Ninepoint Fixed Income Strategy

October 2023 Commentary

Monthly commentary discusses recent developments across the Ninepoint Diversified Bond, Ninepoint Alternative Credit Opportunities and Ninepoint Credit Income Opportunities Funds.

Summary

- Major Central Banks are now firmly on pause, and the bar to hike further is very high.

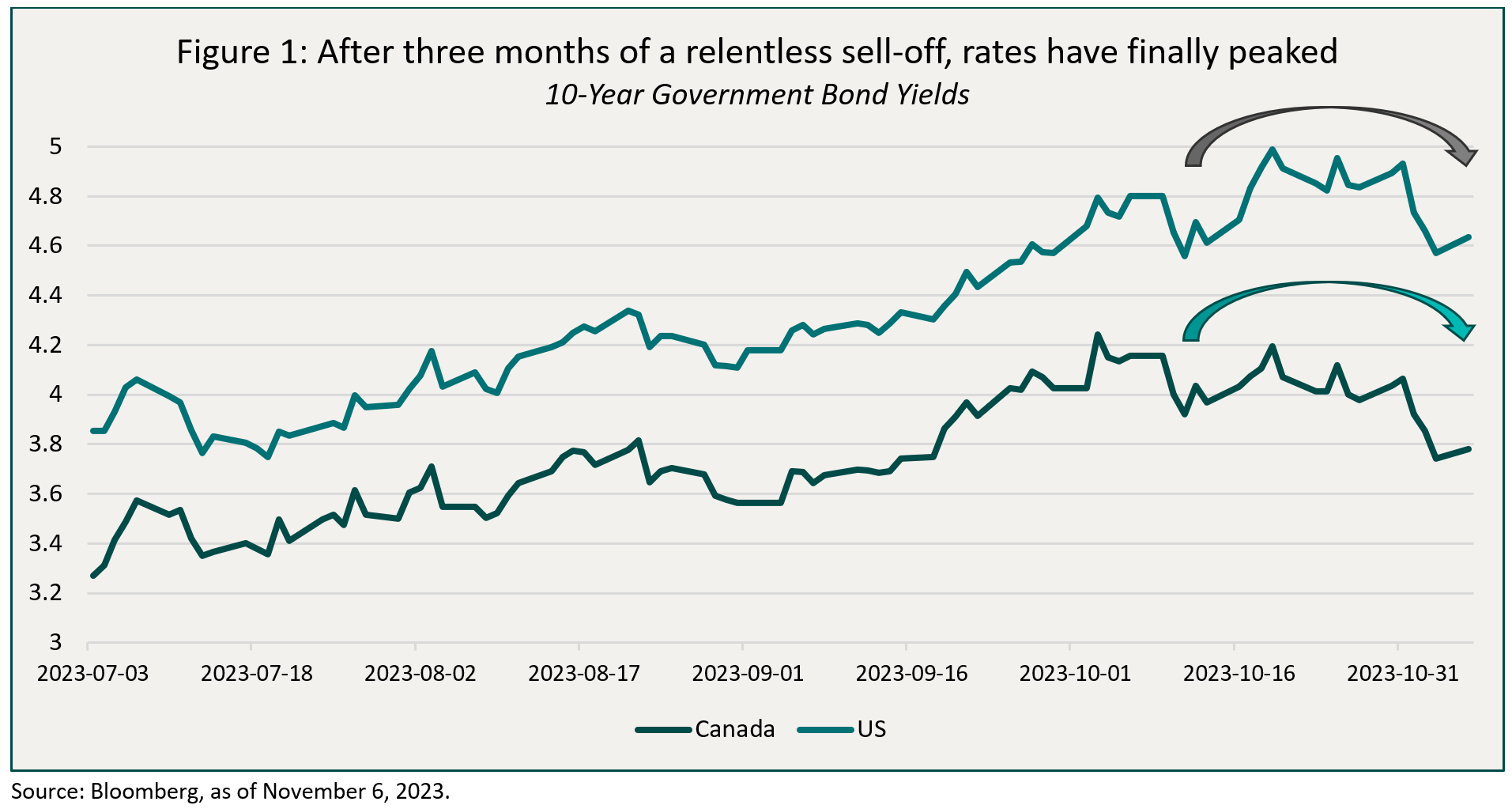

- After a relentless sell-off in October, long-term interest rates have finally peaked.

