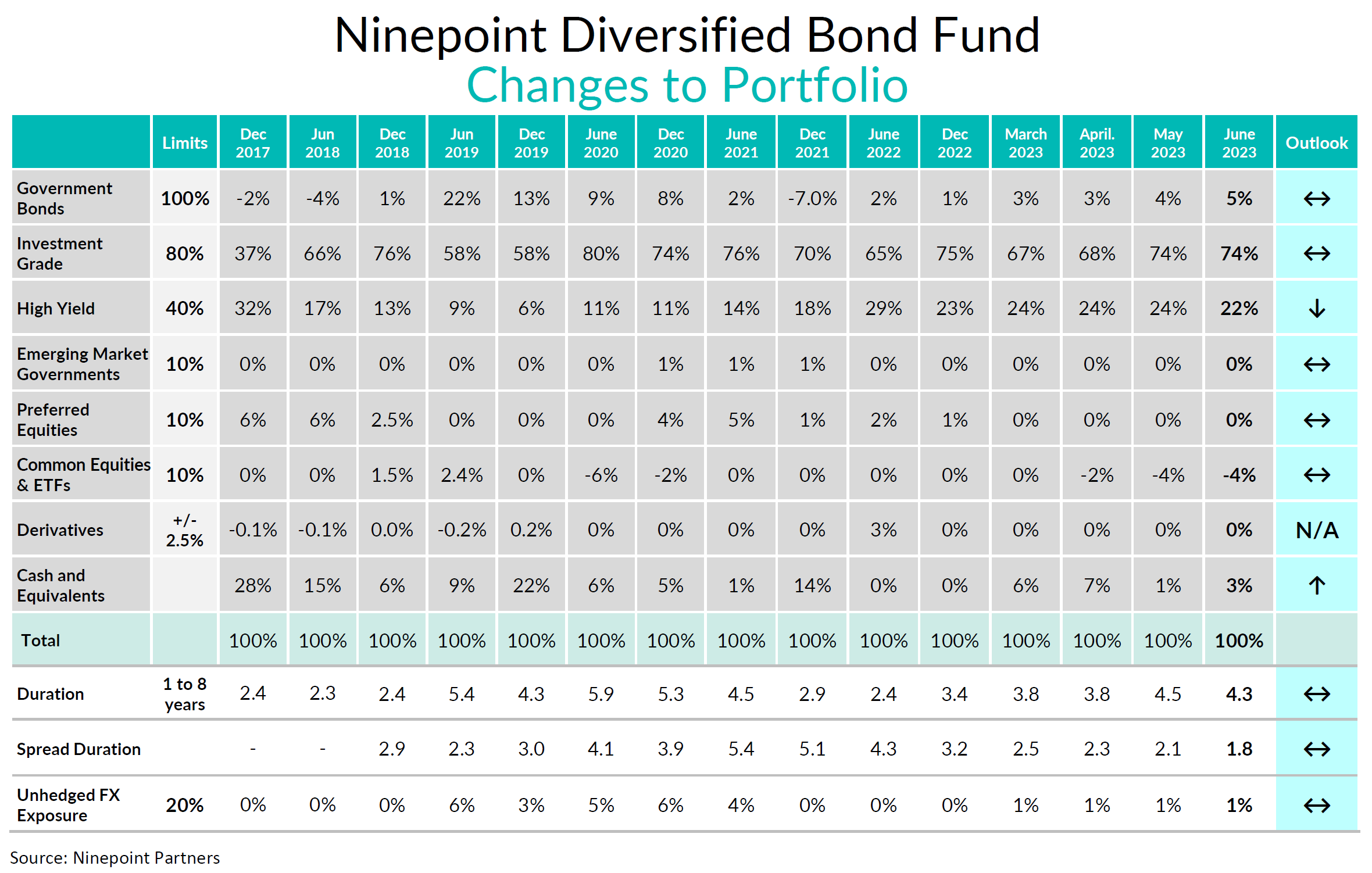

Given our macroeconomic outlook, the portfolio remains defensively positioned, while still offering a very attractive yield-to-maturity of 8.0%. Duration is holding steady at 4.3 years (vs 4.5 years last month and 3.9 the month prior). We don’t expect to move much beyond 5 years of duration. Additionally, spread duration continued to move down and ended the month at 1.8 years. A function of the inverse yield curve and our desire to insulate the portfolio from potentially wider credit spreads. In terms of liquidity, 30% of the portfolio matures within the next 12 months. We expect our High Yield exposure to continue to gradually drift lower as our very short dated HY bonds mature. We increased our short position in HYG (used for credit hedging purposes), which now stands at our target of -5% (subtracting from duration and spread duration).

