Ninepoint Fixed Income Strategy

December 2023 Commentary

Monthly commentary discusses recent developments across the Ninepoint Diversified Bond, Ninepoint Alternative Credit Opportunities and Ninepoint Credit Income Opportunities Funds.

Summary

- Despite all the ups and downs in rates, high quality short-term corporate bonds performed well, generating a lot of income for the funds.

- Long-term interest rates rallied a lot in Q4, we expect a consolidation before the next leg lower.

- Canadian LRCN and Hybrid bonds remain cheap vs global peers.

- With IG and HY credit spreads almost back to 2021 levels, we see little reason to add more credit exposure. We are comfortable with our current defensive posture.

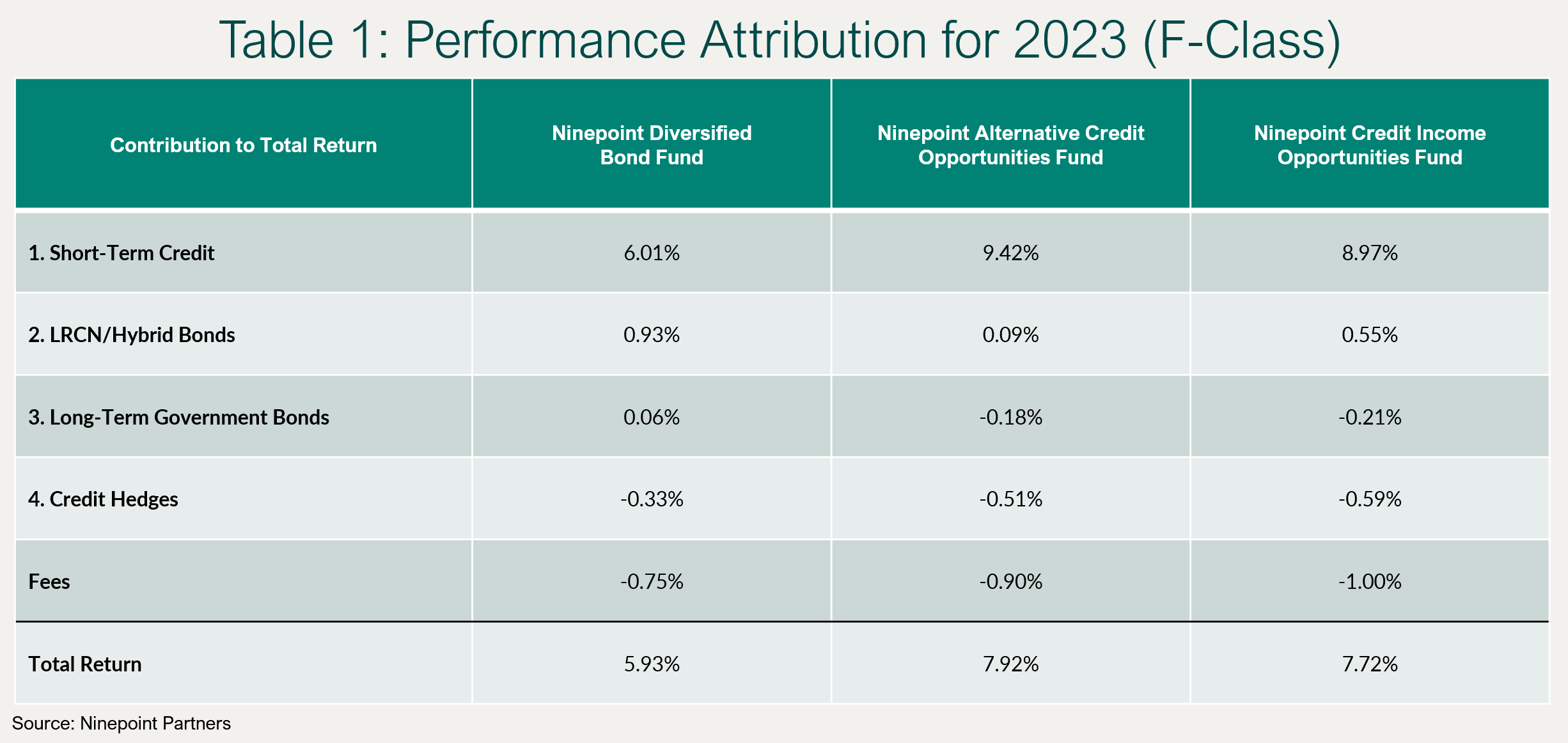

Given that we have already published our 2024 Outlook last month, we will focus this monthly commentary on our 2023 performance attribution. As discussed in our Outlook, we split the portfolios into four general categories or building blocks. We will therefore present performance attribution using those same groups in Table 1 below.