- Global economic activity is decelerating further, and that now includes labour markets.

Macro

Without any catalyst to change the recent momentum, long-term interest rates continued to increase in October, reaching as high as 5% for the U.S. 10-Year (Figure 1). As discussed last month, this sell-off was driven by a variety of factors, including; elevated government bond supply, surprisingly good economic growth in the U.S, and a hawkish Federal Reserve in September. The result was a 100bps increase in long-term interest rates over that 3-month period, a rather dramatic repricing that left most investors unwilling to catch the proverbial falling knife. These dynamics left the government bond market in a very oversold condition, in prime position for a reversal. All that was needed was a spark, and we got several in quick succession.

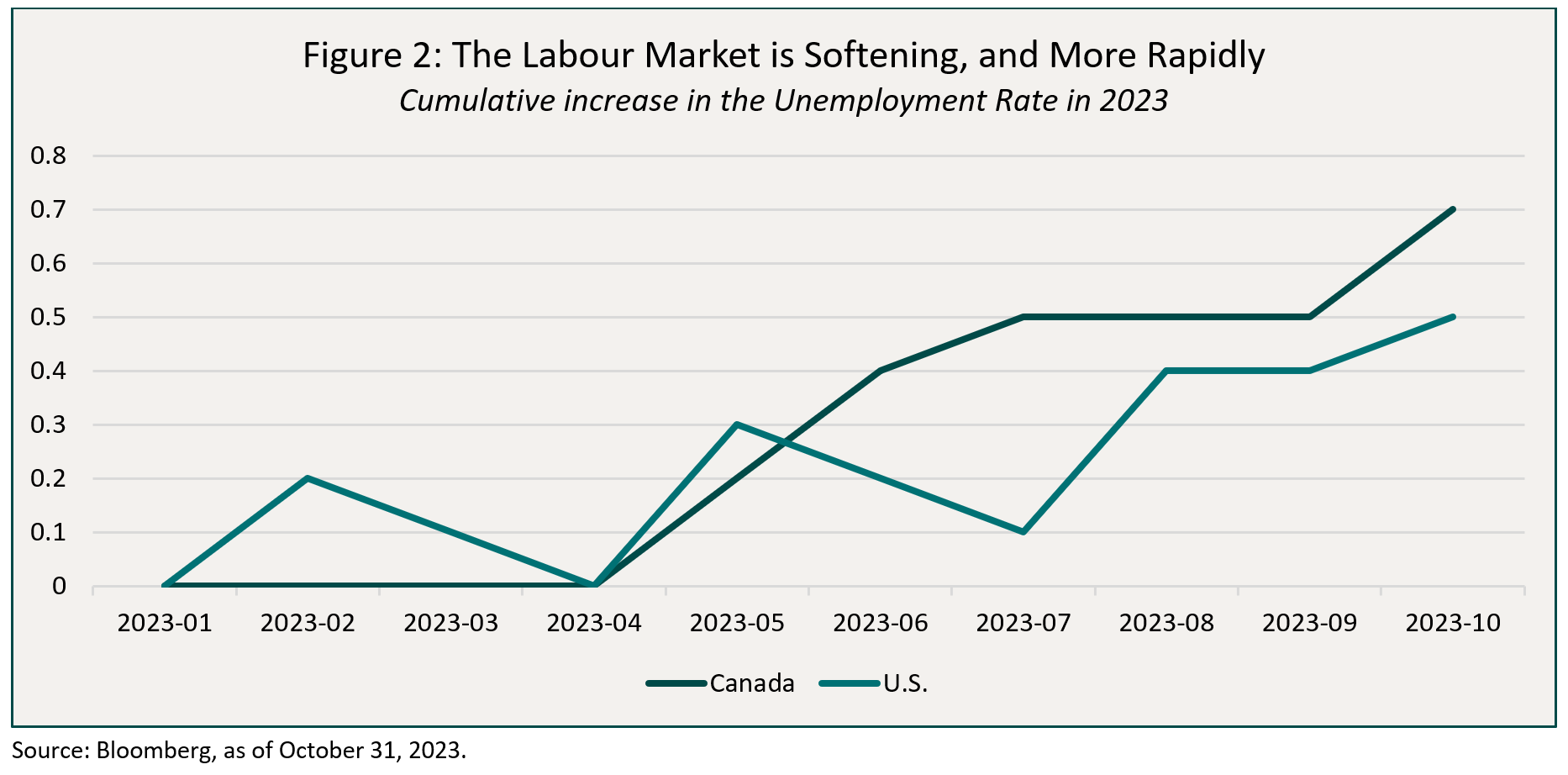

Around month-end, we typically get many high-frequency economic data releases. Overall, the early data for the first month of Q4 has been quite disappointing. European PMIs remain weak and in contraction territory, the Euro Zone’s GDP contracted in Q3, Chinese PMIs surprised to the downside, as per Bloomberg U.S. ISM manufacturing plunged several points to 46.7 and even the ISM Services index slowed meaningfully, to 51.8. We also received employment data for the month of October, which disappointed to the downside. Job growth in many countries is starting to slow. In Canada and the U.S., the unemployment rate continues its ascent (Figure 2 below). Since the start of the year, we have had a cumulative increase of 0.7% and 0.5% in the unemployment rates of Canada and the U.S., respectively.

While Q3 GDP in the U.S. was exceptionally strong, fuelled by a debt-driven consumer and government spending binge, overall, the tone continues to be bleak elsewhere. And even in the U.S., monthly indicators like employment and PMIs are surprising to the downside.

Additionally, the November 1st FOMC meeting produced no surprises, with Powell highlighting the need for prudence and patience at this juncture in the cycle, and acknowledging both the lagged impacts of monetary policy and of the recent tightening in financial conditions (i.e. higher long-term bond yields). This further cemented the view that the Fed has done enough, and that going forward, the bar to hike further is quite high.

Finally, bond supply, driven by ever-increasing government deficits, had been a source of angst amongst bond investors. Thankfully, the U.S. Treasury Quarterly Refunding Announcement (where they tell us how much of each tenor they plan on issuing for the following period) surprised everyone with lower-than-expected issuance of 10 and 30-year bonds.