Ninepoint Alternative Credit Opportunities Fund (NACO)

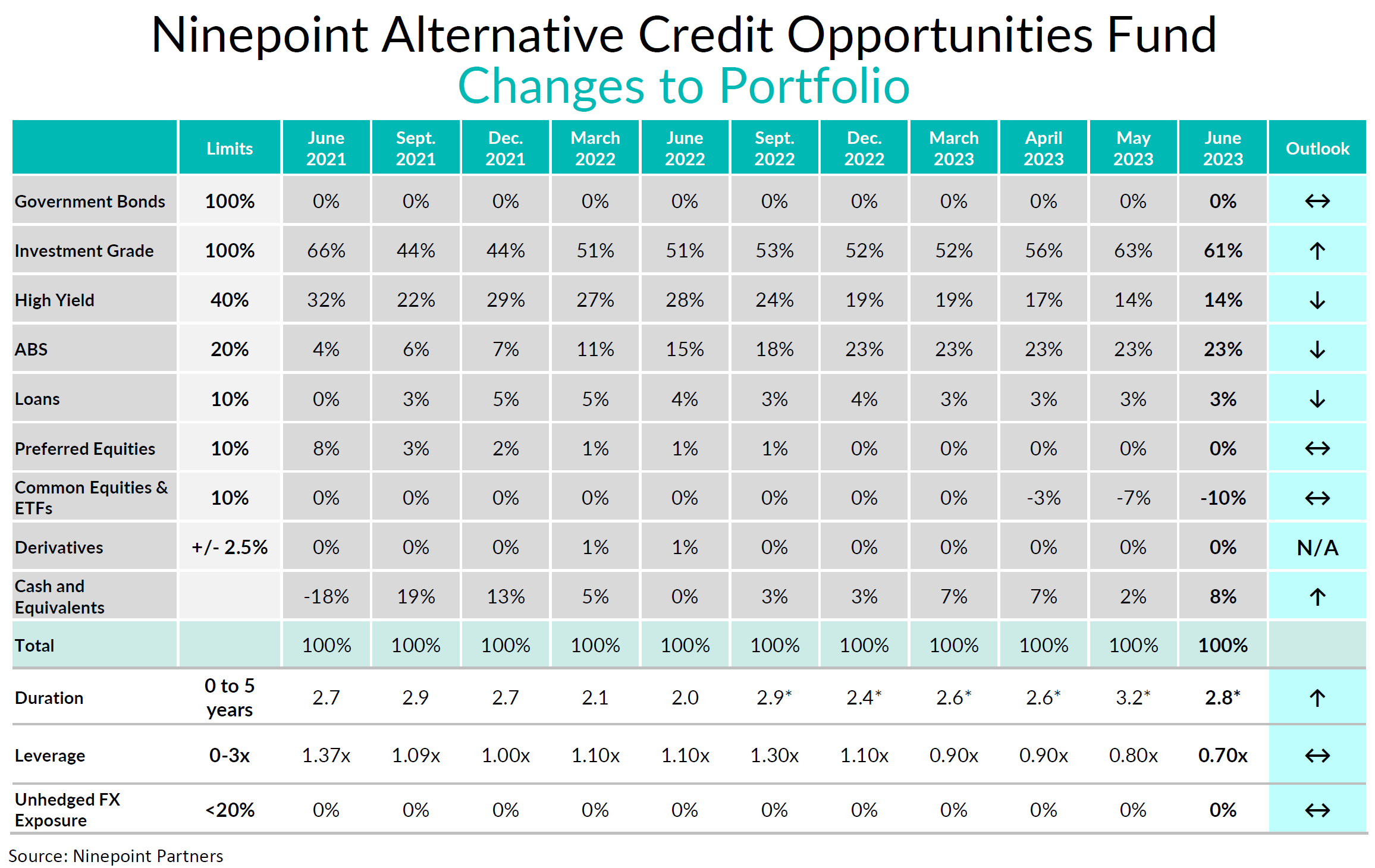

Given our macroeconomic outlook, the portfolio remains defensively positioned but still offers a very attractive yield-to-maturity of 9.9%. Duration drifted a little lower from last month (2.8 vs 3.2 years), primarily due to several retractions in credit (as opposed to a reduction in government bonds positions). Expect duration to drift a little higher as we add to our TLT options position. We brought down leverage during the month and as of month-end was 0.7x (vs 0.8 last month). Given the yield curve is the most inverted it has been all year, we are finding many attractive opportunities in the front end, both outright and in switch. We also trimmed select high yield securities while moving into high quality short dated corporate bonds. In terms of liquidity, 30% of the portfolio matures within the next 12 months. Our HYG hedge now stands at our target of 10% (subtracting from duration and spread duration).