As a reminder, for simplicity, at this point in the cycle, we divide our portfolios into four building blocks:

1. Short-Term High-Grade Credit (under 3-years, A- average rating) as our anchor and main source of income,

2. LRCN/Hybrid Bonds of Canadian Investment Grade issuers, as they are very cheap and offer good upside with low risk of default,

3. Long-Term Government Bonds, as a safe-haven asset, they tend to perform very well in a challenging economic environment,

4. Credit Hedges, primarily through a short position in US High Yield ETFs, because they are the most vulnerable in an economic downturn and are currently priced to perfection.

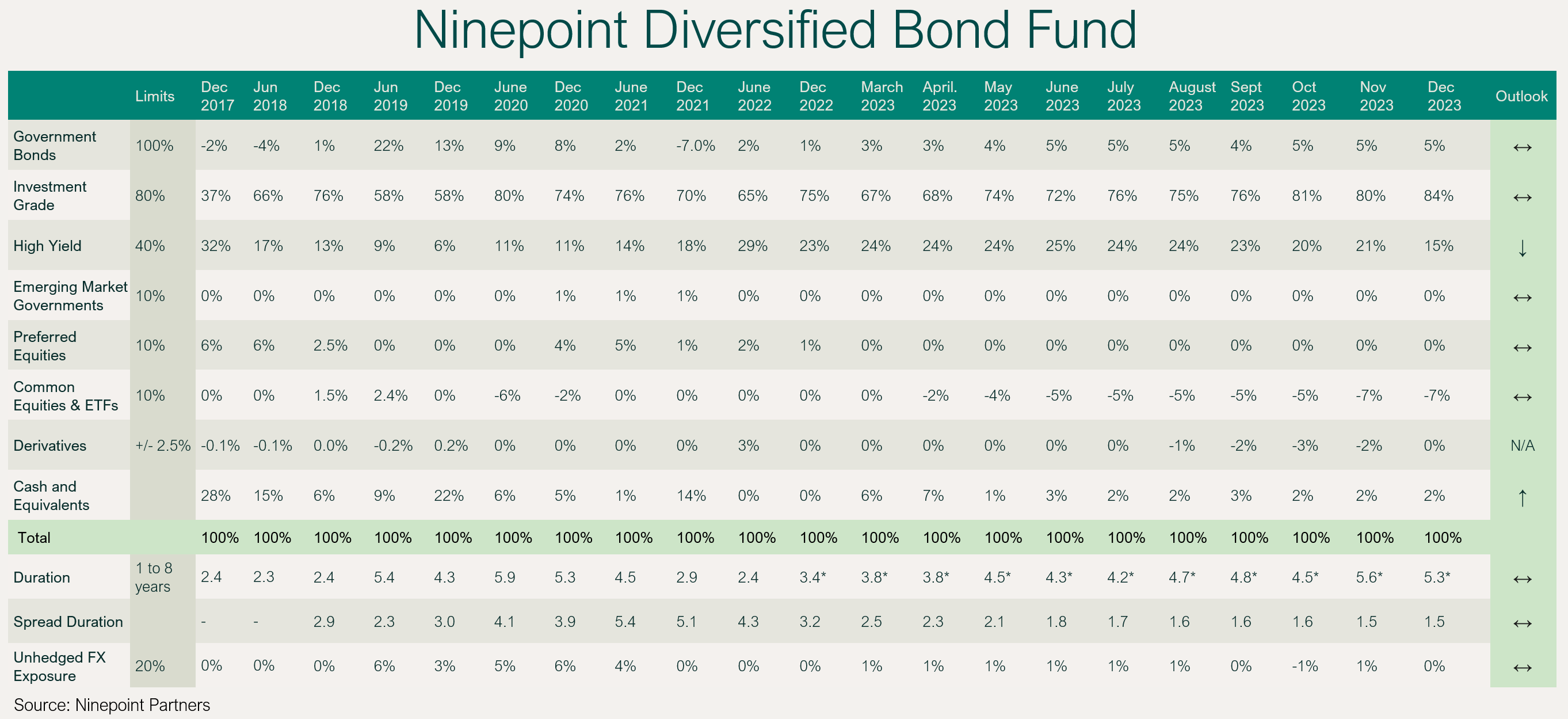

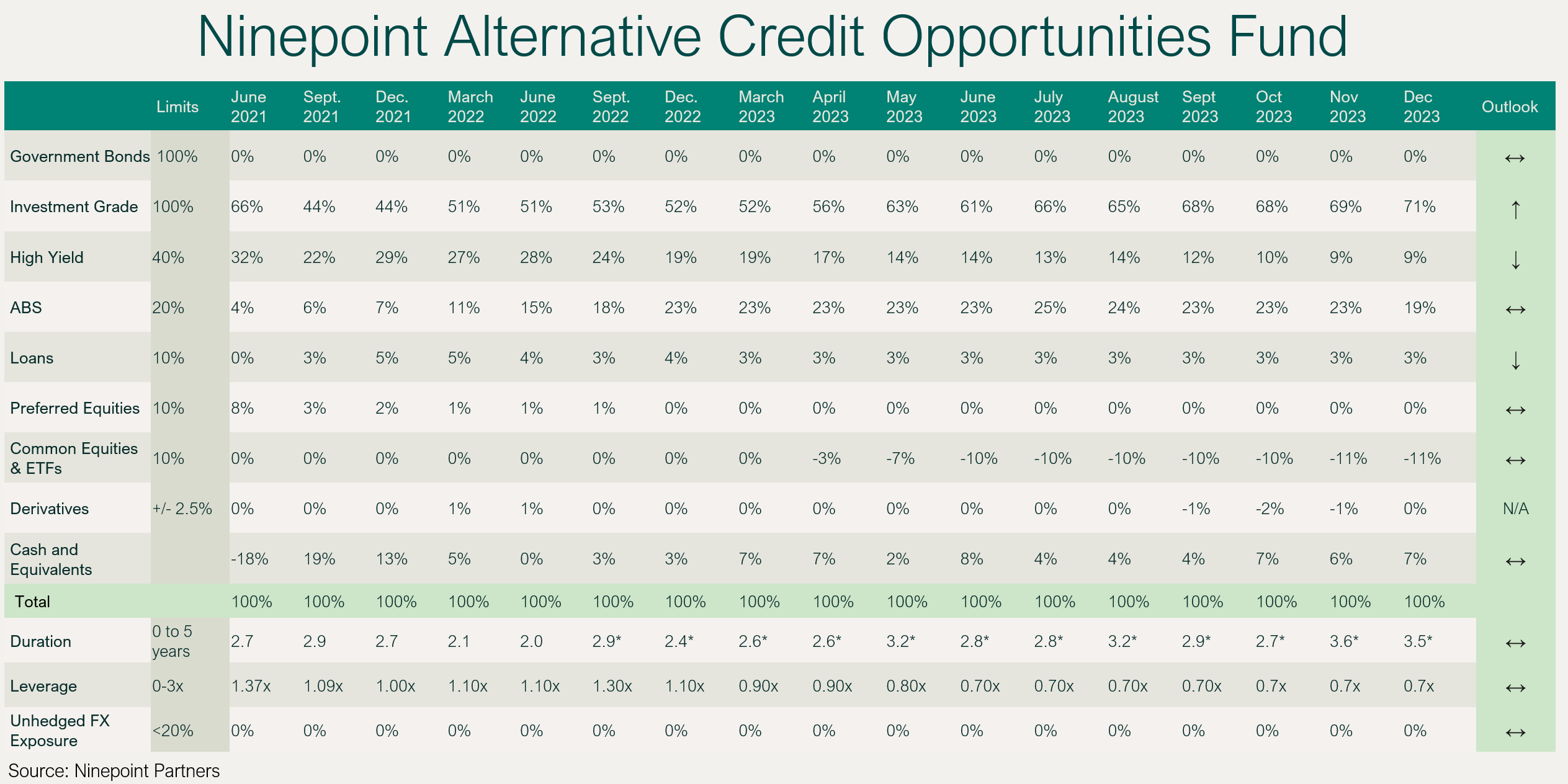

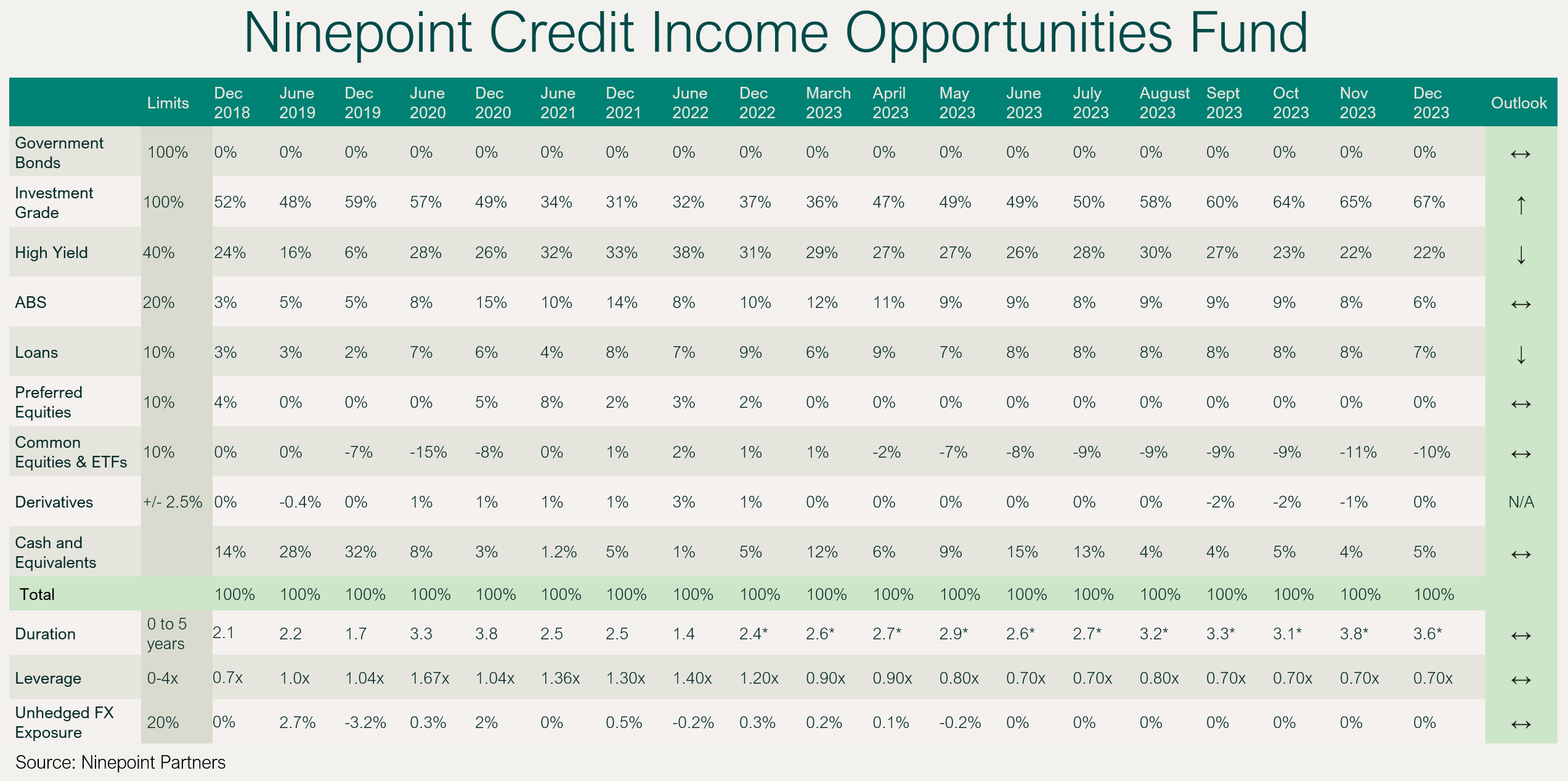

As expected, our short-term corporate bonds, which make up most of the portfolios, contributed the vast majority of the return. For the Alternative Credit Opportunities (NACO) and the Credit Income Opportunities (Ops) funds, the return is illustrated net of funding costs (i.e. the cost of leverage). For the foreseeable future, we expect this segment of the portfolios to maintain similar weights to last year (~80% for DBF, ~170% for NACO and Ops). With the Q4 rally in both rates and credit spreads, the overall yield of this segment of the portfolio has declined somewhat, but remains above 6%, providing us with a solid starting point for 2024.