Taken all together, this confluence of catalysts completely turned the table in the bond market, driving yields lower, particularly at the long-end, where the sell-off had been most acute. With this behind us, we have probably seen this cycle’s high for long-term rates.

We also believe that the Fed, ECB, and BoC are done with interest rate increases for this cycle. Economic momentum is waning and that should be enough to see a slow but steady normalization in inflation. The bar is very high now to restart rate hikes, and given the recent inflationary experience and their willingness to reassert their credibility as inflation fighters, the bar will also be high to initiate rate cuts. As the economy deteriorates further, Central Bankers will likely drag their feet longer than they otherwise would to cut rates, increasing the likelihood that this upcoming slowdown will be more like a recession than a soft landing.

In the funds, we will maintain our current defensive stance:

• Lend to better quality companies and for short term periods to maximize yield while minimizing volatility,

• Keep long-term government bonds for ballast,

• And some credit hedges for added ballast.

We do not expect to materially change the composition of the funds for the foreseeable future. The tactical next move, when we enter recession, will be to eventually migrate from our current defensive positioning to opportunistic mode.

Credit

Given the volatility in the rates market, risk assets had a challenging month. With US equities lower on the month, both Canadian and US investment grade spreads widened in October, 5bps and 1bp respectively. Immense rate volatility coupled with a softer tone in risk assets led to an extremely quiet month in terms of bond issuance in Canada. While a few small utility deals did come to market, October 2023 was one of the slowest months in terms of primary supply over the past decade. As per TD Securities, YTD issuance now stands at ~$83bn, which trails the ~$99bn this time last year. Given December tends to be seasonally slow, it is hard to imagine 2023 hitting the supply estimates that the syndication desks had forecasted for this year (~$100bn). That being said, the strong rally in the rates market that began in November may spark the interest of issuers before we approach U.S. Thanksgiving later this month. Lastly, Ford was upgraded to BBB- by S&P, which resulted in the issuer being moved back into the investment grade index and removed from the high yield index. While we expected Ford to eventually receive an upgrade, we are surprised by S&Ps timing given the challenging quarter Ford reported just one week prior to the upgrade. All three funds benefitted from the material spread compression as the issuer is owned across the funds.