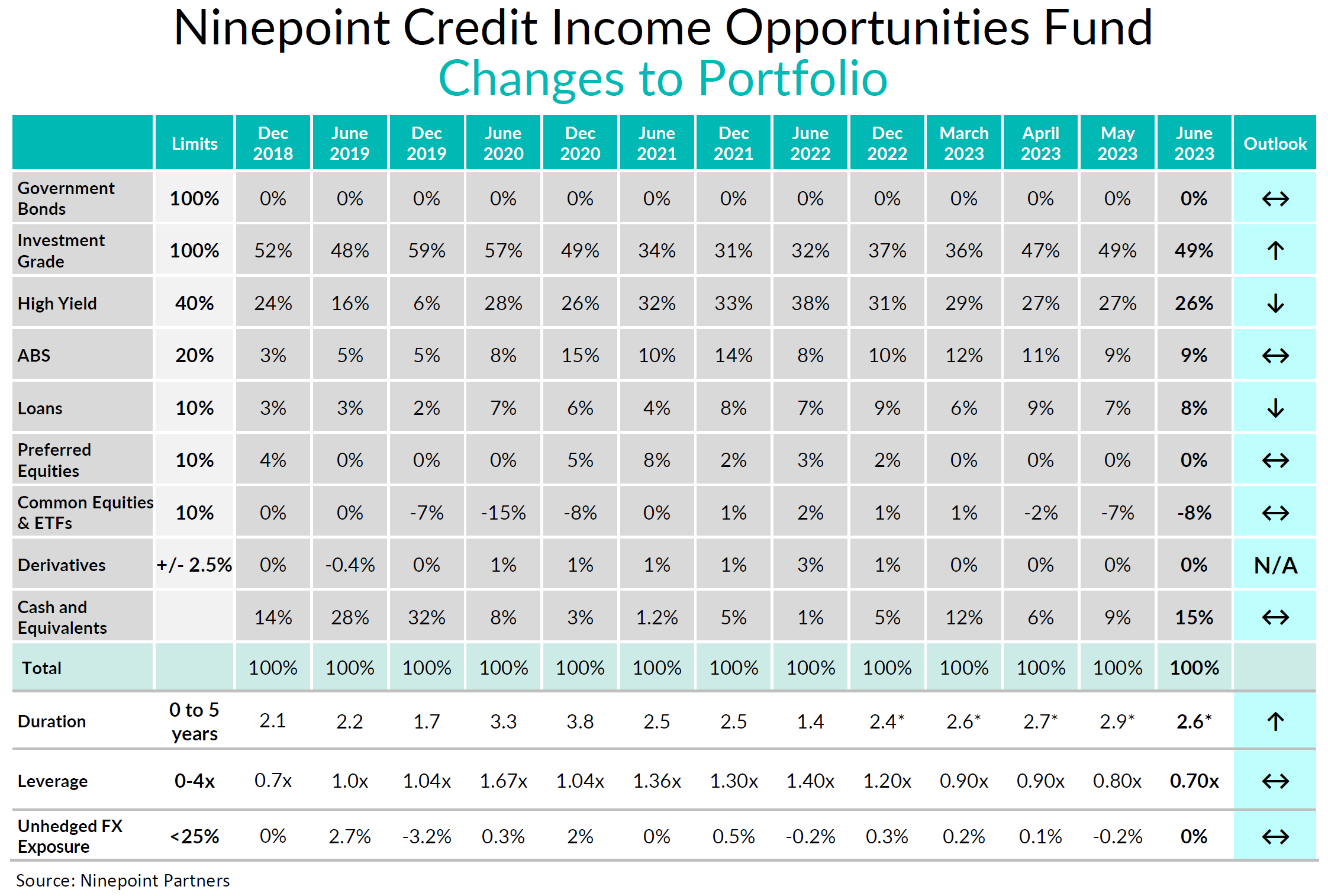

Ninepoint Credit Income Opportunities Fund (Credit Ops)

Given our macroeconomic outlook, the portfolio remains defensively positioned but still offers a very attractive yield-to-maturity of 10.8%. Duration is down slightly from last month (2.6 vs 2.9 years), reflecting a move to shorted dated credit (as opposed to a reduction in long term government bonds exposure). Spread duration moved down again by 0.7 years and sits at 4.0 years. Expect duration to keep drifting higher as we add to our TLT options position. We trimmed some securities that have had a good run which resulted in leverage ticking down to 0.7x (vs 0.8x last month). In terms of liquidity, 30% of the portfolio matures within the next 12 months. Our HYG hedge is now at target (-10%), subtracting from both duration and spread duration.

Conclusion

The summer of 2023 will be crucial for our recession thesis. We expect economic data to broadly decelerate. Some indicators are already flashing red (manufacturing, investment, goods inflation), while others have been slower to react to monetary policy (consumption, services sector, services inflation). Over the coming months, we will continue to carefully evaluate the progression of economic releases and update our views accordingly.