LRCN and Hybrid Bonds had a volatile year, selling-off hard with the banking stress of March, and recovering only later in Q3 and Q4. Given our outlook for a softer economic environment in 2024, we expect that segment of the portfolio to contribute its cash yield (about 5.5%), but price gains to be limited. Why not more downside, given the credit sensitive nature of those bonds? If we do get a recession, interest rates will be cut by the Fed/BoC, probably by about 200-300bps. That should be enough to offset the spread widening of these bonds, keeping their prices roughly unchanged. Given the recent rally, we have taken some profit, reducing our weight on these securities by a few percent across the funds.

For the full year, our position in long-term government bonds was a small benefit to the performance of the DBF, and a small net detractor to the performance of NACO and Ops. At the worst, towards the end of October, they detracted by as much as 2.5% from performance, only to reverse that loss as long-term bonds rallied in the last two months of the year. With the magnitude of the rally in late 2023, we expect a period of consolidation, particularly given the overly ambitious market expectations for interest rate cuts as early as March. But, as the economy gradually loses steam and the prospect for rate cuts becomes imminent, we expect the rally in long-term government bonds to resume. We are primarily exposed through option positions on the TLT ETF (30-year US government bond ETF). We sold put spreads to buy call spreads, spending no premium by design. With our current positioning, a further rally in the U.S. 30-year government bond to 3% (from the current rate of ~4.2%) would contribute about 3 to 4% of NAV, depending on the fund. We do not intend on increasing this position, but we will keep rolling it forward as options expire.

The last building block of our portfolios is credit hedges. As of year end, we have a short position in US High Yield ETFs (HYG and JNK). Earlier in 2023, we also had payer spreads in CDX IG (think put spreads on pure US credit spreads), which were monetized with the March credit sell-off. On net, our credit hedging program detracted from performance by about 30bps for DBF, and 50-60bps for NACO and Ops, respectively. In such an uncertain economic environment, this was a fair price to pay for extra ballast, and with HY spreads as tight as they are now (back to 2021 levels, when we had 0% rates, QE and fiscal easing), we view this as a highly asymmetric hedge, and therefore do not plan on reducing it. In a recession scenario, HY credit spreads could widen to around 800 to 1000bps, not stay at 350bps where they are now. We therefore see a lot of upside to this short position, if our recession scenario is to materialize.

Conclusion

The funds returned between 6% to 8% in 2023, and most of that return was driven by the core income position, short-term corporate bonds. The backdrop going into 2024 is quite similar to last year, and we expect that portion of the portfolio to continue to generate the bulk of our returns. But, whereas our long-term government bonds and credit hedges contributed very modestly or even detracted from performance last year, 2024 could be the year where they deliver, and help drive higher returns.

This situation is very similar to what happened to us in 2019 and 2020. We were defensive all year in 2019, as the global economy weakened. Little did we know that a global pandemic was coming, but our models were pointing to a downturn nonetheless. We underperformed in 2019, but in 2020, our defensive positioning paid off, hedges were monetized, and we acted from a position of strength. We are following a very similar playbook.

We will remain defensively positioned across the portfolios for the foreseeable future. If we get a hard landing, we should benefit handsomely. And, given how far credit spreads have already rallied, even if we do not go into recession, we believe that there is not much gas left in the tank should the soft-landing scenario materialize. Markets are already fully pricing that in.

Happy New Year!