Ninepoint Diversified Bond Fund (DBF)

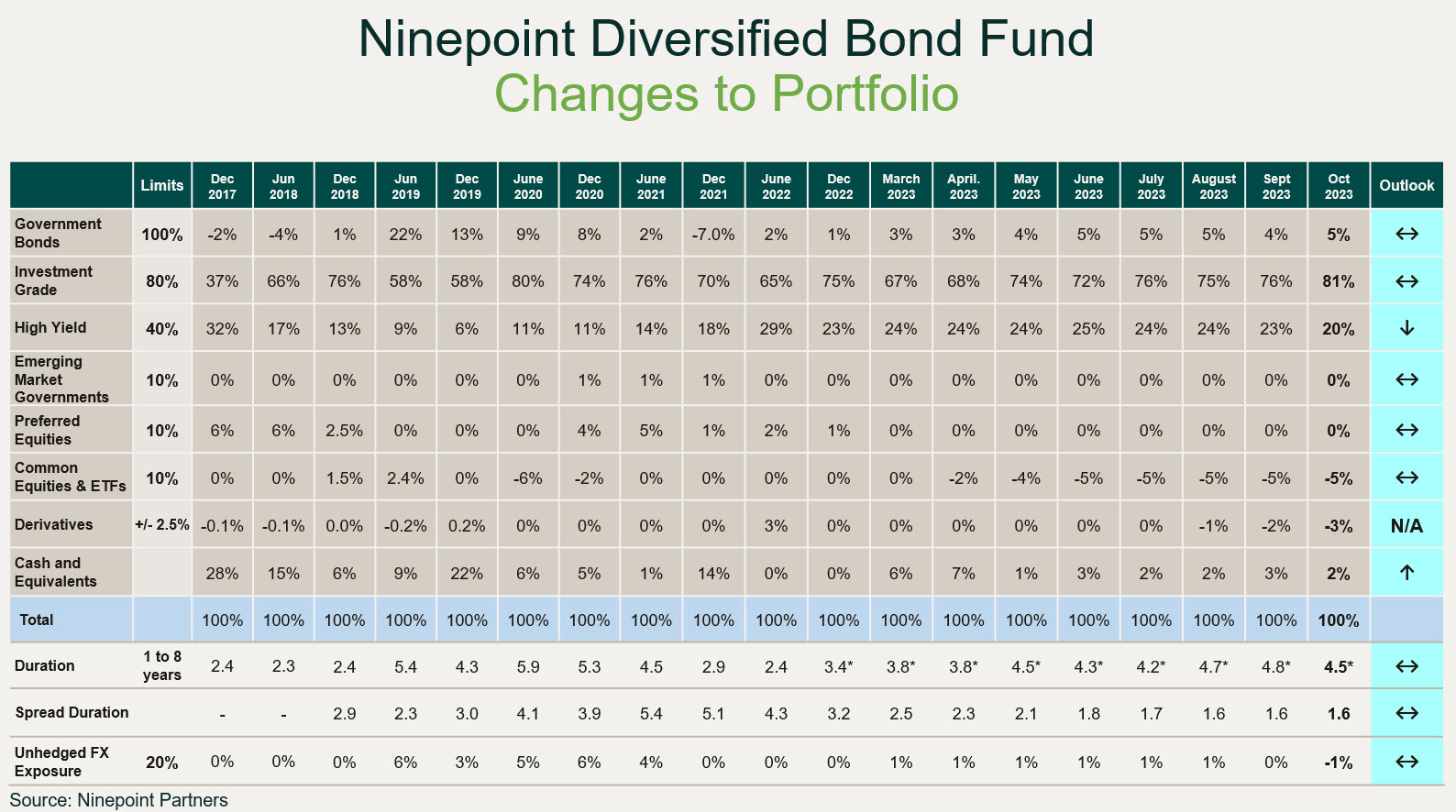

As mentioned above, positioning in the fund did not change materially in the month given there has been no change to our macro outlook. The fund remains defensively positioned. Our High Yield weight moved down month-over-month (helped by the Ford upgrade) and we expect this weight to continue to decline into next year given numerous upcoming high yield maturities. The average credit quality is right at BBB+. The yield-to-maturity of the fund moved up 20bps and now sits at 8.4%. Duration ended the month at 4.5 years while our short position in HYG (used for credit hedging purposes) remains at our target of -5%.