The funds are well positioned to weather market volatility. We are generating lots of yield from lower-risk short-dated corporate bonds, have ample liquidity, some credit hedges and long-term government bond duration for ballast. This is the same playbook we employed in 2019 and early 2020, and it served our clients well, allowing us to act from a position of strength once the recession finally started.

Until next month,

Mark, Etienne & Nick

Ninepoint Partners

1 All Ninepoint Diversified Bond Fund returns and fund details are a) based on Series F units; b) net of fees; c) annualized if period is greater than one year; d) as at June 30, 2023 1 All Ninepoint Credit Income Opportunities Fund returns and fund details are a) based on Class F units; b) net of fees; c) annualized if period is greater than one year; d) as at June 30, 2023. 1 All Ninepoint Alternative Credit Opportunities Fund returns and fund details are a) based on Class F units; b) net of fees; c) annualized if period is greater than one year; d) as at June 30, 2023.

The Risks associated worth investing in a Fund depend on the securities and assets in which the Funds invests, based upon the Fund's particular objectives. There is no assurance that any Fund will achieve its investment objective, and its net asset value, yield and investment return will fluctuate from time to time with market conditions. There is no guarantee that the full amount of your original investment in a Fund will be returned to you. The Funds are not insured by the Canada Deposit Insurance Corporation or any other government deposit insurer. Please read a Fund's prospectus or offering memorandum before investing.

Ninepoint Credit Income Opportunities Fund is offered on a private placement basis pursuant to an offering memorandum and are only available to investors who meet certain eligibility or minimum purchase amount requirements under applicable securities legislation. The offering memorandum contains important information about the Funds, including their investment objective and strategies, purchase options, applicable management fees, performance fees, other charges and expenses, and should be read carefully before investing in the Funds. Performance data represents past performance of the Fund and is not indicative of future performance. Data based on performance history of less than five years may not give prospective investors enough information to base investment decisions on. Please contact your own personal advisor on your particular circumstance. This communication does not constitute an offer to sell or solicitation to purchase securities of the Fund.

Ninepoint Partners LP is the investment manager to the Ninepoint Funds (collectively, the “Funds”). Commissions, trailing commissions, management fees, performance fees (if any), other charges and expenses all may be associated with mutual fund investments. Please read the prospectus carefully before investing. The indicated rate of return for series F units of the Fund for the period ended June 30, 2023 is based on the historical annual compounded total return including changes in unit value and reinvestment of all distributions and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The information contained herein does not constitute an offer or solicitation by anyone in the United States or in any other jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. Prospective investors who are not resident in Canada should contact their financial advisor to determine whether securities of the Fund may be lawfully sold in their jurisdiction.

The opinions, estimates and projections (“information”) contained within this report are solely those of Ninepoint Partners LP and are subject to change without notice. Ninepoint Partners makes every effort to ensure that the information has been derived from sources believed to be reliable and accurate. However, Ninepoint Partners assumes no responsibility for any losses or damages, whether direct or indirect, which arise out of the use of this information. Ninepoint Partners is not under any obligation to update or keep current the information contained herein. The information should not be regarded by recipients as a substitute for the exercise of their own judgment. Please contact your own personal advisor on your particular circumstances. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds managed by Ninepoint Partners LP. Any reference to a particular company is for illustrative purposes only and should not to be considered as investment advice or a recommendation to buy or sell nor should it be considered as an indication of how the portfolio of any investment fund managed by Ninepoint Partners LP is or will be invested. Ninepoint Partners LP and/or its affiliates may collectively beneficially own/control 1% or more of any class of the equity securities of the issuers mentioned in this report. Ninepoint Partners LP and/or its affiliates may hold short position in any class of the equity securities of the issuers mentioned in this report. During the preceding 12 months, Ninepoint Partners LP and/or its affiliates may have received remuneration other than normal course investment advisory or trade execution services from the issuers mentioned in this report.

Ninepoint Partners LP: Toll Free: 1.866.299.9906. DEALER SERVICES: CIBC Mellon GSSC Record Keeping Services: Toll Free: 1.877.358.0540

Related Funds

Historical Commentary

- Fixed Income Strategy 12/2023

- Fixed Income Strategy 11/2023

- Fixed Income Strategy 10/2023

- Fixed Income Strategy 09/2023

- Fixed Income Strategy 08/2023

- Fixed Income Strategy 07/2023

- Fixed Income - H1 2023 Market Review and Outlook

- Fixed Income Strategy 05/2023

- Fixed Income Strategy 04/2023

- Fixed Income Strategy 03/2023

- Fixed Income Strategy 02/2023

- Fixed Income Strategy 01/2023