Mark, Etienne & Nick

Ninepoint Partners

Appendix: Portfolio Characteristics

1 All Ninepoint Diversified Bond Fund returns and fund details are a) based on Series F units; b) net of fees; c) annualized if period is greater than one year; d) as at December 31, 2023 1 All Ninepoint Credit Income Opportunities Fund returns and fund details are a) based on Class F units; b) net of fees; c) annualized if period is greater than one year; d) as at December 31, 2023. 1 All Ninepoint Alternative Credit Opportunities Fund returns and fund details are a) based on Class F units; b) net of fees; c) annualized if period is greater than one year; d) as at December 31, 2023.

The Risks associated worth investing in a Fund depend on the securities and assets in which the Funds invests, based upon the Fund's particular objectives. There is no assurance that any Fund will achieve its investment objective, and its net asset value, yield and investment return will fluctuate from time to time with market conditions. There is no guarantee that the full amount of your original investment in a Fund will be returned to you. The Funds are not insured by the Canada Deposit Insurance Corporation or any other government deposit insurer. Please read a Fund's prospectus or offering memorandum before investing.

Ninepoint Credit Income Opportunities Fund is offered on a private placement basis pursuant to an offering memorandum and are only available to investors who meet certain eligibility or minimum purchase amount requirements under applicable securities legislation. The offering memorandum contains important information about the Funds, including their investment objective and strategies, purchase options, applicable management fees, performance fees, other charges and expenses, and should be read carefully before investing in the Funds. Performance data represents past performance of the Fund and is not indicative of future performance. Data based on performance history of less than five years may not give prospective investors enough information to base investment decisions on. Please contact your own personal advisor on your particular circumstance. This communication does not constitute an offer to sell or solicitation to purchase securities of the Fund.

Ninepoint Partners LP is the investment manager to the Ninepoint Funds (collectively, the “Funds”). Commissions, trailing commissions, management fees, performance fees (if any), other charges and expenses all may be associated with mutual fund investments. Please read the prospectus carefully before investing. The indicated rate of return for series F units of the Fund for the period ended December 31, 2023 is based on the historical annual compounded total return including changes in unit value and reinvestment of all distributions and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The information contained herein does not constitute an offer or solicitation by anyone in the United States or in any other jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. Prospective investors who are not resident in Canada should contact their financial advisor to determine whether securities of the Fund may be lawfully sold in their jurisdiction.

The opinions, estimates and projections (“information”) contained within this report are solely those of Ninepoint Partners LP and are subject to change without notice. Ninepoint Partners makes every effort to ensure that the information has been derived from sources believed to be reliable and accurate. However, Ninepoint Partners assumes no responsibility for any losses or damages, whether direct or indirect, which arise out of the use of this information. Ninepoint Partners is not under any obligation to update or keep current the information contained herein. The information should not be regarded by recipients as a substitute for the exercise of their own judgment. Please contact your own personal advisor on your particular circumstances. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds managed by Ninepoint Partners LP. Any reference to a particular company is for illustrative purposes only and should not to be considered as investment advice or a recommendation to buy or sell nor should it be considered as an indication of how the portfolio of any investment fund managed by Ninepoint Partners LP is or will be invested. Ninepoint Partners LP and/or its affiliates may collectively beneficially own/control 1% or more of any class of the equity securities of the issuers mentioned in this report. Ninepoint Partners LP and/or its affiliates may hold short position in any class of the equity securities of the issuers mentioned in this report. During the preceding 12 months, Ninepoint Partners LP and/or its affiliates may have received remuneration other than normal course investment advisory or trade execution services from the issuers mentioned in this report.

Ninepoint Partners LP: Toll Free: 1.866.299.9906. DEALER SERVICES: CIBC Mellon GSSC Record Keeping Services: Toll Free: 1.877.358.0540

Related Funds

Historical Commentary

- Fixed Income Strategy 11/2023

- Fixed Income Strategy 10/2023

- Fixed Income Strategy 09/2023

- Fixed Income Strategy 08/2023

- Fixed Income Strategy 07/2023

- Fixed Income Strategy 06/2023

- Fixed Income - H1 2023 Market Review and Outlook

- Fixed Income Strategy 05/2023

- Fixed Income Strategy 04/2023

- Fixed Income Strategy 03/2023

- Fixed Income Strategy 02/2023

- Fixed Income Strategy 01/2023