Ninepoint Alternative Credit Opportunities Fund (NACO)

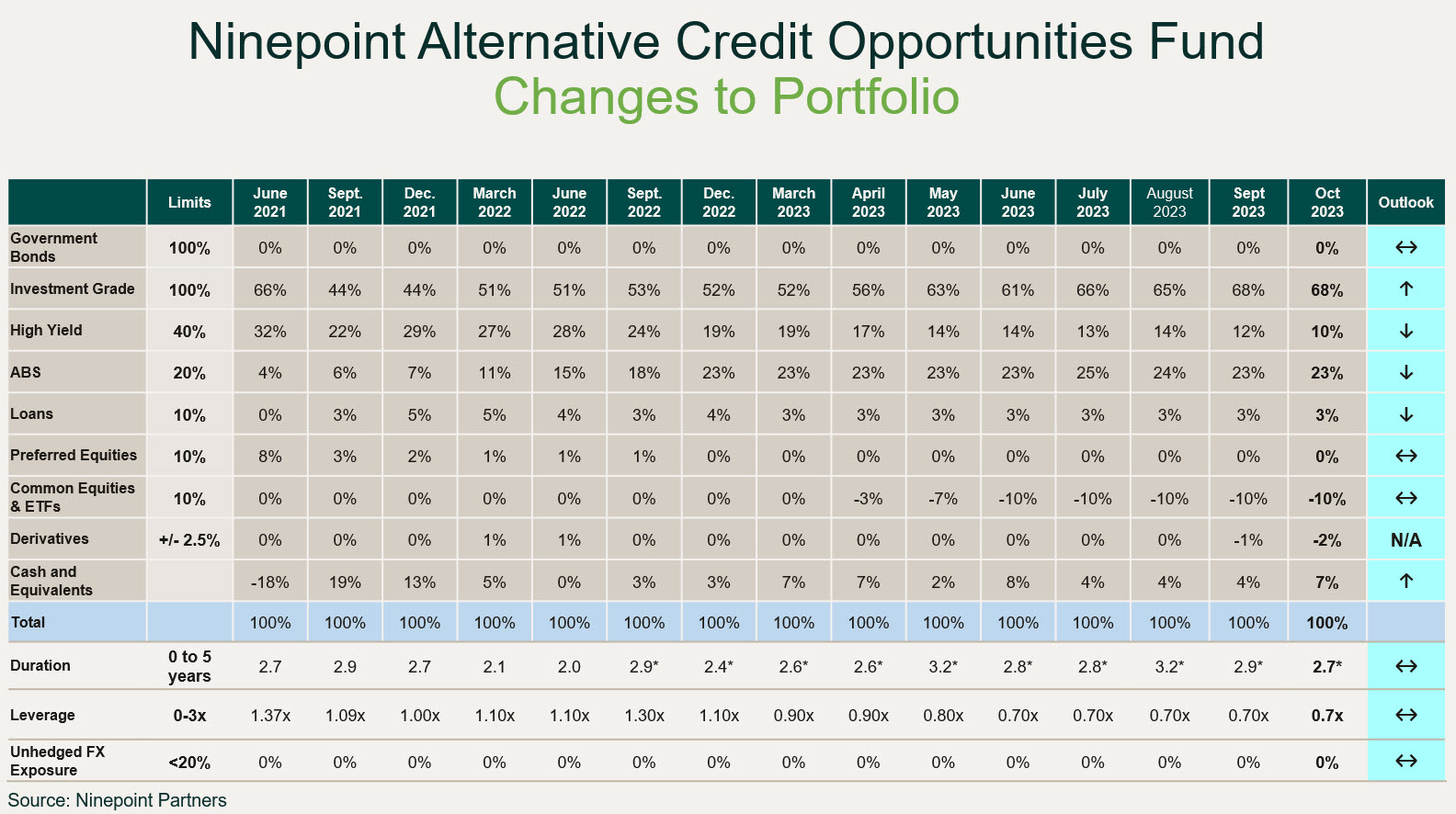

Positioning in the fund did not change materially in the month given there has been no change to our macro outlook. The fund remains defensively positioned. Our High Yield weight moved down month-over-month (helped by the Ford upgrade) and we expect this weight to continue to decline into next year given numerous upcoming high yield maturities. Average credit quality moved up one notch to BBB+. The yield-to-maturity of the fund ended the month at 10%. Duration and leverage remain at 2.7 years and 0.7x, respectively. Lastly, our short position in HYG (used for credit hedging purposes) remains at our target of -10%.

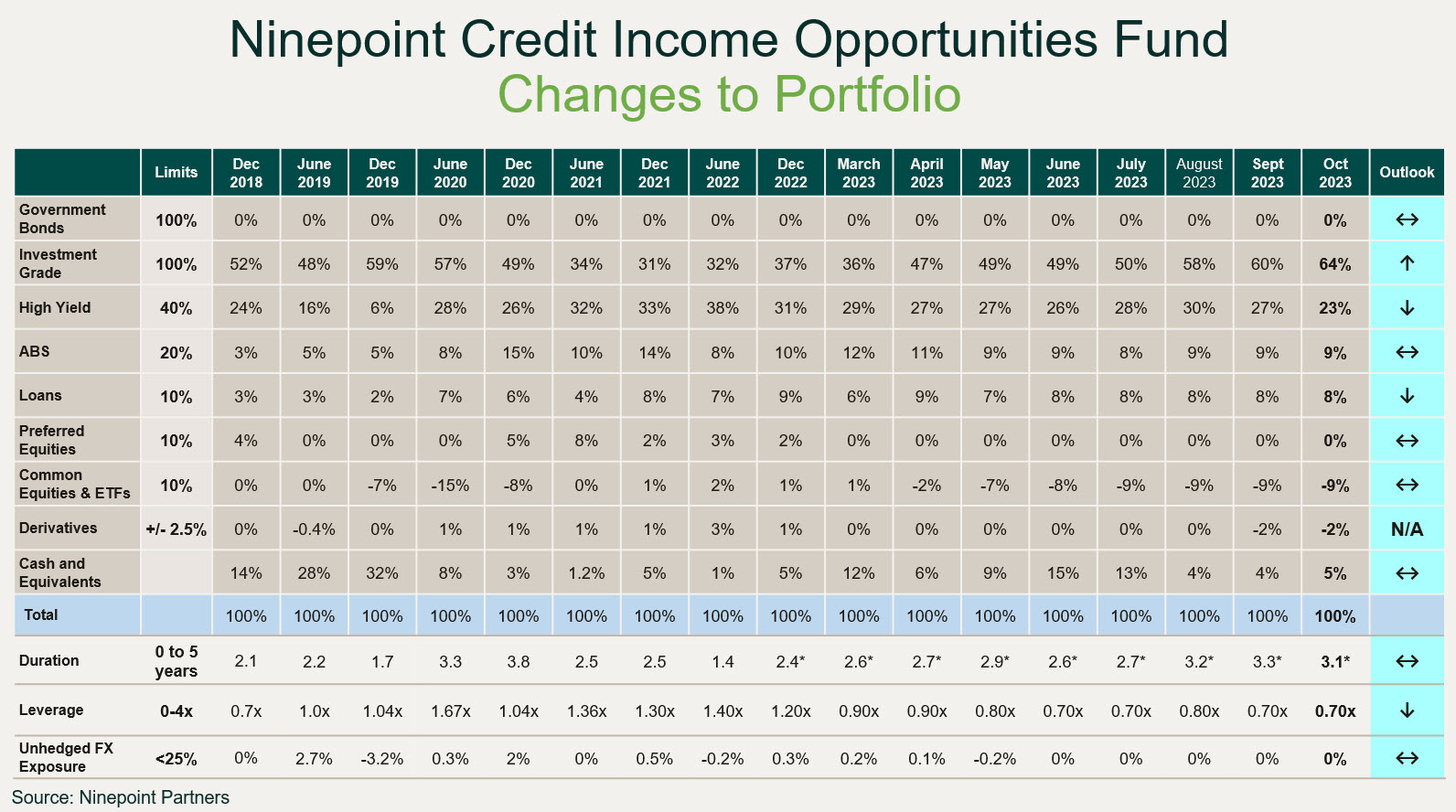

Ninepoint Credit Income Opportunities Fund (Credit Ops)

Positioning in the fund did not change materially in the month given there has been no change to our macro outlook. The fund remains defensively positioned. Our High Yield weight moved down month-over-month (helped by the Ford upgrade) and we expect this trend to continue to decline into next year given numerous upcoming high yield maturities. Average credit quality remains at BBB. The yield-to-maturity of the fund ended the month at 10.9% unchanged from the month prior. Duration and leverage remain at 3.1 years and 0.7x respectively. Lastly, our short position in HYG (used for credit hedging purposes) remains at our target of -10%.

Until next month,

Mark, Etienne & Nick

Ninepoint Partners

1 All Ninepoint Diversified Bond Fund returns and fund details are a) based on Series F units; b) net of fees; c) annualized if period is greater than one year; d) as at October 31, 2023 1 All Ninepoint Credit Income Opportunities Fund returns and fund details are a) based on Class F units; b) net of fees; c) annualized if period is greater than one year; d) as at October 31, 2023. 1 All Ninepoint Alternative Credit Opportunities Fund returns and fund details are a) based on Class F units; b) net of fees; c) annualized if period is greater than one year; d) as at October 31, 2023.

The Risks associated worth investing in a Fund depend on the securities and assets in which the Funds invests, based upon the Fund's particular objectives. There is no assurance that any Fund will achieve its investment objective, and its net asset value, yield and investment return will fluctuate from time to time with market conditions. There is no guarantee that the full amount of your original investment in a Fund will be returned to you. The Funds are not insured by the Canada Deposit Insurance Corporation or any other government deposit insurer. Please read a Fund's prospectus or offering memorandum before investing.

Ninepoint Credit Income Opportunities Fund is offered on a private placement basis pursuant to an offering memorandum and are only available to investors who meet certain eligibility or minimum purchase amount requirements under applicable securities legislation. The offering memorandum contains important information about the Funds, including their investment objective and strategies, purchase options, applicable management fees, performance fees, other charges and expenses, and should be read carefully before investing in the Funds. Performance data represents past performance of the Fund and is not indicative of future performance. Data based on performance history of less than five years may not give prospective investors enough information to base investment decisions on. Please contact your own personal advisor on your particular circumstance. This communication does not constitute an offer to sell or solicitation to purchase securities of the Fund.

Ninepoint Partners LP is the investment manager to the Ninepoint Funds (collectively, the “Funds”). Commissions, trailing commissions, management fees, performance fees (if any), other charges and expenses all may be associated with mutual fund investments. Please read the prospectus carefully before investing. The indicated rate of return for series F units of the Fund for the period ended October 31, 2023 is based on the historical annual compounded total return including changes in unit value and reinvestment of all distributions and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The information contained herein does not constitute an offer or solicitation by anyone in the United States or in any other jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. Prospective investors who are not resident in Canada should contact their financial advisor to determine whether securities of the Fund may be lawfully sold in their jurisdiction.

The opinions, estimates and projections (“information”) contained within this report are solely those of Ninepoint Partners LP and are subject to change without notice. Ninepoint Partners makes every effort to ensure that the information has been derived from sources believed to be reliable and accurate. However, Ninepoint Partners assumes no responsibility for any losses or damages, whether direct or indirect, which arise out of the use of this information. Ninepoint Partners is not under any obligation to update or keep current the information contained herein. The information should not be regarded by recipients as a substitute for the exercise of their own judgment. Please contact your own personal advisor on your particular circumstances. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds managed by Ninepoint Partners LP. Any reference to a particular company is for illustrative purposes only and should not to be considered as investment advice or a recommendation to buy or sell nor should it be considered as an indication of how the portfolio of any investment fund managed by Ninepoint Partners LP is or will be invested. Ninepoint Partners LP and/or its affiliates may collectively beneficially own/control 1% or more of any class of the equity securities of the issuers mentioned in this report. Ninepoint Partners LP and/or its affiliates may hold short position in any class of the equity securities of the issuers mentioned in this report. During the preceding 12 months, Ninepoint Partners LP and/or its affiliates may have received remuneration other than normal course investment advisory or trade execution services from the issuers mentioned in this report.

Ninepoint Partners LP: Toll Free: 1.866.299.9906. DEALER SERVICES: CIBC Mellon GSSC Record Keeping Services: Toll Free: 1.877.358.0540

Related Funds

Historical Commentary

- Fixed Income Strategy 12/2023

- Fixed Income Strategy 11/2023

- Fixed Income Strategy 09/2023

- Fixed Income Strategy 08/2023

- Fixed Income Strategy 07/2023

- Fixed Income Strategy 06/2023

- Fixed Income - H1 2023 Market Review and Outlook

- Fixed Income Strategy 05/2023

- Fixed Income Strategy 04/2023

- Fixed Income Strategy 03/2023

- Fixed Income Strategy 02/2023

- Fixed Income Strategy 01/2023